With the expiration of key provisions from Trump’s Tax Cuts and Jobs Act approaching in 2025, it’s necessary to start out planning your tax technique now to be ready for the upcoming modifications.

Particular person Tax Charges Lowered

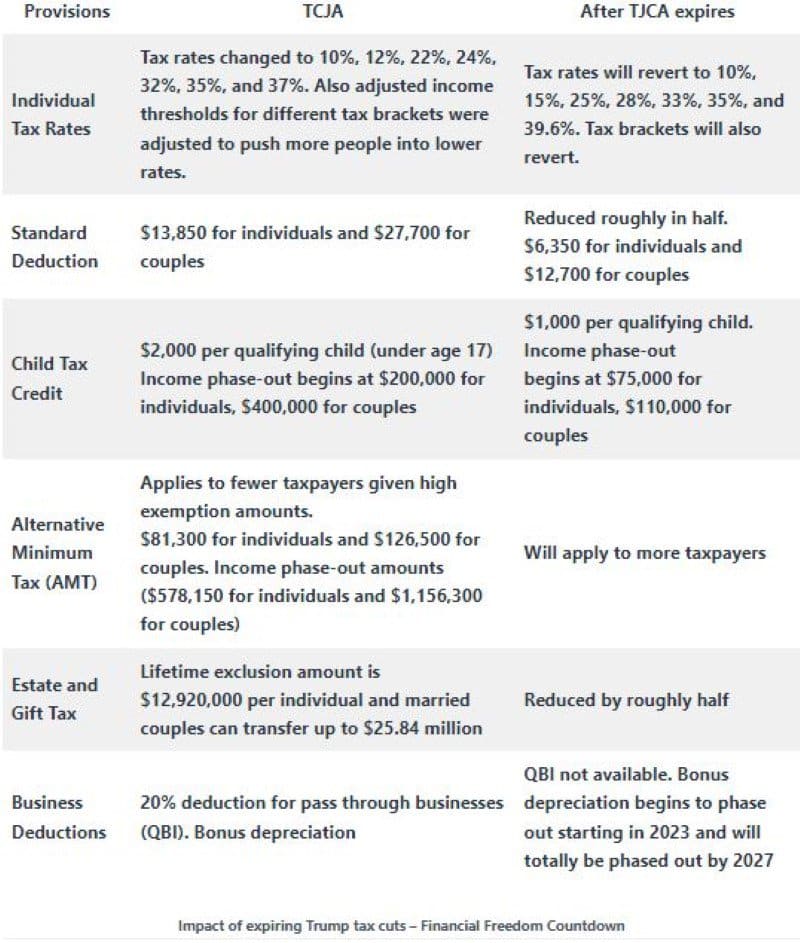

The TCJA revised the tax construction by lowering tax charges throughout numerous revenue brackets and modifying the revenue ranges related to every tax bracket.

Beforehand, there have been seven tax brackets with respective charges of 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%.

Beneath the TCJA, these have been adjusted to charges of 10%, 12%, 22%, 24%, 32%, 35%, and 37%, leading to a discount of taxes for almost all of taxpayers.

Normal Deduction Doubled

The usual deduction was practically doubled beneath the TCJA. It elevated from $13,000 to $24,000 for joint filers and $6,500 to $12,000 for people.

Increased Different Minimal Tax (AMT) Exemption Quantities

The TCJA additionally modified how the Different Minimal Tax (AMT) is calculated, so it utilized to solely high-income people. It now solely impacts fewer individuals as a result of extra vital exemption quantities ($81,300 for people and $126,500 for {couples}).

Nonetheless, after the TCJA expires, extra individuals might need to pay it once more as a result of the exemption quantities and revenue phase-out thresholds will lower.

Youngster Tax Credit score Doubled

The TCJA doubled the kid tax credit score from $1,000 to $2,000 per baby. Presently, you will get this credit score for every baby beneath 17, and it begins to section out in the event you make greater than $200,000 as a person or $400,000 as a pair.

After the TCJA expires, the kid tax credit score will lower to $1,000 per qualifying baby, and it’ll begin to section out in the event you make greater than $75,000 as a person or $110,000 as a pair.

Retirement Planning

When the TCJA expires, the tax brackets will return to what they have been earlier than, which suggests some individuals might need to pay extra in taxes for the reason that high tax bracket will improve from the present 37% to 39.6%.

Given this case, it will be prudent to discover avenues for pulling revenue ahead inside the subsequent few years to leverage the present decrease brackets. You are able to do this by exercising inventory choices now and avoiding deferred compensation plans.

Conventional IRAs require minimal distributions (RMDs) commencing at age 73 and are taxable as strange revenue. Then again, Roth IRAs don’t impose RMDs, and all future progress and distributions stay exempt from taxation.

One of many advantages of early retirement is that taxpayers have a number of years between their retirement date and RMD age to transform their IRAs to Roth IRAs in a decrease tax bracket.

In case you are not planning for early retirement and your revenue is predicted to proceed to extend over the following couple of years, by changing your conventional IRA to a Roth IRA earlier than 2026, you’ll assume the upfront revenue tax legal responsibility (probably at a decrease tax price), quite than dealing with it on the time of distribution.

The SECURE Act eradicated the Stretch IRA provisions. For people who’re topic to the 10-year rule on inherited IRAs, it’s advisable to ponder the potential of choosing extra substantial distributions earlier than the expiration of the TCJA, particularly if there may be concern relating to the potential rise in tax charges in the course of the later levels of the necessary 10-year window for full distribution of the account.

Capital Good points Tax

With inventory markets at report highs, investing in shares has resulted in numerous unrealized capital features.

With the TJCA, the tax brackets for long-term capital features and certified dividends aren’t linked to the strange revenue tax brackets.

Verify together with your tax advisor on promoting a few of your shares in the event you anticipate probably larger future tax charges.

You could possibly maximize Lengthy Time period Capital Good points whereas within the decrease bracket on your marginal price and harvesting losses to offset features when applicable.

Lifetime Reward and Property Tax Exemption Doubled

The TCJA doubled the lifetime reward and property tax exemption limits.

As of 2023, people are eligible to switch as much as $12.92 million, whereas married {couples} can switch as much as $25.84 million with out incurring federal reward taxes or property taxes, both throughout their lifetime or as a part of their property.

This traditionally excessive exemption quantity might be halved after the 2025 tax yr.

Verify together with your tax advisor whether it is value accelerating these gifting plans to your youngsters and grandchildren every year. For these with even bigger estates, it’s time to contemplate potential bigger lifetime presents.

Tax technique needs to be a key consideration when organising residing trusts.

Enterprise Deductions

The TCJA launched certified enterprise revenue (QBI) deduction, facilitating pass-through companies to deduct a most of 20 p.c of their earnings. Discover 2019-07 launched a brand new protected harbor provision for rental actual property beneath Part 199A of the Inside Income Code, making rental properties eligible for QBI.

Beneath the Tax Cuts and Jobs Act (TCJA), the qualification for 100% bonus depreciation was launched relying on the yr you positioned the property into service. For actual property investing, many inside upgrades to buildings are eligible for functions of bonus depreciation. Using a value segregation examine is without doubt one of the strategies to make sure eligibility for the accessible bonus depreciation proportion.

Present provisions permit for a faster depreciation of sure property, which is a boon for lowering taxable revenue. Nonetheless, post-sunset, the elongation of this timeline might imply larger taxable revenue. Verify together with your tax advisor for capitalizing on the prevailing provisions by accelerating depreciation to decrease your taxable bracket.

What Occurs if Trump Tax Cuts Expire?

Because the TCJA provisions edge nearer to their expiration date of 2025, people should stay proactive of their tax planning efforts. It’s essential to reassess your funding technique and discover alternatives to make the most of the present tax provisions.

Hope for Extension of Tax Cuts Seems Bleak

With the 2024 Presidential election season in full swing, animosity between the events is excessive. With out immediate motion from Congress, the automated expiration of the varied tax provisions appears extra seemingly.

Relying on the result of the elections and the negotiations in Congress, it’s advisable to not delay tax planning.

Tax planning might be advanced, particularly when coping with altering tax legal guidelines. Search steerage from a licensed tax skilled to make sure your monetary objectives align with the evolving tax panorama.

Like this content material? Comply with Monetary Freedom Countdown

The ten States Taxing Social Safety in 2024 and the two That Simply Stopped

Whereas many bask within the perception that their golden years might be tax-friendly, residents in 9 particular states are dealing with a actuality verify as their Social Safety advantages come beneath the taxman’s purview. Conversely, a wave of aid is ready to scrub over two states, marking an finish to their period of taxing these advantages. This shift paints a posh portrait of retirement planning throughout the U.S., underscoring the significance of staying knowledgeable of the ever altering tax legal guidelines. Are you residing in certainly one of these states? It’s time to uncover the impression of those tax modifications in your retirement technique and probably rethink your locale selection for these serene post-work years. Listed below are the states taxing social safety advantages.

The States Taxing Social Safety in 2024 and the two That Simply Stopped

Retire Overseas and Nonetheless Acquire Social Safety? Keep away from These 9 International locations The place It’s Not Potential

Dreaming of retiring to a sun-drenched seaside or a quaint village? Many Individuals envision spending their golden years overseas, savoring the delights of latest cultures and landscapes. Nonetheless, a vital a part of this dream hinges on the monetary stability supplied by Social Safety advantages. Earlier than packing your luggage and bidding farewell, it’s essential to know that not all international locations play by the identical guidelines in relation to amassing these advantages abroad. Listed below are the 9 international locations the place your dream of retiring overseas might hit a snag, as Social Safety advantages don’t cross each border. Keep away from residing in these international locations so your retirement plans don’t get misplaced in translation.

Shift From Worker to Investor Mindset with the Cashflow Quadrant Methodology by Robert Kiyosaki

Numerous programs have been established that present a significantly better understanding of what revenue era is, how it may be used, and the way people can manage their monetary life as they work in the direction of monetary freedom. One of many extra profitable and better-known examples of monetary schooling is the Cashflow Quadrant, the e book by Robert Kiyosaki. Wealthy Dad’s Cashflow Quadrant was revolutionary for the way in which it organized cash and helped individuals higher discover ways to improve their revenue. Because the identify implies, there are 4 quadrants inside the Cashflow Quadrant. By mastering every of the 4 classes – or specializing in a single – an individual can improve their income stream and in the end make more cash.

Shift From Worker to Investor Mindset with the Cashflow Quadrant Methodology by Robert Kiyosaki

AARP Survey Reveals Over 50% of Individuals 50 and Older Worry Monetary Wreck in Retirement

A current AARP survey highlights a dire state of affairs for older Individuals: 20% of adults aged 50 and above haven’t any retirement financial savings in any respect. This lack of monetary preparedness is inflicting vital nervousness, with 61% of this age group nervous they received’t come up with the money for to help themselves in retirement.

AARP Survey Reveals Over 50% of Individuals 50 and Older Worry Monetary Wreck in Retirement

Is Tapping Your 401(ok) to Delay Social Safety Till 70 a Dangerous Transfer for Your Retirement?

Selecting when to assert Social Safety is an important choice for retirees. The 2 primary choices are claiming advantages at 62 to preserve retirement financial savings or utilizing 401(ok) funds to delay Social Safety till 70. Each methods include professionals and cons, relying in your monetary wants and long-term objectives.

Is Tapping Your 401(ok) to Delay Social Safety Till 70 a Dangerous Transfer for Your Retirement?

Is the 4.28% Treasury I Bond Fee Your Final Probability to Lock in a Sturdy 30-12 months Fastened Fee? Right here’s Why It’s Prone to Drop After October

Inflation has turn into a big concern. In the course of the previous three years of surging inflation, I bonds supplied a protected and engaging funding possibility. Nonetheless, with current decrease CPI numbers, the present composite price for I bonds has dropped to 4.28%, a pointy decline from the engaging 9.62% annual price accessible in Could 2022. As charges lower, traders are actually contemplating whether or not it’s nonetheless value shopping for Sequence I bonds earlier than the October thirty first deadline when charges are anticipated to reset decrease.

Retirement Expectations Conflict with Actuality as Social Safety’s Future Stays Unsure

As financial considerations proceed to develop, a big disconnect persists between how non-retirees understand their future monetary stability and the precise expertise of present retirees, notably with respect to Social Safety.

Retirement Expectations Conflict with Actuality as Social Safety’s Future Stays Unsure

2025 Social Safety COLA Forecast Disappoints Retirees Struggling to Preserve Up with Hovering Inflation

The official Social Safety cost-of-living adjustment (COLA) numbers launched on tenth October are a disappointing 2.5%, a pointy drop from the three.2% improve retirees obtained in 2024. Subsequent yr’s COLA falls far in need of the 8.7% adjustment for 2023, which was the biggest improve in over 40 years and meant to assist seniors and folks with disabilities sustain with hovering costs. This meager adjustment raises considerations about how seniors will address persistent inflation

Did you discover this text useful? We’d love to listen to your ideas! Depart a remark with the field on the left-hand aspect of the display and share your ideas.

Additionally, do you need to keep up-to-date on our newest content material?

1. Comply with us by clicking the [+ Follow] button above,

2. Give the article a Thumbs Up on the top-left aspect of the display.

3. And lastly, in the event you suppose this info would profit your family and friends, don’t hesitate to share it with them!

John Dealbreuin got here from a 3rd world nation to the US with solely $1,000 not understanding anybody; guided by an immigrant dream. In 12 years, he achieved his retirement quantity.

He began Monetary Freedom Countdown to assist everybody suppose in a different way about their monetary challenges and reside their greatest lives. John resides within the San Francisco Bay Space having fun with nature trails and weight coaching.

Listed below are his advisable instruments

M1 Finance: John in contrast M1 Finance towards Vanguard, Schwab, Constancy, Wealthfront and Betterment to seek out the excellent funding platform. He makes use of it as a result of very low minimums and charges, automated funding with automated rebalancing. The pre-built asset allocations and fractional shares helps one get began immediately.

Private Capital: It is a free instrument John makes use of to trace his internet value regularly and as a retirement planner. It additionally alerts him wrt hidden charges and has a funds tracker included.

Streitwise is out there for accredited and non-accredited traders. They’ve one of many lowest charges and excessive “pores and skin within the recreation,” with over $5M of capital invested by founders within the offers. It is additionally open to international/non-USA investor. Minimal funding is $5,000.

Platforms like Yieldstreet present funding choices in artwork, authorized, structured notes, enterprise capital, and many others. Additionally they have fixed-income portfolios unfold throughout a number of asset courses with a single funding with low minimums of $10,000.