Right this moment’s Animal Spirits is delivered to you by YCharts and Material:

See right here for YCharts restricted time deal for the YCharts platform

Go to meetfabric.com/spirits for extra data on life insurance coverage from Material by Gerber Life

Get a random Animal Spirits chart right here

On at the moment’s present, we focus on:

Pay attention right here

Suggestions:

Charts:

Tweets/Bluesky:

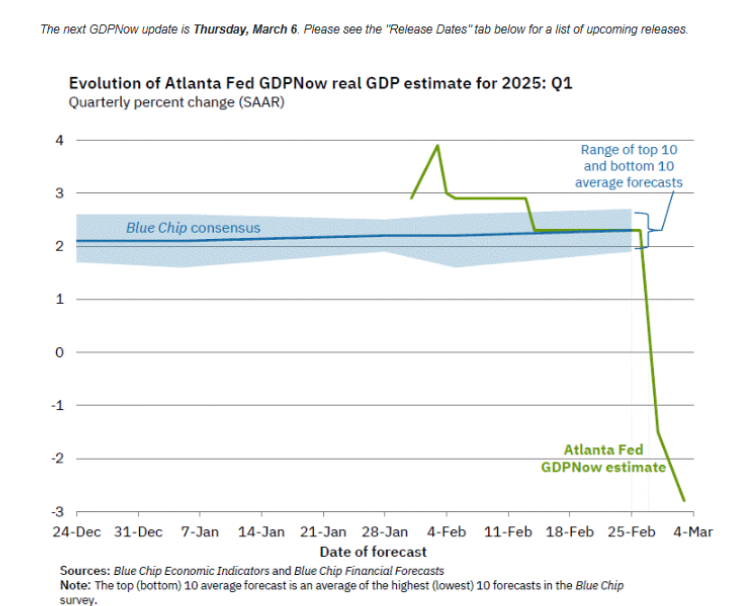

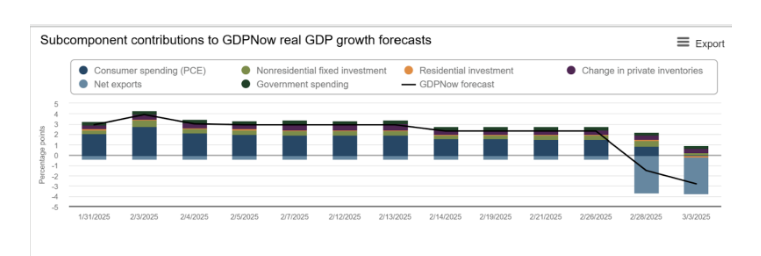

Until all of us get up from this collective tariffs nightmare, the truth is recession. Recession with inflation, which known as stagflation. It is the worst sort of recession, as a result of folks lose their jobs and costs keep excessive together with rates of interest.

— Daryl Fairweather ⛅ (@FairweatherPhD) March 4, 2025

Goal: “In gentle of ongoing client uncertainty & a small decline in February Web Gross sales, mixed with tariff uncertainty….the Firm expects to see significant YoY revenue strain in its Q1 relative to the rest of the yr…” $TGT pic.twitter.com/lf5CrFCydP

— The Transcript (@TheTranscript_) March 4, 2025

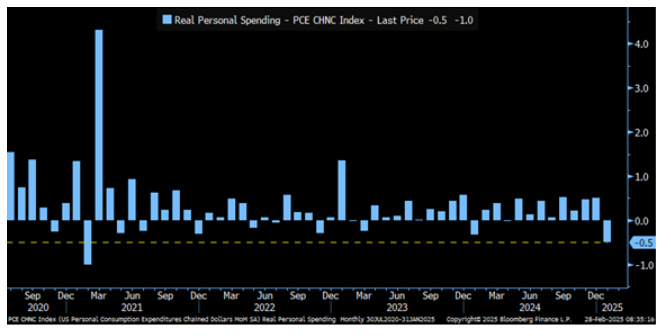

Actual private spending fell by probably the most since 2021. pic.twitter.com/s0sYzuaLuk

— Kathy Jones (@KathyJones) February 28, 2025

People saved 4.6% of their after-tax revenue in January, up from 3.5% in December.https://t.co/eDZgP9dKNk

— BEA Information (@BEA_News) February 28, 2025

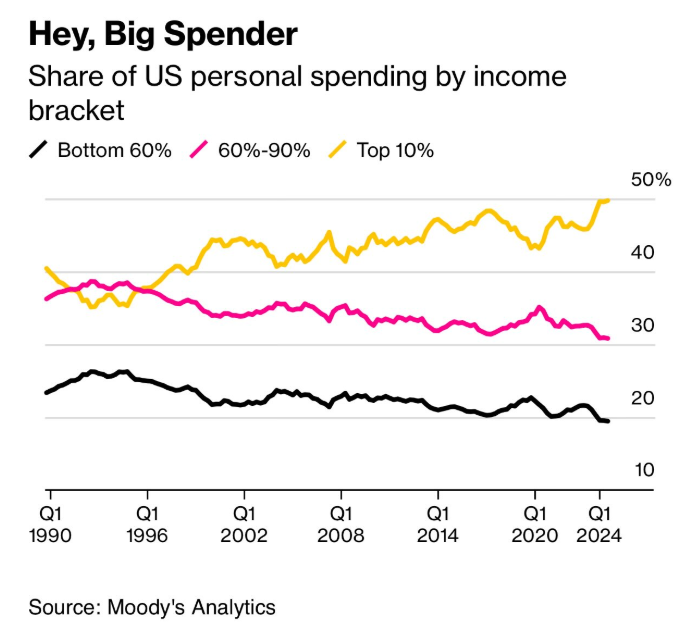

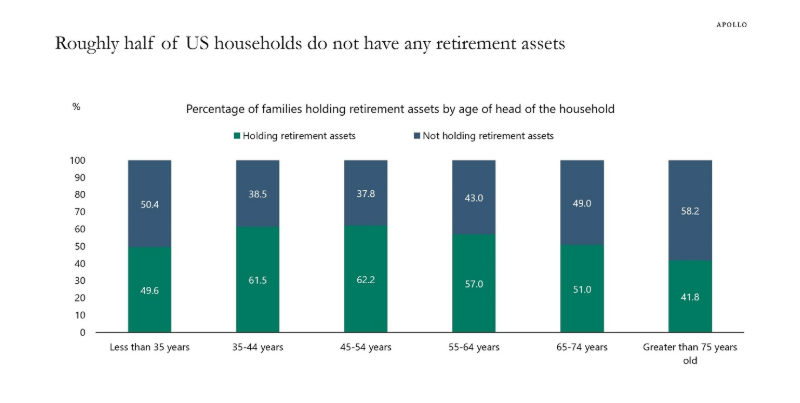

1. Trump is extra common with younger folks than outdated folks. Most younger folks don’t personal shares or properties (aka they’re asset-light).

2. Trump can be extra common amongst working and center class people. Most of those people are additionally asset-light.

It stands to purpose {that a} fall…

— Chamath Palihapitiya (@chamath) March 3, 2025

DoorDash has turned the nook to profitability and nonetheless continues to develop its order quantity.

Complete orders are actually up 735% during the last 5 years.$DASH pic.twitter.com/fqdVuYwCeP

— FinChat (@finchat_io) February 11, 2025

No one introduced a tax or a spending program. Perhaps it’s best to wait to search out out what’s truly being proposed. https://t.co/TNBFxoYVjz

— David Sacks (@DavidSacks) March 3, 2025

Right. I bought all my cryptocurrency (together with BTC, ETH, and SOL) previous to the beginning of the administration. https://t.co/dN6nuGQUtu

— David Sacks (@DavidSacks) March 3, 2025

Noticed the Trump assertion at the moment, similar as everybody else —

I imagined a Strategic Reserve could be simply Bitcoin. That makes probably the most sense to me.

Many crypto belongings have deserves, however what we’re speaking about right here is not a US funding portfolio — we’re speaking a couple of reserve, and… https://t.co/YwLBBCt55y

— Hunter Horsley (@HHorsley) March 3, 2025

U.S. pending residence gross sales have fallen to a brand new all-time low pic.twitter.com/dxKfa5OA8n

— Kevin Gordon (@KevRGordon) February 27, 2025

Netflix has taken the largest hit. eMarketer’s evaluation (see chart under) makes that abundantly clear. For the reason that first quarter of 2024 (i.e. when Prime Video launched adverts), Netflix CPMs have fallen greater than these of Prime Video, Disney+, Max, Peacock and Hulu. pic.twitter.com/k9xh0aZDOZ

— Kourosh (@kouroshshafi) February 25, 2025

Comply with us on Fb, Instagram, and YouTube.

Try our t-shirts, espresso mugs, and different swag right here.

Subscribe right here:

Nothing on this weblog constitutes funding recommendation, efficiency information or any advice that any specific safety, portfolio of securities, transaction or funding technique is appropriate for any particular particular person. Any point out of a selected safety and associated efficiency information just isn’t a advice to purchase or promote that safety. Any opinions expressed herein don’t represent or suggest endorsement, sponsorship, or advice by Ritholtz Wealth Administration or its workers.

The Compound, Inc., an affiliate of Ritholtz Wealth Administration, obtained compensation from the sponsor of this commercial. Inclusion of such ads doesn’t represent or suggest endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investing in speculative securities entails the chance of loss. Nothing on this web site must be construed as, and will not be utilized in reference to, a proposal to promote, or a solicitation of a proposal to purchase or maintain, an curiosity in any safety or funding product

This content material, which accommodates security-related opinions and/or data, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There might be no ensures or assurances that the views expressed right here will probably be relevant for any specific info or circumstances, and shouldn’t be relied upon in any method. It’s best to seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “put up” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital belongings, or efficiency information, are for illustrative functions solely and don’t represent an funding advice or provide to supply funding advisory companies. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding resolution. Previous efficiency just isn’t indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from varied entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or suggest endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the chance of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.