Hello guys. I’m Sarah Mueller from Early Chicken Mother and at the moment I’m going to be sharing with you the Prime Sinking Funds Everybody Ought to Have.

One of many issues you could encounter whenever you begin budgeting as a newbie is spending cash in locations you hadn’t anticipated. That is to be anticipated in budgeting – you’ll should make changes alongside the way in which.

That will help you out, check out these 23 finances classes or “sinking funds.”

Sinking Fund outlined: A sinking fund (or reserve fund) is a finances class that you simply don’t essentially want each month, however that you simply need to contribute to, as a way to begin build up a stability. You “sink” or get monetary savings right into a finances class or “fund” and let it construct up over time.

Utilizing sinking funds is a much less worrying method to finances and pay your payments than attempting to take care of every one when it’s due.

A sinking fund is totally different than an emergency financial savings as a result of in a sinking fund, you might be telling your cash the place to go, as an alternative of letting an emergency dictate the place you spend it.

Prime Sinking Funds Everybody Ought to Have

Right here’s the way it works for us.

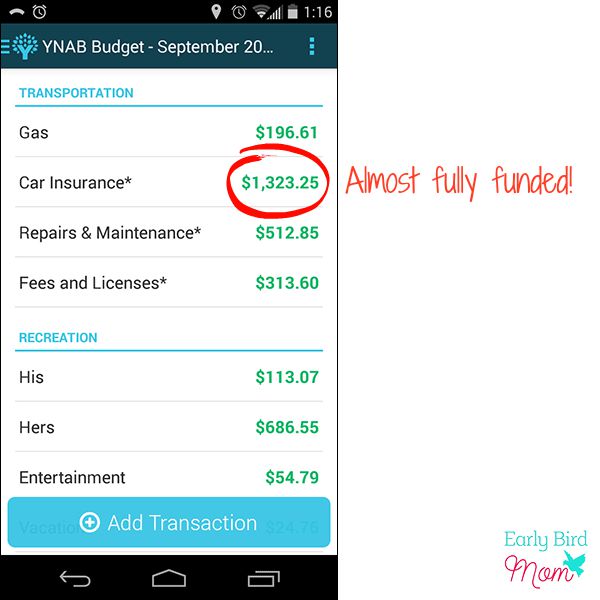

We pay our automobile insurance coverage simply annually. However with 2 automobiles and dwelling in a excessive value state, our insurance coverage invoice is $1600. Yikes! I don’t need to should face that invoice with out cash within the financial institution.

So as an alternative of scraping up the cash when the invoice is due, we put $130 each month into our automobile insurance coverage sinking fund. By the point the insurance coverage invoice is due, we now have the full quantity saved up. I can write a test with out having to fret that it received’t clear.

One other instance of a useful sinking fund is for variable utility payments.

In case your winter heating payments are a lot greater than your spring and fall payments, you could expertise a shock whenever you open that February invoice! However in the event you’ve been placing a bit further right into a utilities sinking fund all yr, you’ll be able to pay that February invoice with out having to take cash out of say, the grocery finances.

Here’s a record of 23 totally different sinking funds:

- Automotive repairs

- Automotive insurance coverage

- New automobile financial savings

- Owners insurance coverage

- Life insurance coverage

- Taxes

- Physician / dentist

- Treatment

- Trip

- Christmas / Holidays

- Presents

- Charges and licenses (automobile registration, and so on.)

- Dues and subscriptions (magazines, memberships)

- Faculty and schooling charges

- Faculty tuition

- Pets

- Utilities

- House upkeep and repairs

- Youngsters sports activities and actions

- Miscellaneous

- Journey

- Faculty financial savings

- Emergency fund

The place do you discover the cash to place into these sinking funds?

You begin with essentially the most vital ones. This implies payments which are due quickly and bigger payments.

If you already know your automobile insurance coverage is due in 3 months, begin including to that fund first. You won’t be capable to absolutely fund it earlier than it’s due, however even having some cash put aside helps.

Discover methods to save in your bills (like electrical energy and groceries). Then put the cash saved towards your sinking funds.

You may also contribute a bit every month to a number of the smaller funds.

In the event you put $5-$10 a month into the items fund, you’ll have sufficient to purchase a gift for a party in only a month or two. Store round at a couple of cashback websites earlier than you order (right here’s Sarah Titus’ favourite cashback website) and also you’ll have a terrific current that wasn’t a burden to purchase.

You may also spend some further time working from residence. Earn an additional couple hundred {dollars} a month to fund your sinking funds and ease the pressure in your finances.

Associated:

So what do you DO with the cash you set into these funds?

You would put it into separate financial savings accounts, however this will get difficult when you have many alternative sinking funds. You would even have 1 account for month-to-month payments and 1 that you simply use to pay for these irregular bills.

I handle the cash in our sinking funds with the budgeting software program tracker known as You Want a Finances (YNAB). My husband and I each use their smartphone app and enter our purchases on the go.

No matter system you employ, be certain that it’s straightforward to see how a lot cash you’ve put aside for every fund. The less complicated it’s, the extra possible you might be to stay along with your system.

What number of funds are too many?

You would go loopy and arrange 100 funds or extra. It actually is dependent upon your character – are you the kind that likes to see the way you spend your cash in nice element or would you moderately maintain it easy and have fewer classes? I discover that 20-30 sinking funds is lots for our finances.

How do you determine how a lot to place into every fund?

In case you have an thought of how a lot you spent on a class previously 12 months, ideally you’d divide that quantity by 12. Then contribute that quantity every month. In case you have a invoice arising and you already know the quantity, divide the quantity of the invoice by the variety of months it’s important to save. Then save that quantity every month.

Right here’s instance: Let’s say your daughter performs soccer.

Sports activities charges value $50 per semester plus $50 for uniform and kit. Add in $10 for further bills and also you’re anticipating $110 per yr for this sport. $110 divided by 12 is $9.16. So it is best to save $10 within the sports activities fund every month. So long as your first cost isn’t due for a couple of months, you’ll come up with the money for to cowl your sports activities bills.

What do you do when you have a invoice and your sinking fund doesn’t come up with the money for but?

You could have to borrow from one other fund. We just lately did this after we had some sudden automobile repairs. Our automobile restore fund didn’t cowl the invoice. Since I’d already saved up our full Christmas finances, I took the cash from there. I knew that I’d have time to carry the Christmas fund again as much as it’s full quantity earlier than December.

What about issues like retirement?

I don’t embrace long run financial savings objectives like retirement as a result of that cash comes instantly out of our paychecks and by no means hits our checking account or our month-to-month finances. I do embrace a university fund as a result of that cash does come out of our finances.

Use this record of sinking funds as a place to begin and customise it to satisfy your individual wants.

Tweak your funds every month as you finances. Make adjustments primarily based on what payments are due and the way a lot cash it’s important to finances. After a couple of months, you’ll have a useful record and bigger payments needs to be simpler to handle.