SoFi Cash

Product Title: SoFi Cash

Product Description: SoFi’s checking account is a checking and financial savings mixture that earns a excessive rate of interest.

Abstract

SoFi is a pupil mortgage firm that has added a checking account. This account is a checking and financial savings combo with few charges and no minimal deposit and earns a excessive rate of interest.

Professionals

- Aggressive rate of interest

- No charges in anyway

- No account minimums

- ATM price reimbursement

Cons

- On-line financial institution, no bodily branches

- Few account choices

- Low limits on peer to look transfers

SoFi® made its title as a contemporary and extra “enjoyable” pupil mortgage refinancing firm. Why had been they enjoyable? Not solely did they provide low charges on pupil mortgage refinancing, however in addition they held occasions all year long and even supplied profession providers.

They held training occasions that included networking occasions, comfortable hours, and different related “experiences.” This helped them construct one of many largest pupil mortgage refinance firms in america, with over 800,000 members.

It was a special strategy to pupil loans. Up till then, most mortgage suppliers competed on value (rate of interest on the mortgage). Whereas SoFi competed on value, too, in addition they supplied value-added bonuses that helped folks fall in love with them.

They’ve since branched out to a number of different merchandise, together with deposit accounts.

Desk of Contents

Is SoFi Checking and Financial savings a Financial institution?

Sure — they didn’t begin off as a financial institution, however they acquired regulatory approval to change into one.

However they’re now formally a financial institution with their very own FDIC insurance coverage supplied by SoFi Financial institution, N.A. They’ve the usual $250,000 of insurance coverage, however in addition they have as much as $2,000,000 by the SoFi Deposit Safety program.

Your cash is protected there.

SoFi Checking & Financial savings Account

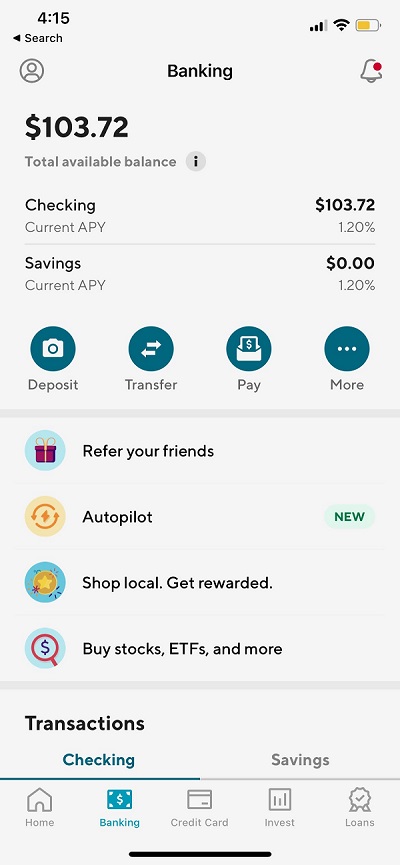

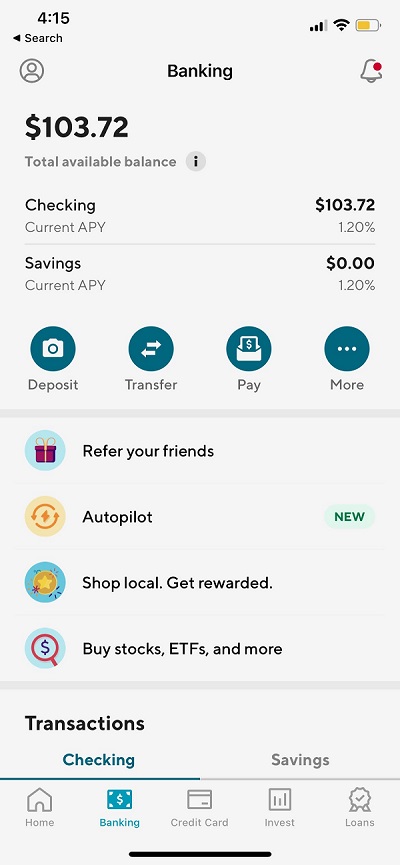

Sofi Checking and Financial savings is a single “product,” however you get a separate checking and financial savings account. Each accounts have a excessive rate of interest, and also you get a debit card that transacts on the checking account.

There are not any account charges and no account minimal. There isn’t any month-to-month upkeep price, no non-sufficient funds price, and no overdraft charges. You may get private checks free of charge in addition to invoice pay and transfers. In case you use the debit card exterior of america, they won’t cost a overseas transaction price both (they are going to move on the 1% price that Visa fees).

There are additionally no ATM charges — they are going to reimburse you for any ATM charges so long as you employ an ATM with a Visa®, Plus®, or NYCE® emblem.

Lastly, you get a membership to SoFi, which implies you may attend these occasions I talked about within the opening part. Whereas this isn’t an unique membership, it’s a good little perk you may reap the benefits of so long as you reside close to the place they maintain these occasions.

SoFi Financial institution is a member FDIC and doesn’t present greater than $250,000 of FDIC insurance coverage per authorized class of account possession,as described within the FDIC’s rules. Any further FDIC insurance coverage is offered by the SoFi Insured Deposit Program. Deposits could also be insured as much as $2M by participation in this system. See full phrases atSoFi.com/banking/fdic/termsSee record of taking part banks atSoFi.com/banking/fdic/receivingbanks

Sofi’s account price coverage is topic to alter at any time.

SoFi members with Direct Deposit or $5,000 or extra in Qualifying Deposits in the course of the 30-Day Analysis Interval can earn 4.50% annual proportion yield (APY) on financial savings balances (together with Vaults) and 0.50% APY on checking balances. There isn’t any minimal Direct Deposit quantity required to qualify for the acknowledged rate of interest. Members with out both Direct Deposit or Qualifying Deposits, in the course of the 30-Day Analysis Interval will earn 1.20% APY on financial savings balances (together with Vaults) and 0.50% APY on checking balances. Solely SoFi members with direct deposit are eligible for different SoFi Plus advantages. Rates of interest are variable and topic to alter at any time. These charges are present as of 8/27/2024. There isn’t any minimal stability requirement. Further info might be discovered at http://www.sofi.com/authorized/banking-rate-sheet.

Overdraft Protection is restricted to $50 on debit card purchases solely and is an account profit out there to prospects with direct deposits of $1,000 or extra in the course of the present 30-day Analysis Interval as decided by SoFiBank,N.A. The 30-Day Analysis Interval refers back to the “Begin Date” and “Finish Date” set forth on the APY Particulars web page of your account, which contains a interval of 30 calendar days (the“30-DayEvaluationPeriod”). You possibly can entry the APY Particulars web page at any time by logging into your SoFi account on the SoFi cellular app or SoFi web site and choosing both (i)Banking> Financial savings> Present APY or (ii)Banking> Checking> Present APY. Members with a previous historical past of non-repayment of unfavourable balances are ineligible for Overdraft Protection.

Vaults

Vaults are like sub-accounts in your Sofi account. They’re not separate accounts however methods for you to consider varied financial savings objectives.

You possibly can arrange a Vault for an emergency fund, to avoid wasting in your first home, or to purchase a brand new automotive. All of them earn the identical rate of interest.

You possibly can have as much as 20 vaults at one time and there are not any further charges or minimums on vaults.

The one factor you may’t do is spend cash from a Vault. You possibly can solely spend it out of your most important Sofi account. If you wish to spend it, you need to switch it from the Vault to the principle account.

In case your most important account runs out of cash, you may arrange “reserve spending” so that cash in your vault can be utilized to cowl transactions in your most important account. In case you set this up, it’ll transfer cash so transactions are authorized. In case you don’t, the transaction gained’t be authorized.

There are uncommon circumstances when they are going to override reserve spending to maneuver cash within the case of:

- Checks and ACHs deposited into your spending stability which might be returned or reversed

- Debit card purchases that pre-authorize a decrease quantity than the ultimate transaction quantity (examples embody fuel station purchases and restaurant ideas).

Lastly, should you shut a vault, that cash goes straight into your most important spending stability.

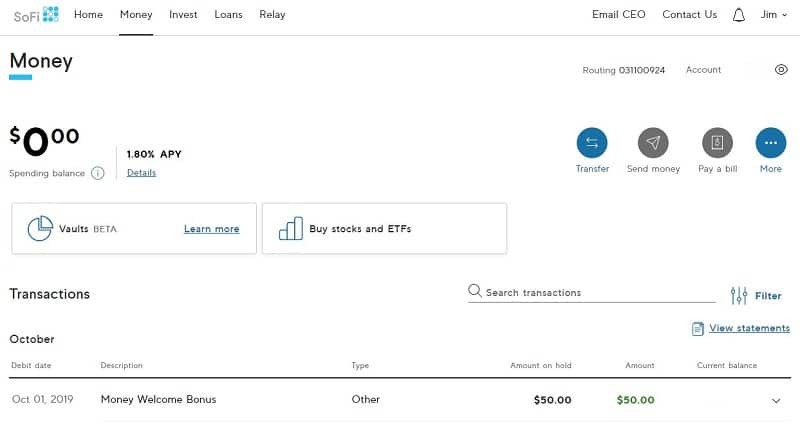

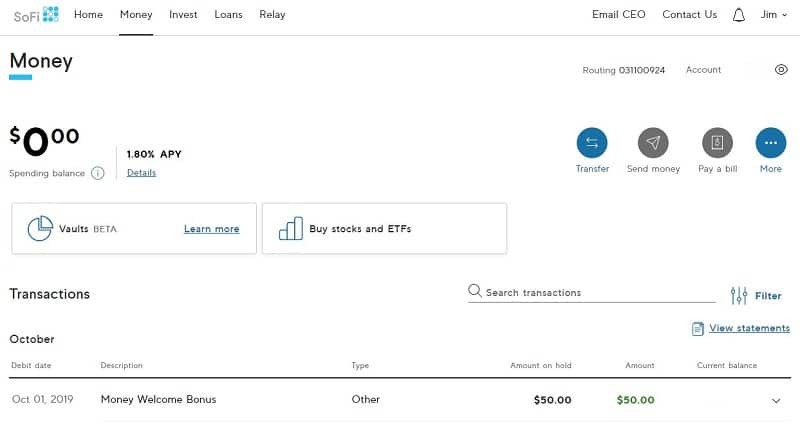

Account Opening Walkthrough

Opening an account takes simply 7-8 minutes.

The primary web page is to register for Sofi, together with title, e mail, and password.

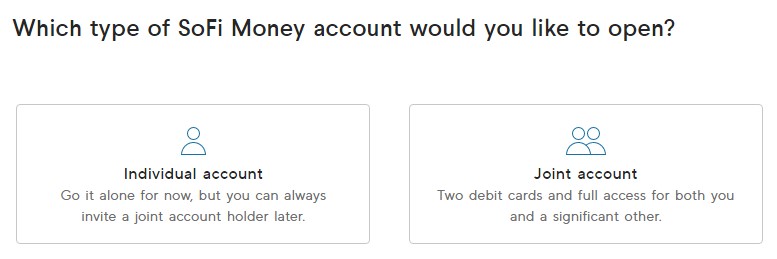

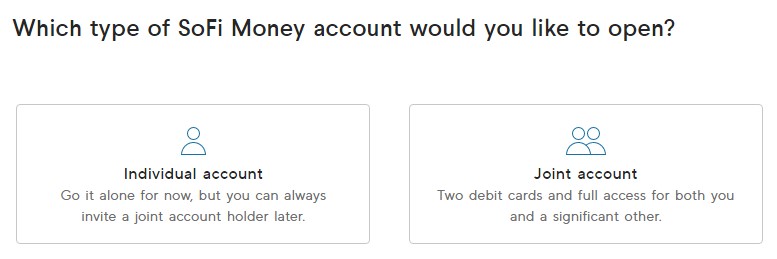

Then, you choose whether or not to open a person account or a joint account.

To maintain issues easy, I opened a person account.

Subsequent, you need to enter your everlasting handle. They use a device that helps populate the handle, just like how Google Maps auto-populates as you sort, so it’s tremendous quick. You then enter a telephone quantity that they use for two-factor authentication.

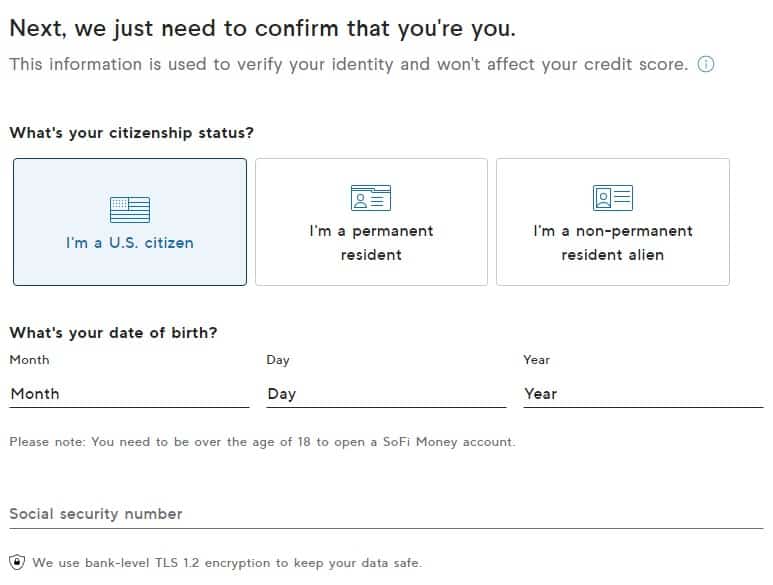

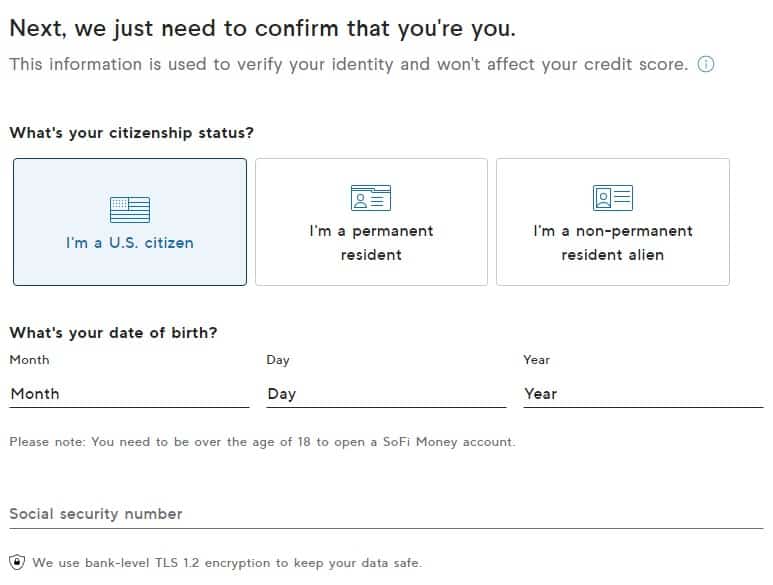

Lastly, you need to verify it’s you along with your date of delivery and Social Safety Quantity:

(there’s another regulatory web page asking questions like whether or not you’re an officer of a publicly traded firm, FINRA, and so forth.)

Then, increase – you’ll in all probability be confirmed!

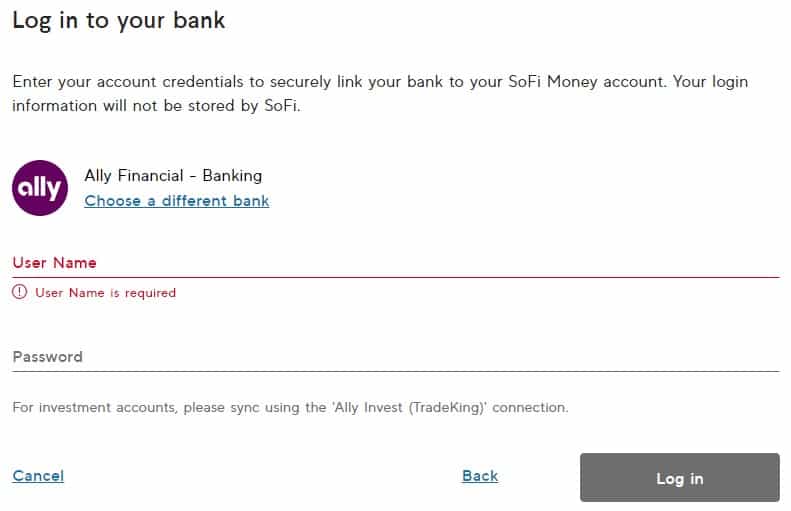

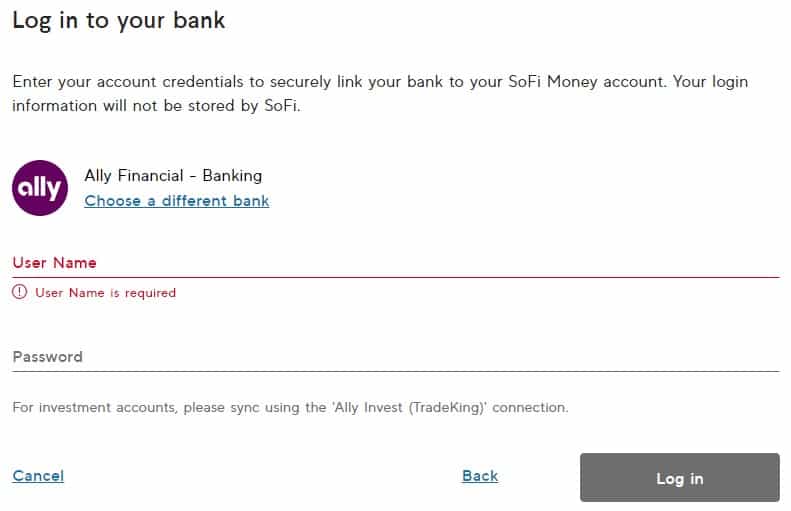

Linking up an account is tremendous simple too, simply need to log in along with your credentials.

(the picture reveals Ally Financial institution however I opted to hyperlink up Financial institution of America)

It takes simply a few days for the switch to finish, a typical period of time for an ACH switch.

And identical to that, we’re off and operating.

The Cash Welcome Bonus of as much as $300 is the referral bonus they provide should you open an account utilizing an current member’s referral hyperlink and obtain qualifying direct deposits totaling no less than $5,000. (right here’s our record of all of SoFi’s bonuses)

Any Catches?

SoFi limits you to a sure variety of transactions to stop fraud.

For peer to look withdrawals, you’re restricted to $250 per day and $3,000 monthly. Invoice pay is restricted to $10,000 per transaction.

Via ATM or Level of Sale Money Withdrawal, you’re restricted to $610 (Ally Financial institution limits you to $1,000 per day). Over-the-counter money withdrawal is restricted to $150, and your Level of Sale spend restrict is $3,000. Lastly, you’re restricted to 12 point-of-sale transactions per day.

These are usually not onerous limits, however there could also be instances when you’ll run into them.

Lastly, no wire transfers.

Wish to stand up to $300 to open an account? SoFi Cash will provide you with as much as $300 should you open your account and fulfill a number of different circumstances.

It’s simply that straightforward. And when you’re executed, you may refer your mates and provides them $25 a pop too.

Everybody wins!

Study extra about SoFi Checking & Financial savings

Disclosure: New and current Checking and Financial savings members who haven’t beforehand enrolled in Direct Deposit with SoFi are eligible to earn a money bonus after they arrange Direct Deposit of no less than $1,000 in the course of the Direct Deposit Bonus Interval. Money bonus can be primarily based on the full quantity of Direct Deposit. Direct DepositPromotion begins on 12/7/2023 and can be out there by 12/31/24. Full phrases at sofi.com/banking. SoFi Checking and Financial savings is obtainable by SoFi Financial institution, N.A., Member FDIC.

SoFi members with Direct Deposit or $5,000 or extra in Qualifying Deposits in the course of the 30-Day Analysis Interval can earn 4.50% annual proportion yield (APY) on financial savings balances (together with Vaults) and 0.50% APY on checking balances. There isn’t any minimal Direct Deposit quantity required to qualify for the acknowledged rate of interest. Members with out both Direct Deposit or Qualifying Deposits, in the course of the 30-Day Analysis Interval will earn 1.20% APY on financial savings balances (together with Vaults) and 0.50% APY on checking balances. Solely SoFi members with direct deposit are eligible for different SoFi Plus advantages. Rates of interest are variable and topic to alter at any time. These charges are present as of 8/27/2024. There isn’t any minimal stability requirement. Further info might be discovered at http://www.sofi.com/authorized/banking-rate-sheet.