One of many extra incessantly requested questions I’m requested is what to do when an investor has come into a considerable amount of money (maybe from an inheritance or sale of a enterprise). Ought to they make investments it unexpectedly or by greenback price averaging (DCA)? Thankfully, the empirical analysis findings present the optimum reply from a purely monetary perspective.

Tutorial analysis, together with the 1979 research A Word On The Suboptimality Of Greenback–Price Averaging as an Funding Coverage, the 1992 research No one Good points From Greenback Price Averaging: Analytical, Numerical and Empirical Outcomes, and the 2011 research Does Greenback Price Averaging Make Sense For Buyers?, has discovered that buyers put the chances considerably of their favor by investing all of the belongings instantly—and when DCA outperforms (within the minority of circumstances), it tends to take action by a lot lower than when it underperforms (within the majority of circumstances).

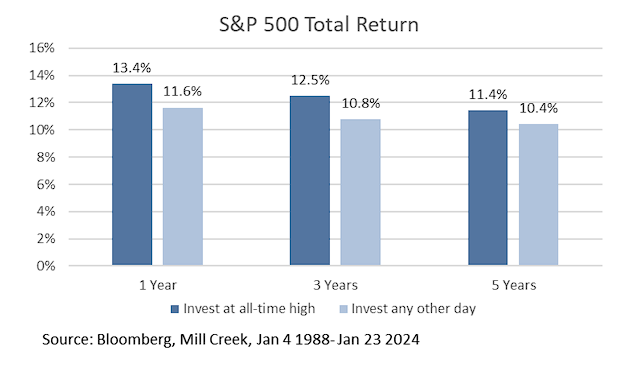

Once I offered this proof to an investor, I used to be requested: “Whereas that has been the case on common, the market has simply set an all-time excessive, so perhaps I ought to simply watch for a market pullback?” Due to Michael Criminal, chief funding officer at Mill Creek Capital Advisors, we are able to look at the empirical proof. Criminal reviewed the returns of the S&P 500 Index over the one-, three- and five-year durations following an all-time excessive and in contrast them with the returns if they’d been purchased on another day. His information pattern lined Jan. 4, 1988, via Jan. 23, 2024. As proven within the desk under, shopping for when the S&P 500 Index was at an all-time excessive outperformed shopping for on another day over every holding interval examined, with the outperformance starting from 1 share level to as a lot as 1.8 share factors.

Regardless of the empirical proof, DCA stays a preferred technique amongst particular person buyers. The technique’s reputation is probably going defined, at the very least partially, by the lack of information of the proof we’ve reviewed. The recognition can be demonstrated by DCA being a risk-averse technique as a result of these using it are holding money till the plan is totally applied. As well as, behavioralists would clarify that the recognition outcomes from DCA buyers searching for to attenuate the potential remorse (loss aversion) of investing a lump sum.

Investor Takeaway

The historic proof makes clear that DCA is an inferior funding technique. That mentioned, it might nonetheless serve a function: If you’re so danger averse that you wouldn’t make investments for those who have been pressured to decide on between investing a lump sum or in no way, DCA turns into ‘the lesser of evils.’

Larry Swedroe is head of economic and financial analysis for Buckingham Wealth Companions, collectively Buckingham Strategic Wealth, LLC and Buckingham Strategic Companions, LLC.

For informational and academic functions and shouldn’t be construed as particular funding, accounting, authorized, or tax recommendation. Sure data relies on third social gathering information and should turn into outdated or in any other case outmoded with out discover. Third-party data is deemed dependable, however its accuracy and completeness can’t be assured. The opinions expressed listed below are their very own and should not precisely replicate these of Buckingham Strategic Wealth, LLC or Buckingham Strategic Companions, LLC, collectively Buckingham Wealth Companions. Neither the Securities and Change Fee (SEC) nor another federal or state company have accepted, decided the accuracy, or confirmed the adequacy of this text. LSR-23-617