Seasonality has lengthy influenced inventory market developments, providing insights into predictable cycles of energy and weak spot all year long. Yale Hirsch, the creator of the Inventory Dealer’s Almanac, is among the most well-known contributors to finding out these patterns. His analysis has highlighted that sure durations of the yr constantly current higher alternatives for traders to generate returns, whereas different occasions warrant warning.

The adage ” Promote Could and Go Away “ is a standard subject of debate that many traders are accustomed to. The historic evaluation helps that the market tends to be the weakest of the yr in the course of the summer season months. Hirsch’s Inventory Dealer’s Almanac launched the concept that the inventory market follows a seasonal rhythm, the place sure occasions of the yr supply better return potential. This work has helped traders determine key home windows the place market efficiency traditionally improves, permitting them to align their methods accordingly.

- “Promote in Could and Go Away”: Some of the well-known adages in market seasonality, this idea displays the tendency for shares to underperform in the course of the summer season months, roughly from Could by way of October. Traders are sometimes suggested to exit or cut back publicity throughout this time to keep away from potential draw back threat.

- The Finest Six Months: Conversely, the interval from November by way of April has been traditionally stronger for shares, with larger common returns. This seasonal development is predicated on information displaying that a good portion of inventory market beneficial properties typically happen throughout this half of the yr.

The Math

The chart under reveals that $10,000 invested available in the market from November to April has considerably outperformed the quantity invested from Could by way of October.

Apparently, the max drawdowns are considerably bigger in the course of the “Promote In Could” durations. Earlier necessary dates of main market declines occurred in October 1929, 1987, and 2008.

Nevertheless, not each summer season works out poorly. Traditionally, there have been many durations when “Promote In Could” didn’t work, and markets rose. 2020 and 2021 have been examples of huge Federal Reserve interventions that pushed costs larger in April and subsequent summer season months. Nevertheless, 2022 was the alternative, as April declined sharply because the Fed started an aggressive rate of interest climbing marketing campaign the previous month.

Technical evaluation, nevertheless, can enhance outcomes.

The Function of the MACD in Seasonal Investing

Whereas the seasonal developments present a helpful framework, Hirsch’s analysis goes additional by making use of technical indicators just like the MACD to refine entry and exit factors. The seasonal MACD (Transferring Common Convergence Divergence) sign, specifically, serves as a set off that confirms when it’s the suitable time to re-enter the market after the weaker summer season interval.

The MACD is a momentum-based indicator that measures the connection between two shifting averages of a safety’s value—usually the 12-day and 26-day exponential shifting averages (EMAs). When the shorter-term EMA crosses above the longer-term EMA, it generates a purchase sign, indicating the potential begin of an uptrend. In seasonal investing, this technical indicator is mixed with Hirsch’s seasonal developments to supply extra precision in market timing.

- Seasonal MACD Purchase Sign: This sign usually triggers close to the tip of October or early November, aligning with the beginning of the “Finest Six Months” interval. It confirms that market momentum is shifting upward and is a good time to re-enter the market.

- Seasonal MACD Promote Sign: Equally, on the finish of the “Finest Six Months” (often in late April or early Could), the MACD promote sign signifies weakening momentum, suggesting it might be time to cut back fairness publicity.

On Friday, October 11, 2024, the S&P 500 index triggered its seasonal MACD purchase sign, marking the start of what has traditionally been a seasonally robust interval for the inventory market. This sign arrives simply earlier than November, reinforcing Hirsch’s findings that the months forward are inclined to ship higher returns.

3-Market Helps For Seasonality

In 2024, three major drivers will doubtless help markets from the center of October by way of year-end and sure into early 2025.

Earnings

The primary is earnings season, which has proved regular to this point, though this week and subsequent will likely be essential in company outlooks. As mentioned within the newest BullBearReport, analysts considerably lowered the “earnings bar” heading into the reporting season. As famous in “Trojan Horses,” analysts are at all times mistaken, and by a big diploma.

“Because of this we name it ‘Millennial Earnings Season.’ Wall Avenue constantly lowers estimates because the reporting interval approaches so ‘everybody will get a trophy.’”

The chart under reveals the modifications for the Q3 earnings interval from when analysts offered their first estimates in March 2023. Analysts have slashed estimates during the last 30 days, dropping estimates by roughly $3.40/share, however practically $18 decrease than their preliminary estimate.

After all, decreasing the bar will generate a excessive “beat price” by firms, which is able to assist gas inventory costs within the quick time period.

Efficiency Chasing

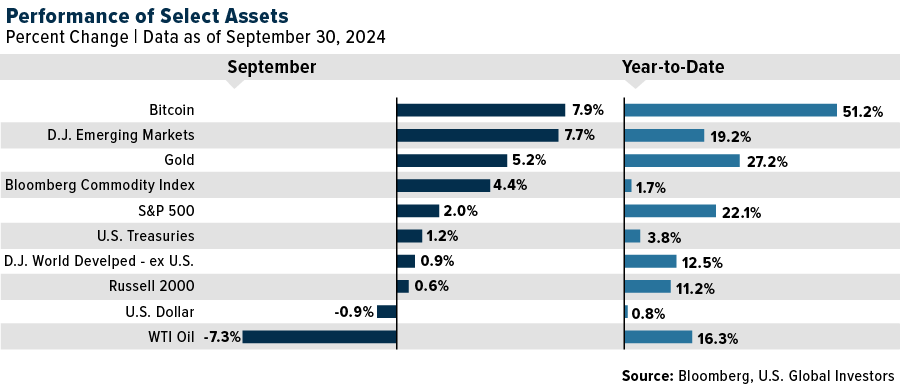

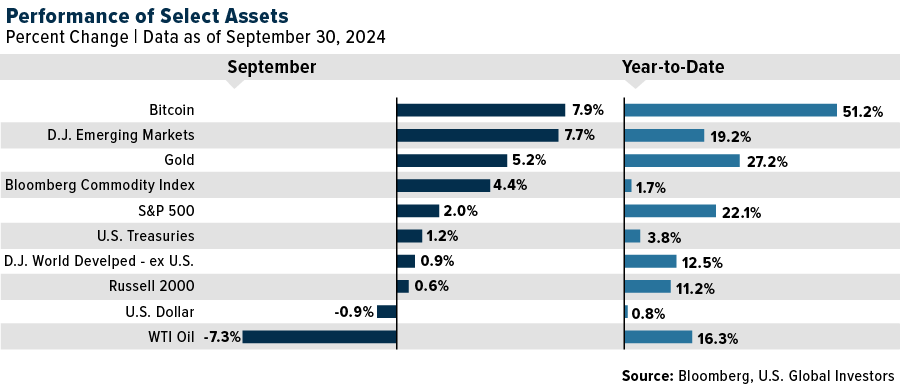

Secondly, in response to Morningstar, in the course of the first half of 2024, solely 18.2% of actively managed mutual and exchange-traded funds outperformed the cap-weighted S&P 500 index. There are a number of causes for this, together with the dearth of allocation to the “Magnificent 7,” dispersion in returns of holdings, and lack of allocation to non-traditional belongings.

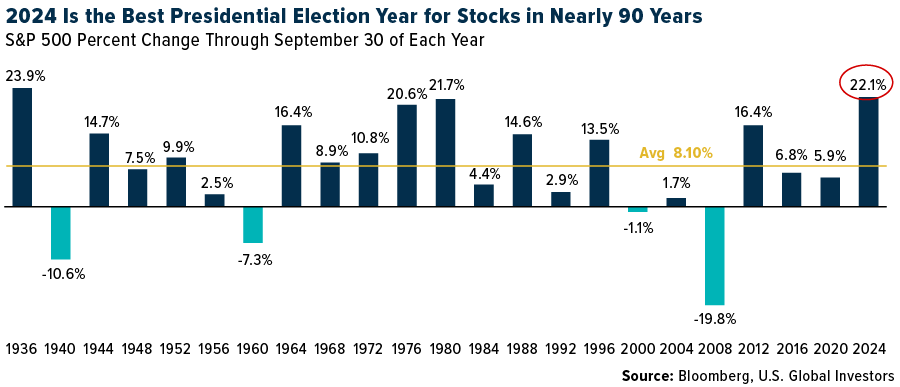

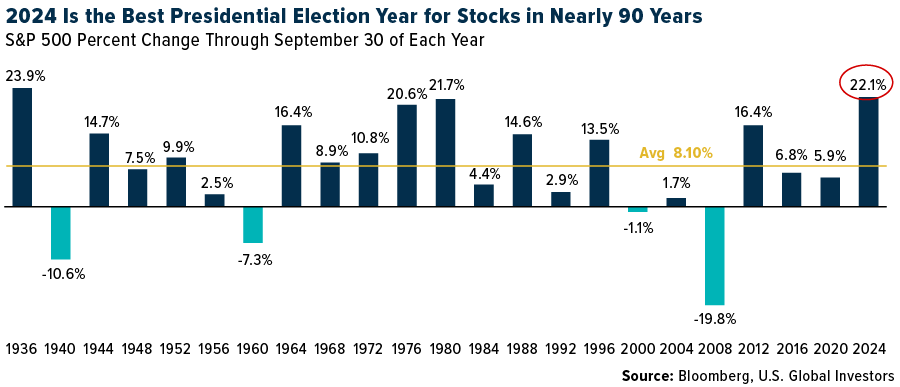

This underperformance happens throughout the very best presidential election yr in roughly 90 years, which is able to stress fund managers to play “catch up” with efficiency shifting into year-end reporting. Given the “profession threat” to managers of serious underperformance, extra shopping for stress might manifest.

Company Share Buybacks

Lastly, company share buyback home windows will reopen in November and December as firms exit their earnings “blackout interval.” Notably, the final two months of the yr characterize the very best two-month interval for company executions as firms rush to finish buybacks for the present tax yr. With practically $1 Trillion in authorizations for 2024, the tempo of buybacks will likely be exceptionally robust this yr.

As famous by Goldman Sachs:

“The VWAP machines will likely be lining as much as purchase $6bn value of equities each day throughout November and December.”

Sure, that’s $6 billion every buying and selling day, which offers ample shopping for energy to carry asset costs into year-end.

Seasonality: Not A Threat-Free Journey

For traders, this seasonality sign may very well be a possibility to extend publicity to equities, significantly in large-cap shares that are inclined to drive the broader market. Nevertheless, it’s important to acknowledge that whereas the MACD sign aligns with historic developments, it doesn’t assure future efficiency.

Regardless of the historic reliability of seasonality and the MACD purchase sign, traders should nonetheless concentrate on dangers.

- Financial Coverage: Inflation, rates of interest, and world financial uncertainty might weigh on inventory efficiency, even throughout a seasonally robust interval. Given the current bout of robust information, if the Federal Reserve slows the tempo of price cuts, this might disappoint markets. A very good instance is 2018, the place the Federal Reserve’s extra hawkish stance preceded a 20% correction in November and December.

- Geopolitical Dangers: Ongoing geopolitical tensions, whether or not in Japanese Europe, the Center East, or relations between main financial powers, can rapidly disrupt monetary markets. Sudden occasions, reminiscent of escalating conflicts or commerce wars, might derail the seasonal developments.

- Market Volatility: Volatility can spike unexpectedly, resulting in sharp market corrections. Even throughout robust durations just like the “Finest Six Months,” short-term market corrections are at all times potential. Traders must be ready for heightened volatility, particularly if different threat elements, like earnings surprises or financial information, create uncertainty.

- Historic Traits Are Not Ensures: Previous efficiency, whereas instructive, doesn’t assure future outcomes. Though the MACD purchase sign has been a dependable indicator previously, exterior elements might cut back its predictive energy. Traders have to be cautious and never rely solely on seasonality and technical alerts.

Most crucially, the technical backdrop additionally poses near-term dangers. The market has been up six weeks in a row, which traditionally is a really lengthy stretch and not using a correction.

From a purely technical view, with the markets deviating nicely above MONTHLY shifting averages and overbought, a correction or consolidation is turning into more and more doubtless earlier than the year-end advance can take form.

Navigating Into Yr-Finish

With the S&P 500 now in a seasonally robust interval, bolstered by the weekly MACD purchase sign, traders could wish to take into account a number of methods:

- Improve Fairness Publicity: Giant-cap shares traditionally carry out nicely throughout this era. You may take into account growing publicity to diversified index funds or sector ETFs that align with historic developments.

- Evaluation Portfolio Threat: Whereas the MACD purchase sign is a optimistic indicator, it is best to assess your portfolio’s threat tolerance and guarantee it aligns together with your long-term targets.

- Rebalance Allocations: Now could also be time to rebalance by lowering positions in riskier belongings or diversifying throughout asset lessons.

- Use Cease-Loss Orders: To handle draw back threat, think about using stop-loss orders.

Yale Hirsch’s analysis on market seasonality, paired with the facility of the MACD sign, presents a disciplined method to navigating historic market developments. The current MACD purchase sign for the S&P 500 offers traders with a probably advantageous entry level into the market as we head into the traditionally robust “Finest Six Months” interval. Nevertheless, it’s essential to stay conscious of the dangers, together with macroeconomic headwinds and market volatility.

Commerce accordingly.

Publish Views: 1,388

2024/10/22