I do know, what concerning the Federal Reserve? We talked about this in Wednesday’s electronic mail, however I figured that I ought to take an additional minute or two of our time to provide some element.

SO, Jerome Powell and his band of merry Fed Governors will get collectively subsequent Wednesday to announce their resolution on rates of interest.

Will the Fed decrease rates of interest like so many customers need?

The reply is “NO.”

This week’s “heat” inflation reads all however locked the choice, no less than in my thoughts. Hell, there at the moment are some economists rolling out their takes that the Fed could enhance rates of interest.

They could possibly be proper over the subsequent few months if we see a development within the inflation knowledge revealing that inflation is coming again.

For now, don’t anticipate the Fed to do something with charges subsequent week, however the Fed assembly is way from a risk-free occasion. As a matter of reality, Jerome Powell has usually carried out extra harm along with his phrases in the course of the press convention than the Fed’s resolution on charges.

Right here’s what you need to watch – or hear – for subsequent week…

A change to the “increased for longer.”

Wall Avenue is caught-up on delicate modifications to language. Hear for something that may be a stronger derivation of the now well-known “increased for longer” to provide the true story on the place charges are going.

Hear for speak concerning the liquidity in banks.

This has become a heat button for the markets lately as one or two banks have disclosed waning capital. I feel any point out shall be to calm any fears which will stay from final March’s banking debacle.

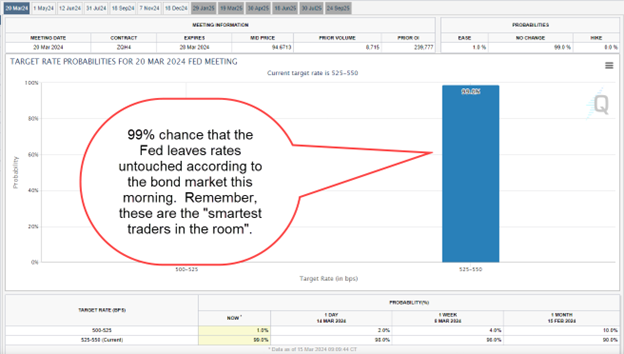

The true “knowledge” is within the Fed Funds futures.

This software exhibits that the futures market is pricing within the first price reduce on June 12, and even that may be a 50/50 proposition. This implies all hope – which the market was floating on just some months in the past – of a price reduce has been taken out of the market.

Backside Line

Subsequent Wednesday’s Fed assembly offers extra danger than reward for the market.

The technical and nostalgic backdrop of the market means that Jerome Powell and the Fed’s feedback should keep away from point out of any hawkish tone which will get traders pondering we gained’t see decrease charges till late summer time.

Any trace of the Fed’s willingness to get extra aggressive towards inflation will set off that wholesome we simply spoke about.

By submitting your electronic mail deal with, you’ll obtain a free subscription to Cash Morning and occasional particular presents from us and our associates. You may unsubscribe at any time and we encourage you to learn extra about our Privateness Coverage.

Concerning the Writer

Chris Johnson (“CJ”), a seasoned fairness and choices analyst with almost 30 years of expertise, is widely known for his quantitative experience in quantifying traders’ sentiment to navigate Wall Avenue with a deeply rooted technical and contrarian buying and selling type.