With the Union Funds 2024 simply across the nook, the Affiliation of Nationwide Exchanges Members of India (ANMI), a physique comprising buying and selling members throughout the nation of inventory exchanges, has listed down a wishlist that might be useful for the Indian share market individuals.

The checklist consists of the reintroduction of rebates underneath Part 88E for Securities Transaction Tax (STT) and Commodity Transaction Tax (CTT) paid.

As per ANMI, India levies Securities Transaction Tax (STT) within the money market and derivatives section. Nevertheless, the identical is simply levied on the time of switch of useful possession (delivery-based) and no STT is levied if the commerce doesn’t end in supply.

Moreover, India is the one nation levying STT and CTT taxes within the delivery-based in addition to derivatives and commodities futures section, thus, ANMI reckons {that a} rebate underneath Part 88E for STT and CTT paid ought to be reintroduced.

ANMI President Vinod Kumar Goyal had already submitted affiliation’s suggestions to the CBDT Chairperson.

How will the reintroduction of rebate underneath Part 88E assist?

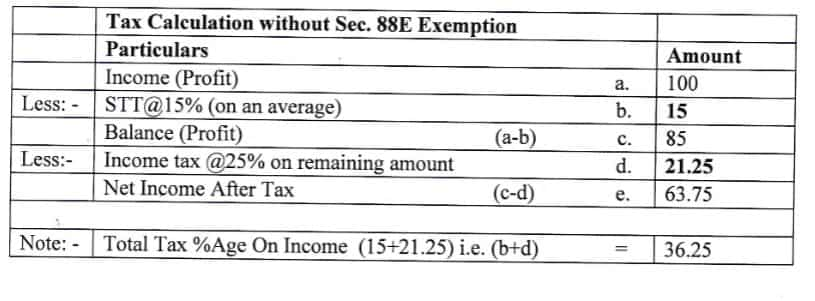

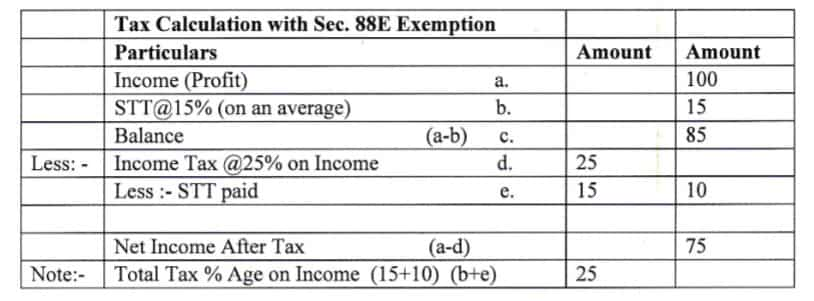

Firstly, part 88E advantages may be continued as utilized to entities having a enterprise earnings. ANMI explains the advantages of 88E by the next illustrations.

Illustration: A

Illustration: B

The above illustration proves that sec. 88E profit ends in a discount of earnings tax by 11.25 per cent (36.25-25). In such circumstances, ANMI submits that for entities dealing in securities and treating earnings as enterprise earnings, STT ought to be handled as tax paid, not an expense, i.e., tax rebate u/s 88E to be restored.

Additional, ANMI believes that the reintroduction of part 88E will end in elevated volumes and due to this fact a a lot bigger assortment of STT/CTT. Thus, income loss might be negligible.

For all different information associated to enterprise, politics, tech and auto, go to Zeebiz.com.

DISCLAIMER: The views and funding ideas expressed by funding specialists on zeebiz.com are their very own and never these of the web site or its administration. zeebiz.com advises customers to test with licensed specialists earlier than taking any funding choices.