Wish to “supercharge” your buying and selling outcomes? In fact, you do! Nicely, learn on as a result of in the present day’s lesson is a power-packed value motion buying and selling tutorial that’s going to offer you some stable, actionable methods which you could start implementing instantly to assist enhance your buying and selling outcomes.

Wish to “supercharge” your buying and selling outcomes? In fact, you do! Nicely, learn on as a result of in the present day’s lesson is a power-packed value motion buying and selling tutorial that’s going to offer you some stable, actionable methods which you could start implementing instantly to assist enhance your buying and selling outcomes.

The ‘methods’ that observe are basically among the methods in my buying and selling ‘struggle chest’; the identical strategies that I exploit on a weekly foundation to search out high-probability entries into the market. I’ve written about a few of these over time on this weblog and in our members’ space, however I needed to offer you a fast abstract of my favourite suggestions and tweaks that I exploit to reinforce my general R return. As you might know, I measure my returns in R (R = unit of Threat) and never percentages. For me, every thing comes right down to what number of R’s I’ve risked vs. what number of R’s I’ve returned. To study extra about this, take a look at my lesson on danger reward and cash administration.

Listed here are my 3 favourite buying and selling methods that considerably enhance my possibilities of returning extra R’s per commerce…

Second-chance entries of main indicators or breakouts

Usually, a pleasant sign will kind, and for no matter purpose we’ll miss the preliminary entry. On this case, you don’t need to panic or ‘chase’ the market, as a result of more often than not there is a chance for a second probability commerce entry. You simply need to be affected person.

The concept is {that a} market will usually retrace to an space it broke out from or to the world of a powerful value motion sign, at the very least as soon as after the preliminary transfer, usually it would retrace again to it greater than as soon as.

We are able to implement this technique by merely ready for value to retrace again to the place an apparent value motion sign fashioned or to an space of a powerful breakout stage or occasion space. Then, as soon as value has retraced again to that space, you simply enter within the authentic course of the transfer.

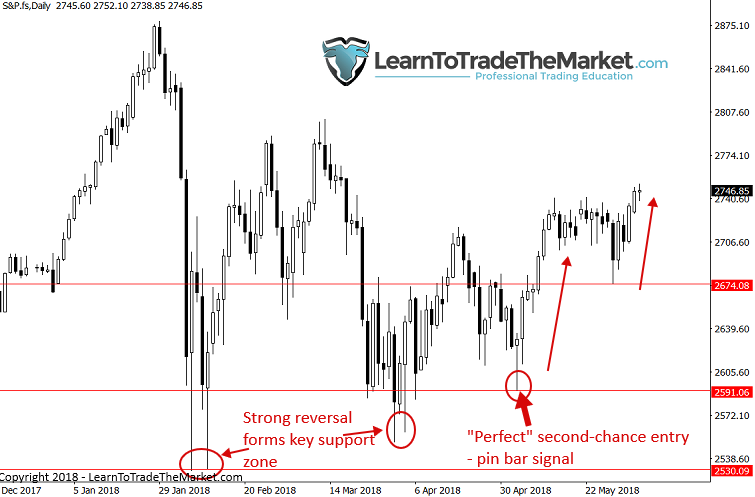

Right here’s an instance:

On this case, the S&P500 had carved out an apparent assist zone / occasion space down close to 2590 – 2530. When the pin bar sign that’s circled on the chart beneath fashioned, it was a second-chance (and an apparent one) to get in on the upcoming upward surge…

Within the subsequent instance chart beneath, we see a transparent AUDUSD pin bar reversal fashioned at a really robust resistance stage. Now, I would be the first to note that on the time, this may have been a considerably laborious commerce to enter brief as a result of it was counter-trend. However, the market adopted by means of decrease after which it retraced again as much as the place the primary pin bar fashioned and fashioned one other pin bar, supplying you with that apparent second-chance entry to promote once more…

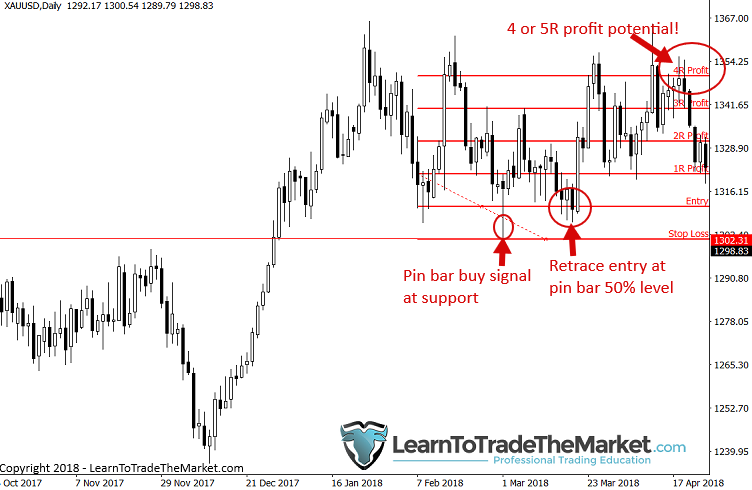

Within the final instance chart above, you possibly can have entered with a cease loss above the primary pin bar reversal excessive and gotten an excellent danger reward ratio potential for those who entered on that retrace of the pin bar’s tail. This could tremendously enhance the potential R return of a commerce since your cease loss is tight and there’s huge potential for a powerful transfer in case you are not stopped out. You’ll be able to see what occurred above. Word: you actually should not have to make use of or attempt to get a ‘tight’ / small cease loss on these second-chance entries, a wider cease loss can be high-quality and actually a wider cease will usually help you keep within the commerce longer and lowers the possibility of an early shake-out / stop-out earlier than the market strikes in your favor. You’ll get higher at cease loss placement by means of training, time and apply.

50% entries of indicators and swings

I personally LOVE 50% entries each of value motion indicators (primarily pin bars) and coming into after a 50% retrace of a significant market swing…

A 50% pin bar entry is one thing I usually name a “pin bar tweaked entry” whereby you sometimes set a restrict order at a pin bar’s 50% stage. Usually, value will retrace to the pin bar 50% stage, particularly on longer-tailed pins. This will get you in with a really tight / small cease loss and thus tremendously will increase the Threat vs. Reward potential of the commerce. You’ll be able to study extra about this entry approach in an article I wrote referred to as The Commerce Entry Trick.

Right here is an instance of coming into a latest Gold pin bar because it hit the 50% stage of the pin bar. Word, it was nearly two weeks later that value hit that stage, however that doesn’t matter. What issues is endurance and understanding these entry tweaks and ready for them to occur…

There are total books written on buying and selling 50% retracements of main market swings. The truth is, historical past exhibits that the majority market strikes will retrace roughly 50% after which resume the unique transfer course. That is clearly an enormous clue that we will use and search for.

Within the instance beneath, you will note two 50% retracements of down-moves within the AUDUSD. Each additionally had sign confluence, that means a value motion sign fashioned close to the 50% stage, supplying you with additional confidence {that a} transfer again the opposite course was coming…

Pyramiding – snowball income in runaway trending markets

Word: That is just for superior and skilled merchants as a result of it’s comparatively troublesome to implement correctly and takes superior data and understanding of value motion and market dynamics to tug off.

What I’m speaking about is pyramiding right into a place in a really robust / runaway trending market. This lets you considerably enhance the Reward potential of a commerce and is actually the one option to correctly make some huge cash out there, quick.

I not too long ago wrote an article that particulars with chart pictures learn how to commerce a runaway development, so you’ll want to verify that out first.

However, the fundamental thought is that while you’re assured a market is shifting aggressively in a single course, ideally after a big sign or important breakout, you possibly can strive pyramiding in by including positions at strategic factors. This can work to construct an even bigger place and IF the market retains shifting aggressively in a single course, you can also make a pleasant chunk of change in a small period of time. In fact, you have to plan your exit technique so that you just don’t lose all that cash if the market does preserve shifting in your favor!

It’s best to solely ever have 1R in danger even with this pyramiding technique (you progress earlier positions to breakeven or lock in revenue because the commerce progresses in your favor), and usually you’d be aiming for 2R, however in a runaway development the place you’re pyramiding, that very same 1R ‘seed’ can flip into 5R and even 10R rewards. Word, for bigger positions there’s a bigger danger of gaps over the weekend; the market might hole towards you, once more that is another excuse this technique is for superior merchants solely.

Confluence

Maybe my favourite buying and selling ‘trick’ that can undoubtedly “supercharge” your buying and selling outcomes, is buying and selling with confluence.

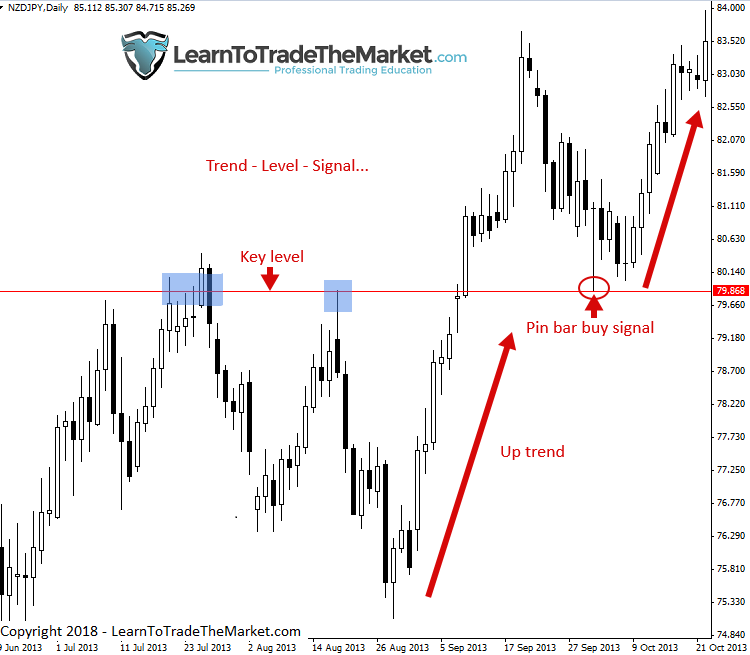

This implies, we’re searching for a number of supporting components or items of proof that agree for a commerce. We’re ready for the ‘stars to align’ so to talk, to place the chances in our favor. Certainly, that is how buying and selling success is born and the way fortunes are made, and the central theme right here is endurance. You’ll have to attend weeks or months for the proper Development, Stage and Sign to align, however while you get that T.L.S. alignment you recognize you may have a really robust commerce in your palms.

Now, let’s have a look at a number of examples of various T.L.S. combos. You don’t at all times want all three, you possibly can contemplate and take trades which have solely a development and a sign, for instance. Simply know that the extra items of confluence that line up, the higher. I increase in higher element with many extra chart examples of all of the completely different items of confluence I search for in my value motion buying and selling course.

This instance exhibits a pleasant pin bar sign that fashioned in-line with a powerful development. Discover it was a pin bar promote sign within the context of a downtrend after value had pulled again to the upside barely, what I name “promoting energy in a downtrend”:

The subsequent instance is exhibiting how one can enter a commerce with only a sign at a key stage. This was a latest pin bar sign within the Dow Jones Index that fashioned at an apparent key assist / occasion space. So, you had a transparent / apparent sign at a transparent / apparent stage, the development nonetheless, was not apparent, extra of a sideways market, however this goes to indicate that 2 out of three can work generally:

- “The right storm” …

Lastly, that is what I might name my “desert island” buying and selling technique; the buying and selling technique I might take to a desert island if I used to be marooned there for years (someway with good wifi, lol) and will solely decide one technique.

This occurs after we get a Development, Stage and Sign all lined up. You’ll be able to have extra items of confluence lining up too, like an EMA or 50% retrace swing level, and many others. The extra the higher. However, while you get a T.L.S. line up, it’s time to cease pondering and begin appearing:

Conclusion

The buying and selling ‘methods’ and tweaks that you just examine above have helped me improve my profitability by giving me an edge in my commerce entries and in addition by permitting me to extend the chance to reward ratio and snow-ball my returns per commerce. You actually should maximize your winners as a result of actually, good trades don’t actually come round all too usually. In the event you’re buying and selling correctly (being affected person and disciplined, and many others.) you aren’t going to be buying and selling ceaselessly, you’ll be buying and selling with a low-frequency method, so take note of the ideas mentioned above to try to maximize your winners.

Perceive that I’m not utilizing these approaches on each commerce, however I’m at all times looking out for them and searching for alternatives to use them as I analyze the market on a day-to-day foundation and search for commerce setups on the finish of the buying and selling day.

Buying and selling is actually like a struggle. It’s you vs. not simply each different dealer, but in addition you vs. you. You actually will need to have your ‘struggle chest’ full of various ‘weapons’ that will help you enhance your possibilities of successful and maximize your returns. The methods mentioned above, together with the ideas I educate in my superior value motion buying and selling course, gives you every thing you might want to wage a profitable combat within the markets and hopefully come out victorious.

What did you consider this lesson? Please share it with us within the feedback beneath!