The newest retail gross sales report appears to have given Wall Road one thing to cheer about. Headlines touting resilience in client spending elevated hopes of a “smooth touchdown” boosting the inventory market. Nonetheless, as is usually the case, the satan is within the particulars. We uncover a extra troubling image after we peel again the layers of this seemingly constructive knowledge. Seasonal changes, downward revisions, and rising delinquency charges on bank cards and auto loans recommend a extra cautious view. The buyer—the spine of the U.S. financial system—could also be in additional hassle than the headline numbers point out.

The Mirage of Seasonal Changes

The July retail gross sales report confirmed a pointy improve of 1.0% month-over-month, surpassing expectations. Nonetheless, whereas that quantity helps the thought of a resilient client, these spikes have been extra anomalous than not. Since 2021, actual retail gross sales have nearly flatlined. Such is unsurprising as shoppers run out of financial savings to maintain their way of life.

The next chart of actual retail gross sales clearly reveals the buyer dilemma. Over the previous two years, retail gross sales haven’t grown to assist extra strong financial progress charges. Notably, flat actual retail gross sales progress was pre-recessionary and a “pink flag” of weakening financial progress. Nonetheless, given the huge surge in spending pushed by repeated rounds of Authorities stimulus, the reversion of retail gross sales to the long-term pattern has taken longer than earlier durations, main economists to imagine “this time is completely different.”

However earlier than we escape the champagne, let’s look at how these numbers are calculated. Retail gross sales knowledge is notoriously risky. Components like climate, holidays, and even the day of the week play a big function. To clean out these fluctuations, the information is seasonally adjusted. The chart reveals the magnitude of those seasonal changes since 1992. Curiously, the magnitude of those changes is growing over time.

However what occurs when these changes paint a very rosy image?

Downward Revisions: A Rising Pattern

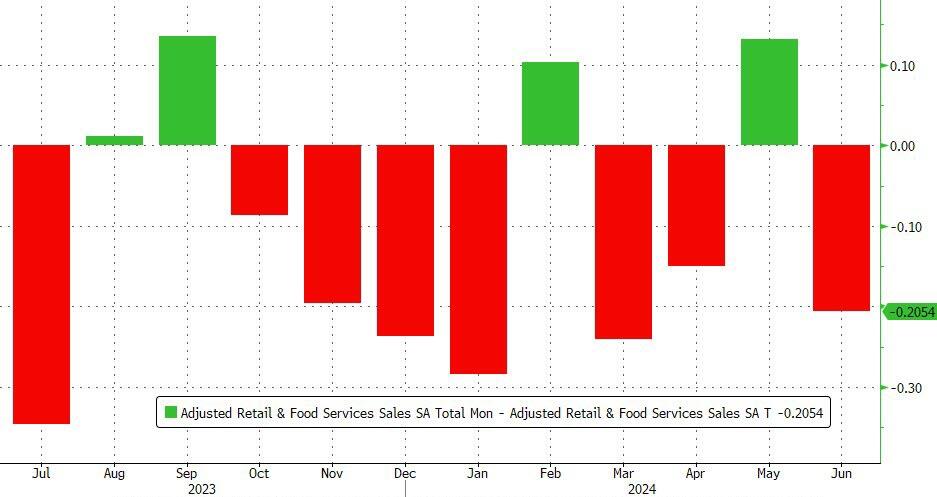

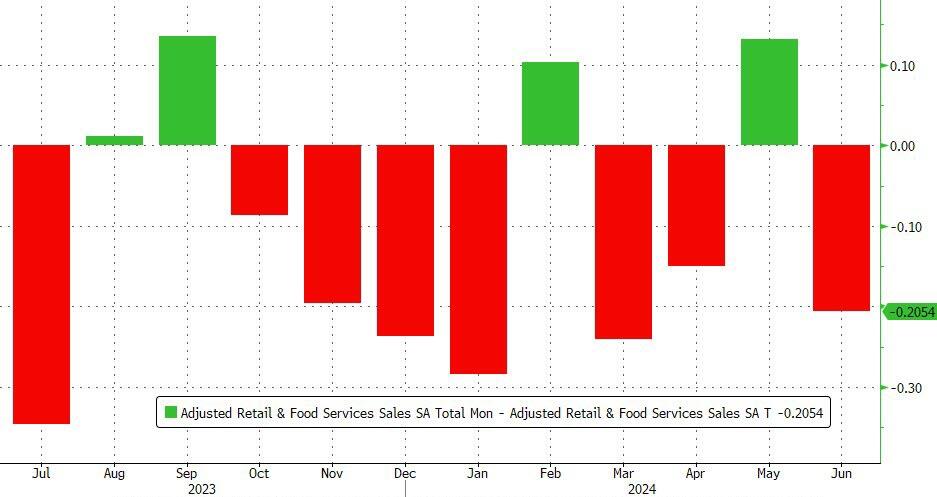

Seasonal changes are a double-edged sword. Whereas they intention to supply a clearer view of underlying tendencies, they’ll additionally distort actuality, particularly in an financial system as dynamic and unpredictable as ours. Sadly, these changes are sometimes revised in hindsight as extra knowledge turns into obtainable. For instance, a “pink flag” is that eight of the previous twelve-monthly retail gross sales stories have been revised considerably decrease, making the current month-to-month “beat” a lot much less spectacular.

Why are retail gross sales being revised downward so regularly? One potential rationalization is that preliminary estimates are overly optimistic, maybe because of seasonal changes. As extra correct knowledge turns into obtainable, the true image emerges, and it’s not as fairly as many imagine. So, is there probably a greater technique?

As famous, month-to-month retail gross sales are risky because of varied occasions. Christmas, Thanksgiving, Easter, summer time journey, back-to-school, and climate all impression client spending. Due to this fact, “seasonally adjusting” the uncooked data could seem essential to clean out these durations of upper volatility. Nonetheless, such a course of introduces substantial human error. Utilizing a simplistic 12-month common of the non-seasonally adjusted knowledge (uncooked knowledge) offers a smoother and extra dependable evaluation of client energy. Traditionally, when the 12-month common of the uncooked knowledge approaches or declines beneath 2% annualized, it’s a “pink flag” for the financial system. Once more, the huge spike in COVID-related stimulus is reversing in direction of ranges that ought to concern traders.

In different phrases, if we strip out the seasonal changes and apply a smoothing course of to risky knowledge, the difficulty of client energy turns into extra questionable.

One other “pink flag” is realizing that retail gross sales ought to develop because the inhabitants grows. If we take a look at retail gross sales per capita, we see that earlier than 2010, retail gross sales grew at a 5% annualized pattern. Nonetheless, that modified after the “monetary disaster,” retail gross sales fell nicely beneath the earlier pattern regardless of an growing inhabitants. Whereas that hole improved following the Covid-stimulus helps, the hole is as soon as once more widening.

As you’ll be able to see, the information reveals a way more subdued image of client spending, which raises a important query: Are we being lulled right into a false sense of safety by the headline numbers? The fact is probably going much more sobering.

The Debt Bomb: Rising Delinquency Charges

Maybe probably the most alarming sign comes from the rising bank card and auto mortgage delinquency charges. Customers have been relying closely on credit score to keep up their spending habits within the face of excessive inflation and stagnant wage progress. The unfold between retail gross sales and client credit score to disposable private revenue rises as COVID-related stimulus runs dry and inflation is outstripping wages, forcing shoppers to show to credit score.

However there’s a restrict to how a lot debt shoppers can tackle earlier than the home of playing cards tumbles.

In accordance with the most recent knowledge, delinquency charges (greater than 90 days) on each auto loans and bank cards have reached their highest degree since 2012. Notably, delinquency charges are rising the quickest for youthful generations that are inclined to have decrease incomes and fewer financial savings. (Charts courtesy of Mish Shedlock)

These rising delinquency charges are a warning signal that customers battle to maintain up with their debt obligations. As extra shoppers fall behind on their funds, the danger of a broader financial slowdown will increase. In any case, client spending accounts for almost 70% of U.S. GDP. If the buyer falters, all the financial system is in danger.

The Implications for Future Consumption

Given these “pink flags,” it’s tough to see how the present degree of client spending will be sustained. Rising delinquency charges, downward revisions to retail gross sales, and questionable seasonal changes all recommend the buyer is working out of spending energy.

Within the close to time period, we could proceed to see headline retail gross sales numbers that seem wholesome, particularly if seasonal changes proceed to supply a tailwind. Nonetheless, the underlying knowledge tells a special story. As extra shoppers attain their debt limits and delinquency charges proceed to rise, we might see a big spending slowdown later this 12 months.

That slowdown would have far-reaching implications for the broader financial system. Retailers might see additional income declines, resulting in potential layoffs and additional weakening of client spending. Banks and monetary establishments might additionally face greater mortgage losses, significantly within the bank card and auto mortgage sectors.

In abstract, whereas the most recent retail gross sales report could have given the market a short-term increase, suggesting a “smooth touchdown” economically, the underlying knowledge suggests we ought to be cautious. Seasonal changes and downward revisions are masking the precise state of client spending, whereas rising delinquency charges are a transparent signal of hassle forward.

Traders and policymakers would do nicely to look past the headlines and concentrate on the financial system’s actual dangers. The buyer could also be hanging on for now, however the cracks are beginning to present. Ignoring these pink flags might result in a impolite awakening within the months forward.

Put up Views: 1,932

2024/08/23