When Mint shut down on March 23, 2024, I had the identical response as you: Wait, what?.

After years of monitoring spending, planning budgets, and customarily feeling like I had my funds in examine, Mint simply up and left.

It wasn’t precisely the breakup I used to be ready for.

In case you’ve been a Mint person, you know the way a lot simpler it made managing cash—linking all of your accounts, preserving tabs on bills, and reminding you of upcoming payments (typically too bluntly, however hey, it labored).

So, when it disappeared, I went looking for a substitute. Spoiler: not all budgeting apps are created equal.

Fortunately, there are some nice Mint alternate options on the market. I’ve examined a bunch of them, and I’m right here to share those that stood out.

Let’s examine them out—your subsequent budgeting BFF could be only a scroll away.

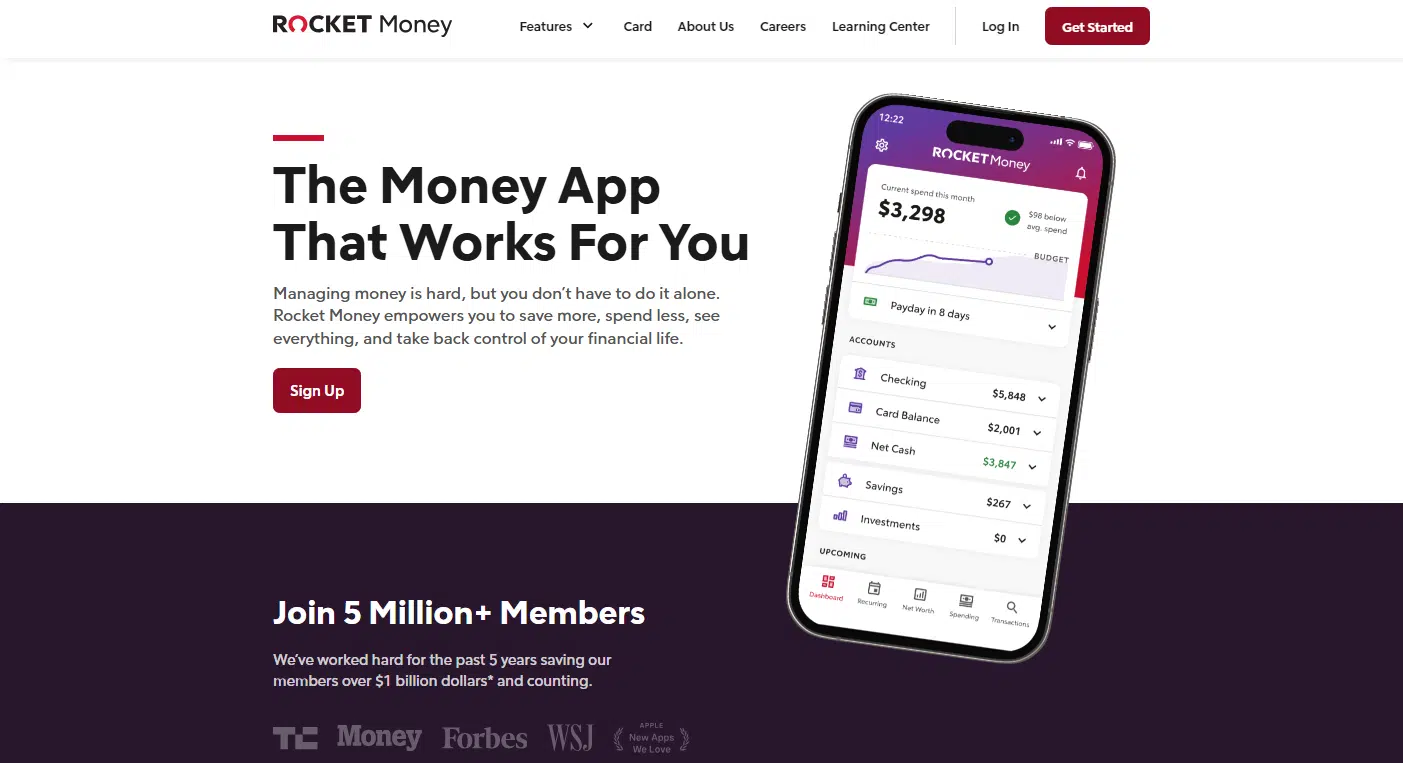

Rocket Cash packs a severe punch on the subject of managing your funds. it tackles the whole lot from monitoring subscriptions to negotiating payments.

Sure, you heard that proper.

It could haggle in your behalf to decrease payments you’d relatively not take care of (and, who wouldn’t love that?).

The free model covers fundamental budgeting wants, however in the event you’re able to stage up, their premium membership provides limitless funds classes, automated Good Financial savings accounts, and account sharing for a number of customers. Good for households or {couples} juggling shared bills.

Premium members additionally get entry to invoice negotiation companies, the place Rocket Cash retains 30%–60% of what they prevent.

Price:

- Free Plan: Consists of account linking, steadiness alerts, subscription monitoring, and spend monitoring.

- Premium Plan: Begins with a 7-day free trial, then shifts to $6–$12 monthly (you resolve the value). Options embody limitless budgets, monetary targets, subscription cancellation help, precedence assist, and web value monitoring.

Anybody bored with monitoring their subscriptions manually (we’ve all missed a couple of) or households searching for a software to prepare their shared monetary targets. Simply understand that premium options include a price ticket, however they’re value it in the event you want the additional instruments.

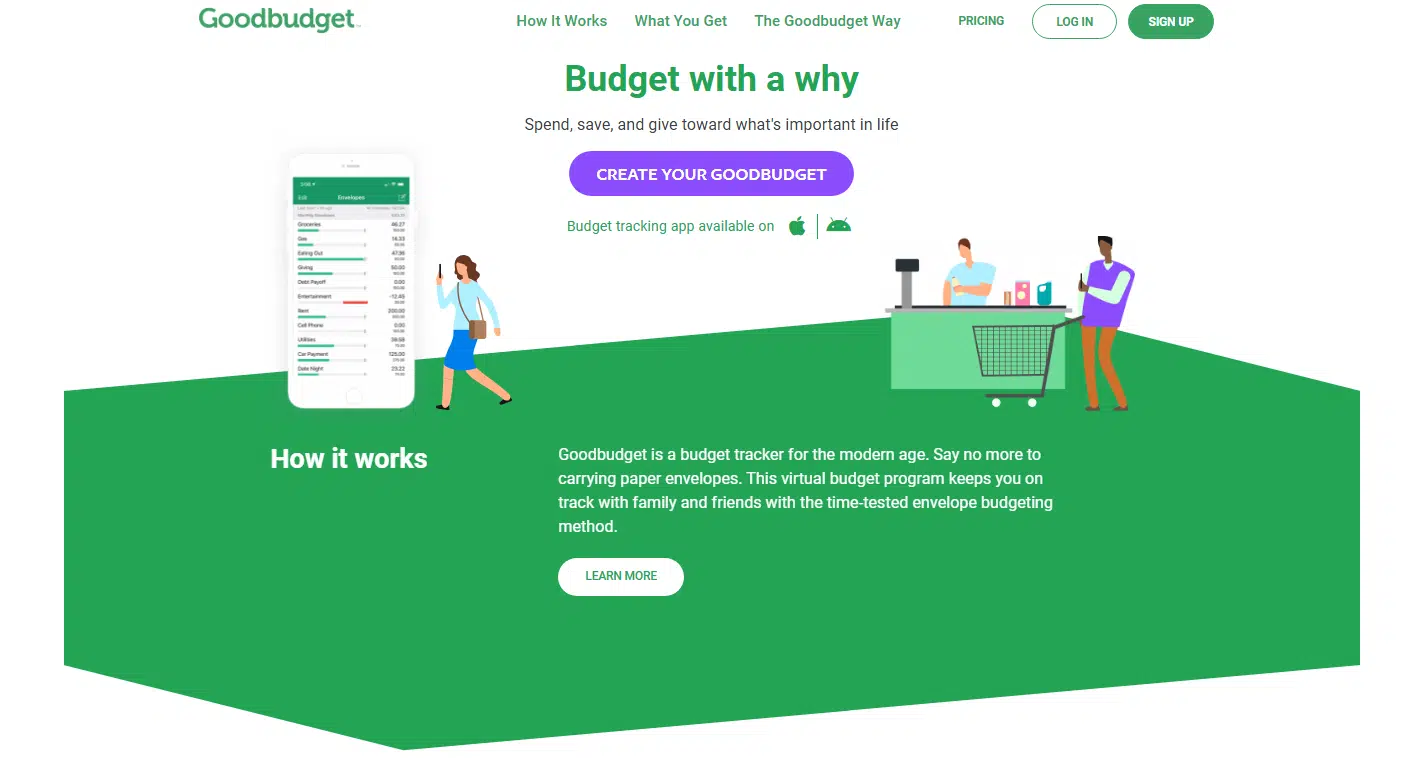

In case you’ve ever heard of the envelope budgeting technique (you understand, the place you divvy up your money into envelopes for particular bills), Goodbudget is principally that—however digital.

No extra carrying envelopes round or attempting to recollect which one had your “enjoyable cash” versus “gasoline cash.” With Goodbudget, you create digital envelopes for issues like groceries, lease, eating out, or perhaps a latte fund (no judgment).

The free model retains issues easy with as much as 20 envelopes, which is greater than sufficient for smaller budgets. However in the event you’re managing family funds or want limitless envelopes, the premium plan is ideal. Very perfect for {couples} or households as a result of you’ll be able to share budgets and deal with your monetary targets collectively.

Price:

- Free Plan: Consists of 10 common envelopes, 10 additional envelopes, one linked account, two units, one 12 months of historical past, debt monitoring, and group assist.

- Premium Plan: Prices $10 monthly or $80 per 12 months. Consists of limitless envelopes and accounts, 5 units, seven years of historical past, computerized financial institution syncing (US solely), debt monitoring, and e-mail assist.

In case you love construction and want a transparent approach to manage your spending, Goodbudget nails it. Plus, the premium collaboration instruments make it perfect for anybody managing shared bills.

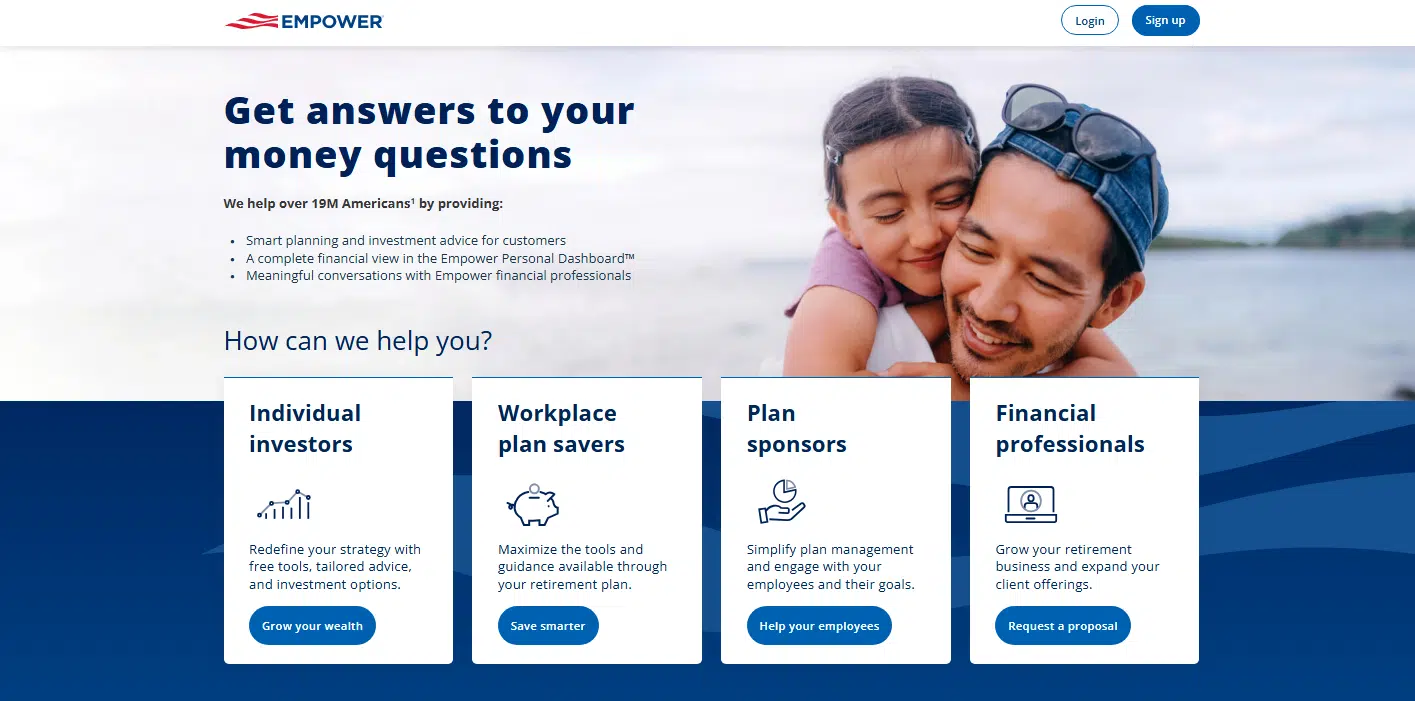

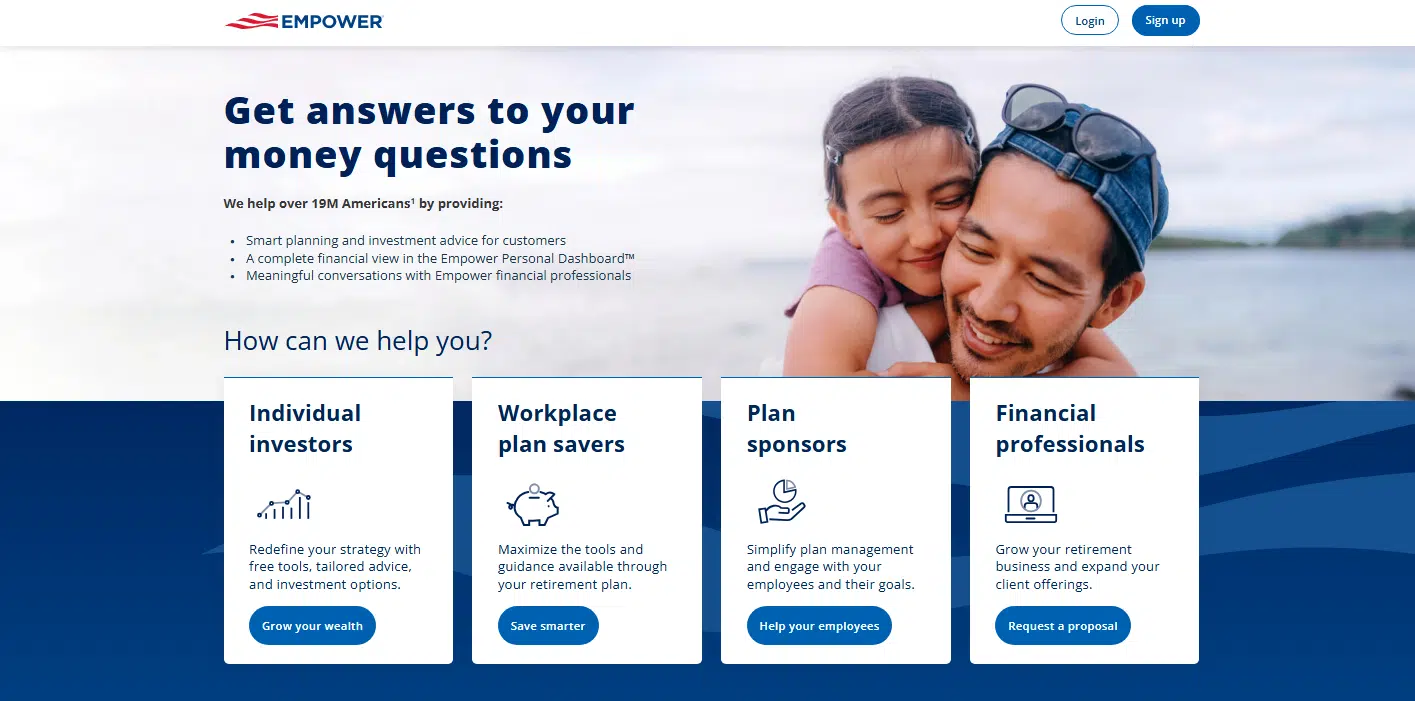

Beforehand referred to as Private Capital, Empower provides you a full suite of budgeting instruments with out charging you a dime. You’ll be able to observe your spending, handle your financial savings, and even preserve tabs in your web value—multi functional place.

For many who need to bounce deeper into funding administration, Empower gives premium companies that include a further price. However even with out that, the free model is greater than sufficient for on a regular basis budgeting and monetary planning.

Price:

- Free: Consists of funds planning, spending and financial savings monitoring, and web value administration.

- Premium: Further charges apply in the event you select to make use of the funding administration instruments.

Empower is ideal for budgeters who desire a dependable, no-cost software to interchange Mint. Additionally nice for individuals interested in monitoring their total monetary image, together with their web value.

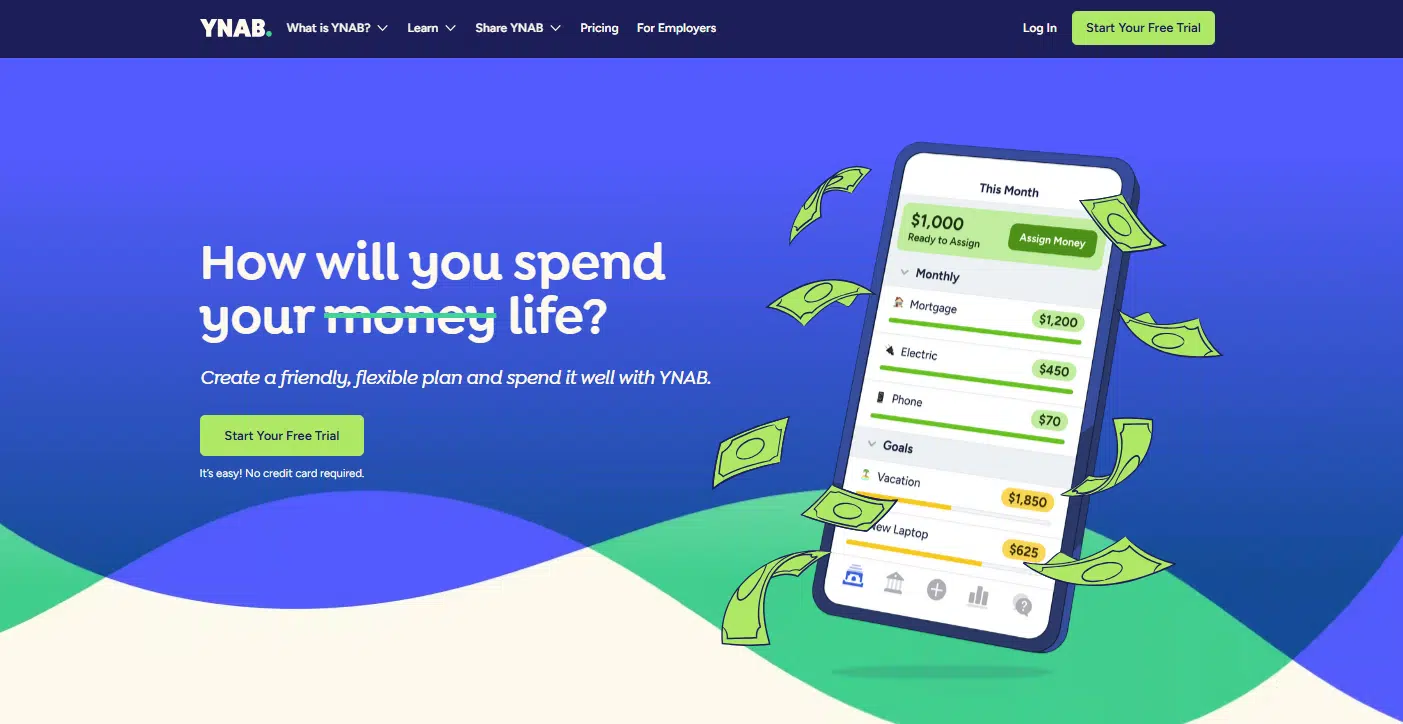

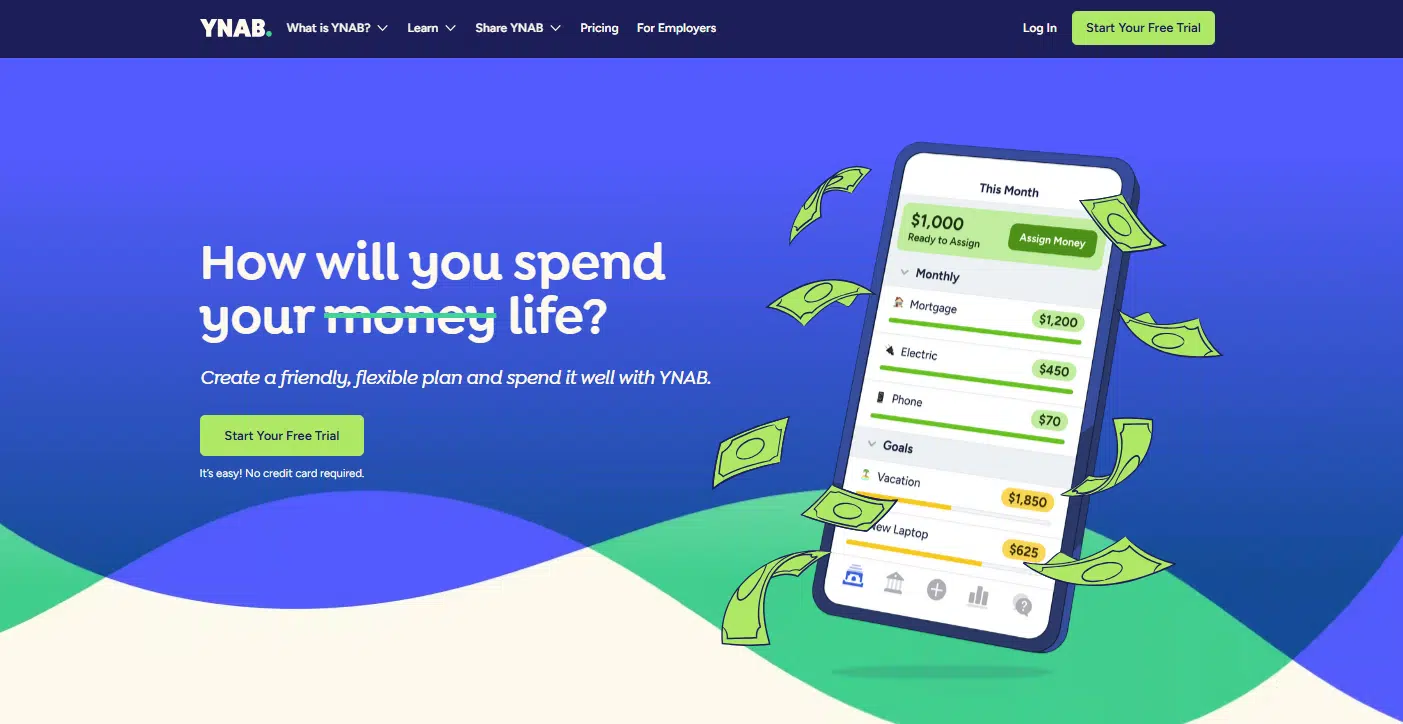

You Want a Price range (or YNAB, if we’re preserving it quick) is all about zero-based budgeting. The concept? You assign each greenback a “job” earlier than it even leaves your account.

YNAB is finest for individuals who need to take management of their spending and make each cent depend. YNAB’s system helps you intend your funds proactively, which is a flowery manner of claiming you understand the place your cash goes forward of time.

In contrast to another budgeting apps, YNAB doesn’t supply a free model, but it surely backs up its value with highly effective instruments. You’ll be able to customise your budgets, observe monetary targets, and even share budgets with as much as six individuals (nice for households or buddies). It additionally contains debt payoff instruments and web value monitoring, supplying you with a whole monetary image.

YNAB firm even claims the common person saves $600 of their first two months.

Price:

- Month-to-month Plan: $14.99/month.

- Annual Plan: $109/12 months (works out to about $9.08/month, saving you $70 yearly).

- Each choices include a 34-day free trial to check issues out risk-free.

In case you’re severe about budgeting and need to get hands-on together with your funds, YNAB is a superb decide. {Couples}, households, or teams managing shared bills may even love the collaboration options.

PocketGuard is designed to simplify budgeting and provide help to keep away from overspending by exhibiting precisely how a lot “pocket cash” you’ve left after overlaying your payments and saving targets. And for these of you who relied on Mint, excellent news—PocketGuard makes it simple emigrate your information, so the swap is clean.

The free model covers the fundamentals: monitoring spending, revenue, and even your web value. However in the event you’re able to step up your sport, the premium plan, PocketGuard Plus, unlocks limitless budgets, a debt payoff plan, and customizable classes.

Price:

- Free Plan: Consists of spending and revenue monitoring, fundamental budgets, and web value monitoring.

- Premium Plan (PocketGuard Plus): $12.99/month or $74.99/12 months (billed yearly). Provides limitless budgets, customized classes, and a debt payoff software.

In case you’re targeted on paying down debt or desire a easy approach to observe your spending with out the fluff, PocketGuard suits the invoice.

Quicken Simplifi is all about serving to you are taking management of your cash with as little effort as potential. The app gives highly effective options like personalised spending plans, invoice monitoring, and detailed monetary studies—all tailor-made to your distinctive monetary habits. When you hyperlink your financial institution accounts and billing info, Simplifi provides you a transparent image of your revenue, spending, and financial savings.

What units Simplifi aside is its customizable classes and sensible monitoring instruments. It even retains a watch out for retailer refunds and alerts you about transactions so that you’re by no means caught off guard.

Price:

- $3.99/month (billed yearly). Whereas there’s no free model, discounted promotional costs can be found all year long.

Simplifi is ideal for individuals who desire a no-nonsense budgeting software that’s versatile sufficient for any stage of cash administration. It’s perfect if you wish to observe each penny, keep on high of payments, or attain your financial savings targets quicker.

Your Cash, Your Guidelines

Alright, discovering the precise budgeting app is about taking management of your cash in a manner that feels pure and, dare I say, type of empowering.

You don’t must settle. There are apps for each type of budgeter—whether or not you want preserving issues easy or want a deep dive into each penny you spend. The trick is selecting the one which works for you. Don’t overthink it! Begin with a software that feels approachable and tweak your technique as you go.

On the finish of the day, your funds displays your life. Make it be just right for you, not the opposite manner round. So, go forward—seize one in every of these Mint alternate options, get your plan collectively, and begin crushing these cash targets.