Certainly one of Warren Buffett’s largest and longest held investments is Coca-Cola (NYSE: KO). For some traders, realizing that Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) owns a inventory is sufficient cause to purchase it. However there is a main caveat right here, as a result of Buffett has owned Coca-Cola for a very long time. So the query right now is whether or not the drink big could make you a millionaire from this level, not how effectively it has carried out for Buffett’s Berkshire Hathaway. You may need to watch out about what you pay.

Coca-Cola wants no introduction

The Coca-Cola identify is likely one of the world’s best-known and liked shopper staples manufacturers. The corporate’s namesake soda is bought in each developed markets and rising ones, backed by an unbelievable distribution system and the corporate’s spectacular advertising and marketing crew. However Coca-Cola is extra than simply its namesake model.

It operates in varied soda classes, espresso, tea, sports activities drinks, and orange juice, amongst different beverage areas. And given its large scale — the corporate’s market cap is a big $290 billion — it has the heft wanted to purchase smaller, up-and-coming manufacturers to broaden its product lineup. Merely put, Coca-Cola is a well-run firm, which is the explanation the inventory has been a core holding for Berkshire Hathaway for many years.

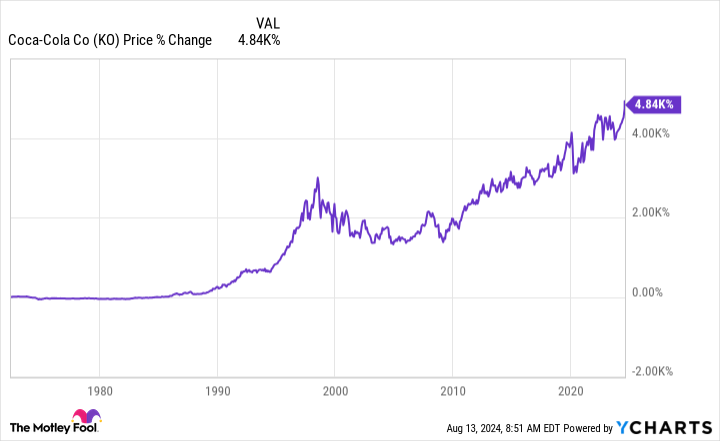

But there’s one small downside right here for those who’re Coca-Cola right now, highlighted by the truth that Buffett’s Berkshire Hathaway has owned it for many years. As the next chart highlights, Coca-Cola’s inventory has risen dramatically through the years. Positive, it has been a robust performer for Berkshire Hathaway and anybody else who purchased it a very long time in the past, however is it a very good purchase right now?

Coca-Cola is not low-cost

Buffett was skilled by famed worth investor Benjamin Graham. To paraphrase certainly one of Graham’s most vital sayings, even a very good firm is usually a dangerous funding for those who pay an excessive amount of for it. That Coca-Cola has been a giant winner for Buffett says little about whether or not it is going to be a very good funding for you, maybe serving to you to succeed in millionaire standing. That is the place you must contemplate right now’s valuation.

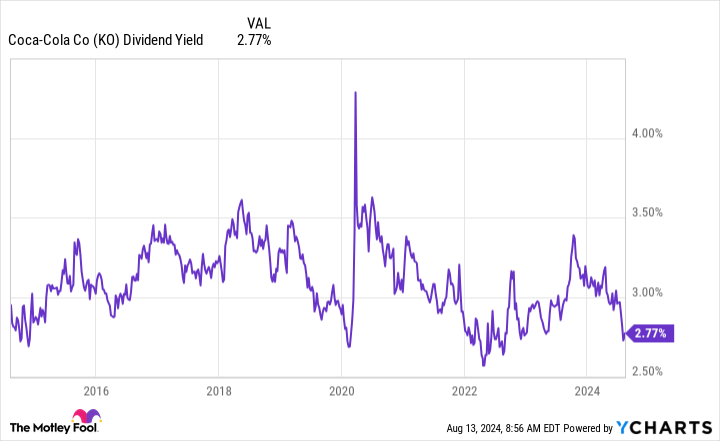

Proper now, Coca-Cola seems to be something however low-cost. Its price-to-sales ratio, price-to-earnings ratio, and price-to-book worth ratios are all above their five-year averages. The dividend yield is close to its lowest ranges over the previous decade. Sadly, Coca-Cola seems to be totally priced to costly proper now.

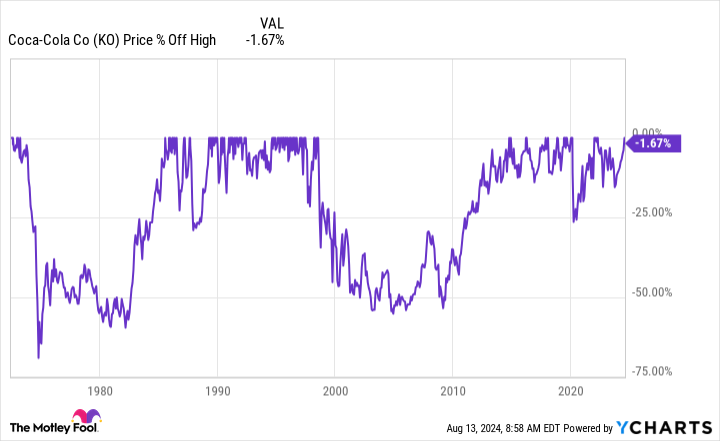

That mentioned, Coca-Cola has skilled a variety of massive drawdowns in its historical past. As the next chart highlights, 20% to 50% declines aren’t unusual. For those who just like the inventory, you will need to maintain it in your watchlist, simply in case there is a massive sell-off resulting in a decrease valuation that will provide you with a greater likelihood of upper long-term returns. Nonetheless, there are two issues to bear in mind.

There are market-related drops on show in that chart, such because the one which passed off round COVID and the Nice Recession. These varieties of declines are usually shorter, however they may require you to purchase when the market is in the course of a nosedive. After which there are longer-term declines in Coca-Cola’s inventory, when the shares are affected extra by company-specific points. Shopping for throughout a interval of enterprise weak point, too, would require a contrarian mindset, simply of a unique nature. The secret is to concentrate on the energy of the manufacturers and companies that Coca-Cola owns.

Be prepared, or you possibly can miss out

Coca-Cola seems to be costly right now. From these value ranges, it is going to be more durable to trip this inventory to millionaire standing. For those who’re affected person, nonetheless, there’s prone to be a extra enticing entry level someplace — however it’ll require you to have nerves of metal so you should buy Coke inventory when others are promoting.

So do not simply put Coca-Cola in your watchlist and transfer on. Actually get to know the corporate and make a plan to provoke a place when it is cheaper — maybe on a 20% drawdown, with plans to purchase extra if the shares go even decrease. If you aren’t getting prepared forward of time, you would possibly look again and discover you missed an opportunity to get in on an important firm whereas it was quickly out of favor.

Must you make investments $1,000 in Coca-Cola proper now?

Before you purchase inventory in Coca-Cola, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Coca-Cola wasn’t certainly one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $763,374!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of August 12, 2024

Reuben Gregg Brewer has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Berkshire Hathaway. The Motley Idiot has a disclosure coverage.

Might Coca-Cola Be a Millionaire-Maker Inventory? was initially revealed by The Motley Idiot