The Financial institution of England’s efforts to deliver down inflation have been “completely ineffective” as a result of most value modifications have been past the central financial institution’s management, one of many UK’s high enterprise figures stated.

Article content material

(Bloomberg) — The Financial institution of England’s efforts to deliver down inflation have been “completely ineffective” as a result of most value modifications have been past the central financial institution’s management, one of many UK’s high enterprise figures stated.

Archie Norman, chairman of the retailer Marks & Spencer Group Plc, stated that probably the most aggressive UK cycle of rate of interest rises for the reason that late Nineteen Eighties “didn’t truly cut back inflation very a lot.”

Commercial 2

Article content material

Article content material

Since December 2021, the BOE has raised its benchmark lending fee from 0.1% to five.25% to tame inflation, which peaked at 11.1% in late 2022. Whereas the Shopper Costs Index has since dropped again to 4%, it’s nonetheless twice the financial institution’s 2% goal.

Concerning the function financial coverage performed in controlling costs, Norman stated: “There’s a marginal impact, however inflation was pushed by world macro costs. It had no bearing on the value of fuel. It had no actual bearing on the value of meals.”

The feedback increase questions in regards to the central financial institution’s latest determination to carry charges at 5.25% and the effectiveness of BOE coverage within the trendy economic system. Price rises have change into more and more political in a 12 months by which there will likely be a basic election as rising borrowing prices have put householders beneath stress.

Prime Minister Rishi Sunak is hoping for early fee cuts to raise the economic system out of a shallow recession and increase the Conservatives’s electoral possibilities. Fellow lawmakers, anxious the ruling get together is trailing the Labour opposition by 20 factors in polls, are calling on the BOE to pivot towards decrease borrowing prices quickly.

Article content material

Commercial 3

Article content material

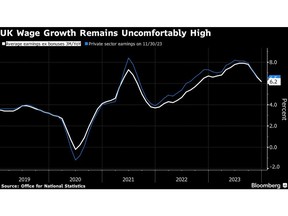

The BOE declined to remark. Nonetheless, the officers stay involved that the previous spike in costs is filtering by way of to wages and providers inflation, each of that are rising at over 6% — a degree incompatible with the two% goal.

Dave Ramsden, deputy governor for markets, final month stated fee hikes have been efficient. “The restrictive stance of financial coverage more and more weighed on exercise by way of 2023 and has led to a loosening within the labor market.”

Norman’s remarks recommend the BOE’s function in managing the economic system and inflation has been overstated.

“We most likely typically hearken to bit an excessive amount of to central bankers,” stated Norman, a former Tory member of Parliament who has been a number one determine within the UK retail trade for years. “The impression of upper rates of interest hasn’t actually materialized. Home costs have on the entire being extra sturdy than individuals thought.”

The BOE’s personal figures recommend greater charges increase the economic system greater than they restrain demand. A hike in charges prices generated extra revenue on the nation’s £1.7 trillion in financial savings than they add to the price of servicing the £1.5 trillion of mortgages within the brief time period.

Commercial 4

Article content material

“What we’ve proved within the final three years is that financial coverage is completely ineffective,” Norman stated. “Placing up rates of interest didn’t truly sluggish the economic system very a lot.”

His remarks feed right into a rising political debate in regards to the BOE’s dealing with of inflation and whether or not it ought to quickly pivot towards chopping charges in a bid to spice up development.

The impression of upper borrowing prices will overwhelm the tax cuts pushed thorough final week in Chancellor of the Exchequer Jeremy Hunt’s finances. The 4% lower in Nationwide Insurance coverage contributions he has introduced since November will save the typical employee simply £900.

By comparability, the financial institution warned in December that just below 5 million households face a mean £2,900 enhance of their annual mortgage fee as they roll off present offers between the June 2023 and the tip of 2026. Greater than 2 million should reset this 12 months.

Hunt acknowledged that “tackling inflation is painful” as a result of it “means greater rates of interest.” Labour has branded the price the Tory “mortgage timebomb.” Monetary markets anticipate the BOE to start out chopping charges within the second half of the 12 months.

Commercial 5

Article content material

The BOE has stated the massive strikes in inflation during the last two years have been largely past its management, pushed as an alternative by hovering pure fuel and meals costs after Russia invaded Ukraine. That and the pandemic disrupted provide chain disruptions all over the world. sending the value of products hovering.

Feedback by Ben Broadbent, the BOE’s outgoing deputy governor for financial coverage, has even echoed Norman’s declare that fee hikes have made little distinction to headline inflation. Broadbent advised members of Parliament on the Treasury Committee that inflation has been “transitory,” as central banks initially anticipated.

“That has confirmed to be the case,” Broadbent stated at a listening to final month. “A lot of the disinflation we’ve had — the truth is, all of it during the last 12 months — has been in tradeable costs, on power and tradeable items.”

BOE officers additionally imagine that the impression of upper charges on the economic system has nearly handed. Two thirds of the impression on customers and companies is already being felt, it estimates.

But these fee hikes have achieved little to rein in demand. Unemployment stays close to file lows, at 3.8%. The economic system dipped right into a shallow recession on the finish of 2023, contracting 0.5% within the ultimate two quarters, however is now believed to be rising. The deep stoop that the BOE forecast 15 months in the past if charges reached present ranges has not materialized.

Commercial 6

Article content material

Even the property market has been largely proof against greater borrowing prices. Home costs elevated 1.2% within the 12 months to February, based on mortgage lender Halifax. Transactions have fallen steeply as mortgages have change into more and more unaffordable, although.

John Neal, chief govt of Lloyd’s of London, the insurance coverage market, stated he was happy the period of near-zero rates of interest, which lasted 13 years, is over.

“We simply weren’t used to what an actual economic system seems to be and seems like,” Neal stated in an interview final month. “If the world’s about development and alternative, you’ll be able to’t run with zero charges and nil inflation. There isn’t any alternative. Nothing operates on that foundation.”

—With help from Andrew Atkinson.

Article content material