The 2 finest methods to point out your worth to purchasers?

- Generate extra earnings

- Cut back their bills

However most of us don’t have a crystal ball to foresee market situations, and making guarantees about returns to prospects or purchasers is usually frowned upon (to place it mildly).

For a lot of advisors, the following smartest thing – behind creating sudden psychic talents – is to supply tax optimization companies that may assist uncover money-saving alternatives for purchasers.

On this overview, we’re exploring how Nitrogen’s Tax Drag capabilities will let you optimize consumer returns, differentiate your agency and improve due diligence processes.

Again to the Fundamentals: What’s Tax Drag (and Why is it Essential)?

“Tax Drag” is an umbrella time period for the destructive affect of taxes on a consumer’s returns, often triggered by distributions and capital good points in non-qualified accounts.

Tax Drag is commonly thought of a lack of earnings and a monetary burden to purchasers, though the particular Tax Drag a consumer experiences will rely on their earnings, money owed, accounts, and different components. A latest SEI report on Tax Drag notes that “nearly each change you make to your portfolio – an allocation adjustment, or perhaps a distribution – can generate dangerous uncomfortable side effects: taxes.”

For advisors that wish to develop their e book of purchasers and preserve a excessive degree of service, manually optimizing Tax Drag is out of the query – it could merely be too complicated and time-consuming.

Turning Tax Burdens into Consumer Advantages

Nitrogen is altering that equation. With our securities and portfolio-level analytics, your agency has entry to the Tax Drag inside every particular person holding of a portfolio or proposal. In just some clicks, you’ll be able to guarantee your consumer has essentially the most tax-efficient portfolio attainable.

Let’s discover a number of of the important thing advantages Nitrogen’s Tax Drag offers:

1. You may improve your due diligence course of

As an advisor, it’s crucial that you’ve got due diligence processes in place to make sure your purchasers are receiving suggestions finest suited to their wants. Nonetheless, researching data surrounding a selected advice (after which discovering a solution to clearly current your findings to purchasers) will be time-consuming.

With Nitrogen’s Tax Drag, you will have practically instantaneous entry to the potential tax implications of various funding choices, displayed side-by-side with consumer insights.

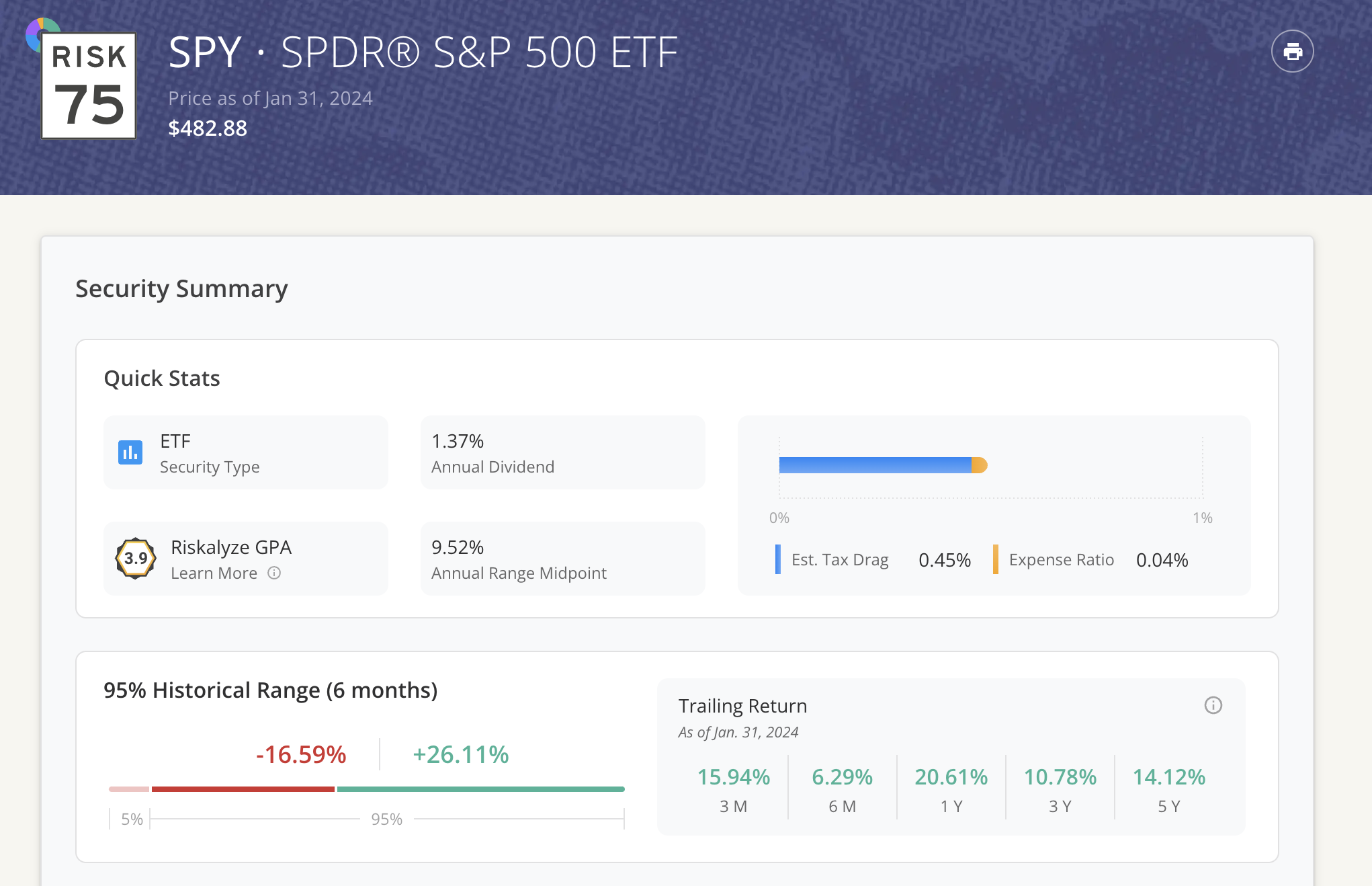

Under is an instance display of what it might seem like whenever you click on into a person holding. Discover how the estimated Tax Drag is proven alongside different key data just like the GPA and 95% Historic Vary knowledge.

With that knowledge in hand, you’ll be able to constantly choose investments which can be extra tax-efficient for the consumer and higher talk the general dangers and returns inside their portfolio.

2. You may converse your purchasers’ language and entice extra prospects

When used accurately, numbers can inform a robust story. In all probability, your purchasers could not even pay attention to the cash they’re shedding out on as a result of Tax Drag.

By translating the affect of Tax Drag into actual, tangible numbers, you show your dedication to their monetary well-being and foster stronger relationships constructed on belief and transparency.

Plus, do you know that blissful purchasers may very well result in extra purchasers? One latest research discovered that “advisors attribute about 88% of their new enterprise to referrals from current purchasers.”

Associated: Win Prospects Quicker with Tax Drag

3. You may uncover alternatives for portfolio optimization

Lastly, Nitrogen’s Tax Drag capabilities will let you optimize your consumer portfolios for extra financial savings. It goes past conventional return metrics, revealing hidden tax inefficiencies inside particular person securities and the portfolio as a complete.

Moreover, cash saved by way of a discount of tax liabilities can keep invested for long-term affect. Each penny saved is greater than earned – it’s a penny compounded.

In the long term, sensible tax methods can translate to a major enhance in your purchasers’ wealth potential.

Associated: How Tax Drag Highlights Stark Variations Between ETFs & Mutual Funds

Crunch the Numbers with Nitrogen

To begin calculating Tax Drag inside Nitrogen, you’ll have to set the taxable standing of your new or current account. For brand new accounts, you can be prompted to enter that data throughout the preliminary setup. For current accounts, you’ll be able to set the standing by clicking the three-dot Menu, choosing Setting and clicking Tax Standing.

Be aware that accounts set to “non-taxable” is not going to embrace Tax Drag knowledge.

Calculating Securities-level Tax Drag vs. Portfolio-level Tax Drag

Nitrogen calculates Tax Drag in two major methods: on the securities degree and portfolio degree.

For portfolios, Tax Drag is represented by the weighted common of the Tax Drag for every safety throughout the portfolio, assuming a relentless portfolio composition of no less than three years.

Associated: Discover our Detailed Portfolio Stats

On the securities degree, you’ll be able to calculate Tax Drag for shares, mutual funds and ETFs. Nitrogen divides the after-tax return by the pre-tax return for a particular holding, with the belief that the consumer pays the utmost federal fee on capital good points and unusual earnings fee.

Tax Drag = [1 – ((1+AT) / (1+PT))] x 100, the place AT = 3-12 months Annualized Distribution After-Tax Return and PT = 3-12 months Annualized Return (Pre-Tax).

Be aware that the after-tax return displays the after-tax distribution return, which means it doesn’t embrace any assumptions or consideration for the tax penalties incurred for promoting or liquidating positions. Moreover, any state and native tax liabilities are usually not included within the calculation.

Chances are you’ll not be capable of see the long run, however with Tax Drag you’ll be able to reveal hidden tax inefficiencies and gasoline development. By embracing tax optimization and leveraging highly effective instruments like Nitrogen’s Tax Drag, your agency can higher join with purchasers and solidify your place as their trusted advisor.

Get Began with Nitrogen Tax Drag

Able to uncover tax-saving alternatives on your purchasers? Click on right here to discover our fast information on setting taxable statuses for brand new and current accounts.

To see Nitrogen’s Platform in motion, schedule a free demo right now.