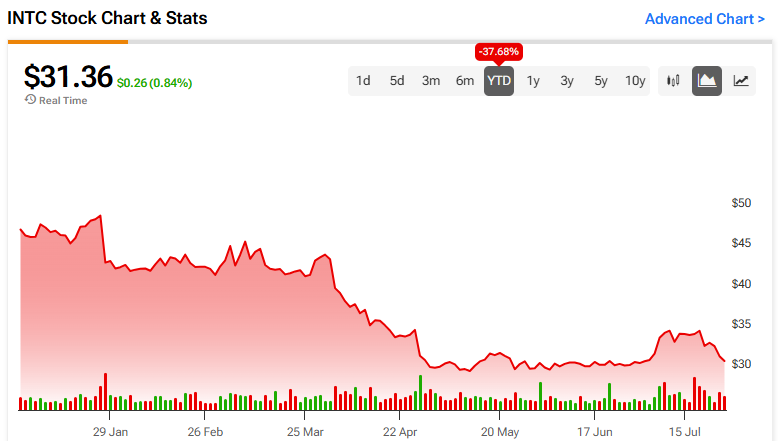

Intel (INTC) has underperformed its friends within the chip-making world in latest months and years. Down 37.7% for the reason that starting of the yr and 32% over 5 years, the inventory’s valuation is beginning to change into fairly enticing based mostly on projected progress in Consumer Computing Group (CCG) and Knowledge Heart and AI Group (DCAI). I’m bullish on Intel, with the agency buying and selling at 30.3x non-GAAP ahead earnings and a price-to-earnings-to-growth (PEG) ratio of 0.6x (1.0x or much less is usually seen as undervalued).

Intel’s Failures

Intel has struggled to maintain up with its friends in a number of respects lately, and analysts have famous a number of failings below the management of CEO Pat Gelsinger. The primary of those is Microsoft’s (MSFT) resolution emigrate away from Intel in favor of Qualcomm (QCOM) for its new Floor Copilot+ PC units. This arguably highlights Intel’s lagging efficiency in PC processors.

In December, Intel launched its Meteor Lake processors with a lot fanfare. Nonetheless, regardless of being the primary Intel chipset to incorporate a Neural Processing Unit (NPU) to help AI and that includes a mixed CPU/GPU structure, the factitious intelligence (AI) efficiency measured was simply 34 TOPS (tera AI operations per second). For reference, Microsoft had mandated 40+ TOPS for the NPU alone.

In response to this unfavorable suggestions, Intel has gone forward with the early announcement of its Lunar Lake chips, which boast 100+ Platform TOPS and 45+ NPU TOPS. Nonetheless, some analysts have recommended that its second failing is the lack to match the ability effectivity of the Qualcomm X Elite collection and its want to make use of Taiwan Semiconductor Manufacturing (TSM) for manufacturing.

Lastly, Intel’s foundry enterprise has seen a drop in exterior revenues. Whereas there’s nothing incorrect with specializing in supplying Intel’s personal wants from its foundries, it’s maybe telling that exterior revenues have fallen. Even Intel is utilizing TSMC’s foundries for its 3nm processes.

Intel’s Prospects

Regardless of these challenges and failings, Intel’s prospects stay sturdy. The corporate has registered energy in key segments like CCG and DCAI, with the previous reporting 31% income progress in Q1. CCG represents greater than half of the corporate’s revenues, and up to date successes have been pushed by Desktop income (+31%) and Pocket book income (+37%) progress. CCG is a enterprise unit that delivers client and industrial PCs, encompassing desktops, laptops, and associated parts.

Furthermore, Intel has bold plans to change into the second-largest exterior foundry by 2030, with vital orders already from corporations like Microsoft. Microsoft has already positioned orders for the 18A course of node, which arguably says rather a lot in regards to the firm’s course.

In response to studies, Intel has reserved all high-NA EUV machines from ASML (ASML) and began taking supply at first of 2024 — being the primary buyer to take action. That is possible the explanation for greater CapEx in Q1, but it surely additionally places Intel on a superb footing to compete technologically, going ahead.

It’s additionally price highlighting that many analysts consider Intel is greatest positioned to climate geopolitical tensions and a possible assault on Taiwan — the island is central to the worldwide chip trade. That’s as a result of Intel’s capability continues to predominate within the U.S. and its allies.

Low-cost Valuation

Analysts’ earnings projections for Intel are very sturdy. The corporate is projected to earn $1.08 per share in 2024, however this shoots as much as $1.92 in 2025, in keeping with 38 analysts offering earnings forecasts. This determine rises once more to $2.50 in 2026, in keeping with 10 analysts, and $3.18 in 2027, in keeping with simply two analysts.

At $31.36 per share, the inventory is at present buying and selling at 29x non-GAAP ahead earnings, which seems low cost in comparison with lots of its friends within the chip sector. Nonetheless, the caveat is that lots of its friends have been extra uncovered to the AI revolution. Nonetheless, Intel continues to be anticipated to develop earnings quick — as famous above — and this leads us to a PEG ratio of 0.6x. That’s very engaging.

Is Intel Inventory a Purchase, In response to Analysts?

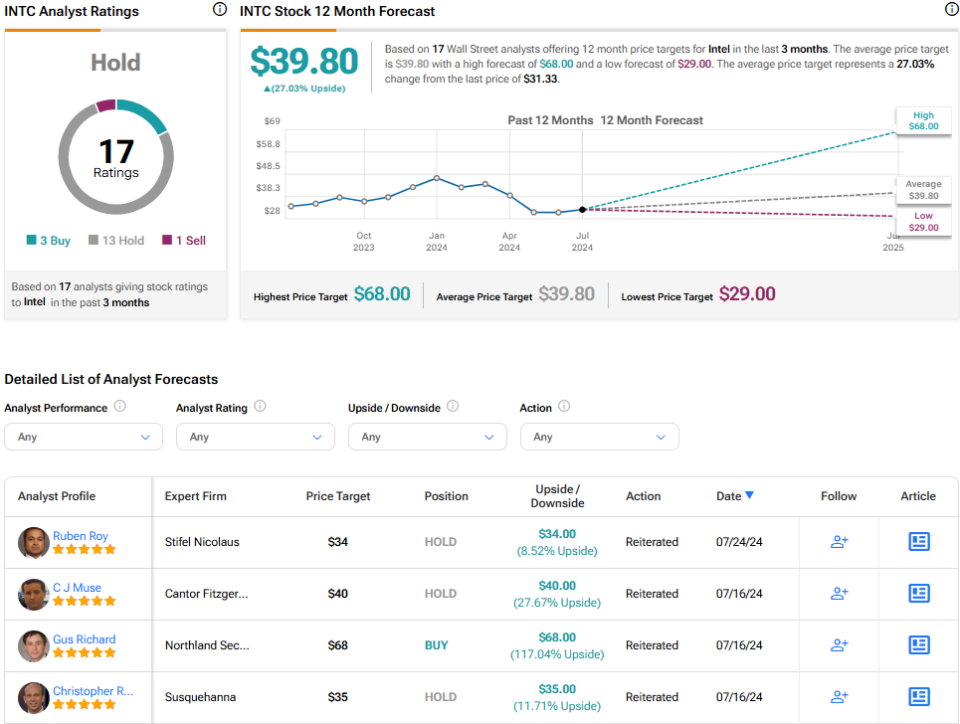

On TipRanks, INTC is available in as a Maintain based mostly on three Buys, 13 Holds, and one Promote score assigned by analysts prior to now three months. The common Intel inventory worth goal is $39.80, implying 27% upside potential.

See extra INTC analyst rankings

The Backside Line on Intel Inventory

The earnings forecast and the valuation metrics for Intel are exceptionally enticing, and the upside anticipated from analysts displays this. Whereas the corporate’s observe document isn’t nice, I’m buoyed by the earnings forecast and the optimistic developments within the CCG and DCAI segments, making me bullish on the inventory.