In one other life, I wrote course of administration software program for giant organizations within the authorities. These organizations had processes that “advanced” out of years of non-public relationships and big three-ring binders. (It wasn’t till that job that I realized Excel spreadsheets had limits to the rows and columns in a sheet!)

The processes had develop into extraordinarily tough to handle, with frequent errors, as a result of it was too difficult. It relied on reminiscence and relationships. The leaders of the organizations realized this and tasked us with fixing this drawback.

Each time we labored with a brand new group, our first job was to doc their processes. Then we simplified it. Then we constructed a course of administration package deal that helped them get higher visibility into their course of.

Once I checked out my very own private funds, I noticed I had the same problem.

I opened accounts every time I wanted them. I haphazard linked them. I signed up for financial institution promotions at each flip. I bought bank cards and threw outdated ones in a drawer in order that they wouldn’t harm my credit score rating. It was a large number.

Right now, my monetary basis seems well-designed. However it didn’t begin out that approach.

Like Michaelangelo famously mentioned in regards to the statue of David, you merely chip away all the pieces that isn’t the statue of David. Duh.

In order that’s what I did!

Right here’s how you are able to do the identical.

Desk of Contents

1. Draw Your Monetary Map

Earlier than you’ll be able to enhance something, you could know what you have got.

To perform this, we have to draw a Monetary Map:

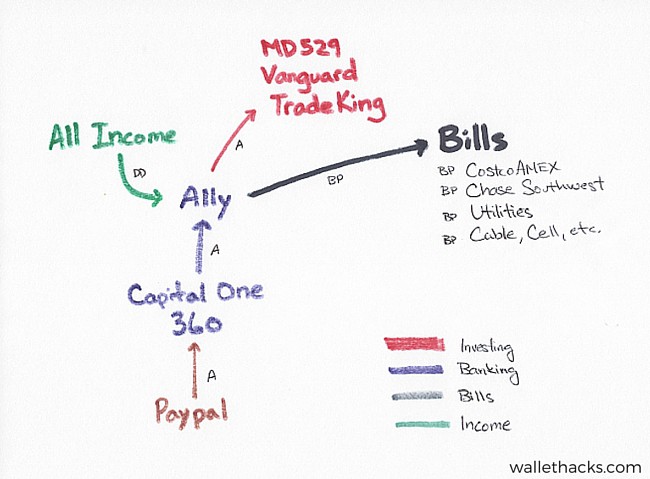

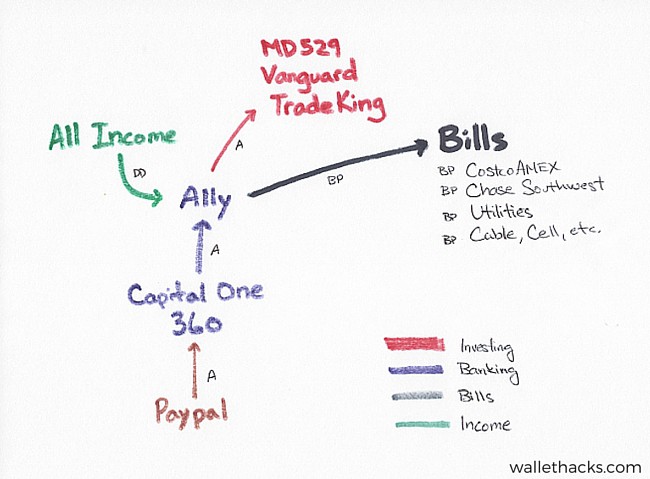

(this map is from years in the past – Tradeking was acquired by Ally in 2016 – thus serving to me simplify with out me having to do something!)

Step one is to draw your monetary map. A monetary map is a drawing of all of your monetary accounts and their relationships. It exhibits you which ones accounts are linked, by on-line hyperlinks that mean you can provoke transfers, the roles of every, and helps get that mannequin out of your head.

Within the map above, you’ll be able to see that my PayPal is linked to my Capital One 360 account with an A, which stands for ACH. PayPal can push cash to Capital One however Capital One can’t push it again. You may see that each one of our revenue flows into our Ally account, which acts as our hub.

It additionally identifies areas the place you have got accounts you don’t want and will even provide help to bear in mind accounts you’ve forgotten. So many situations of Lacking Cash are financial institution accounts folks neglect after they’ve moved.

2. Reshape Your Monetary Map

Your map might seem like a large number of arrows and circles. That’s OK.

Earlier than you simplify, you wish to arrange your system inside the present mess. It sounds counterintuitive however you’ll be chopping away accounts. You don’t wish to reduce and reconnect accounts on the similar time.

You wish to form your map with the tip end in thoughts. You do that in order that once you begin closing accounts, you don’t run into any issues with folks paying you otherwise you paying different folks, and many others.

In constructing your map, you need a checking account as your hub. In our case, all of our paychecks go into this hub account. All of our invoice funds are paid out of this account.

I like designating a single account because the hub so I can see all the pieces in a single place. You may go for no matter you’d like, however the result’s that these accounts are keepers.

3. Begin Closing & Consolidating Accounts

As soon as your hub is ready, and you’ll wait just a few months to make sure no new transactions happen in different accounts, however then you can begin closing accounts. There is no such thing as a value or penalty to shut a checking account.

With brokerage accounts, there could also be a value for an account switch. The system is named ACATS, which stands for Automated Buyer Account Switch Service, and a few brokers cost a small charge to switch accounts. This lets you switch property as property, moderately than liquidating them and transferring the money. A switch may be higher since there are often no tax implications. When you promote, there’s a taxable occasion. (many brokers will supply a new account bonus to assist offset this value)

When you’ve got 401(okay) plans at earlier employers, you could want to roll them over right into a Rollover IRA. They’re identical to a 401(okay) from a tax perspective, you often get numerous choices. Listed here are what it’s best to contemplate when rolling over a 401(okay). And in case you are intimidated by the method, a service like Capitalize will help you however you’ll be able to simply do that your self.

You don’t need to cancel or switch all the pieces directly. You may decide to do the simple stuff first, like financial institution accounts, and push off the extra concerned ones, like brokerages, till later.

As for bank cards, you have got just a few choices when you’re involved about your credit score rating. When you intend to want your rating (purchase a home, automotive, and many others.), don’t do something with it simply but. When you personal a automotive and personal a home, with no close to time period mortgage wants, you’ll be able to take a small hit by closing a bank card. Go for the newer ones first, so you retain the typical historical past as excessive as doable, or the smaller credit score limits, so you retain your utilization down.

Here’s a information on the best way to safely shut a bank card.

I like to recommend utilizing just one or two bank cards. Preserve your life easy. The additional benefit of a 3rd, fourth, or fifth card is never value it. You may stick the remaining in a desk drawer when you’re involved a few decrease rating from canceling.

Lastly, when you do cancel playing cards, ensure you improve the credit score limits of the others to restrict the harm.

4. Redraw & Enhance Your Monetary Map

When you’ve pared away a few of the fats, redraw your map and take into consideration the way you may enhance it.

I don’t like making an attempt to enhance a course of whereas I’m simplifying it as a result of you may get caught within the weeds. It might be tempting to attempt to tweak issues right here and there however all that point you spend researching might decelerate the simplifying course of.

The one exception to that is when you determine to pick out a brand new checking account hub. When you’ve been utilizing a brick-and-mortar financial institution with a ridiculously low-interest price (all of them supply horrid charges), change to an on-line financial institution that pays extra curiosity.

5. Replace Your “Treasure Map”

I’ve a doc known as a “Treasure Map” that explains all of our accounts, why they exist, and the place they are often discovered. The aim of the map is to elucidate our monetary system within the occasion I can’t.

When you don’t have one but, I like to recommend you create one. The doc is easy, creating it may well take a while relying on how difficult your monetary life is!

By going by this train, you might be basically justifying every account to an imaginary third celebration. You’ll rapidly be taught which accounts matter and which may be eliminated, which will help you within the simplification course of.

6. Automate As A lot As You Can

After your monetary map has been decluttered, you could automate as a lot as you’ll be able to. A easy system is nice. A easy system the place you’ve automated as a lot as you’ll be able to is even higher.

I automate my saving, by organising computerized transfers wherever they should go, and I automate my invoice pay.

I do that for month-to-month payments, like my utilities, in addition to my bank card funds. We don’t carry a stability and our month-to-month stability is roughly the identical (I monitor transactions so I don’t get shocked), so that is routine for us. I don’t have to log into my checking account and pay a utility invoice or a bank card. That’s simply one other factor to neglect.

The one payments I pay manually are people who I solely see yearly, like a heating oil supply or propane supply. Every thing else is computerized.

7. Digitize Your Information

My submit on the best way to arrange your monetary paperwork offers a step-by-step information to the best way to arrange the mass of paper you could be getting out of your monetary establishments, however the important thing guidelines are easy.

- Digitize all the pieces. (go for digital statements every time doable)

- Preserve the unique if it authorities issued, notarized, private property, tax or mortgage associated. Shred the remaining.

99.9% of the paper you get is ineffective. And that’s after you join paperless/digital statements.

I scan it if I can’t obtain it and I preserve the unique if the unique can be actually laborious to get.

I don’t assume I’ve ever wanted a lot of the paper paperwork I’ve obtained.

8. Lower Companies You Don’t Want

As you drew your monetary map or automated your invoice pay, you in all probability noticed some providers you had been paying for. Think about simplifying your life by chopping these away.

By lowering these bills, you cut back one different factor to fret about, you save slightly extra cash, and your funds are just a bit extra streamlined to what you need.

It will probably seem to be a unending course of, that’s OK, simply preserve at it and your life will get simpler and simpler.

What’s going to you do subsequent to simplify your funds?