March 22, 2024 (Investorideas.com Newswire) Graphite One (TSXV:GPH, OTCQX:GPHOF) plans to speculate $435 million to construct a graphite anode manufacturing plant in Trumbull County, Ohio, between Cleveland and Pittsburgh (the “Website”).

By way of its wholly-owned subsidiary, Graphite One Alaska, the Vancouver-based firm has chosen Ohio’s Voltage Valley as the positioning, coming into right into a 50-year land-lease settlement on 85 acres. The deal additionally incorporates an choice to buy the property as soon as referred to as the Warren Depot, a part of the Nationwide Protection Stockpile infrastructure, till the brownfield website was processed by the Ohio EPA Voluntary Motion program a decade in the past, certifying that the land doesn’t want additional cleanup.

Graphite One plans to start out building throughout the subsequent three years on the Website, as a part of the corporate’s technique to grow to be the primary vertically built-in producer to serve the US EV battery market. Its provide chain technique includes mining, manufacturing and recycling, all achieved domestically.

The Ohio facility represents the second hyperlink in Graphite One’s superior graphite supplies provide chain; the primary hyperlink is Graphite One’s Graphite Creek mine in Alaska, at the moment working towards completion of its Feasibility Examine in 4Q 2024, on an accelerated timetable, with a $37.5 million Protection Manufacturing Act grant from the Division of Protection offered in July 2023.

Topic to financing, the plant will manufacture artificial graphite till a supply of pure graphite turns into accessible from the Firm’s Graphite Creek mine, positioned close to Nome, Alaska, in keeping with the March twentieth information launch.

Till the federal government deserted the Ohio property, the 160-acre website was used to retailer 26 sorts of supplies together with chrome ore, lead, tin, copper, zinc, nickel, rubber, mercury and graphite.

“It is nice to come back full circle, this website also referred to as the previous Warren Depot included graphite within the Nationwide Protection Stockpile greater than 30 years in the past, the final time the U.S. really mined graphite,” mentioned Graphite One’s President and CEO, Anthony Huston. “Ohio is the proper residence for the second hyperlink in our technique to construct a 100% U.S.-based superior graphite provide chain – from mining to refining to recycling. The U.S., merely can not keep a twenty first Century tech-driven economic system with out Important Minerals like graphite.”

The corporate says it is going to produce 25,000 tons per yr of battery-ready anode materials, and plans to ramp up manufacturing to 100,000 tpa.

EV hub

Based on Graphite One, the “Voltage Valley” Website is within the coronary heart of the car trade, with ample low-cost electrical energy produced from renewable vitality sources. It’s accessible by street and rail, with close by barging amenities.

The state of Ohio is actively searching for EV-related trade to diversify its economic system. “With manufacturing being one in every of Ohio’s largest financial drivers, I’m proud to see this new U.S.-based superior graphite provide chain in Niles,” mentioned Republican Congressman Dave Joyce. “This new mission will carry over 160 jobs and spur much more financial development within the space. I look ahead to seeing the success of this mission proper right here in [district] OH-14.”

Among the many introduced tasks coming to Ohio, South Korean-based LG Vitality Resolution has partnered with Normal Motors in Ultium Cells LLC, which is constructing a $2.3 billion electric-vehicle manufacturing plant in Lordstown, Ohio; Honda and LG Vitality Resolution will assemble a brand new EV battery plant in Fayette County; and Honda additionally introduced $700 million to retool three of its present factories in Union, Logan, and Shelby counties for EV manufacturing.

Nationwide Protection Stockpile a Important Minerals Checklist

Within the years earlier than World Battle II, the USA created the Nationwide Protection Stockpile (NDS) to accumulate and retailer important strategic supplies for nationwide protection functions. The Protection Logistics Company Strategic Supplies (DLA Strategic Supplies) oversees operations of the NDS and their major mission is to “defend the nation in opposition to a harmful and expensive dependence upon international sources of provide for important supplies in occasions of nationwide emergency.”

How governments can speed up the mining of important minerals, and the obstacles in the way in which

Regardless of this, in 1992 Congress directed that the majority of the strategic and significant supplies the US had accrued within the Nationwide Protection Stockpile be bought.

The first function of the Nationwide Protection Stockpile was to lower the chance of dependence on international or single suppliers of strategic and significant supplies utilized in protection, important civilian, and important industrial purposes.

Whereas a lot of the remainder of the world was scrambling to tie up management of strategic minerals, America intentionally hamstrung itself.

Issues started to vary below former President Trump, and it needed to – on the time the US was 100% reliant on imports of 13 important minerals, together with graphite.

In 2017 Trump signed an govt order to encourage the exploration and growth of recent US sources of those metals.

In December 2017, the U.S. Geological Survey launched its Skilled Paper 1802 titled “Important Mineral Assets of the United States- Financial and Environmental Geology and Prospects for Future Provide”.

The report represented the US Authorities’s most complete evaluation of the nation’s mineral useful resource profile and potential, serving to tell federal mineral coverage. The report lists 23 metals and minerals which can be important to “the nationwide economic system and nationwide safety of the USA.”

In 2018, the US Authorities’s Important Minerals Checklist was printed. By 2020, the Important Minerals Checklist was codified into federal regulation, with a mandate for it to be up to date each three years. As of 2024, the Important Minerals Checklist has grown to 50 components.

“The USA wants resilient, numerous, and safe provide chains to make sure our financial prosperity and nationwide safety. Pandemics and different organic threats, cyber-attacks, local weather shocks and excessive climate occasions, terrorist assaults, geopolitical and financial competitors, and different situations can cut back important manufacturing capability and the supply and integrity of important items, merchandise, and providers.”

The EO identifies three expertise sectors as important provide chains:

- Superior semiconductors

- Excessive-capacity batteries, together with electrical car (EV) batteries

- Prescribed drugs

The EO additionally identifies “important minerals and different… strategic supplies” as a fourth provide chain, important to expertise manufacturing and the protection industrial base.

Enhancing US dependence on graphite imports

One of many battery metals the world wants extra of is graphite, a key ingredient in EV batteries and vitality storage methods for which there aren’t any substitutes.

Analysts estimate that by 2030, it is going to take at the least 5 million tonnes of graphite per yr to fill battery demand. That is roughly 4 occasions the 1.3 million tonnes mined globally, in keeping with the USGS’s Mineral Commodities Summaries 2023.

For this reason the US Division of Vitality ranked graphite close to the highest of its checklist of minerals important to America’s vitality future. In 2022, President Biden issued a Presidential Dedication below the 1950 Protection Manufacturing Act (DPA), declaring graphite and 4 different key battery minerals which can be susceptible to provide disruptions, as “important to the nationwide protection.” That DPA authority offered Graphite One the $37.5 million grant to speed up its Feasibility Examine.

Graphite One might characterize a good portion of the quantity of graphite demanded by the USA, at the moment.

Contemplate: In 2023, the US imported 83,000 tonnes of pure graphite, of which 89% was flake and high-purity, appropriate for electrical autos.

Primarily based on the prefeasibility research, the Graphite Creek mine is anticipated to supply, on common, 51,813 tonnes of graphite focus per yr throughout its projected 23-year mine life.

If all goes in keeping with plan, the feasibility research – forward of schedule by one yr – would transfer Graphite One’s Graphite Creek deposit that a lot nearer to changing into America’s solely supply of mined graphite, serving to to shed its import reliance. (In actual fact, the FS contemplates a tripling of manufacturing, from 50,000 tonnes of graphite focus per yr as estimated within the PFS to greater than 150,000 tonnes.)

Graphite Creek mine

The one technique to alleviate import dependence is for the USA to seek out its personal supply of graphite manufacturing, and at AOTH we imagine a mission like Graphite One’s Graphite Creek deposit ticks all of the containers.

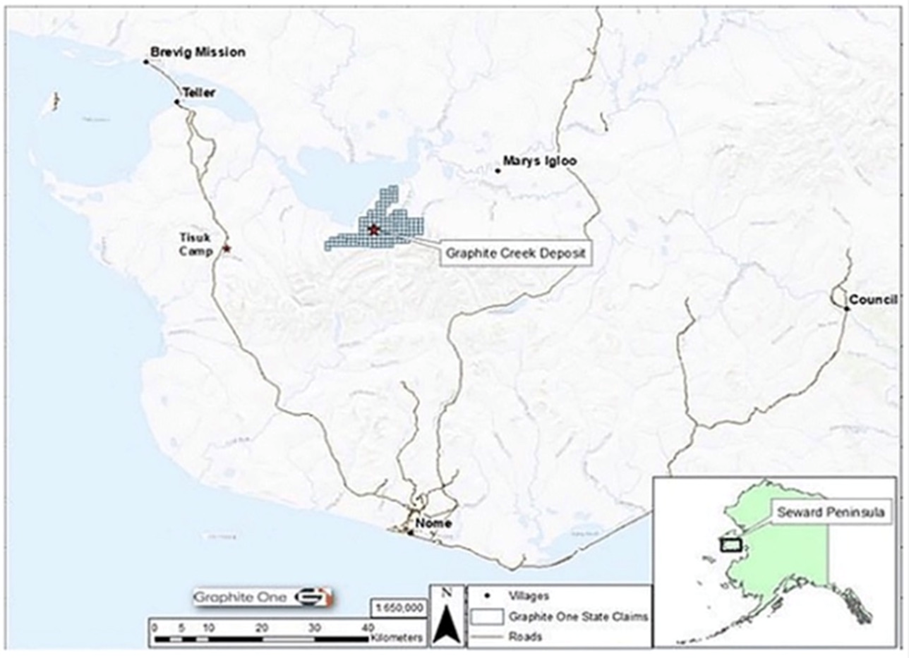

Based on the US Geological Survey, Graphite Creek is America’s largest recognized flake graphite useful resource, and is among the many largest on the planet.

On March 13, 2023, Graphite One up to date its useful resource estimate, which confirmed a rise of 15.5% in measured and indicated tonnage with a corresponding improve of 13.1% in contained tonnes of graphite.

Measured and indicated assets now stand at 37.6 million tonnes at 5.14% graphite, with an inferred useful resource of 243.7 million tonnes at 5.07% graphite.

Based on the PFS, the mine is predicted to supply, on common, 51,813 tonnes of graphite focus per yr throughout its projected 23-year mine life. The corporate itself is anticipated to supply about 75,000 tonnes of merchandise a yr, of which 49,600 tonnes can be anode supplies, 7,400 tonnes purified graphite merchandise and 18,000 tonnes unpurified graphite merchandise.

In October, Graphite One introduced the completion of the 2023 drill program together with a collection of assay outcomes. With the infusion of DoD funds, G1’s program quadrupled the scope of 2022’s, with 57 holes accomplished for a complete of 8,736 meters – the most important drill program in Graphite One’s historical past. Of the 57 holes, 5 holes had been geotechnical and the remaining 52 useful resource holes all intersected visible graphite mineralization and continued to reveal distinctive consistency of a shallow, high-grade graphite deposit that continues to be open each to the east and west of the present mineral useful resource estimate.

Extra broadly talking, Graphite One’s actions must be thought-about a bolt-on to what’s already occurring in northwestern Alaska with respect to the constructing of the primary deepwater port within the US Arctic area.

The U.S. Military Corps of Engineers and Alaska’s Division of Transportation have chosen two websites for a deepwater port facility: Nome and Port Clarence. Nome has obtained $600 million in authorities grants and seems to be effectively on its technique to doubling the dimensions of its present port to accommodate the world’s largest industrial and army vessels. Work is predicted to start out this yr.

Port Clarence is simply about 25 miles from Graphite One’s Graphite Creek deposit, which means G1 might grow to be an anchor buyer for a port on BSNC land at Level Spenser. At AOTH, we’re agnostic as to which deepwater port website will get constructed – each Port Clarence and Nome are inside a brief distance of Graphite Creek and will simply be linked by street.

Whereas the event of Graphite Creek is in feasibility research stage, the mission has been given a leg up by the federal authorities, which in 2021 gave the mission Excessive-Precedence Infrastructure Challenge (HPIP) standing. This ensures that the assorted federal allowing companies coordinate their critiques of tasks as a method of streamlining the approval course of. In different phrases, having HPIP signifies that Graphite Creek will possible be fast-tracked to manufacturing.

The mission is not close to a salmon fishery and it has the backing of native communities akin to Nome, which has an extended historical past of useful resource extraction.

The corporate has assist from the best political workplaces in Alaska – the governor, each senators and Alaska’s single Home member. They clearly see an funding to extend home capabilities for graphite as cash effectively spent.

The Bering Straits Native Company has pledged its help for the mission together with an up-front US$2 million funding with an choice to extend its funding as much as US$10.4 million.

As a matter of nationwide safety, the USA should construct port infrastructure and begin growing this area if it needs to take care of Arctic sovereignty, and we see Graphite One’s Graphite Creek mission as becoming in completely with these strategic plans.

We additionally see Graphite One taking a number one function in loosening China’s tight grip on the US graphite market by mining feedstock from its Graphite Creek mission in Alaska and delivery it, both by Nome or Port Clarence, to its deliberate graphite anode manufacturing plant in Voltage Valley, Ohio.

Graphite One Inc.

TSXV:GPH, OTCQX:GPHOF

2024.03.21 share value: Cdn$0.93

Shares Excellent: 129.0m

Market cap: Cdn$123M

GPH web site

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free publication

Authorized Discover / Disclaimer

Forward of the Herd publication, aheadoftheherd.com, hereafter referred to as AOTH.

Please learn all the Disclaimer rigorously earlier than you employ this web site or learn the publication. If you don’t comply with all of the AOTH/Richard Mills Disclaimer, don’t entry/learn this web site/publication/article, or any of its pages. By studying/utilizing this AOTH/Richard Mills web site/publication/article, and whether or not you really learn this Disclaimer, you might be deemed to have accepted it.

Any AOTH/Richard Mills doc just isn’t, and shouldn’t be, construed as a proposal to promote or the solicitation of a proposal to buy or subscribe for any funding.

AOTH/Richard Mills has based mostly this doc on info obtained from sources he believes to be dependable, however which has not been independently verified.

AOTH/Richard Mills makes no assure, illustration or guarantee and accepts no duty or legal responsibility as to its accuracy or completeness.

Expressions of opinion are these of AOTH/Richard Mills solely and are topic to vary with out discover.

AOTH/Richard Mills assumes no guarantee, legal responsibility or assure for the present relevance, correctness or completeness of any info offered inside this Report and won’t be held accountable for the consequence of reliance upon any opinion or assertion contained herein or any omission.

Moreover, AOTH/Richard Mills assumes no legal responsibility for any direct or oblique loss or harm for misplaced revenue, which you’ll incur because of the use and existence of the data offered inside this AOTH/Richard Mills Report.

You agree that by studying AOTH/Richard Mills articles, you might be appearing at your OWN RISK. In no occasion ought to AOTH/Richard Mills accountable for any direct or oblique buying and selling losses brought on by any info contained in AOTH/Richard Mills articles. Data in AOTH/Richard Mills articles just isn’t a proposal to promote or a solicitation of a proposal to purchase any safety. AOTH/Richard Mills just isn’t suggesting the transacting of any monetary devices.

Our publications aren’t a advice to purchase or promote a safety – no info posted on this website is to be thought-about funding recommendation or a advice to do something involving finance or cash except for performing your personal due diligence and consulting along with your private registered dealer/monetary advisor. AOTH/Richard Mills recommends that earlier than investing in any securities, you seek the advice of with knowledgeable monetary planner or advisor, and that you must conduct an entire and unbiased investigation earlier than investing in any safety after prudent consideration of all pertinent dangers. Forward of the Herd just isn’t a registered dealer, seller, analyst, or advisor. We maintain no funding licenses and will not promote, provide to promote, or provide to purchase any safety.

Extra Information:

This information is printed on the Investorideas.com Newswire – a worldwide digital information supply for traders and enterprise leaders

Disclaimer/Disclosure: Investorideas.com is a digital writer of third get together sourced information, articles and fairness analysis in addition to creates authentic content material, together with video, interviews and articles. Authentic content material created by investorideas is protected by copyright legal guidelines apart from syndication rights. Our website doesn’t make suggestions for purchases or sale of shares, providers or merchandise. Nothing on our websites must be construed as a proposal or solicitation to purchase or promote merchandise or securities. All investing includes danger and doable losses. This website is at the moment compensated for information publication and distribution, social media and advertising and marketing, content material creation and extra. Disclosure is posted for every compensated information launch, content material printed /created if required however in any other case the information was not compensated for and was printed for the only curiosity of our readers and followers. Contact administration and IR of every firm immediately relating to particular questions.

Extra disclaimer information: https://www.investorideas.com/About/Disclaimer.asp Study extra about publishing your information launch and our different information providers on the Investorideas.com newswire https://www.investorideas.com/Information-Add/

World traders should adhere to laws of every nation. Please learn Investorideas.com privateness coverage: https://www.investorideas.com/About/Private_Policy.asp