Phrases apply to American Specific advantages and gives. Enrollment could also be required for choose American Specific advantages and gives. Go to americanexpress.com to be taught extra.

I like speaking about journey bank cards. They’ve helped me journey the world for over a decade and saved me a fortune in flights, inns, and different journey perks. I by no means become bored with evaluating their perks, making use of for brand spanking new playing cards, and optimizing my advantages.

As of late, relating to journey rewards playing cards, there are usually two varieties that get quite a lot of consideration: playing cards with low or no annual charges which can be good for inexperienced persons; and premium playing cards for the jet set crowd, with their excessive charges and luxurious perks.

There aren’t too many playing cards that fall in between. At present I wish to speak about a card that does: the American Specific® Gold Card.

Whereas it’s a favourite amongst avid factors and miles collectors, it typically will get disregarded of the bigger dialog. I feel that’s a mistake, as this card has rather a lot to supply.

The Amex Gold lately bought a refresh and an elevated welcome provide, making it a wonderful time to contemplate this powerhouse of a card. I personally suppose it’s a card extra vacationers ought to have of their pockets and it’s one I take advantage of.

Right here’s every little thing it’s essential know concerning the Amex Gold that can assist you determine if it’s best for you:

What’s the American Specific® Gold Card?

The American Specific® Gold Card is a card issued by American Specific. I feel it’s a terrific selection for vacationers who get pleasure from eating out, as you’ll earn extra factors eating at eating places (as much as $50,000 on these purchases per calendar yr), in addition to a ton of assertion credit in the identical vein (I’ll get into specifics beneath).

With this card, you’ll earn Membership Rewards® factors, which you’ll be able to switch to any of their 21 airline and lodge companions (they’ve some strong companions too).

This card gives:

- Earn 60,000 Membership Rewards® Factors after you spend $6,000 on eligible purchases in your new Card in your first 6 months of Card Membership. Plus, obtain 20% again in assertion credit on eligible purchases made at eating places worldwide throughout the first 6 months of Card Membership, as much as $100 again. Restricted time provide. Supply ends 11/6/24.

- Earn 4x Membership Rewards factors per greenback spent on purchases at eating places worldwide, on as much as $50,000 in purchases per calendar yr, then 1x factors for the remainder of the yr

- Earn 4x Membership Rewards factors per greenback spent at U.S. supermarkets on as much as $25,000 in purchases per calendar yr, then 1x factors for the remainder of the yr.

- Earn 3x Membership Rewards factors per greenback spent on flights booked instantly with airways or on AmexTravel.com

- Earn 2x Membership Rewards factors per greenback spent on pay as you go inns and different eligible purchases booked on AmexTravel.com

- Earn 1x Membership Rewards level per greenback spent on all different eligible purchases.

- As much as $524 value of assertion credit (which I’ll break down beneath)

- No international transaction charges

The cardboard comes with a $325 annual price (See Charges and Charges).

Breaking Down the Amex Gold’s Assertion Credit

American Specific is thought for providing quite a lot of perks and advantages with its playing cards (that’s why I like their playing cards). As I discussed, this card comes with as much as $524 value of assertion credit. Should you can make the most of them, that’s greater than sufficient to offset the annual price. Since there are such a lot of credit (all with their very own tremendous print), I wish to break each down.

As much as $120 in Uber Money

That is most likely the simplest profit for most individuals to make use of. While you add your Gold Card to the Uber app, you’ll get $10 in Uber Money distributed every month, (including as much as $120 over the course of the yr). You should use it for rides or to order meals via Uber Eats, although I don’t love you can solely use it within the U.S. since I’m typically on the highway.

Earlier than your buy, guarantee that Uber Money is toggled on as a cost methodology, after which after your buy you’ll see the credit score deduction in your in-app receipt.

You could have downloaded the newest model of the Uber App and your eligible American Specific Gold Card have to be a way of cost in your Uber account. The Amex profit might solely be utilized in United States.

As much as $120 Eating Credit score

On the flip aspect, I discover this profit a bit tougher to make use of. You may earn as much as $10 in assertion credit month-to-month while you pay with the Amex Gold Card at Grubhub, The Cheesecake Manufacturing unit, Goldbelly, Wine.com, and 5 Guys. I feel it’s type of a random assortment of firms, however in the event you use any of those firms typically, that’s one other $120 per yr proper there.

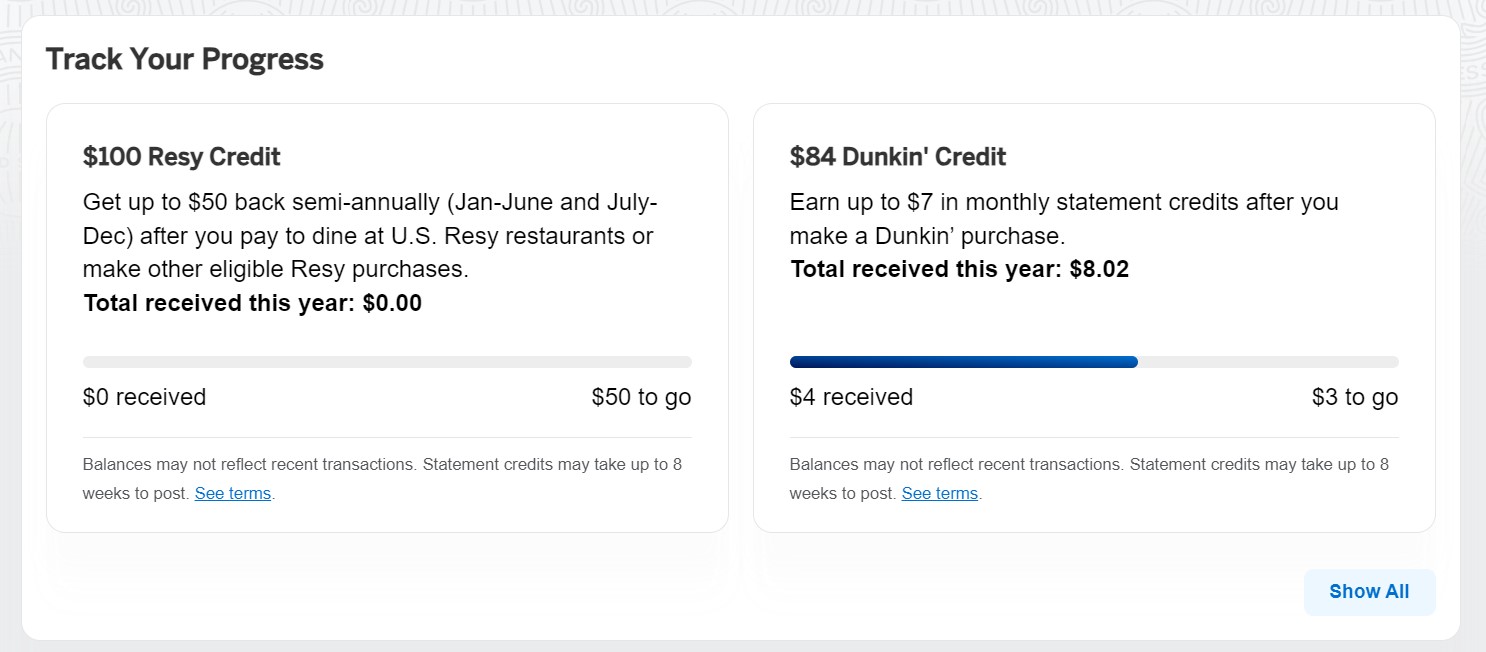

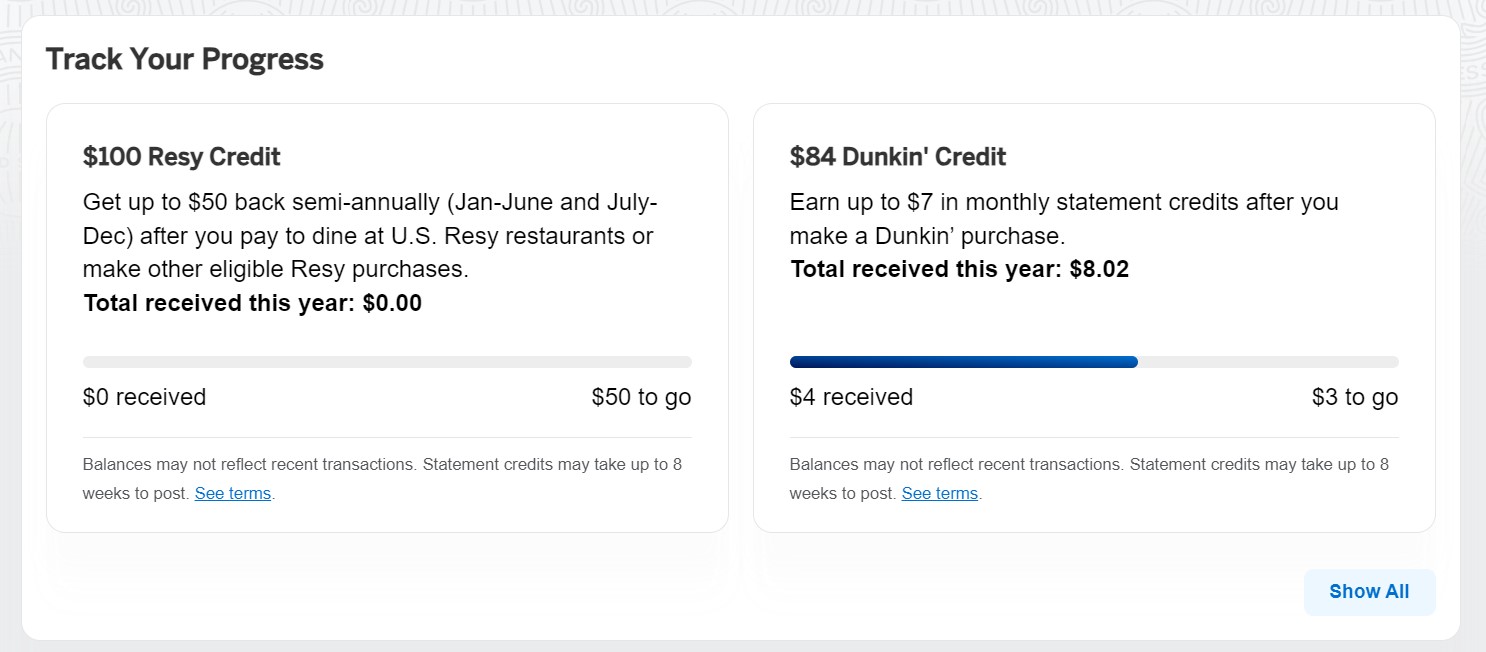

As much as $84 Dunkin’ Credit score

This profit was added with the cardboard’s latest refresh. Should you’re a fan of Dunkin’, with this credit score you may earn as much as $7 in month-to-month assertion credit after you enroll and pay along with your Amex Gold Card at Dunkin’ places. Since most are on the U.S. East Coast (New York, New Jersey, Connecticut, and Florida have probably the most places), it’ll be most helpful to fellow East Coasters.

As much as $100 Resy Credit score

That is one other profit that was lately added. Resy is a restaurant-reservation web site (owned by Amex) the place you can also make reservations at over 16,000 eating places around the globe.

With the Resy credit score, you may rise up to $100 in assertion credit every calendar yr after you pay along with your Gold Card to dine at U.S. Resy eating places (or make different eligible Resy purchases). In contrast to many of the card’s different assertion credit, this profit is rolled out semi-annually, which means you rise up to $50 credit score within the first half of the yr, after which the opposite $50 the second half. You may also test your progress within the app or web site:

I like semi-annual assertion credit as a result of they offer you a bit extra flexibility, though that is one other credit score that’s pretty simple to make use of in the event you dine out regularly. You don’t really need to make a reservation with Resy; the restaurant simply wants to supply Resy reservations. It’s best in the event you reside in or regularly go to a serious metropolis that has quite a lot of eating places on Resy.

As much as $100 lodge expertise credit score

That is the cardboard’s solely journey assertion credit score. With this profit, you may obtain a $100 credit score in direction of eligible expenses with each reserving of two nights or extra via AmexTravel.com. Eligible expenses differ by property, however it might embrace eating credit (like complimentary breakfast) or spa therapies.

Enrollment is required for choose advantages talked about on this part.

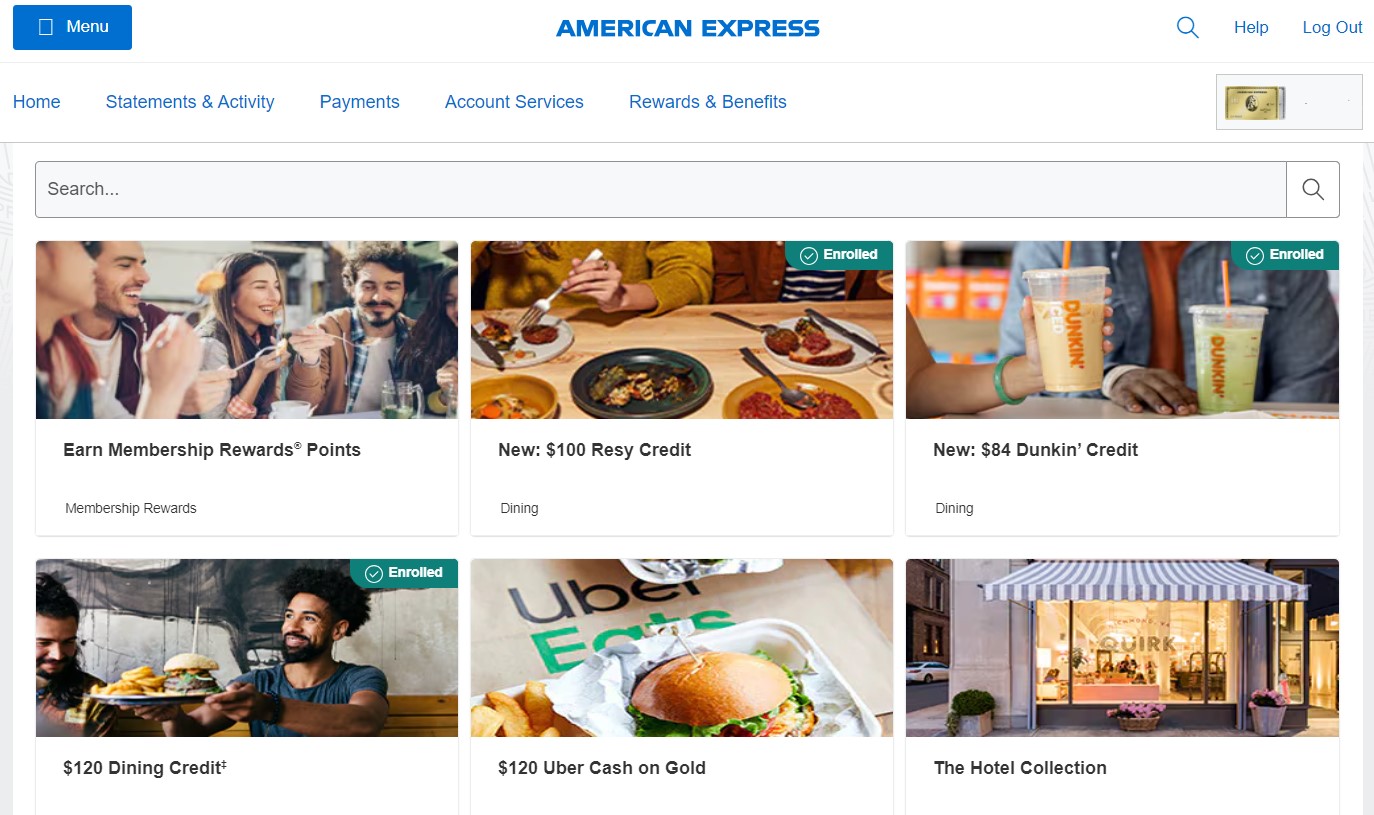

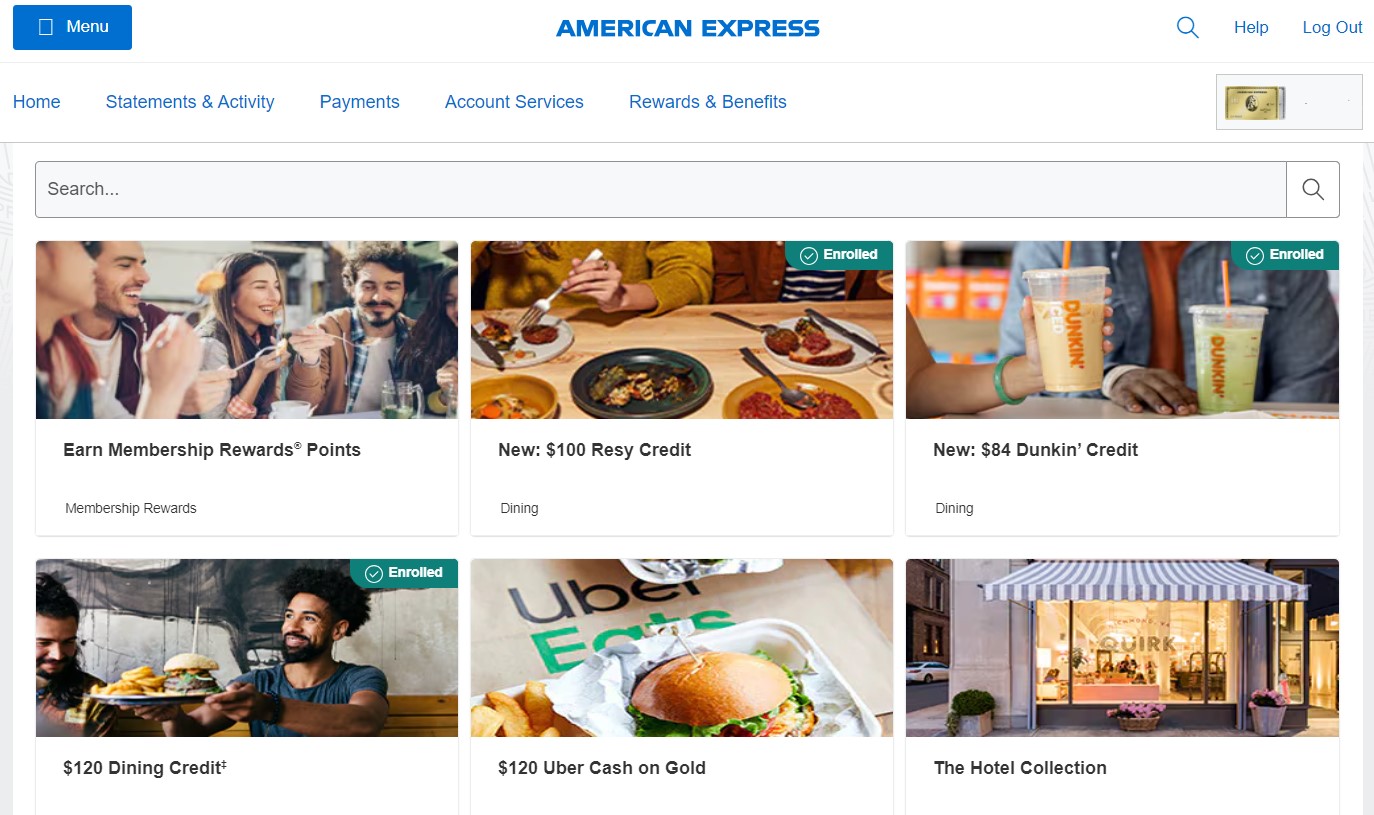

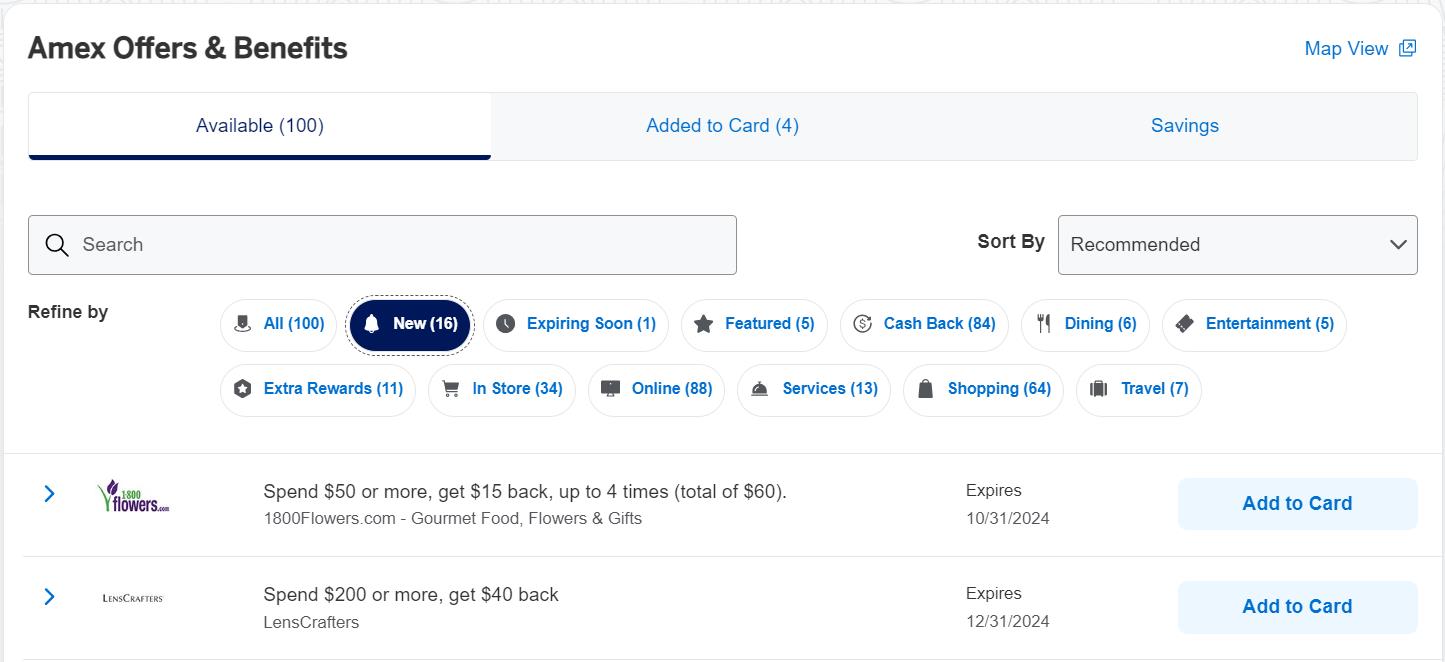

Entry to Amex Presents

Along with all these assertion credit, by holding an American Specific card you get entry to Amex Presents. These are ever-changing gives the place it can save you cash or earn bonus factors with choose retailers. The gives are focused, so each cardholder has their very own distinctive array of gives at any given time.

Amex Presents are structured like this:

- Spend X, get Y quantity again (like within the screenshot above; this is almost all of Amex Presents)

- Spend X, get Y variety of bonus factors

- Get extra Membership Rewards factors per greenback you spend at that retailer (i.e. get 5 MR factors per greenback you spend at The Hole)

- Get X% again while you use the hyperlink supplied

It’s necessary to know that it’s a must to hit that “Add to Card” hyperlink earlier than you may make the most of every provide. When you most likely received’t have the ability to make the most of most gives, typically you could, which is one other approach to recoup the annual price on this card. It’s value it to test again every now and then so you may add any gives to your card that you simply may use (simply keep in mind to pay along with your Gold Card to redeem the provide).

Utilizing Your Membership Rewards Factors

With the American Specific® Gold Card, you earn Membership Rewards factors. To get probably the most out of your factors, you’ll wish to switch them to one in all Amex’s journey companions:

- Aer Lingus AerClub (1:1 ratio)

- Aeromexico Rewards (1:1.6 ratio)

- Air Canada Aeroplan (1:1 ratio)

- Air France-KLM Flying Blue (1:1 ratio)

- All Nippon Airways Mileage Membership (1:1 ratio)

- Avianca LifeMiles (1:1 ratio)

- British Airways Govt Membership (1:1 ratio)

- Cathay Pacific Asia Miles (1:1 ratio)

- Alternative Privileges® (1:1 ratio)

- Delta SkyMiles (1:1 ratio)

- Emirates Skywards (1:1 ratio)

- Etihad Visitor (1:1 ratio)

- HawaiianMiles (1:1 ratio)

- Hilton Honors (1:2 ratio)

- Iberia Plus (1:1 ratio)

- JetBlue TrueBlue (250:200 ratio)

- Marriott Bonvoy (1:1 ratio)

- Qantas Frequent Flyer (1:1 ratio)

- Singapore KrisFlyer (1:1 ratio)

- Virgin Atlantic Flying Membership (1:1 ratio)

Most transfers are prompt, although a number of (like Iberia and Cathay Pacific) can take as much as 48 hours.

You may also use your Membership Rewards factors to e book flights and inns in Amex Journey, the journey portal. Although, as I’ve talked about earlier than, this isn’t the very best use of your factors. I usually wouldn’t do it.

American Specific Welcome Bonus Restrictions

In contrast to different firms (like Chase), American Specific solely means that you can earn a welcome bonus as soon as per card. Ever. Plus, you may’t earn a welcome bonus on a card in any respect if you have already got (or have held) the next tier card in the identical household.

For the Amex Gold Card, meaning you received’t have the ability to get the welcome provide if you have already got The Platinum Card® from American Specific.

I’m mentioning this as a result of it’s necessary to consider if you wish to get different Amex playing cards finally. Because of this for American Specific playing cards, it’s greatest to open playing cards transferring up within the meals chain, so to talk (so get the Gold Card earlier than the Platinum Card).

Professionals of the Amex Gold

- Excessive incomes charges at eating places, US supermarkets, and on flights (when booked instantly or via AmexTravel)

- A lot of assertion credit

- Entry to Amex Presents

Cons of the Amex Gold

Who’s the Amex Gold for?

The primary draw of this card is having the ability to earn 4x factors on eating places worldwide and U.S. supermarkets. It stands alone in that side amongst playing cards with transferable factors (probably the most precious type of factors). In case you are a foodie that may make use of the credit and different perks, then you definately’ll love this card.

Should you’re an avid traveler, this card is greatest used together with different playing cards (relatively than as the one card in your pockets). It could pair nicely with one other card that earns 3x on all journey and has extra strong journey advantages (such because the Chase Sapphire Most popular® Card or the Chase Sapphire Reserve®). Plus, you’ll diversify your rewards into two of probably the most precious factors currencies: Amex’s Membership Rewards and Chase’s Final Rewards.

As with all bank card, you shouldn’t get this card in the event you’re already carrying a stability or plan to hold a stability. Rates of interest for journey bank cards are notoriously excessive, and this card is not any completely different. The factors simply aren’t value it in the event you’re paying curiosity every month.

This card can also be not for anybody with poor credit score, as you want glorious credit score to qualify. (If that’s you, take a look at greatest bank cards for adverse credit so you can begin enhancing your rating immediately.)

Should you’re a foodie like me and spend a good portion of your price range on meals, the American Specific® Gold Card is a good card so as to add to your pockets. By racking up extra factors at eating places around the globe and U.S. supermarkets, you need to use the spending that you simply already do to earn your self flights and lodge stays around the globe. And that’s what it’s all about!

E book Your Journey: Logistical Ideas and Tips

E book Your Flight

Discover a low-cost flight through the use of Skyscanner. It’s my favourite search engine as a result of it searches web sites and airways across the globe so that you all the time know no stone is being left unturned.

E book Your Lodging

You may e book your hostel with Hostelworld. If you wish to keep someplace aside from a hostel, use Reserving.com because it persistently returns the most cost effective charges for guesthouses and inns.

Don’t Neglect Journey Insurance coverage

Journey insurance coverage will shield you in opposition to sickness, harm, theft, and cancellations. It’s complete safety in case something goes flawed. I by no means go on a visit with out it as I’ve had to make use of it many occasions previously. My favourite firms that supply the very best service and worth are:

Wish to Journey for Free?

Journey bank cards will let you earn factors that may be redeemed without spending a dime flights and lodging — all with none additional spending. Try my information to selecting the correct card and my present favorites to get began and see the newest greatest offers.

Want Assist Discovering Actions for Your Journey?

Get Your Information is a big on-line market the place you will discover cool strolling excursions, enjoyable excursions, skip-the-line tickets, personal guides, and extra.

Able to E book Your Journey?

Try my useful resource web page for the very best firms to make use of while you journey. I record all those I take advantage of once I journey. They’re the very best at school and you’ll’t go flawed utilizing them in your journey.