Creating wealth isn’t about discovering secret formulation or making fortunate guesses. It’s about recognizing and understanding patterns which have stood the check of time. These patterns seem constantly throughout markets, economies, and human habits.

By finding out and internalizing these patterns, you’ll be able to higher perceive how wealth is constructed and maintained. The next patterns characterize foundational ideas that profitable wealth-builders have leveraged all through historical past.

Whereas no single sample ensures success, their mixed understanding offers a strong framework for making knowledgeable monetary choices. In case you actually need to create wealth, examine and observe these ten patterns:

1. The Compound Development Sample: How Small Returns Develop into Life-Altering Wealth

Albert Einstein supposedly described compound curiosity because the world’s eighth surprise, noting that those that perceive it earn it whereas those that don’t pay it. The magic of compounding lies in its exponential nature – an idea that turns into extra highly effective the sooner you start.

If you reinvest your returns, every cycle builds upon the final, creating an accelerating development curve. This precept applies to each monetary and non-financial points of wealth constructing. A single greenback invested at a modest return charge can develop into substantial wealth over many years via compounding.

This sample extends past monetary returns – it applies to data, relationships, and enterprise development. Every new talent you be taught combines with earlier data to create distinctive insights. Each skilled connection can result in exponential networking alternatives. In enterprise, every glad buyer can develop into a supply of referrals, creating compound development in your buyer base.

2. The Market Cycle Sample: Dancing with Bulls and Bears

Markets transfer in cycles of enlargement and contraction, following recognizable patterns of accumulation, markup, distribution, and markdown phases. These cycles happen throughout all timeframes and markets, from shares to actual property to commodities.

Understanding these rhythms helps keep perspective throughout market extremes. Throughout euphoric peaks, markets can appear unstoppable, resulting in overconfidence and extreme risk-taking. At devastating lows, restoration can appear not possible, inflicting many to desert sound long-term methods.

The important thing isn’t to completely time these cycles however to acknowledge the place we is likely to be inside them. This consciousness helps you keep emotional equilibrium and make extra rational choices. By understanding market cycles, you’ll be able to higher place your investments to climate totally different market situations whereas making the most of alternatives throughout numerous phases.

3. The Diversification Sample: Constructing Your All-Climate Portfolio

Diversification represents nature’s approach of managing threat. Simply as ecosystems thrive via biodiversity, funding portfolios develop into extra resilient via selection. This sample includes spreading investments throughout asset courses that reply in a different way to financial situations.

When some property battle, others might thrive, making a pure stabilizing impact. The purpose isn’t maximizing returns however optimizing them inside your threat tolerance. Correct diversification goes past proudly owning totally different shares—it consists of various asset courses, geographic areas, and funding methods.

This sample additionally applies to revenue sources and enterprise methods. Having a number of streams of revenue offers stability and alternatives for development. In enterprise, diversifying your buyer base, product strains, or service choices can shield towards market modifications whereas creating new development alternatives.

4. The Behavioral Finance Sample: Mastering Your Funding Psychology

Human psychology follows predictable patterns in monetary markets, and understanding these patterns may help you make higher funding choices. Loss aversion makes you are feeling the ache of losses roughly twice as intensely because the pleasure of equal positive aspects, typically resulting in untimely promoting throughout market downturns.

Affirmation bias leads you to hunt data supporting your beliefs whereas dismissing contradicting proof. This may end up in holding onto shedding investments too lengthy or avoiding promising alternatives that don’t suit your preconceptions.

Recognizing these patterns in your habits is step one towards making extra goal choices. Essentially the most profitable traders develop programs to counter these pure biases. This may embrace creating funding checklists, sustaining choice journals, or working with trusted advisors who can present goal suggestions.

5. The Threat Administration Sample: Enjoying Protection to Win

Profitable wealth constructing requires understanding that defending capital is as vital as rising it. This sample focuses on figuring out and managing various kinds of threat – market, credit score, liquidity, and operational dangers.

The bottom line is discovering uneven alternatives the place potential rewards considerably outweigh doable losses. This method ensures survival throughout powerful occasions whereas positioning for development throughout favorable situations. Threat administration isn’t about avoiding threat completely -but taking calculated dangers with favorable odds.

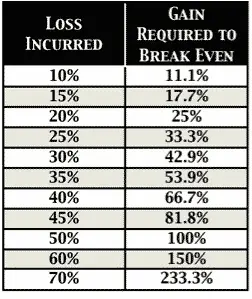

Skilled traders typically analyze what might go fallacious moderately than deal with potential returns. They perceive {that a} 50% loss requires a 100% acquire to interrupt even. This defensive mindset helps protect capital throughout market downturns and offers the mandatory ammunition to make the most of alternatives.

6. The Worth Investing Sample: Discovering Hidden Gems in Plain Sight

Worth investing includes figuring out property buying and selling beneath their intrinsic price. This method, championed by Benjamin Graham and Warren Buffett, includes trying past market noise to seek out elementary worth. It requires persistence, thorough evaluation, and the self-discipline to behave when alternatives come up.

The sample repeats as a result of markets commonly overreact to short-term information, creating alternatives for long-term traders. Worth traders search for robust companies with momentary issues, property which can be out of favor with the market, or conditions the place worry has pushed costs beneath cheap ranges.

This sample works as a result of human nature causes markets to swing between extremes of worry and greed. By specializing in elementary worth moderately than market sentiment, you’ll be able to revenue from these emotional swings whereas sustaining a margin of security.

7. The Greenback-Price Averaging Sample: Gradual and Regular Wins the Race

Constant, common investing helps overcome the problem of market timing. By investing mounted quantities at common intervals, you naturally purchase extra shares when costs are low and fewer when costs are excessive. This removes the emotional burden of making an attempt to select excellent entry factors.

This sample works significantly properly in office retirement accounts or systematic funding plans. It turns market volatility into a bonus moderately than a supply of stress. The bottom line is sustaining the self-discipline to proceed investing throughout market downturns when emotional instincts may counsel in any other case.

The ability of this sample lies in its simplicity and effectiveness over time. It combines the advantages of compound development with a scientific method that reduces the affect of market volatility in your long-term outcomes.

8. The Revenue Era Sample: Constructing Your Cash Machine

Sustainable wealth typically comes from constructing a number of streams of revenue. This sample includes creating programs that generate common money stream via dividends, curiosity, rental revenue, or enterprise operations. The main target is on property that produce revenue moderately than solely counting on worth appreciation.

Initially, it’s essential to reinvest this revenue, permitting it to compound and ultimately create a self-sustaining cycle of wealth era. As your revenue streams develop, they will present monetary flexibility and cut back dependence on any single supply of revenue.

The best income-generating property typically require a big upfront funding of time or capital however can present constant returns for years or many years. This may embrace constructing a enterprise, creating an actual property portfolio, or creating mental property.

9. The Entrepreneurial & Innovation Sample: Using the Waves of Change

Technological and market improvements create waves of alternative. Understanding adoption curves and innovation cycles helps establish rising tendencies early. This sample includes recognizing how new applied sciences or enterprise fashions can disrupt present programs and create wealth-building alternatives.

The bottom line is balancing the potential of innovation with the dangers of unproven concepts. Profitable entrepreneurs and traders typically place themselves on the intersection of established tendencies and rising alternatives. They perceive that timing is essential – too early could be as pricey as too late.

Innovation patterns are likely to observe predictable cycles of improvement, adoption, maturity, and eventual disruption. By understanding these cycles, you’ll be able to higher establish alternatives whereas avoiding the pitfalls of over-hyped tendencies.

10. The World Financial Sample: Considering Like a World Investor

World financial patterns emerge from demographics, know-how, and coverage modifications. Understanding these macro tendencies helps place your investments to profit from long-term shifts within the worldwide financial system.

This consists of recognizing demographic transitions, technological revolutions, and the continual evolution of world markets. Main financial shifts typically create dangers and alternatives throughout totally different areas and sectors. Considering globally whereas appearing regionally can present vital benefits in an interconnected world.

Profitable traders take note of cyclical and secular tendencies within the world financial system. They perceive how modifications in a single area can create ripple results worldwide and place their investments accordingly.

Conclusion

These patterns present a complete framework for understanding how wealth is created and maintained over time. Every sample reinforces the others, making a holistic wealth-building method past easy funding methods.

The important thing to success lies not in flawlessly executing any single sample however in understanding how they work collectively and making use of them constantly over time. By finding out these patterns and adapting them to your circumstances, you’ll be able to develop a extra systematic and profitable method to constructing lasting wealth.

Begin by specializing in the patterns that resonate most strongly together with your scenario, then regularly incorporate others as your understanding grows. Wealth constructing is a journey moderately than a vacation spot; these patterns can information you.

Success comes not from discovering shortcuts however from understanding and dealing with these elementary patterns. They characterize the gathered knowledge of generations of profitable traders and entrepreneurs and supply a confirmed path towards constructing and sustaining long-term wealth.