Retirement remains to be a comparatively new idea.

All through most of human historical past, individuals labored late into life, possibly retired for just a few years or labored till they keeled over.

Retiring to a lifetime of leisure is an idea that’s solely been round in a giant approach for the reason that post-WWII period. I wrote about this earlier than:

Within the Nineteen Forties, solely 3% of males who retired stated they did so as a result of they have been on the lookout for a lifetime of leisure. Most retired for well being causes or labored till they have been near kicking the bucket. That quantity rose to 17% by 1963 and 48% in 1982.

If retirement is a latest growth, retirement planning is mainly a new child.

In her new ebook, Easy methods to Retire, Christine Benz interviewed numerous retirement consultants. She talked to Wade Pfau concerning the challenges monetary advisors face relating to managing purchasers throughout retirement:

However a part of it’s that retirement planning remains to be a comparatively new discipline inside monetary companies. It’s exhausting to assign it a birthday. You might argue that it solely goes again so far as Invoice Bengen’s analysis in 1994, when he checked out sustainable spending from a risky funding portfolio and created the 4% rule.

So actually the start of retirement planning doesn’t predate the Nineteen Nineties. A variety of advisors nonetheless don’t absolutely perceive the mechanics of what occurs if you swap from saving and accumulating into spending out of your belongings–and making an attempt to switch the paycheck–in retirement. They haven’t actually thought via the implications of what makes retirement totally different.

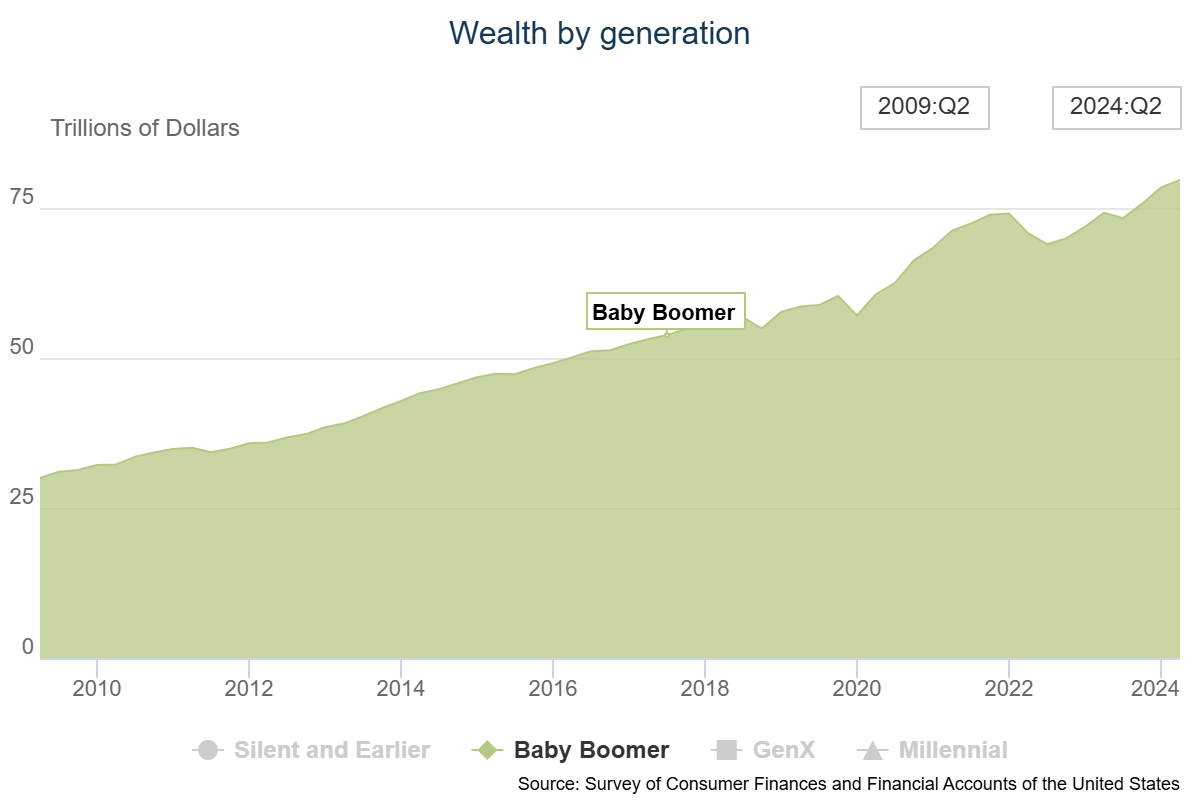

The newborn boomer technology controls $80 trillion in wealth:

They may reside longer than any technology in historical past up thus far.

This tidal wave of individuals and wealth will current an unlimited alternative for monetary advisors within the years forward but in addition loads of challenges.

The typical age of monetary advisors on this nation is someplace within the vary of 58-60. So many advisors will themselves be retiring simply as their purchasers want them essentially the most. The following 20-30 years might be fascinating to look at as this trade evolves.

I spoke with Christine concerning the alternatives and the challenges that lie forward for purchasers and advisors alike. We additionally spoke about:

- The largest query advisors must reply for each shopper.

- The ins and outs of retirement withdrawal methods.

- The psychology of spending and why retirees have bother splurging.

- How monetary planning adjustments in retirement.

- Math vs. feeling in retirement planning.

- Will we have now sufficient advisors to satisfy the demand within the coming years?

- Easy methods to cope with DIY traders turned purchasers and extra.

Test it out at The Unlock:

We’re ramping up content material for monetary advisors at The Unlock. In the event you’re a monetary advisor, subscribe to The Unlock publication right here. We’re doing deep dives into finest practices, trade analysis, wealth tech, and progress insights that we’ve by no means shared wherever else.

We’ve bought a number of nice stuff coming so that you don’t need to miss out.

Additional Studying:

A $12 Trillion Alternative For Monetary Advisors

This content material, which incorporates security-related opinions and/or data, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There may be no ensures or assurances that the views expressed right here might be relevant for any specific details or circumstances, and shouldn’t be relied upon in any method. You need to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “put up” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital belongings, or efficiency information, are for illustrative functions solely and don’t represent an funding suggestion or supply to supply funding advisory companies. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding resolution. Previous efficiency isn’t indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from varied entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or suggest endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the chance of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.