EUR/USD: Switzerland Strengthens the Greenback

● The important thing occasion of the previous week was undoubtedly the FOMC (Federal Open Market Committee) assembly of the US Federal Reserve on March 20. As anticipated, the American Central Financial institution unanimously determined to take care of the important thing rate of interest at its highest degree in 23 years, 5.50%, for the fifth consecutive assembly. For the reason that price was anticipated, market contributors have been considerably extra within the feedback and forecasts of the Fed’s management. Crucial assertion got here from the pinnacle of the regulator, Jerome Powell, who talked about the consideration of three phases of borrowing price discount this 12 months, totalling 75 foundation factors (bps). The long-term price forecast was raised from 2.50% to 2.60%.

In feedback following the assembly, stable development in the US economic system was famous. The GDP forecast for this 12 months was elevated from 1.4% to 2.1%, and for 2025 from 1.8% to 2.0%. The labour market additionally seems to be in good well being, with unemployment at a low degree. Based on the brand new forecast, it may attain 4.0%, in comparison with the beforehand anticipated 4.1%. The variety of new jobs created exterior of the agriculture sector (NonFarm Payrolls) in February was 275K, considerably exceeding each the earlier determine of 229K and the forecast of 198K.

● Relating to inflation, whereas it has eased, it stays “elevated,” as famous within the assertion. Shopper Worth Index (CPI) figures for February confirmed a 3.2% improve on a year-over-year foundation. Inflation is anticipated to settle at 2.4% by the tip of 2024, with the core Private Consumption Expenditures (PCE) index anticipated to be at 2.6%. Beforehand, each figures have been forecasted to be 2.4% in December.

The feedback emphasised that the long-term goal is to convey inflation right down to 2.0% whereas attaining most employment. Thus, the Federal Reserve will stay vigilant about inflationary dangers. Changes to financial coverage parameters could also be made if components emerge that hinder its goals. These components embody, however will not be restricted to, the labor market state of affairs, financial development, inflation within the US, the state of the worldwide economic system, and worldwide occasions.

As already talked about, the principal state of affairs for 2024 consists of three price reductions of 25 foundation factors every. Nonetheless, members of the FOMC haven’t discounted the opportunity of there being simply two and even one discount. A survey by Reuters discovered that 72 out of 108 economists, or two-thirds, anticipate the primary price lower to happen in June, with the next ones anticipated within the fall of this 12 months.

● The inventory market responded positively to the outcomes of the Federal Reserve’s assembly. The S&P 500, Dow Jones, and Nasdaq indices all moved greater, a response not mirrored by the Greenback Index (DXY), as information of the start of financial coverage easing didn’t please buyers. Consequently, EUR/USD surged sharply. Nevertheless, on March 21, the American foreign money recouped its losses after the Swiss Nationwide Financial institution (SNB) unexpectedly decreased its key rate of interest by 25 foundation factors to 1.5% at its quarterly assembly, opposite to market expectations of sustaining the speed at 1.75%.

“The easing of financial coverage was made doable due to the efficient fight in opposition to inflation during the last two and a half years,” the SNB said. “Inflation has been under 2% for a number of months and is throughout the vary that corresponds to the definition of worth stability. Based on the newest forecast, inflation is anticipated to stay inside this vary within the coming years.”

Thus, the SNB turned the primary main central financial institution to begin easing its coverage after a protracted cycle of price will increase because of the COVID-19 pandemic. Consequently, merchants “forgot” concerning the Fed’s price lower alerts and commenced shopping for {dollars}, as they presently stay the one high-yield foreign money with a low threat degree.

● Assist for the greenback in direction of the tip of the working week was additionally offered by the enterprise exercise knowledge within the US revealed on March 21. The S&P International Composite PMI index elevated to 52.5 from 52.2, and whereas the PMI index for the providers sector decreased from 52.3 to 51.7, it remained above the 50.0 threshold that separates financial development from contraction. In the meantime, the Philadelphia manufacturing sector enterprise exercise index exceeded forecasts, reaching 3.2, and the variety of preliminary jobless claims within the US for the week fell from 215K to 210K.

● EUR/USD concluded the previous five-day week at a mark of 1.0808. Relating to the forecast for the close to future, as of the writing of this evaluate on the night of Friday, March 22, 50% of consultants voted for the strengthening of the greenback and additional decline of the pair. 20% sided with the euro, and 30% took a impartial stance. Among the many oscillators on D1, solely 15% are colored inexperienced, 85% are colored crimson, with 1 / 4 of them indicating the pair is oversold. For pattern indicators, the greens have 10%, whereas the reds maintain an absolute majority of 90%. The closest help for the pair is positioned within the zone of 1.0795-1.0800, adopted by 1.0725, 1.0680-1.0695, 1.0620, 1.0495-1.0515, and 1.0450. Resistance zones are discovered within the areas of 1.0835-1.0865, 1.0900-1.0920, 1.0965-1.0980, 1.1015, 1.1050, and 1.1100-1.1140.

● The upcoming buying and selling week will probably be shorter than typical as a result of Good Friday in Catholic international locations, the place banks and inventory exchanges will probably be closed. It is going to even be the final week of the month and the primary quarter. Market contributors will probably be summarizing the quarter, and there will probably be few essential statistical releases. However, notable within the calendar is Thursday, March 28, when knowledge on retail gross sales in Germany will probably be launched, in addition to revised annual knowledge on the US GDP and the amount of jobless claims. On Friday, March 29, regardless of the vacation, statistics on the patron market in the US will probably be launched, and Federal Reserve Chair Jerome Powell is scheduled to talk.

GBP/USD: BoE Hawks Morph into Doves

● Information on shopper inflation within the UK, launched on Wednesday, March 20, a day forward of the Financial institution of England (BoE) assembly, indicated a slight deceleration and fell a bit under expectations. The year-on-year CPI slowed from 4.0% to three.4%, in opposition to the anticipated 3.5%. February’s core CPI, on an annual foundation, dropped to 4.5% after three months of stability at 5.1%. Conversely, the CPI noticed a month-on-month improve of 0.6% following a decline of the identical magnitude in January, but this improve nonetheless fell wanting the market’s 0.7% expectation. February noticed producer buy costs lower by 0.4%, with a year-on-year lack of 2.7%, returning to ranges seen in Could 2022 as a result of decreases in vitality, metals, and a few agricultural product costs.

Just some hours earlier than the regulator’s assembly, preliminary enterprise exercise knowledge have been additionally launched, exhibiting optimistic however blended outcomes. The Manufacturing PMI rose to 49.9, carefully approaching the vital 50.0 mark (with a forecast of 47.8 and a earlier worth of 47.5). The providers sector index, in distinction, dropped from 53.8 to 53.4, regardless of expectations that it could maintain regular. Consequently, the Composite PMI edged down from 53.0 to 52.9, remaining throughout the development zone of the economic system.

● Relating to the Financial institution of England’s assembly on Thursday, March 21, as anticipated, the regulator saved the important thing rate of interest for the pound unchanged at 5.25% for the fifth consecutive assembly. The Governor, Andrew Bailey, said that the economic system has not but reached the stage the place charges could be lowered however added that all the pieces is shifting within the “proper route.”

● The shock got here when two members of the BoE’s Financial Coverage Committee, who had beforehand voted for a price improve, reversed their place, resulting in renewed promoting of the pound. Based on economists at Japan’s MUFG Financial institution, the voting end result “justifies an elevated chance of an earlier price lower than we had anticipated. […] Whether or not the Financial institution of England makes the ultimate determination in June or August stays an open query. We preserve our view that there will probably be a price lower of 100 foundation factors this 12 months.” “The pound may endure additional within the brief time period if the market’s conviction in a June price lower strengthens, together with the potential magnitude of price cuts for this 12 months,” the MUFG specialists added.

● “Certainly, the Financial institution of England has taken one other step in direction of decreasing rates of interest,” echo their colleagues at Germany’s Commerzbank. “However whether or not this may occur ahead of anticipated, just because not one of the policymakers voted for a price improve, isn’t fully clear but.” Commerzbank believes that “in opposition to the backdrop of the general dovish sentiment triggered by the SNB’s surprising price lower, the pound ended up on the dropping facet and have become the second-worst foreign money. Additionally, relying on market sentiments, it has the prospect to turn into one of the vital susceptible currencies.”

● Beginning the previous week at a degree of 1.2734, GBP/USD concluded it at 1.2599. Analyst opinions on its near-term route have been cut up: half (50%) voted for the pair’s decline, 25% for its rise, and 25% maintained neutrality. The indicator readings on D1 are precisely the identical as for EUR/USD. Amongst oscillators, solely 15% look north, 85% south, with 1 / 4 of them signalling the pair is oversold. For pattern indicators, 10% advocate shopping for, and 90% promoting. Ought to the pair transfer southward, it should encounter help ranges and zones at 1.2575, 1.2500-1.2535, 1.2450, 1.2375, 1.2330, 1.2085-1.2210, 1.2110, 1.2035-1.2070. Within the occasion of an upward motion, resistance will probably be met at ranges 1.2635, 1.2730-1.2755, 1.2800-1.2820, 1.2880-1.2900, 1.2940, 1.3000, and 1.3140.

● No vital occasions associated to the economic system of the UK are scheduled for the upcoming week. Merchants also needs to keep in mind that March 29 is a public vacation within the nation as a result of Good Friday.

USD/JPY: How the BoJ Sank the Yen

● In principle, if the rate of interest rises, the foreign money strengthens. However that is simply in principle. Actuality can differ considerably, as demonstrated by the Financial institution of Japan’s (BoJ) assembly on Tuesday, March 19.

Till that time, the BoJ had been the one central financial institution on this planet to take care of a adverse rate of interest degree of -0.1% since February 2016. Now, for the primary time in 17 years, the regulator raised it to a variety of 0.0-0.1% each year. It additionally deserted management over the yield of ten-year authorities bonds (YCC). As media studies, this transfer “represents a departure from probably the most aggressive and unconventional financial easing coverage we’ve got seen in fashionable historical past.” But, following this momentous determination, as an alternative of appreciating, the yen … plummeted, and USD/JPY reached a excessive of 151.85. Analysts consider this occurred as a result of every of those central financial institution actions met market expectations and had already been priced in.

● Information on inflation in Japan for February, revealed in direction of the tip of the workweek, supplied some help to the Japanese foreign money. The nation’s Statistical Bureau reported that the annual nationwide Shopper Worth Index (CPI) rose by 2.8%, up from 2.2% beforehand. Consequently, buyers concluded that the persistence of worth strain above the goal degree of two.0% would permit the Financial institution of Japan to take care of rates of interest at a optimistic degree.

Nevertheless, sustaining charges doesn’t imply growing them. And as economists from ING, the biggest banking group within the Netherlands, wrote, the yen’s place relies upon extra on the Federal Reserve’s price cuts than on a price hike by the BoJ. They said: “It will likely be tough for the yen to sustainably strengthen past volatility across the price hike till charges within the US are lowered.”

● The yen acquired one other, however very weak, help from rising speculations about doable intervention by the Japanese authorities within the foreign money sphere, in less complicated phrases, about foreign money interventions. Japan’s Finance Minister, Shunichi Suzuki, did declare that foreign money actions must be secure and that he’s carefully monitoring trade price fluctuations. Nevertheless, these have been merely phrases, not concrete actions, thus they did not considerably assist the nationwide foreign money. Consequently, the week concluded with the pair marking the ultimate notice at 151.43.

● Relating to the close to way forward for USD/JPY, the bearish camp for the pair contains 50% of consultants, 40% stay undecided, and 10% voted for additional strengthening of the US foreign money. Technical evaluation instruments appear to be unaware of rumours about doable foreign money interventions. Consequently, all 100% of pattern indicators and oscillators on D1 are pointing upwards, with 20% of the latter within the overbought zone. The closest help ranges are discovered at 150.85, 149.70, 148.40, 147.30-147.60, 146.50, 145.90, 144.90-145.30, 143.40-143.75, 142.20, and 140.25-140.60. Resistance ranges and zones are positioned at 151.85-152.00, 153.15, and 156.25.

● On Friday, March 29, the Shopper Worth Index (CPI) values for the Tokyo area will probably be revealed. In addition to this, no different vital occasions associated to the Japanese economic system are scheduled for the approaching days.

CRYPTOCURRENCIES: Bitcoin – The Calm Earlier than the Halving

● After bitcoin reached a brand new all-time excessive of $73,743 on March 14, a wave of selloffs and profit-taking by short-term speculators adopted. BTC/USD sharply retreated, dropping roughly 17.5%. An area minimal was recorded at $60,778, after which the main cryptocurrency, in anticipation of the halving, started to realize momentum once more.

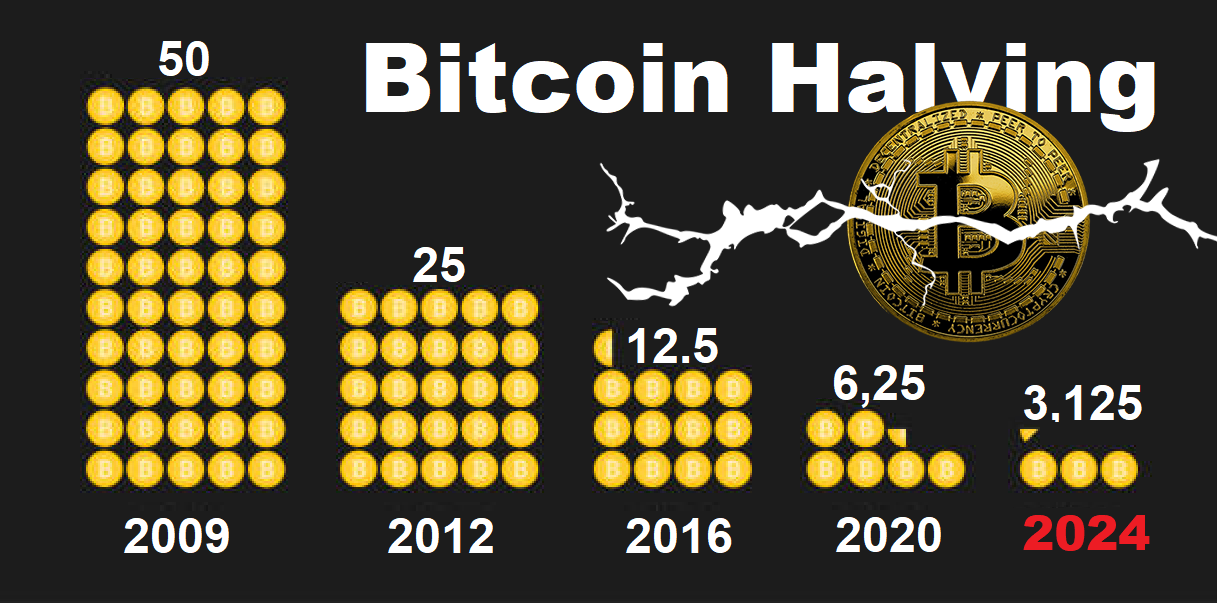

It is price recalling {that a} halving is an occasion that happens roughly each 4 years, after one other 210,000 blocks have been mined, and ends in the mining reward for a brand new block within the bitcoin blockchain being lower in half. This naturally raises the query: why is that this accomplished? The halving is designed as a mechanism to fight inflation. As miners’ rewards lower, fewer new cash are produced with every spherical. That is meant to take care of a shortage of bitcoin out there and positively impression the token’s worth from a provide and demand perspective.

The whole issuance of bitcoin is capped at 21 million cash. As of December 2023, miners have already extracted 19.5 million cash, which is sort of 93% of the whole quantity. Halvings will proceed till the final bitcoin is mined, which is forecasted to happen someday between 2040 and 2048. In 2040 (the eighth halving), miners’ rewards will probably be 0.1953125 BTC, and in 2048 (the tenth halving) – 0.048828125 BTC. After this, miners will earn earnings solely from transaction charges. The upcoming, fourth halving is most certainly to happen on April 20 this 12 months, with the reward for mined blocks lowering from 6.25 BTC to three.125 BTC.

● Due to the hype surrounding spot bitcoin ETFs and the FOMO (Concern of Lacking Out) impact in anticipation of the halving, a sure shortage of the primary cryptocurrency is already observable. Based on Bitcointreasuries, a good portion of BTC is owned by state and personal funding corporations, governments, trade and funding funds. In whole, they maintain roughly 12% of the whole quantity of bitcoins. About 10% is saved on centralized cryptocurrency exchanges, and one other 8.09% belongs to accounts which have been inactive for a few years. Including to those figures the share of the asset attributed to bitcoin’s founder, Satoshi Nakamoto (4.76%), it may be concluded that about 35% of mined cash are already unavailable to different personal buyers.

Grayscale Bitcoin Belief, iShares Bitcoin Belief, and Constancy Sensible Origin Bitcoin Fund lead by way of bitcoin possession volumes with 380,241 BTC, 230,617 BTC, and 132,571 BTC, respectively. MicroStrategy has turn into the biggest holder of bitcoins amongst public corporations with 205,000 BTC on its steadiness sheet. Marathon Digital holds the second place with 15,741 BTC, whereas Tesla and Coinbase International share the third and fourth locations with 9,720 BTC and 9,480 BTC, respectively. Amongst different, private, personal corporations, Block.one leads in possession degree with 164,000 BTC, in accordance with obtainable data. It’s adopted by the MTGOX trade with a steadiness of 141,686 BTC. Stablecoin issuer Tether owns 66,465 BTC. The fourth place is taken by the BitMEX trade with 57,672 BTC.

Within the rating of bitcoin possession amongst international locations, the USA leads with 215,000 BTC, adopted by China with 190,000 BTC, the UK with 61,000 BTC, and Germany with 50,000 BTC.

● Analysts at Normal Chartered Financial institution have revised their bitcoin worth goal for the tip of 2024 from $100,000 to $150,000, with ethereum probably reaching $8,000 by the identical interval. By the tip of 2025, the primary and second cryptocurrencies may recognize to $200,000 and $14,000, respectively. The specialists justify their forecast by the dynamics of gold following the approval of bitcoin ETFs and the optimization of the valuable metallic to its digital counterpart in an 80% to twenty% ratio.

Based on Normal Chartered consultants, bitcoin may recognize additional – as much as $250,000 – if inflows into ETFs attain $75 billion. Sovereign funding funds’ actions may additionally speed up development charges. “We see an growing chance that main reserve managers would possibly announce bitcoin purchases in 2024,” say the financial institution’s analysts.

● Dan Tapiero, CEO of funding agency 10T Holdings, talked about an analogous determine – $200,000. “I do not suppose it is that loopy,” he said. Based on the financier’s calculations, the potential to triple from the present worth roughly corresponds to the proportion distinction between the peaks of 2017 and 2021. Moreover, from the bear market lows to the 2021 peak, digital gold elevated in worth 20 occasions. This means a $300,000 goal as a optimistic state of affairs.

“It is laborious to pinpoint actual markers and timing in these issues. I feel we’ll attain that [zone] throughout the subsequent 18-24 months, maybe even sooner,” Tapiero believes. “The availability lower through the speedy improve in demand for ETFs together with the halving point out a major development potential. I feel the primary cryptocurrency will pull the remaining together with it.” The CEO of 10T Holdings additionally famous “good probabilities” for the approval of ETFs based mostly on Ethereum. Nevertheless, he hesitated to say whether or not these ETFs can be registered in Could or if it could occur later.

● OpenAI’s ChatGPT, when requested whether or not the BTC worth may attain the $100,000 mark earlier than the halving, deemed this goal believable. Based on the AI’s calculations, the latest correction doesn’t have an effect on development prospects and solely confirms the inaccuracy of short-term forecasts. ChatGPT estimated the likelihood of reaching $100,000 at 40%, whereas the chance of hitting the $85,000 mark was assessed at 60%.

● As of the writing of this evaluate, on the night of Friday, March 22, BTC/USD is buying and selling round $63,000. The whole market capitalization of cryptocurrencies has decreased to $2.39 trillion (from $2.58 trillion every week in the past). The Crypto Concern & Greed Index has dropped from 83 to 75 factors, shifting from the Excessive Greed zone to the Greed zone.

● Regardless of the latest halt in bitcoin’s decline, some consultants don’t rule out the chance that BTC/USD may take one other dip southward. As an example, Kris Marszalek, CEO of Crypto.com, believes that the present volatility of BTC continues to be low in comparison with earlier cycles. This suggests that with a rise in volatility, not solely new highs but additionally new lows might be set.

Analysts at JPMorgan consider that bitcoin may fall by 33% after the halving. In the meantime, Mike Novogratz, CEO of Galaxy Digital, is assured that the ground is at $50,000, and the worth of the coin won’t ever fall under that degree until some dramatic occasion happens. Based on him, bitcoin’s development is primarily pushed by buyers’ insatiable urge for food for the token, quite than macroeconomic components such because the coverage of the US Federal Reserve. This was evidenced by the truth that the worth of bitcoin hardly observed the Federal Reserve’s assembly on March 20.

NordFX Analytical Group

Discover: These supplies will not be funding suggestions or tips for working in monetary markets and are meant for informational functions solely. Buying and selling in monetary markets is dangerous and can lead to a whole lack of deposited funds.

#eurusd #gbpusd #usdjpy #Foreign exchange #forex_forecast #signals_forex #cryptocurrency #bitcoin #nordfx