Are the “Mega-Cap” shares lifeless? Perhaps. However there are 4 explanation why they might be staged for a comeback. The latest market correction from the July peak actually received buyers’ consideration and rattled the extra excessive complacency. As we famous beforehand:

“Whereas there have actually been extra prolonged durations out there with no 2% decline, it’s important to keep in mind that low volatility represents a excessive “complacency” with buyers. In different phrases, the longer the market strikes larger with no vital correction, the extra assured buyers develop into. They reply by elevating their allocations to equities (threat) and decreasing their allocations to money (security).”

As repeatedly mentioned in June and July, a 5-10% correction is regular and happens nearly yearly.

“Traditionally, when the 37-week fee of change is larger than 30%, such occasions sometimes precede brief—to intermediate-term corrections. Whereas the bulls are very assured, the danger of a 5% to 10% correction over the following three months stays elevated.” – July thirteenth

Unsurprisingly, retail {and professional} buyers have witnessed a extra excessive quantity of promoting of large-cap positioning during the last three weeks.

“The degree of de-grossing by some methods, alongside the correlated drawdowns in alpha / crowding efficiency, means that we might be principally finished with the drawdown and de-grossing. Nonetheless, efficiency/alpha/gross flows may stay uneven over the following few months.” – John Schlegel, JPM

As John notes, the query is whether or not the correction course of is over and whether or not buyers will return to the “mega-caps” of their portfolios.

4-Causes Mega-Caps Are Not Useless But

The latest sell-off in “Mega-cap” shares, specifically, is unsurprising. We’ve warned about buyers crowding into comparatively few shares to chase market returns.

“The bifurcation between the highest 10 corporations, as measured by market capitalization, and the opposite 490 shares within the index has created an phantasm of market bullishness. Regardless of the extraordinarily crowded commerce into the three sectors comprised of these ten shares, we proceed to see skilled buyers crowd into these shares at a report clip.”

There are 4 (4) explanation why buyers, each skilled and retail, had been chasing a handful of shares. They’re additionally the identical causes that “Mega-caps” will possible regain their favor.

First, these shares are extremely liquid, and managers can shortly transfer cash into and out with out vital worth actions. The significance of liquidity can’t be missed for insurance coverage corporations, pensions, hedge funds, and endowments. These buyers should transfer thousands and thousands of {dollars} at a time, and small corporations aren’t liquid sufficient for sizeable inflows and outflows.

Secondly, the passive indexing impact has not gone away. As buyers change their investing habits from shopping for particular person shares to the convenience of buying a broad index, capital inflows unequally shift into the biggest capitalization shares within the index. During the last decade, capital inflows into exchange-traded funds (ETFs) have exploded.

As we mentioned in “Profession Threat,”

“The highest-10 shares within the S&P 500 index comprise greater than 1/third of the index. In different phrases, a 1% achieve within the top-10 shares is identical as a 1% achieve within the backside 90%. As buyers purchase shares of a passive ETF, the shares of all of the underlying corporations should get bought.“

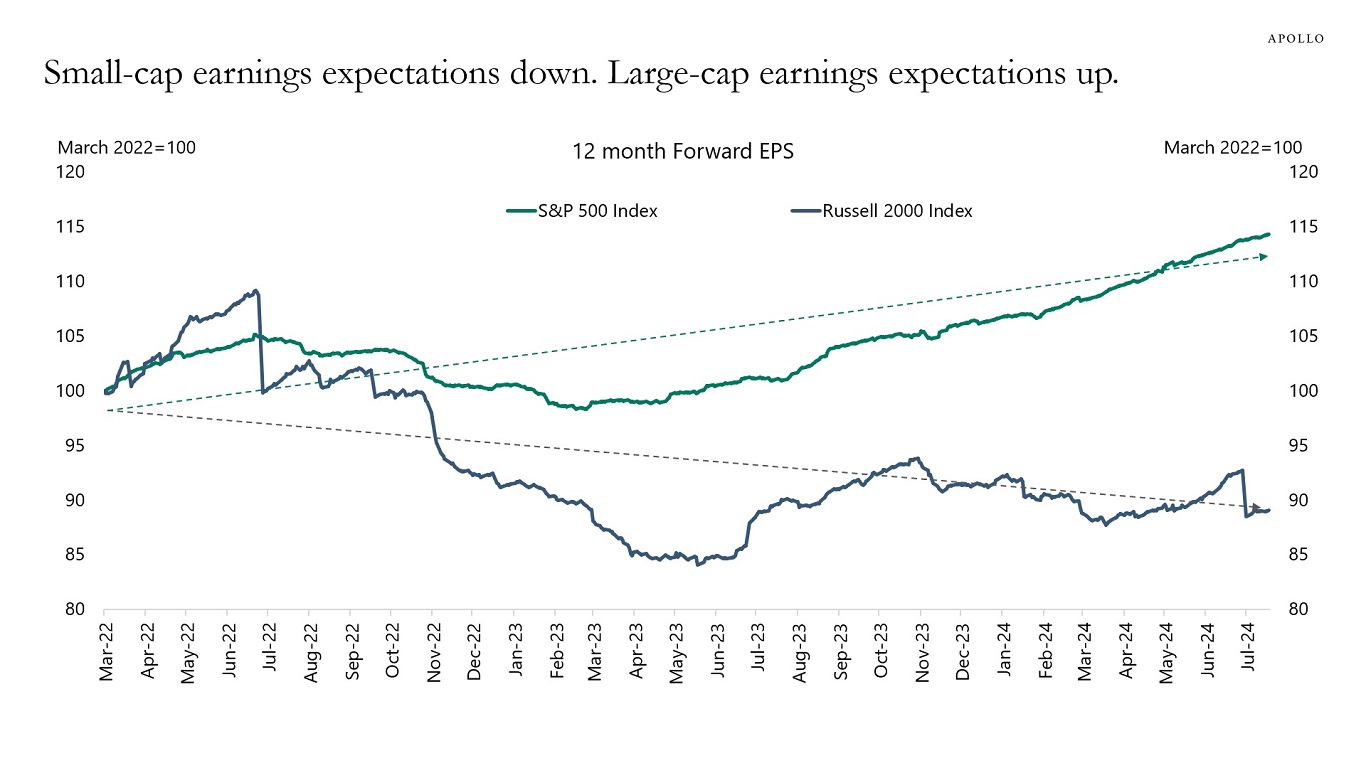

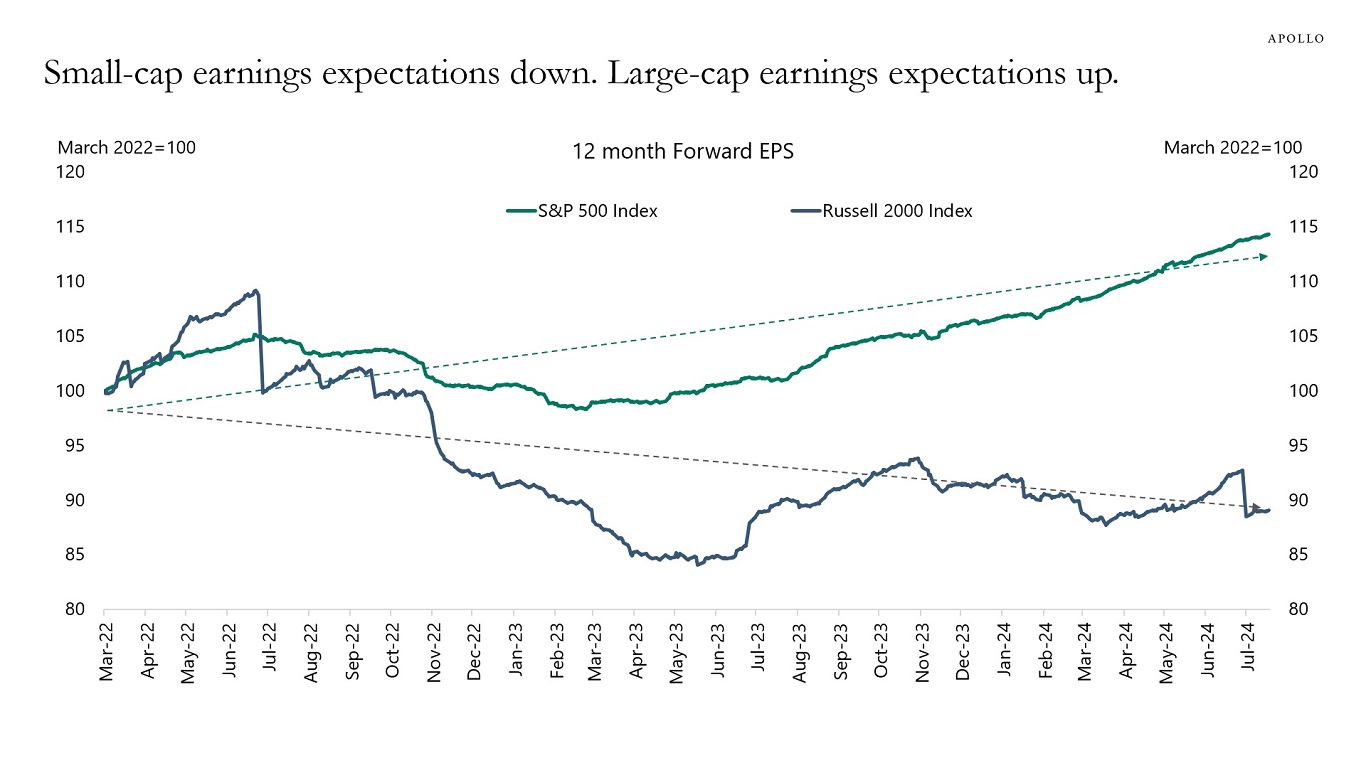

Third, the “Mega-cap” corporations have extra substantial earnings development than their small—and mid-cap brethren. For now, the large-cap, primarily the “Mega-Cap” corporations, are driving many of the earnings development. With the financial system displaying clear indicators of decay, earnings of small and mid-cap corporations stay essentially the most weak to modifications in financial demand.

Lastly, and doubtless most importantly, large-cap, predominantly “Mega-cap” corporations have interaction in share repurchases rather more than small and mid-caps. Company share buybacks will method $1 trillion this 12 months and exceed that in 2025, with Apple alone accounting for greater than 10% of these purchases.

As we famous beforehand, this isn’t an insignificant issue supporting the rise in asset costs. Since 2000, company share buybacks have offered 100% of all of the “internet fairness purchases.”

Subsequently, it needs to be unsurprising that there’s a excessive correlation between the ebbs and flows of company share buybacks and market efficiency.

With earnings season principally behind us, the “buyback window” for the biggest corporations is now open. Such will enable the “Mega-caps” to start out repurchasing shares.

Nonetheless, whereas the help for the “Mega-caps” stays, the present correction course of is probably going incomplete.

Correction Is Doubtless Not Over But

So are “Mega-Caps” possible changing into a “mega-buy?” That could be stretching it a bit, however what is probably going is that the latest underperformance is probably going close to its conclusion.

From a purely technical perspective, the “Mega-Cap” shares have witnessed a pointy contraction over the previous couple of weeks. Utilizing the Vanguard Mega Cap Development ETF (MGK) as a proxy for the biggest corporations, the latest correction has reversed many of the earlier overbought and prolonged situations.

MGK is oversold on a number of ranges, and the MACD indicator is nicely beneath zero, which has beforehand coincided with short-term market bottoms. Moreover, MGK examined and held the 200-DMA, which was additionally the bottom in October 2023. Nonetheless, whereas technically oversold, many buyers are “trapped” by the latest decline, so we’ll possible see some “promoting strain” as they give the impression of being to exit, which might arrange a retest of the 200-DMA earlier than the correction is full.

MGK already accomplished an preliminary 38.2% correction degree utilizing a Fibonacci retracement sequence from the latest excessive. Whereas the 200-DMA is offering preliminary help to MGK, a failure of that help would deliver a 50% retracement degree into focus. Such would align with the lows of the April correction.

Given the short-term oversold situations and the decline in sentiment, the reflexive bounce within the “Mega-Caps” we noticed final week was unsurprising. Nonetheless, as we advised, given such a pointy rotation from latest highs, it could solely be a “tactical buying and selling alternative” earlier than the completion of the correction course of. It’s because “bullish sentiment” stays elevated, traditionally not what’s seen at corrective lows.

We suspect that whereas we may see an oversold bounce following the latest sell-off, “trapped longs” will possible use any such alternative to exit positions. Subsequently, we recommend the next guidelines for no matter comes subsequent.

The Guidelines

The principles are easy however efficient.

- Increase money ranges in portfolios.

- Cut back fairness threat, notably in areas extremely depending on financial development.

- Add or improve the length of bond allocations, which are likely to offset threat throughout recessionary downturns.

- Cut back publicity to commodities and inflation trades as financial development slows.

If an additional correction happens, the preparation lets you survive the affect. Defending capital will imply much less time spent getting again to breakeven afterward. Alternatively, it’s comparatively straightforward to reallocate funds to fairness threat if the market reverses and resumes its bullish pattern.

Investing during times of market uncertainty may be tough. Nonetheless, you’ll be able to take steps to make sure that elevated volatility is survivable.

- Have extra emergency financial savings, so you aren’t “pressured” to promote throughout a decline to satisfy obligations.

- Prolong your time horizon to 5-7 years, as shopping for distressed shares can get extra distressed.

- Don’t obsessively examine your portfolio.

- Think about tax-loss harvesting (promoting shares at a loss) to offset these losses towards future positive aspects.

- Keep on with your investing self-discipline no matter what occurs.

If I’m appropriate, and this present corrective course of is incomplete, the danger discount will decrease portfolio volatility. Nonetheless, if I’m fallacious, we are able to reallocate to equities and rebalance our portfolios for development as wanted,

Observe your course of.

Publish Views: 512

2024/08/13