We held our second quarterly product launch of the 12 months on Could 14th 2024 and it was an superior turnout! In case you weren’t in a position to tune in dwell final week, you’ll be able to watch the complete recording right here!

We love delivery new merchandise that change the way in which wealth administration companies and advisors work together with shoppers and develop their companies. This newest launch introduces a ton of highly effective new options which might be all about placing you in charge of the way you handle and measure the expansion of your agency, interact with shoppers, and construct retirement plans.

Click on right here to learn the complete press launch

Let’s dive into the newest and biggest on the Nitrogen platform!

1 – Construct Customized Securities with Command Heart

We’re launching an all-new Securities Builder! This provides companies the power to create customized securities, add month-to-month historic efficiency, and share these securities with all of their advisors.

Regardless that Nitrogen has industry-leading safety protection with a 97% recognition price, there are a whole lot of causes a agency could need to handle customized securities on their very own. Perhaps your fashions are tactical in nature, and also you need the analytics on them rolled up into an SMA. Now your advisors can suggest them simply the way you configure them. Safety Builder allows agency executives on Nitrogen Final to create customized securities that may be proposed by all of the advisors in your agency.

Be taught extra about Securities Builder >

2 – Measure Consumer Sentiment Throughout Your Agency

We’ve talked to numerous scaling RIA companies which might be on the lookout for a scalable, measurable strategy to see consumer satisfaction. Nonetheless, asking traders to price their advisor on a scale from 1-10 can really feel somewhat low-cost in such a relational enterprise.

How do we discover out which advisors are really taking good care of their shoppers and empowering them to speculate fearlessly?

That’s why we’ve introduced insights from our Test-ins function into Command Heart.

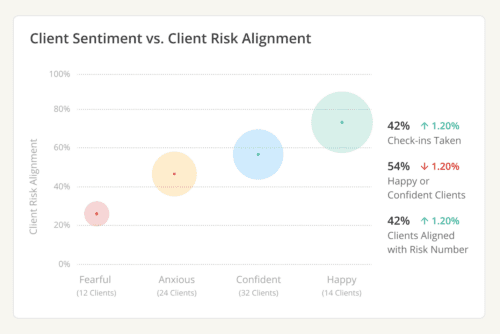

Advisors love utilizing Test-ins, proper? It’s their favourite strategy to get an automatic checkup from shoppers frequently. Their consumer simply has to present them two faucets on their smartphone, letting the advisor know the way they’re feeling in regards to the markets, and about their very own plan, and the advisor will get an early warning signal when a consumer wants somewhat engagement.

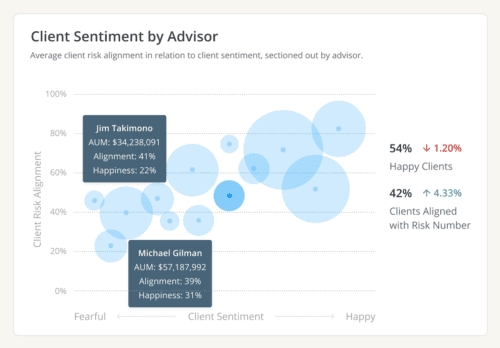

Now with Consumer Sentiment Insights in Command Heart, you’ll be able to drill in to see the place advisors are on a scale of consumer sentiment and threat alignment. You may take this one step additional by drilling into particular advisors to see which of their shoppers are fearful, anxious, assured, or completely satisfied.

And that’s the place these Insights actually come to life — it helps you lastly reply the query, “how do I inform my advisors aside?”

You may drill in on any advisor at your agency and see their zoomed-in model of all metrics on the Insights dashboard and see who’s above or beneath pattern. As you’ll be able to see, that is rapidly going to develop into a vital a part of your platform. As a result of you’ll be able to’t develop what you’ll be able to’t measure

Be taught extra about Insights >

3 – Construct a Retirement Plan with Revenue By Supply

We love studying from advisors. We requested a panel of advisors, “What’s the primary query you get out of your shoppers?” And each single advisor on the panel agreed on this: “Am I going to be okay?” Retirement Maps does an amazing job of framing up that dialog and advisors love it for a bunch of causes:

- It places threat capability in context. For the consumer who need to tackle zero threat, retire early, and dwell like a king (do you have got any of these?) …you’ll be able to illustrate why they may must tackle extra threat. As a result of they will’t make it from Los Angeles to New York in six hours in the event that they’re afraid to fly.

- It helps uncover held-away property. Purchasers love seeing their map bounce into the inexperienced. And also you’d be shocked how typically a consumer’s want to bolster their Retirement Map jogs their reminiscence about an previous account you don’t handle.

- The underlying analytics are highly effective. We’ve obtained the distinct benefit of getting security-level threat analytics below the hood. We don’t must depend on assumptions, we all know which securities and asset courses facilitate roughly volatility, letting us mannequin a Retirement Map in a means no person else can. It resonates with shoppers in a means {that a} monte carlo merely can’t.

- With Timeline occasions, you’ll be able to dynamically mannequin the impacts of main monetary selections like paying for a kid’s school schooling or shifting Danger Numbers in retirement. It’s extremely highly effective when you’ll be able to plot occasions onto the Timeline and present shoppers the impression on the Retirement Map in real-time.

- All of it shows superbly in our studies. By widespread demand, studies show every timeline occasion, making this the quickest strategy to generate a easy, one-page monetary plan.

So, in relation to that query — “Am I going to be okay?” — Retirement Maps lets you say, “Sure.” However for retirees, we don’t assume merely treating it as a sure or no query goes far sufficient. It doesn’t really empower them to speculate fearlessly until you’ll be able to assist them reply the how and why for that query.

That’s why we’re asserting a model new view we’re calling Retirement Revenue By Supply.

With only a single faucet, you’ll be able to change from Retirement Maps to Revenue By Supply giving your shoppers a dynamic view into every account and product that’s going to produce their earnings wants in retirement. You may even add Timeline occasions to visualise real-time impacts on their retirement earnings.

Have a consumer with a low Danger Quantity that’s involved about outliving their accounts? Retirement Revenue by Supply provides you the instruments as an example how a lot earnings they will generate with simply their social safety and pension earnings.

With just some clicks, you’ll be able to add further earnings streams like annuities or insurance coverage merchandise to spice up their probability of producing sufficient earnings in retirement.

Be taught extra about Retirement Revenue By Supply >

Be a part of us this fall for the Fearless Investing Summit

So, that’s a wrap on our second quarterly launch occasion of the 12 months. However the enjoyable doesn’t cease right here, we’ll be launching extra upgrades and enhancements to the Nitrogen platform on the Fearless Investing Summit this October 23-25 in Nashville. And boy do we’ve some thrilling issues in retailer.

Now if you happen to haven’t been, this isn’t simply our annual buyer convention or the occasion the place we give a sneak peek on the newest product improvements our group is launching, it has was an {industry} gathering. Michael Kitces named it the High Advisor Advertising Convention to attend in 2024, US Information has featured it as a high convention in wealth administration, and we’ve a lot in retailer this 12 months.

Take a look at the web site and block off your calendar for the spotlight of the 12 months. The agenda and lots of of our audio system at the moment are dwell on fearleslessinvestingsummit.com.

Need to expertise the Nitrogen platform your self? Take pleasure in an interactive tour of Nitrogen right this moment.