Because the 2023 tax submitting season ends, retirees throughout the nation are revising their monetary plans for 2024, however an important element might drastically alter their retirement panorama: the taxing of Social Safety advantages. Whereas many imagine their golden years shall be tax-friendly, residents in ten states are dealing with a actuality verify as their Social Safety advantages come underneath the taxman’s purview.

Conversely, two states are bringing reduction by ending their observe of taxing these advantages. This shift highlights the complexity of retirement planning within the U.S. and underscores the significance of staying knowledgeable about altering tax legal guidelines. Are you residing in certainly one of these states? Uncover how these tax adjustments would possibly influence your retirement technique and whether or not it’s time to rethink your locale for these serene post-work years.

Colorado

In Colorado, people youthful than 65 by the top of the tax yr can deduct both $20,000 or their taxable pension/annuity earnings included within the federal taxable earnings, whichever is much less. For these aged 65 and above by the top of the tax yr, Social Safety advantages will not be topic to state taxes.

Connecticut

For Connecticut residents, Social Safety advantages change into taxable when your adjusted gross earnings (AGI) exceeds $75,000, or $100,000 for these submitting collectively. Past this earnings threshold, 25% of Social Safety earnings turns into taxable on the state stage.

Kansas

In Kansas, Social Safety earnings is taxable for people whose AGI exceeds $75,000.

Minnesota

Social Safety earnings in Minnesota is topic to state taxes for people with an AGI over $82,190, or $105,380 for joint filers, and $52,690 for these married however submitting individually.

Montana

Montana contains Social Safety earnings in state taxable earnings to the identical extent it’s included in federal taxable earnings.

New Mexico

For New Mexicans, Social Safety advantages are taxable for these incomes greater than $100,000, or $75,000 for these submitting individually, and $150,000 for surviving spouses or these submitting as head of family or collectively.

Rhode Island

Social Safety advantages in Rhode Island are taxable if retirement advantages are acquired earlier than reaching full retirement age (sometimes 67) or if the AGI exceeds $101,000 for singles or heads of family, $126,250 for joint filers, or $101,025 for these married submitting individually for the 2023 tax yr. People beneath these earnings thresholds might exempt as much as $20,000 of their retirement earnings.

Utah

Utah imposes taxes on Social Safety advantages for people incomes greater than $45,000, or $75,000 for heads of family or these married submitting collectively, and $37,500 for married submitting individually. These underneath these earnings ranges could also be eligible for a nonrefundable tax credit score.

Vermont

In Vermont, Social Safety is taxable for people with AGIs above $60,000, or $75,000 for these married submitting collectively. A partial exemption applies for incomes between $50,000 and $59,999 ($65,001 and $74,999 for joint filers).

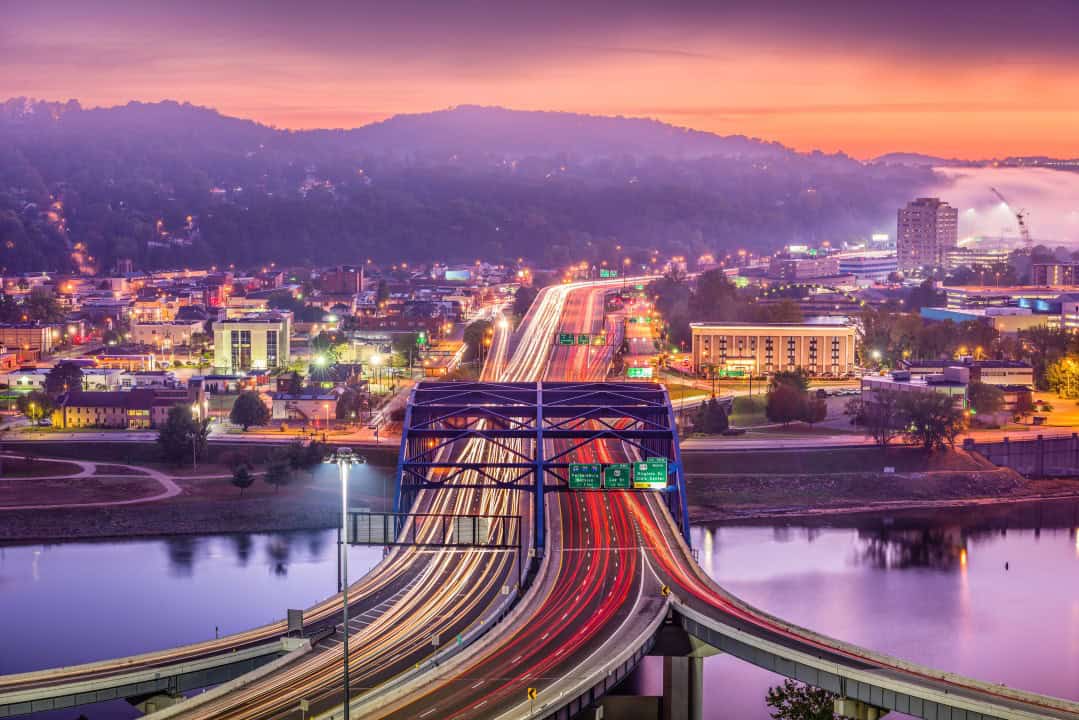

West Virginia

West Virginia handed a legislation to progress from partially taxing Social Safety to utterly eliminating taxation in 3 years.

West Virginia received’t tax your Social Safety advantages in case your federal adjusted gross earnings is $100,000 or much less for married {couples} submitting collectively or $50,000 or much less for all different taxpayers

Nevertheless, in case your earnings is larger than the relevant greenback quantity, West Virginia will levy a state earnings tax in your Social Safety funds to the identical extent you need to pay taxes on that earnings to the federal authorities.

Excellent news for West Virginia resident is the invoice phasing out tax on Social Safety advantages has been signed into legislation. Retroactive to Jan. 1 of this yr, it applies to 35% deduction for 2024, 65% for 2025 and 100% deduction on Social Safety earnings for 2026 taxes and past.

Welcome Reduction for Missouri and Nebraska

As of 2024, Missouri and Nebraska be part of the listing of states that now not tax social safety earnings.

Balancing Taxes and Way of life

Within the ever-evolving panorama of tax legal guidelines and retirement planning, staying knowledgeable and consulting with a tax advisor for probably the most present data is paramount. Whereas the tax implications of the place you select to retire are vital, do not forget that taxes are only one piece of the puzzle. High quality of life, entry to healthcare, proximity to family members, and leisure alternatives additionally play essential roles in choosing your preferrred retirement haven. As you navigate the complexities of retirement tax planning, steadiness these issues with the fiscal realities. By doing so, you’ll be certain that your retirement years will not be solely financially sound but in addition wealthy within the experiences and connections that actually matter.

Revealing the Revenue Wanted to Be part of the High 1% in Each State: Stunning Info That Show NYC Isn’t Quantity One!

SmartAsset’s newest examine uncovers the earnings wanted to affix the highest 1% in each state, highlighting shocking variations in dwelling prices nationwide. Shockingly, New York doesn’t even make the highest 5, regardless that coastal states lead the listing.

Uncover the Secrets and techniques of 401(okay) Millionaires Constructing Wealth as Their Numbers Surge 43% This Yr

Constancy Investments reported a report 485,000 accounts with balances of $1 million or extra within the first quarter. With surging inventory markets, the variety of 401(okay) retirement account millionaires elevated by 15% from the earlier quarter and 43% since March 2023. But, this monetary triumph contrasts sharply with the grim actuality for the typical American, whose 401(okay) steadiness tells a really completely different story.

Dwelling Fairness Provides A Lifeline for Older Owners, however a Dire Future for These With out

Many owners over 60 see their houses as greater than only a place to reside; they’re cornerstones of their monetary safety and retirement plans. This group, which boasts a virtually 80% homeownership fee, has not solely constructed emotional attachment with their houses but in addition views the fairness gathered as an important security web for his or her golden years. In keeping with a Fannie Mae examine, a good portion of this demographic is planning to age in place, counting on their houses as a key a part of their monetary technique for a snug retirement.

Dwelling Fairness Provides A Lifeline for Older Owners, however a Dire Future for These With out

Sensible Retirement Planning: Ought to You Use Your 401(okay) to Delay Social Safety Till 70?

Deciding when to say Social Safety advantages is a essential choice for retirees. Two frequent methods are claiming Social Safety at age 62 and preserving retirement funds or utilizing 401(okay) financial savings and delaying Social Safety till age 70. Every strategy has its benefits and downsides, influenced by particular person monetary conditions and targets.

Sensible Retirement Planning: Ought to You Use Your 401(okay) to Delay Social Safety Till 70?

Shield Your Retirement: Essential Methods to Protect Your Financial savings Throughout Monetary Turbulence

In an period of rising monetary dangers, traders normally depend on the safety of bonds. Nevertheless, with rising inflation, many are seeing their retirement plans unravel as bond funds confronted unprecedented losses in 2022 and proceed to say no this yr.

Did you discover this text useful? We’d love to listen to your ideas! Depart a remark with the field on the left-hand aspect of the display screen and share your ideas.

Additionally, do you need to keep up-to-date on our newest content material?

1. Observe us by clicking the [+ Follow] button above,

2. Give the article a Thumbs Up on the top-left aspect of the display screen.

3. And lastly, in case you assume this data would profit your family and friends, don’t hesitate to share it with them!

John Dealbreuin got here from a 3rd world nation to the US with solely $1,000 not realizing anybody; guided by an immigrant dream. In 12 years, he achieved his retirement quantity.

He began Monetary Freedom Countdown to assist everybody assume in another way about their monetary challenges and reside their greatest lives. John resides within the San Francisco Bay Space having fun with nature trails and weight coaching.

Listed here are his beneficial instruments

M1 Finance: John in contrast M1 Finance towards Vanguard, Schwab, Constancy, Wealthfront and Betterment to search out the good funding platform. He makes use of it as a consequence of zero charges, very low minimums, automated funding with computerized rebalancing. The pre-built asset allocations and fractional shares helps one get began straight away.

Private Capital: It is a free instrument John makes use of to trace his web price regularly and as a retirement planner. It additionally alerts him wrt hidden charges and has a finances tracker included.

Streitwise is accessible for accredited and non-accredited traders. They’ve one of many lowest charges and excessive “pores and skin within the recreation,” with over $5M of capital invested by founders within the offers. It is additionally open to overseas/non-USA investor. Minimal funding is $5,000.

Platforms like Yieldstreet present funding choices in artwork, authorized, structured notes, enterprise capital, and so forth. In addition they have fixed-income portfolios unfold throughout a number of asset courses with a single funding with low minimums of $10,000.