Introduction

There’s an unlimited market of buying and selling methods obtainable on-line, typically showcasing spectacular “backtest” outcomes that recommend these strategies will carry out simply as properly sooner or later as they did up to now. Whereas these methods could seem engaging and promising, key questions come up: How a lot belief ought to we place in these backtested outcomes, and the way assured can we be in risking our capital based mostly on them? Most significantly, why would somebody reveal a extremely worthwhile technique so simply?

Having developed and analyzed quite a few methods myself, I’d prefer to share some insights into learn how to correctly consider the efficiency of a buying and selling technique and clarify why, in lots of instances, backtested outcomes could not translate to success in real-world buying and selling. This analysis could be the distinction between selecting a very sturdy technique and one which’s simply “curve-fitted” to look worthwhile on previous information.

The Downside of Overfitting in Buying and selling Methods

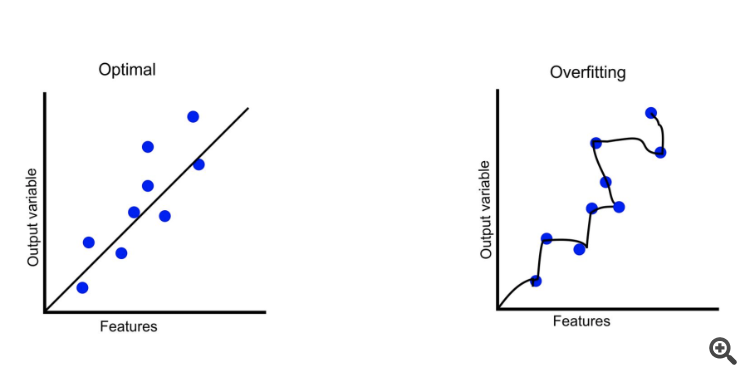

Probably the most widespread points with unreliable methods is overfitting. An overfitted technique is one which seems extremely optimized for previous information, pinpointing the best purchase and promote factors in historic costs, however struggles to carry out constantly in dwell market situations. In essence, overfitting can create the phantasm of an ideal backtest; in actuality, it typically results in poor efficiency and monetary losses when deployed in precise buying and selling environments. Overfitting is very harmful as a result of it capitalizes on random noise or patterns that is probably not current in future information, relatively than true, reproducible market conduct.

Examples of Overfitting

-

Instance 1: The Excellent Commerce that By no means Occurs Once more

Think about this: Suppose I do know {that a} inventory worth will transfer from 20 to 40 after which again all the way down to 30. I may simply design a method to purchase when the worth exceeds 20 and promote as quickly because it crosses 40, which might end in a flawless revenue—on paper. Nevertheless, such exact actions are extremely unlikely to repeat sooner or later, rendering this technique unreliable. The technique works completely on the previous information set, however its success hinges on a really particular sample that’s unlikely to recur.

-

Instance 2: Becoming to Small Market Actions

One other instance may very well be a method that appears for tiny worth fluctuations inside a sure vary, like shopping for a inventory when it dips by 0.5% and promoting when it rises by 0.5%. A method like this may look wonderful in historic backtests, particularly in a extremely risky market the place such fluctuations have been widespread. Nevertheless, when deployed in a much less risky surroundings, it’d generate excessive transaction prices, poor liquidity, and frequent false alerts. What regarded like a worthwhile technique is, the truth is, too narrowly tailor-made to a particular historic interval or market situation.

-

Instance 3: Over-Optimized Indicator Combos

Think about combining a number of technical indicators just like the Shifting Common Convergence Divergence (MACD), Relative Energy Index (RSI), and Bollinger Bands, every with extremely optimized parameters based mostly on previous worth information. This will likely produce a method that seems to completely seize each worthwhile pattern throughout a backtest. Nevertheless, such fine-tuning typically results in overfitting as a result of these indicator parameters are custom-made too exactly to the historic information, they usually could not adapt properly to completely different market situations or new tendencies that emerge.

-

Instance 4: Occasion-Pushed Overfitting

Suppose a dealer designs a method based mostly on the concept that a inventory tends to rise after a particular sort of earnings report or information launch. As an example, the technique could also be fine-tuned to revenue from a 5% common rise after an earnings beat in a particular sector. The technique performs properly in backtesting throughout a interval the place that sample occurred incessantly, however when utilized in dwell buying and selling, it fails to copy these positive factors. In actuality, the market surroundings could have modified, or earnings studies could not observe the identical predictable patterns, inflicting the technique to underperform.

The phantasm of success created by overfitting could be extremely seductive for merchants, notably novices who may take the backtest outcomes at face worth. It’s vital to establish overfitted methods earlier than utilizing them in real-world buying and selling. Beneath, we’ll talk about a couple of key components to assist distinguish genuinely sturdy methods from these which can be merely over-optimized for historic information.

Improvement Strategies: Thought-Pushed vs. Information-Pushed Approaches

The best way a method is developed performs an important position in figuring out its robustness. There are two major approaches to technique growth:

-

Thought-Pushed Method

Right here, the technique arises from a well-defined buying and selling concept or speculation, typically rooted in financial ideas or behavioral patterns noticed out there. This method can contain studying analysis papers or utilizing insights from the dealer’s personal experiences to construct a easy, intuitive mannequin. -

Information-Pushed Method

This methodology makes use of algorithmic instruments to generate methods, sometimes by working hundreds of simulations throughout completely different mixtures of indicators and parameters. Platforms like StrategyQuantX enable merchants to backtest numerous variations, figuring out mixtures that carried out properly up to now and discarding others.

Usually, data-driven approaches are extra inclined to overfitting, as they typically contain experimenting with numerous parameter settings to seek out the “optimum” mixture. In distinction, methods rooted in a strong buying and selling concept are typically extra sturdy and fewer prone to overfit, as they aren’t merely tailor-made to historic information.

Key Traits of Dependable Methods

1. Simplicity and Instinct Are Key

An excellent buying and selling technique must be easy and intuitive. Whereas it could appear that methods leveraging superior know-how and sophisticated algorithms would outperform less complicated ones, they’re typically extra susceptible to overfitting previous patterns that will not maintain up sooner or later.

Methods with many parameters are inclined to “be taught” the historic information too properly, which will increase the chance of failing beneath new situations. Alternatively, a method with fewer parameters is much less prone to overfit, and if it has carried out properly over time, it could be tapping right into a extra persistent market phenomenon.

2. Testing Over a Lengthy Timeframe

For a method to be thought-about dependable, it must be examined on not less than 10 years of historic information. An extended testing interval reduces the chance of overfitting, because it’s far more difficult to fine-tune a method that performs properly over an prolonged timeframe. Moreover, longer backtesting intervals introduce a wide range of market situations, together with bull and bear markets, intervals of excessive and low volatility, and financial occasions, making certain the technique’s robustness throughout numerous situations.

3. Efficiency Throughout A number of Markets

A sturdy technique ought to work throughout completely different markets. As an example, a method that solely reveals profitability on a single asset, comparable to gold, could also be extremely optimized particularly for that market and unlikely to carry out properly elsewhere. Dependable methods are inclined to seize underlying market dynamics that may be noticed throughout numerous property, indicating that they’re much less prone to be overfitted to a particular market’s historic information.

Extra Checks for Technique Validation

Along with the core traits above, a number of exams can present additional insights into a method’s robustness:

-

Stroll-Ahead Testing: This methodology includes backtesting the technique over rolling time home windows and adjusting the mannequin periodically to judge efficiency stability.

-

Out-of-Pattern Testing: By setting apart a portion of historic information that the technique was not educated on, merchants can observe if the mannequin can carry out properly on completely unseen information.

-

Monte Carlo Simulations: This take a look at includes working simulations on the technique with randomized order execution, spreads, or market situations to test if it stays worthwhile beneath variable situations.

Why Counting on Backtest Revenue Curves Can Be Deceptive

Even when a method meets the standards outlined above, it doesn’t essentially imply it should yield constant returns within the dwell market. Many merchants make the error of relying solely on the revenue curve in a backtest report. Sadly, backtesting can generally create a very optimistic view, because it doesn’t at all times account for real-world components comparable to:

-

Latency and Execution Delays: Delays so as execution in dwell buying and selling can have an effect on entry and exit factors, resulting in completely different outcomes than these proven in backtests.

-

Market Slippage: Massive orders or trades executed throughout excessive volatility intervals could incur slippage, the place the precise worth obtained differs from the anticipated worth.

-

Altering Market Situations: Backtests are based mostly on historic information, which can not mirror future market conduct. Structural shifts within the economic system, new rules, and technological developments can render even probably the most sturdy methods out of date.

Abstract

To summarize, figuring out a strong buying and selling technique that isn’t overfitted requires a eager eye and strict standards. Listed here are the details to remember:

- Simplicity and Instinct: An excellent technique must be easy and intuitive, avoiding extreme parameters.

- Enough Testing Interval: Dependable methods must be validated over not less than 10 years of information to make sure consistency.

- Cross-Market Applicability: Methods that carry out properly throughout a number of markets are usually extra sturdy and fewer prone to be overfitted.

Whereas following these guidelines doesn’t assure success, it does considerably cut back the chance of falling for overfitted methods. If a method passes all these situations, you will have a greater probability of discovering a strong buying and selling mannequin.

However even then, does this imply you’ll be able to utterly belief the revenue curve on the report? Sadly, the reply continues to be no. There are further pitfalls in backtesting, notably in platforms like MetaTrader, which I’ll talk about in my subsequent article.

About Us

We’re @lookatus, a devoted staff of merchants and engineers dedicated to creating REAL worthwhile, systematic buying and selling options. With a robust basis in quantitative evaluation and cutting-edge know-how, our mission is to ship dependable, data-driven buying and selling methods that capitalize on market alternatives with precision and consistency. Past constructing superior instruments, we’re enthusiastic about empowering merchants by way of sensible schooling, equipping them with actual, actionable insights to navigate markets intelligently and efficiently.

Contact us at: haylookatus@gmail.com