Inside This Week’s Bull Bear Report

- Is The Santa Claus Rally Nonetheless Attainable?

- How We Are Buying and selling It

- Analysis Report – 2025 Predictions Utilizing Valuation Ranges

- Youtube – Earlier than The Bell

- Market Statistics

- Inventory Screens

- Portfolio Trades This Week

Powell & A Authorities Shutdown Hits Shares

Final week, we famous the continuing market churn that might final into this week’s Fed assembly. To wit:

“That definitely appeared the case this previous week, with the market buying and selling being pretty sloppy. Makes an attempt to push the market increased had been repeatedly met with sellers, and we noticed a rotation from over-owned to under-owned property. Notably, that promoting stress arrived as anticipated, and whereas such might persist till early subsequent week, we ought to be getting near the top of the distribution and rebalancing course of. The excellent news is that the current consolidation paves the best way for ‘Santa Claus to go to Broad and Wall.”

That course of continued as anticipated this previous week however turned violent on Wednesday following the Federal Reserve assembly. Whereas the Fed lower charges as anticipated, the market shock got here from the raise in its outlook for rates of interest in 2025 by a half share level. The market is assuming that the Fed is giving up on the concept that inflation will return to the two% goal subsequent yr, an concept that that they had confidence in as not too long ago as September. That extra hawkish outlook undermined the view that elevated valuations had been justified by simpler financial situations, which now appears to be reversing. We suspect that this view is fairly short-sighted, and given the financial dynamics each overseas and within the U.S., slower financial development will result in a “dovish” pivot by the Fed within the first half of 2025.

The markets additionally struggled with considerations a couple of Authorities shutdown. As we mentioned in October 2023, shutdowns are NOT a risk to the market in the long run. To wit:

“What’s essential to know about Authorities shutdowns is that necessary spending (social safety, welfare, curiosity on the debt) continues as wanted. Shutdowns are primarily about discretionary spending. Such is why it primarily includes Authorities employment and the shuttering of nationwide parks and monuments. In line with Goldman Sachs, the shutdown would have solely impacted about 2% of Federal spending total. Discover that the overwhelming majority of Authorities spending is straight a perform of the social welfare system and curiosity on the debt.”

Please notice that in a Authorities shutdown, all MANDATORY spending continues. In different phrases, the federal government WILL NOT default on its debt, and social safety funds will proceed, regardless of rhetoric on the contrary.

Moreover, market reactions to authorities shutdowns have change into more and more muted. The reason being that the markets have discovered that funding sometimes arrives on the eleventh hour through a ‘persevering with decision’ to supply short-term funding by way of the subsequent political occasion, equivalent to midterm elections, inauguration, and many others. Whereas these short-term spending payments ultimately translate into longer-term spending payments, the actual drawback is that persevering with resolutions (CRs) enhance spending by 8% yearly. Such is why debt has exploded since Congress stopped passing budgets in 2009 below President Obama and opted for CRs. The debt surge is the direct results of routinely compounding 8% annual spending will increase plus extra spending.

Nonetheless, as proven, authorities shutdowns, in the event that they happen, can briefly impression markets, however the occasion tends to be delicate and short-lived.

Nonetheless, the market has triggered a short-term MACD promote sign, which warned traders that some “occasion” might exert downward stress on shares. As famous, the Fed and “Authorities Shutdown” drama sufficiently triggered sellers as portfolio rebalancing and distributions concluded. With relative energy oversold on Friday, the setup for a reflexive rally into year-end has change into a a lot higher-probability occasion. Nonetheless, the continuing promote sign is deep sufficient to restrict no matter reflexive rally does arrive. Such is especially true as cash flows have deteriorated over the previous couple of weeks.

Whereas we nonetheless count on a rally into year-end, as we are going to focus on, there’s a not-so-insignificant chance of additional turmoil. We propose persevering with to handle danger, and with vital positive aspects already booked for this yr, there may be little have to stretch for additional returns at this juncture.

Want Assist With Your Investing Technique?

Are you searching for full monetary, insurance coverage, and property planning? Want a risk-managed portfolio administration technique to develop and shield your financial savings? No matter your wants are, we’re right here to assist.

Will Santa Claus Go to Broad And Wall?

Will “Santa nonetheless go to Broad and Wall?” That’s the query on everybody’s thoughts. As we are going to focus on, there are definitely causes to be involved, however let’s begin with the market statistics and causes behind the fabled year-end rally.

The precise Wall Avenue saying is, “If Santa Claus ought to fail to name, bears could come to Broad & Wall.” The Santa Claus Rally, often known as the December impact, is a time period for extra frequent than common inventory market positive aspects because the yr winds down. Nonetheless, as is at all times the case with information, common returns typically differ from actuality.

Inventory Dealer’s Almanac explored why end-of-year buying and selling has a directional tendency. The Santa Claus indicator is fairly easy. It seems at market efficiency over a seven-day buying and selling interval – the final 5 buying and selling days of the present buying and selling yr and the primary two buying and selling days of the New Yr. The stats are compelling.

“The inventory market has risen 1.48% on common throughout the 7 buying and selling days in query since each 1950 and 1969. Over the 7 buying and selling days in query, inventory costs have traditionally risen 76% of the time, which is excess of the typical efficiency over a 7-day interval.“

The tip of the yr tends to be sturdy for a few causes. First, skilled managers are likely to “window costume” portfolios for year-end reporting functions. Secondly, provided that {many professional} funds make year-end distributions, there tends to be a have to rebalance portfolios. The next graph in orange exhibits combination cumulative returns by day depend for the December months we analyzed. Within the graph, we plotted returns alongside each day aggregated common returns by day. Unsurprisingly, the current sloppy buying and selling and correction this previous week all coincide with the historic norms of December.

Visually, one notices the “candy spot” within the two graphs between the tenth and 14th buying and selling days. The 14th buying and selling day, most often, falls inside just a few days of Christmas.

Nonetheless, there may be at all times a danger.

Did The Fed Steal Christmas?

Whereas there’s a decently excessive chance that inventory costs will climb heading into year-end, there’s a not-so-insignificant 24% probability they gained’t. With the substantial November advance and new highs into early December, the query is whether or not anybody is “left to purchase?” As famous, not each December has a “Santa Claus Rally.” 2018, as proven, is an efficient reminder that now and again, traders obtain a lump of coal of their stockings. At the moment, the Federal Reserve was on a fee climbing marketing campaign and insisted that it was “nowhere close to the impartial fee” on financial coverage. Moreover, because the market had declined steeply since early September, sentiment and investor positioning had been very unfavourable.

Apparently, December 2024 has among the identical backdrops as September 2018.

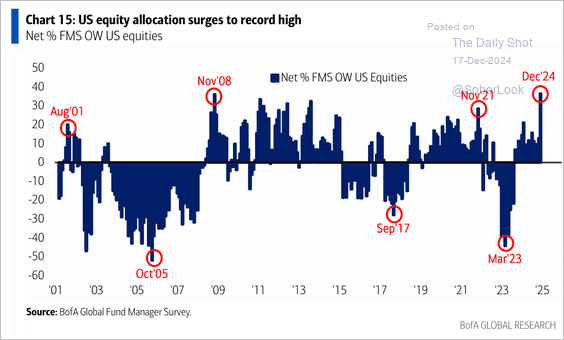

First, the S&P 500 rallied strongly this yr, approaching our year-end goal of 6000. That rally has led to a pointy enhance in bullish sentiment between retail {and professional} traders. As proven, U.S. fairness allocations are at document highs amongst skilled traders.

Moreover, like in 2018, when retail fairness allocations and valuations had been elevated, investor allocations are on the highest on document, coinciding with the second-highest valuation ranges.

There’s additionally an abundance of optimism about future inventory costs, identical to in 2018.

What’s vital to recollect about 2018 is that investor optimism was high quality till the Fed mentioned it “was nowhere close to the impartial fee.” After all, following a 20% decline and two months later, the Fed was magically at that impartial fee.

Immediately, investor exuberance is tied to an additional accommodative easing in 2025. Nonetheless, like in 2018, the Fed urged it isn’t close to its “impartial fee,” as proven in its newest projections. Whereas the “long-run” projections are nonetheless for financial development of 1.8% (down from 2.0% and 1.9% beforehand) and inflation of two%, the short-term outlooks for 2025 had been adjusted modestly increased. That uptick disenchanted traders although the top targets stay the identical, which would require Fed funds to regulate decrease. (Aspect notice: The Fed’s projections are virtually at all times too optimistic, which suggests the current bout of hawkishness will give strategy to a dovish reversal subsequent yr.)

The adjustment to the Fed’s view was minimal from an investing perspective. Nonetheless, the market reacted violently as a result of the mix of exuberance and overbought components created the right surroundings for a reversal.

Technically Talking

First, whereas the market rallied into year-end on many optimistic assumptions, breadth has been deteriorating noticeably. From the NYSE Advance-Decline line to the share of shares buying and selling above their respective 50 and 200-DMA, total participation has declined quickly. Whereas such doesn’t imply a market crash is imminent, such earlier deterioration has ultimately coincided with short-term corrections and consolidations. Unsurprisingly, that’s precisely what occurred because the collision of the Fed and a looming shutdown gave sellers the push they wanted.

Secondly, the market was, and is, technically prolonged on many ranges after the previous two years of extra returns. The month-to-month market evaluation exhibits the S&P 500 is considerably overbought on a relative energy foundation, deviated from the long-term imply, and pushing effectively into the highest of its bullish pattern from the 2009 lows. Whereas we mentioned the identical components in the course of 2021, it took a number of months earlier than the market gave manner and corrected the excesses in 2022. Given the market’s present momentum, we suspect the bullish run will seemingly final into the primary half of subsequent yr however may very well be sooner if earnings expectations decline.

What’s essential to know is that these technical extremes are simply the “kindling” for a correction. To “ignite” the correction, some occasion should present the catalyst. On this case, it was the extra hawkish pivot by the Fed and the specter of a shutdown. As is at all times the case, the occasion that causes a pointy unwinding of the market, like we noticed on Wednesday, is at all times surprising. The “shock issue” causes the sudden shift in market expectations for earnings development and outlooks. The danger going ahead is “if” the Fed is appropriate in its outlook, the extra optimistic outlook for earnings expectations will should be reassessed. If that’s the case, the market will decline to scale back valuations for a brand new actuality.

Provided that present valuations are on the second-highest degree on document, such an occasion would appear extra seemingly. Notably, short-term valuations are solely a perform of sentiment. Traders are paying effectively above the earnings development that’s occurring. Traditionally, earnings have disenchanted these expectations.

Does any of this imply that “Santa Gained’t Go to Broad And Wall?” After all not. Nonetheless, I’d not fully dismiss the chance of “getting a lump of coal” this yr.

Given the uncertainty, each into year-end and 2025, how ought to we method it?

Calculating The Insanity

Let me repeat one thing that appears apropos:

Sir Isaac Newton as soon as mentioned:

“I can calculate the motions of the heavenly our bodies, however not the insanity of the individuals..”

As we head into year-end, we are going to navigate the chance of overly prolonged and bullish markets towards the seasonally sturdy end-of-year interval.

We imagine that capital preservation and danger administration result in higher outcomes over the long run. Nonetheless, managing danger will be irritating within the quick run because the “Concern Of Lacking Out” overrides widespread sense and logic.

If you happen to disagree, that’s okay.

When the chance presents itself and the “insanity has subsided,” these are the questions we are going to ask ourselves earlier than we add publicity to portfolios:

- What’s the anticipated return from present valuation ranges? (___%)

- If I’m improper, what’s my potential draw back, given my present danger publicity? (___%)

- What actions ought to I take now if #2 exceeds #1? (#2 – #1 = ___%)

The way you reply these questions is completely as much as you.

What you do with the solutions can be as much as you.

We’re all attempting to reply the query, “How a lot of the ‘narrative’ already acquired priced into the market?”

By wanting on the information, it could be simple to imagine the reply is “a lot.”

Whereas bullishness prevails, this can be a nice time to put aside the narratives and return our focus to the essential portfolio administration guidelines.

How We Are Buying and selling It

Since we’ve our “stockings hung by the chimney with care,” we are able to stuff them with just a few important funding tips to observe as we method year-end.

- Investing just isn’t a contest. There are not any prizes for successful however extreme penalties for shedding.

- Feelings haven’t any place in investing. You might be typically higher off doing the other of what you “really feel” you have to be doing.

- The ONLY investments you possibly can “purchase and maintain” present an revenue stream with a return of principal perform.

- Market valuations (besides at extremes) are very poor market timing units.

- Fundamentals and Economics drive long-term funding choices – “Greed and Concern” drive short-term buying and selling. Understanding what kind of investor you might be determines the idea of your technique.

- “Market timing” is not possible– managing danger publicity is logical and attainable.

- Funding is about self-discipline and persistence. Missing both one will be damaging to your funding targets.

- There isn’t a worth in each day media commentary– flip off the tv and save your self the psychological capital.

- Investing is not any completely different from playing—each are “guesses” about future outcomes based mostly on chances. The winner is the one who is aware of when to “fold” and when to go “all in.”

- No funding technique works on a regular basis. The trick is realizing the distinction between a nasty funding technique and one briefly out of favor.

Whereas anxiously anticipating the arrival of the “Santa Claus Rally,” we should additionally bear in mind the lesson of 2018.

Nothing is assured.

Be happy to achieve out if you wish to navigate these unsure waters with skilled steerage. Our crew makes a speciality of serving to purchasers make knowledgeable choices in right now’s risky markets.

Have an incredible week.

Analysis Report

Subscribe To “Earlier than The Bell” For Each day Buying and selling Updates

We have now arrange a separate channel JUST for our quick each day market updates. Please subscribe to THIS CHANNEL to obtain each day notifications earlier than the market opens.

Click on Right here And Then Click on The SUBSCRIBE Button

Subscribe To Our YouTube Channel To Get Notified Of All Our Movies

Bull Bear Report Market Statistics & Screens

SimpleVisor Prime & Backside Performers By Sector

S&P 500 Weekly Tear Sheet

Relative Efficiency Evaluation

In final week’s publication, we famous {that a} pullback available in the market could be unsurprising with the index overbought together with expertise, discretionary, and bonds. We noticed a lot of that rebalancing happen as anticipated, and now the market is usually oversold. With Christmas week upon us, managers ought to begin “window dressing” portfolios for year-end reporting. Such will seemingly help the “Santa Claus” rally, and with the market remaining bullishly biased, rising fairness danger into year-end is doable. Don’t overlook to handle your danger in that course of, “simply in case.“

Technical Composite

The technical overbought/offered gauge includes a number of worth indicators (R.S.I., Williams %R, and many others.), measured utilizing “weekly” closing worth information. Readings above “80” are thought of overbought, and under “20” are oversold. The market peaks when these readings are 80 or above, suggesting prudent profit-taking and danger administration. The very best shopping for alternatives exist when these readings are 20 or under.

The present studying is 68.83 out of a attainable 100.

Portfolio Positioning “Concern / Greed” Gauge

The “Concern/Greed” gauge is how particular person {and professional} traders are “positioning” themselves available in the market based mostly on their fairness publicity. From a contrarian place, the upper the allocation to equities, the extra seemingly the market is nearer to a correction than not. The gauge makes use of weekly closing information.

NOTE: The Concern/Greed Index measures danger from 0 to 100. It’s a rarity that it reaches ranges above 90. The present studying is 64.21 out of a attainable 100.

Relative Sector Evaluation

Most Oversold Sector Evaluation

Sector Mannequin Evaluation & Threat Ranges

How To Learn This Desk

- The desk compares the relative efficiency of every sector and market to the S&P 500 index.

- “MA XVER” (Shifting Common Crossover) is set by the short-term weekly shifting common crossing positively or negatively with the long-term weekly shifting common.

- The danger vary is a perform of the month-end closing worth and the “beta” of the sector or market. (Ranges reset on the first of every month)

- The desk exhibits the worth deviation above and under the weekly shifting averages.

The sell-off this previous week took a majority of sectors, together with bonds, effectively under their month-to-month danger ranges. Such units up these sectors, together with bonds, for a rally into year-end as portfolio window costume their portfolios for year-end reporting. We mentioned beforehand that a lot of the buying and selling motion this previous week could be on the draw back as a result of want for funds to make annual distributions and full tax loss promoting for year-end. That has largely been accomplished, giving the market room to rally.

Weekly SimpleVisor Inventory Screens

We offer three inventory screens every week from SimpleVisor.

This week, we’re trying to find the Prime 20:

- Relative Power Shares

- Momentum Shares

- Elementary & Technical Power W/ Dividends

(Click on Photos To Enlarge)

RSI Display screen

Momentum Display screen

Elementary & Technical Display screen

SimpleVisor Portfolio Adjustments

We publish all of our portfolio modifications as they happen at SimpleVisor:

Dec nineteenth

Commerce Alert – Fairness And ETF Mannequin

“In August, we lowered our positions in Diamondback Power (FANG), ExxonMobil (XOM), and the iShares Power ETF (XLE). At the moment, oil costs had been elevated, and we started to see deflationary financial pressures. Since then, these deflationary pressures have continued, as mirrored within the CFNAI and LEI indices. Whereas these pressures proceed, significantly from each different international financial system, vitality shares have change into extraordinarily oversold. Subsequently, we’re returning our vitality positions to focus on weights from underweight for a possible tradeable rally into early subsequent yr.”

Fairness Mannequin

- Improve Diamondback Power (FANG) and Exxon Mobil (XOM) to focus on allocation weights of two% and 1.5% of the portfolio, respectively.

ETF Mannequin

- Improve the iShares Power ETF (XLE) to a goal weight of 4% of the portfolio.

Lance Roberts, C.I.O., RIA Advisors

Have a really Merry Christmas!