By Luisa Maria Jacinta C. Jocson, Reporter

HEADLINE INFLATION possible quickened in February amid greater costs of key commodities like meals, electrical energy and gas, analysts mentioned.

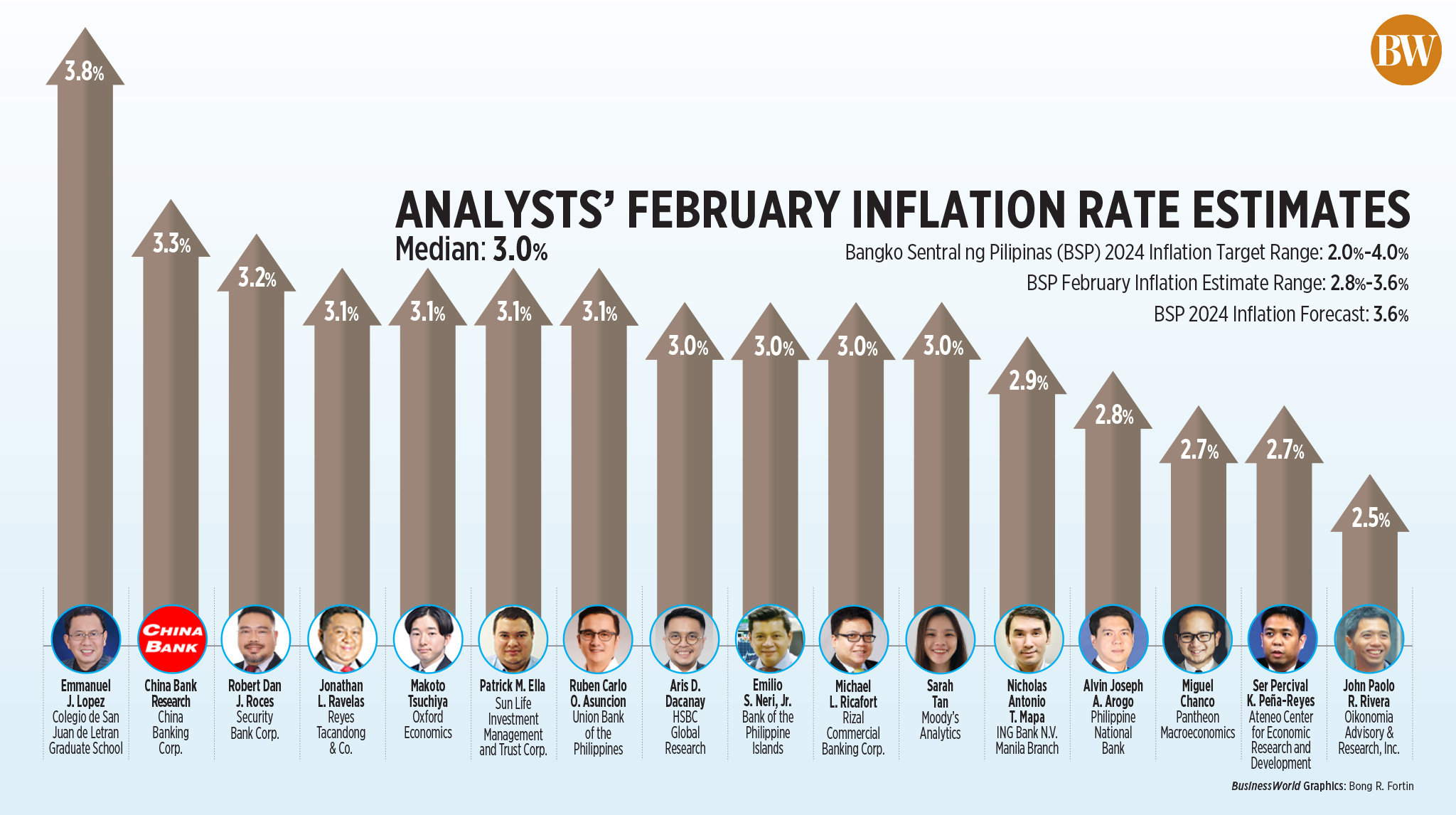

A BusinessWorld ballot of 16 analysts yielded a median estimate of three% for the buyer value index (CPI) in February. That is inside the 2.8-3.6% forecast of the Bangko Sentral ng Pilipinas (BSP) for the month.

If realized, February inflation could be barely quicker than the two.8% print in January however a lot slower than 8.6% in the identical month a yr in the past.

It could additionally mark the first time that inflation picked up on a month-on-month foundation since September 2023.

February would additionally mark the third straight month that inflation was inside the BSP’s 2-4% goal vary.

The Philippine Statistics Authority (PSA) is ready to launch February inflation information on Tuesday (March 5).

“We search for headline inflation to speed up a contact to three% yr on yr in February from 2.8% in January,” Sarah Tan, an economist from Moody’s Analytics, mentioned in an e-mail.

“Key elements driving upward value pressures embody greater costs of key agricultural items resembling rice and meat produce, a rise in electrical energy charges in addition to greater petroleum costs,” she added.

Information from the Agriculture division confirmed that as of Feb. 29, the worth of a kilogram of native well-milled rice ranged from P48 to P55 from P37 to P45 in the identical interval a yr in the past. Common-milled rice rose to P50 per kilogram from P32 to P40.

ING Financial institution N.V. Manila Senior Economist Nicholas Antonio T. Mapa mentioned that rice continued to be a essential driver of inflation.

“Excessive home rice costs and a hike in electrical energy charges additionally fanned inflationary pressures in the course of the month. World rice costs barely eased by the tip of February however its affect on home costs will possible take a while earlier than taking effect,” HSBC economist for ASEAN Aris Dacanay mentioned in an e-mail.

China Financial institution Analysis additionally famous electrical energy charges rose in areas serviced by Manila Electrical Co. (Meralco), in addition to elements of Visayas and Mindanao, in the course of the month.

The general charge for a typical family rose by P0.5738 to P11.9168 per kilowatt-hour (kWh) in February from P11.3430 within the earlier month, Meralco mentioned. This was attributable to a rise within the era cost, which accounts for nearly 80% of a client’s month-to-month electrical energy invoice.

“Additionally, the Division of Vitality reported a rise in crude oil costs attributable to supply-side constraints coming from the Group of the Petroleum Exporting Nations output caps and lingering conflicts alongside the Purple Sea,” Ms. Tan added.

In February alone, pump value changes stood at a internet improve of P1.05 a liter for gasoline, P1.55 a liter for diesel and P0.35 a liter for kerosene.

In the meantime, analysts mentioned that fading base effects have additionally contributed to the potential uptick in inflation.

“Inflation for February might choose as much as 3% yr on yr mathematically attributable to some easing of the excessive base results,” Rizal Business Banking Corp. Chief Economist Michael L. Ricafort mentioned in an e-mail.

Mr. Dacanay additionally famous the “unfavorable” base effects because of the peak in inflation in January 2023, which stood at a 14-year excessive of 8.7%.

“With none sudden change in coverage or exterior situations, these unfavorable base results will possible stay in place till July of this yr and might doubtlessly push inflation to breach the central financial institution’s 2-4% goal band someday within the second quarter,” he added.

RISKS TO OUTLOOK

Within the coming months, analysts mentioned inflation could spike in the midst of the yr.

“Trying forward, we anticipate inflation will breach the BSP’s 2-4% goal once more from April to July attributable to base results. Nevertheless, common headline inflation will possible settle inside goal this yr,” China Financial institution Analysis mentioned.

Philippine Nationwide Financial institution economist Alvin Joseph A. Arogo flagged dangers to the inflation outlook, such because the El Niño climate occasion.

“Our baseline estimates assume that amid the wearing-off of base effects, there shall be a transitory spike in costs due to the threats from El Niño, doable Center East battle escalation, and lagged affect of minimal wage hikes,” he mentioned in an e-mail.

The newest bulletin from the state climate bureau confirmed that the El Niño will possible persist till Could.

Earlier estimates by the central financial institution confirmed that the dry climate sample might affect inflation by 0.02 share level.

“We count on some volatility within the inflation readings over the following few months given the El Niño climate sample might strengthen and preserve meals costs elevated,” Moody’s Analytics Ms. Tan mentioned.

“We perceive that we are actually experiencing El Niño, nonetheless, we be aware that different crops seem to have costs both falling or extra behaved. If authorities can discover a strategy to decrease the price of rice, we might see inflation effectively beneath management,” Mr. Mapa added.

Fading base effects and the El Niño might trigger inflation to peak at 5% within the June-July interval earlier than easing to three.5% in September, Union Financial institution of the Philippines, Inc. Chief Economist Ruben Carlo O. Asuncion mentioned.

POLICY CUT

Regardless of the potential uptick in inflation, analysts count on the BSP to maintain charges regular till it begins coverage easing in the midst of the yr.

Solar Life Funding Administration and Belief Corp. economist Patrick M. Ella mentioned he expects the BSP to chop charges beginning June.

“Ought to February’s inflation print settle inside the BSP’s goal vary of two% to 4%, this may give the BSP confidence to maintain its coverage charge regular after they subsequent meet on April 4,” Ms. Tan mentioned.

The BSP saved its benchmark charge regular at 6.5% at its February assembly. The central financial institution raised borrowing prices by 450 foundation factors (bps) from Could 2022 to October 2023.

“Our base case in the meanwhile is that the Financial Board will begin normalizing (slicing) charges in Could, by 25 bps, with 2024 prone to see a complete of 100 bps in reductions,” Pantheon Chief Rising Asia Economist Miguel Chanco mentioned.

ING’s Mr. Mapa additionally mentioned the BSP will stay on maintain so long as the US Federal Reserve retains charges unchanged.