In the event you personal a debit or a bank card, you should have used it at an ATM or a POS. Nonetheless, not being vigilant throughout ATM withdrawals or POS transactions can pose the chance of a card fraud known as skimming. Learn on to learn the way to guard your playing cards from skimming frauds.

Currently, it has grow to be a lot simpler to hold out monetary transactions utilizing your debit playing cards and bank cards. Nonetheless, with development in expertise, fraudulent methods to dupe individuals are additionally on the rise. Amongst many prevalent monetary frauds, bank card skimming is kind of frequent nowadays. This fraud entails stealing a person’s card data through an ATM or a POS machine at gas stations, service provider shops and so on., utilizing a skimmer – a small gadget connected to the cost terminal.

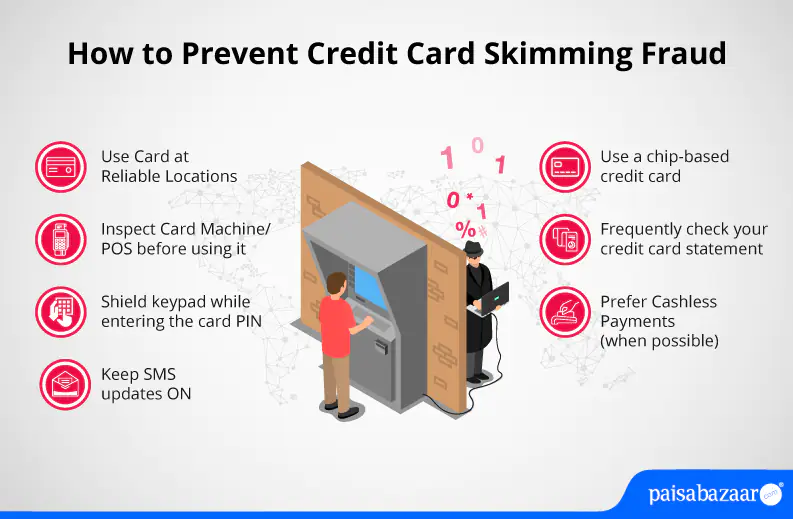

Due to this fact, it’s important that card customers stay vigilant and cautious of such incidents even when utilizing their card for normal objective. Bank card skimming can simply be averted by paying little consideration, in any other case it might result in monetary loss that you just won’t even concentrate on instantly. On your assist, we have now lined vital particulars on bank card skimming that will help you perceive what it’s and the way it may be averted.

What’s Credit score Card Skimming?

Bank card skimming is a monetary fraud the place scammers set up a tool on card terminals of ATM and PoS to extract the consumer’s card data. The skimming units are put in in a means that they seem like components of a machine and are troublesome to identify. These document your card data by studying the magnetic strip to derive data like full title, bank card quantity, Cvv and expiry date. Moreover, a small digicam may also be put in close to the keyboard to document your card PIN as you enter it.

To keep away from the bank card skimming fraud, you’ll be able to guarantee the next:

Use your Card at Dependable Areas

To safeguard your bank card from knowledge skimming, guarantee utilizing your card at ATMs positioned inside financial institution branches or at well-lit areas which might be beneath CCTV surveillance cameras. These areas are much less more likely to have tinkered machines, thereby are comparatively protected and safe than these positioned at remoted or shady areas. Equally, for PoS transactions use your card at dependable and approved retailers and shops at prime areas, as a substitute of distant areas or with uncertified retailers. Additionally, be sure that the cardboard is swiped for the precise quantity as your transaction worth, in your presence and isn’t taken away out of your sight.

Study the ATM/PoS

Earlier than utilizing the cardboard for money withdrawal at an ATM or for a service provider cost at a PoS, it’s advisable to examine the machine fastidiously. Right here, attempt to search for seen indicators of tampering if any, resembling unfastened, broken or damaged components, uncommon or haywire units, wires and extension, or for something that feels inappropriate or out of order. If something is ill-suited or improper, you should instantly change to a special mode of cost like UPI or money.

Defend your Card PIN

Simply as it is best to shield your card PIN from fraudsters over pretend calls, you must also shield it whereas bodily coming into it at an ATM or PoS. It’s higher to protect the keypad by masking it together with your fingers. This may avert hidden cameras to document the keypad, and thereby your entered PIN. Moreover be sure that the individual subsequent in line is standing removed from you, in order that the PIN just isn’t seen to her or him.

Change to Contactless Funds

Bank cards now include the ‘contactless’ function the place you may make transactions as much as Rs. 5,000 with out coming into the cardboard PIN. Thus, eliminating the necessity to present your card to the POS machine. Due to this fact, choosing contactless funds enhances safety by shielding the cardboard from skimming fraud, since no contact with the machine limits the info theft through skimming units.

Use a Chip-based up to date Credit score Card

Bank card issuers now supply chip-based bank cards that include enhanced safety compared to the beforehand issued magnetic strip bank cards. Thereby, to keep away from probabilities of knowledge skimming guarantee utilizing an up-to-date bank card that’s function loaded with newest safety and security measures.

Regulate the Card Statements

Usually preserving a examine in your card assertion and transaction historical past will aid you determine and spot any counterfeit transaction executed in your card. In the event you acknowledge something inappropriate or false, you’ll be able to instantly contact your card issuer for resolving it or can take applicable measures to protect your card from such transactions in future.

Preserve SMS Updates ON

Whereas preserving your card assertion in examine is a wholesome monetary apply, typically it may very well be tedious particularly with a busy schedule. Thereby, to keep away from fraudulent transactions and delayed rectification, it’s higher to maintain SMS updates ON on your card. This may aid you observe your card transactions feasibly. Thus, serving to you to determine frauds instantly.

Frequent Locations to be Cautious of Credit score Card Skimming Fraud

Gas Stations, Service provider Retailers & Eating places: Bank card skimming at these locations might occur when making cost through a POS machine. Skimmers may very well be put in on the card insertion tab or a synthetic keypad may very well be positioned over the unique one to document your keystrokes.

ATM Machines: When withdrawing money be cautious of skimmers put in on the ATM machines on the card slots or a small digicam positioned over the key phrase to document your card PIN. At ATMs, even be cautious of shoulder browsing, and be sure that the subsequent individual in queue doesn’t see your card particulars on the display screen or the PIN once you enter it.

Penalties of Credit score Card Skimming

Unsolicited Loans: Utilizing your card particulars, a fraudster can duplicate a bank card account after which can increase an unsolicited mortgage request in opposition to your bank card in your title.

Unauthorized Purchases: Scammers may also make unauthorized purchases on-line utilizing your card particulars if they’ve what is required to make a card transaction- card quantity, CVV, expiry date, title on the cardboard and PIN.

Clone Credit score Card: Utilizing the cardboard data, fraudsters may also create a replicated clone bank card and may use it for making offline purchases throughout retailers and retail shops. The small print can be shared with third events, who can additional misuse it.

What to do if Knowledge Skimming Occurs in your Credit score Card?

In case you discover an unauthorized transaction in your bank card assertion it should instantly be reported to the cardboard issuer. Usually, bank cards include covers like zero misplaced card legal responsibility, credit score protect cowl and so on, thus, reporting fraudulent incidents to issuers inside the stipulated time will help you get a rational decision.

Chances are you’ll contact your issuer through contacting the bank card buyer care heart, out there on the issuer’s web site or in your card assertion. You may also resort to SMS banking numbers for blocking your card or for speedy fraud decision. For reporting frauds, guarantee preserving vital particulars helpful resembling date and time of the involved transaction, Location of the transaction, quantity, and card particulars.

Paisabazaar Pockets Defend

With the rise in bank card utilization and sadly a corresponding rise in digital frauds, it has grow to be vital to guard your card from potential frauds and monetary threats. Whereas it’s essential to maintain the above protecting measures in place to protect your card, what’s equally vital is to safeguard your card nearly. On your assist, Paisabazaar now offers the ‘Pockets Defend Service’ so as to add an extra layer of safety to your bank card and general monetary properly being.

With this service you may have entry to a single name block function, that’s useful for speedy decision on shedding your card bodily and in case of information theft on account of frauds like card skimming. Moreover, not simply bank cards you’re additionally lined for frauds associated to UPI and cell pockets. Availing the pockets shield service will certainly improve your monetary well-being by shielding you from rising monetary thefts and frauds, securing not simply your cash, but in addition your general properly being that may be largely impacted on account of a monetary loss.