Regardless of claims that inflation is cooling, American households are feeling the monetary squeeze more durable than ever. Hovering prices for necessities like meals, hire, and childcare are straining budgets, with many struggling to maintain up.

As monetary stress intensifies and optimism fades, the most recent Federal Reserve report reveals a grim financial actuality that tens of millions of People are going through immediately.

Struggles with Day-to-Day Bills

American households struggled to cowl some day-to-day bills in 2023 and lots of remained glum about inflation at the same time as worth will increase slowed. This paints a troubling image of monetary instability for a lot of.

Fed Insurance policies Tackling Inflation

The Fed has elevated rates of interest to five.3 % from near-zero ranges as not too long ago as 2022 to chill the economic system and curb speedy worth will increase.

Whereas this transfer has made home-buying much less reasonably priced and bank card debt extra pricey for a lot of households, Fed officers that the coverage is important to get inflation decrease.

The coverage has labored however inflation remains to be seen in elements of the economic system.

Inflation’s Lingering Impression

Inflation cooled notably over the course of 2023, but 65 % of adults stated that worth modifications had made their monetary scenario worse. This lingering influence is especially extreme amongst low-income people.

Many economists imagine the continued concern stems from households specializing in worth ranges — which stay considerably larger than they had been in 2020 — reasonably than on worth modifications, the metric statisticians use to measure inflation.

As an illustration, folks could fixate on their groceries costing $50 as a substitute of $30, reasonably than on the truth that costs are now not rising as shortly as they did final 12 months.

Rising Lease Challenges

Renters reported rising challenges in maintaining with their payments. The report confirmed that 19 % of renters had been behind on their hire sooner or later within the 12 months, up two proportion factors from 2022, indicating worsening housing insecurity.

A latest Redfin survey discovered that half of householders and renters are having problem protecting their housing funds. Round 20% of these struggling have skipped meals or labored further hours to make ends meet, whereas roughly 17% have delay medical care. A notable variety of millennials, who’re typically not retired, have tapped into retirement financial savings to handle housing bills.

Renting has squeezed budgets, as rents in most main US metropolitan areas have surged 1.5 instances quicker than wages over the past 4 years.

Nationwide, rents climbed 30.4% whereas incomes expanded simply 20.2% from 2019 to 2023, information from StreetEasy, a Zillow subsidiary, present.

Houses Are Unaffordable

Homeownership has turn into more and more out of attain for a lot of People, with a Zillow report revealing a troubling 80% enhance within the revenue wanted to afford a house comfortably in simply the previous 4 years.

Whereas median revenue has solely risen by 23% since January 2020, potential consumers now face the difficult requirement of incomes over $106,000 to comprehend their dream of homeownership.

Financial Discontent Amidst Booming Job Market

Shopper confidence stays depressed although the job market is booming and inflation is cooling notably. This paradox highlights a deep-rooted financial discontent among the many inhabitants.

Wage Development vs. Inflation

Though authorities statistics present that paychecks are actually rising quicker than inflation, many People don’t imagine that’s the case.

Solely 33% of adults stated they obtained a elevate in 2023, highlighting the disconnect between statistical enhancements and private perceptions.

Though incomes grew healthily in 2023, so did spending, with greater than half of adults not having cash left over after paying their bills.

This pattern exacerbates the monetary pressure on many households.

Monetary Pressure on Mother and father

Mother and father dwelling with youngsters beneath the age of 18 noticed a major decline in monetary well-being. Little one care bills had been appreciable, with some mother and father spending as much as 70% of their month-to-month housing fee on little one care.

Emergency Expense Preparedness

The share of adults capable of cowl a $400 emergency expense with money available remained unchanged from 2022 at 63%, however that is down from a excessive of 68% in 2021.

This means a lower in monetary resilience.

Disparities Amongst Decrease-Earnings Adults

Decrease-income adults reported larger cases of not having sufficient to eat, not with the ability to cowl payments in full, and skipping medical care. These disparities underscore the financial challenges confronted by weak populations.

96% of individuals making lower than $25,000 reported their monetary scenario has worsened.

Impression of Excessive Inflation

Excessive inflation has created extreme monetary pressures for many U.S. households, forcing them to pay extra for on a regular basis requirements like meals and hire. This has disproportionately affected lower-income People.

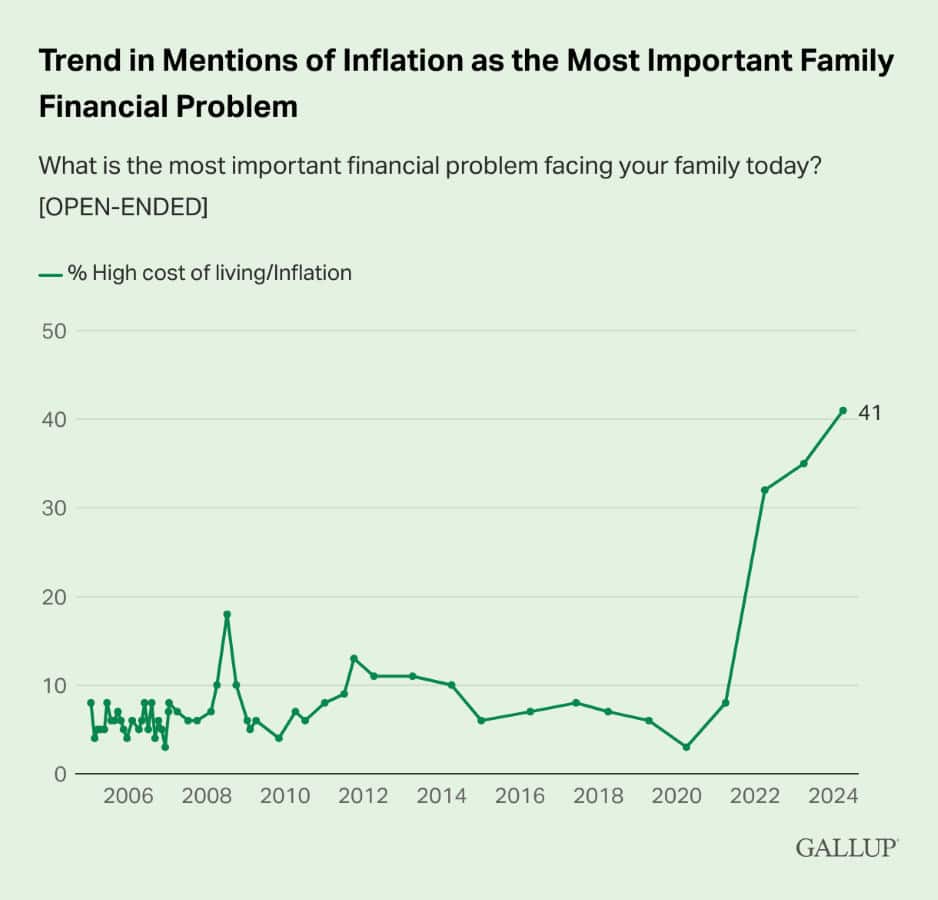

Gallup’s annual Economic system and Private Finance ballot, requested People yearly to call the highest monetary drawback going through their household with out prompting.

Inflation has been the main concern for the previous three years.

This 12 months, the value of proudly owning or renting a house follows inflation because the second most urgent difficulty at 14%, a brand new excessive for this class.

Decline in Monetary Nicely-Being

About 72% of adults stated they had been doing “OK” financially as of October 2023, down from 78% in 2021 and the bottom price since 2016. This decline signifies a broad-based deterioration in monetary well-being.

Political Ramifications

Polls present that People take a dim view of the economic system beneath the Biden-Harris administration. This dissatisfaction is impacting the political panorama.

Notion of Native and Nationwide Economies

The report confirmed enchancment in folks’s emotions about their native economic system, with 42% saying it was “good” or “wonderful.”

Nonetheless, this share stays considerably decrease than 2019 ranges, reflecting ongoing financial nervousness.

The Stark Actuality Behind the Numbers

The Federal Reserve’s newest findings reveal a stark actuality: regardless of official claims of cooling inflation, the monetary pressure on American households persists. As rising prices proceed to outpace revenue beneficial properties, many are left grappling with the problem of protecting fundamental bills.

This financial squeeze underscores the disconnect between optimistic studies and the lived experiences of tens of millions. As we transfer ahead, it’s clear that addressing these monetary pressures is essential for the well-being of American households.

Like Monetary Freedom Countdown content material? Make sure to observe us!

20% of Retirees Are Returning to Work. What Are the Causes Behind the “Unretirement” Wave?

Lately, the idea of retirement has begun to evolve past conventional expectations of leisure and rest. A stunning pattern has emerged, with 1 in 5 retirees returning to work. What’s drawing so many retirees again into the workforce?

20% of Retirees Are Returning to Work. What Are the Causes Behind the “Unretirement” Wave?

11 Causes You Ought to Declare Social Safety Early

Deciding when to say Social Safety is commonly about maximizing your profit. Monetary planners often advise delaying your declare for so long as potential to safe the very best month-to-month fee. Your profit relies in your lifetime earnings, with a full payout obtainable at your full retirement age (FRA), which is at present between 66 and 67 relying in your delivery 12 months. Claiming earlier than FRA ends in a everlasting discount in your month-to-month profit, whereas ready past FRA results in a everlasting enhance. Nonetheless, the choice isn’t solely about maximizing the month-to-month verify. Private components equivalent to well being, household circumstances, and monetary wants can play a major position in figuring out the precise time to say.

11 Causes You Ought to Declare Social Safety Early

Evaluating Retirement Ages: How Does the US Stack Up In opposition to Different Nations?

Retirement age fluctuates throughout nations, influenced by various components equivalent to labor market dynamics, job varieties, financial insurance policies, gender roles, and pension methods. As an illustration, Saudi Arabia stands out as the only real nation providing full retirement advantages to people beneath 50, whereas in 2023, France confronted uproar after elevating its retirement age by two years, sparking widespread strikes. The Group for Financial Co-operation and Growth (OECD) collects and analyzes retirement information utilizing distinct metrics: – The Present Retirement Age signifies the age at which people can retire with full pension advantages after a profession beginning at age 22, with out going through any deductions. – The Efficient Retirement Age represents the common age at which employees aged 40 or older exit the workforce, influenced by private selections or job availability.

Evaluating Retirement Ages: How Does the US Stack Up In opposition to Different Nations?

The ten States Taxing Social Safety in 2024 and the two That Simply Stopped

As 2023 tax submitting season attracts to an in depth, retirees throughout the nation are adjusting their monetary plans for 2024, however an important element may drastically alter the panorama of retirement dwelling: the taxing of Social Safety advantages. Whereas many bask within the perception that their golden years will likely be tax-friendly, residents in 9 particular states are going through a actuality verify as their Social Safety advantages come beneath the taxman’s purview. Conversely, a wave of reduction is ready to clean over two states, marking an finish to their period of taxing these advantages. This shift paints a fancy portrait of retirement planning throughout the U.S., underscoring the significance of staying knowledgeable of the ever altering tax legal guidelines. Are you residing in one among these states? It’s time to uncover the influence of those tax modifications in your retirement technique and presumably rethink your locale selection for these serene post-work years. Listed here are the states taxing social safety advantages.

The States Taxing Social Safety in 2024 and the two That Simply Stopped

Retire Overseas and Nonetheless Accumulate Social Safety? Keep away from These 9 Nations The place It’s Not Attainable

Dreaming of retiring to a sun-drenched seaside or a quaint village? Many People envision spending their golden years overseas, savoring the delights of recent cultures and landscapes. Nonetheless, an important a part of this dream hinges on the monetary stability offered by Social Safety advantages. Earlier than packing your luggage and bidding farewell, it’s essential to know that not all international locations play by the identical guidelines on the subject of gathering these advantages abroad. Listed here are the 9 international locations the place your dream of retiring overseas may hit a snag, as Social Safety advantages don’t cross each border. Keep away from dwelling in these international locations so your retirement plans don’t get misplaced in translation.

John Dealbreuin got here from a 3rd world nation to the US with solely $1,000 not realizing anybody; guided by an immigrant dream. In 12 years, he achieved his retirement quantity.

He began Monetary Freedom Countdown to assist everybody assume in another way about their monetary challenges and reside their finest lives. John resides within the San Francisco Bay Space having fun with nature trails and weight coaching.

Listed here are his advisable instruments

M1 Finance: John in contrast M1 Finance in opposition to Vanguard, Schwab, Constancy, Wealthfront and Betterment to search out the good funding platform. He makes use of it resulting from very low minimums and costs, automated funding with computerized rebalancing. The pre-built asset allocations and fractional shares helps one get began instantly.

Private Capital: This can be a free device John makes use of to trace his web price frequently and as a retirement planner. It additionally alerts him wrt hidden charges and has a price range tracker included.

Streitwise is obtainable for accredited and non-accredited buyers. They’ve one of many lowest charges and excessive “pores and skin within the sport,” with over $5M of capital invested by founders within the offers. It is additionally open to international/non-USA investor. Minimal funding is $5,000.

Platforms like Yieldstreet present funding choices in artwork, authorized, structured notes, enterprise capital, and many others. Additionally they have fixed-income portfolios unfold throughout a number of asset lessons with a single funding with low minimums of $10,000.