Typically high quality corporations which have fallen on arduous occasions could make for excellent investments. The market often sells off their shares to ranges greater than warranted when the underlying enterprise hits a lean patch, or fails to fulfill the market’s baked-in expectations, over the brief time period. But when the long-term prospects are basically intact, such market actions merely make the shares low cost, making them ripe pickings for worth buyers.

Nevertheless, it is also true that many buyers have misplaced their shirts by betting on fallen winners from yesteryear in hopes of a restoration that by no means arrived.

Undoubtedly, it is arduous to differentiate which shares are by which of the 2 classes above. So, let’s look at one instance of every.

One to purchase: Pfizer

Regardless of its high-profile work in creating a coronavirus vaccine firstly of the pandemic, the whole return of Pfizer‘s (NYSE: PFE) shares during the last three years is down by 11%, badly underperforming the market. And it is not as if the corporate can inform shareholders that it will surpass its prime line of $100 billion in 2022 anytime within the subsequent few years. The windfall income have all been realized already, and demand for its anti-coronaviral merchandise will decline till it reaches its long-term degree.

However that does not imply its dividend will cease rising over time, albeit at a gradual tempo.

Nor does it imply that the corporate’s capability to pay its dividend can be threatened, and administration really plans to extend its capital allotted to shareholders as quickly because it’s executed paying down the debt from its current acquisition of Seagen, a most cancers therapeutics enterprise. With $64 billion in debt and compensation on the tempo of the fourth quarter, when it repaid $1.3 billion of its long-term borrowing, that undertaking will take a while.

However with the good thing about Seagen and some different acquisitions, the long run seems to be shiny. In whole, by 2030 Pfizer is aiming to realize $45 billion in new income. Few different companies can say that their subsequent six years will see as a lot extra gross sales in absolute phrases, and with a world-class administration staff, Pfizer is extra more likely to succeed with its objective than stumble.

In that context, its ahead price-to-earnings (P/E) ratio of 12 seems to be cheap, presuming you are prepared to be affected person.

One to keep away from: Walgreens Boots Alliance

Walgreens Boots Alliance (NASDAQ: WBA) is struggling to seek out its house within the U.S. healthcare market. Its conventional fare, consumer-facing pharmacies, is now not adequate to drive progress. On the identical time, its dividend was minimize this 12 months from $0.48 per quarter to $0.25, and it’s unclear when its fee will return to progress.

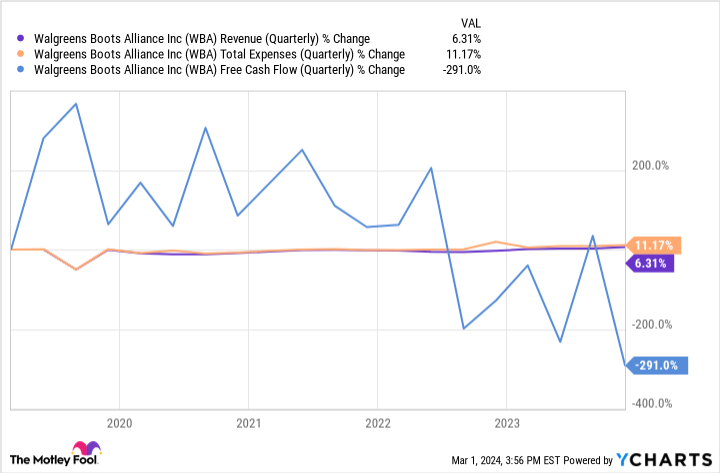

The good transfer is to count on that it’s going to take years. Regardless of its current strategic entry into the first care section, its prime line is just not increasing quickly, and its expenditures are up, inflicting its free money stream (FCF) to fall considerably over time. The beneath chart exhibits Walgreen’s falling FCF trajectory during the last 5 years regardless of close to fixed income.

As you’ll be able to see, prices have risen quicker than income, which has decreased profitability. That is not the scenario one would count on of a well-functioning enterprise that has traditionally been competing primarily in a comparatively steady trade like retail pharmacies.

What’s extra, Walgreens Boots Alliance has no trump card to play in its hand at this level; it faces a grueling mixture of slashing prices essential to generate income by closing shops and the necessity for main new outlays to seize market share. Shareholders already paid the invoice for the dilemma as soon as when the dividend was minimize, and so they would possibly have to pay for it once more, too.

The corporate has been promoting off a whole lot of tens of millions of {dollars} of its investments to cowl its near-term prices. That may possible proceed for the foreseeable future, however finally it’ll run out of investments to promote. Plus, every sale decreases its belongings, which isn’t favorable.

Worse but, Walgreens’ leaders see 2024 that includes extra headwinds than tailwinds, so do not feel like you want to purchase this inventory.

Do you have to make investments $1,000 in Pfizer proper now?

Before you purchase inventory in Pfizer, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Pfizer wasn’t certainly one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of March 8, 2024

Alex Carchidi has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Pfizer. The Motley Idiot has a disclosure coverage.

1 Bruised Dividend Inventory to Purchase Whereas It is Low-cost, and 1 to Keep away from was initially revealed by The Motley Idiot