New knowledge from the 2023 Worker Profit Analysis Institute (EBRI) survey has set off alarm bells, revealing a pointy decline in American employees’ confidence about reaching a cushty retirement—a stage of concern not seen because the 2008 international monetary disaster.

An alarming 80% of employees now anticipate a recession throughout the subsequent 12 months, and 90% are haunted by the specter of extended excessive inflation. These fears spotlight a deepening fear about securing monetary stability as they method their retirement years.

Inflation Continues To Solid a Shadow

The EBRI Retirement Confidence Survey reveals that the specter of inflation looms massive over Individuals, with a overwhelming majority—84% of employees and 67% of retirees—alarmed by the escalating value of residing that complicates their financial savings efforts.

The latest inflation numbers present that costs are nonetheless rising at the same time as of Might 2024.

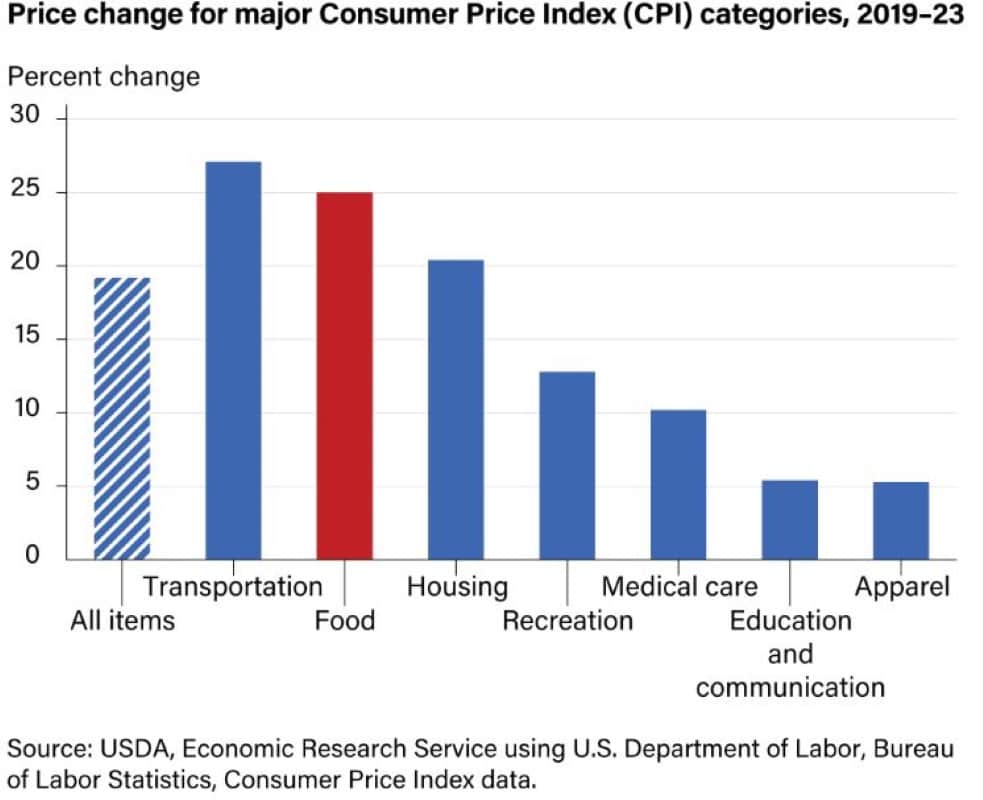

Important Items and Providers Have Elevated Over 25%

Knowledge from USDA reveals that meals has elevated 25% from 2019 to 2023.

Transportation has jumped by 27% in the identical interval and housing has develop into unaffordable for the common Individuals.

Raises At Work Lagging Inflation

About 75% of employees fear their earnings gained’t sustain with inflation, whereas half of the retirees observe their bills overshooting their preliminary estimates. Consequently, family budgets are tightening, with 73% of employees and 58% of retirees foreseeing important reductions of their spending to handle the affect of inflation.

A current Gallup Ballot reveals that 60% of Individuals are nervous about inflation and the financial system.

In 2022 and 2023, inflation and the financial system have emerged because the predominant considerations as a result of unprecedented surge in worth ranges unseen previously 4 many years.

Retirement Financial savings Impacted

The lower in retirement account balances has develop into regarding as Individuals put together for retirement.

40% of employees and 58% of retirees point out decreased retirement account balances over the previous 12 months.

Elevated volatility in inventory market investments has resulted in 74% of employees choosing extra conservative investments of their office retirement plans.

Paul Culbreth, CFP, shares an instance of his 64-year-old shopper residing in North Carolina who’s often nervous about retirement and whether or not she has sufficient cash to retire.

He says, “She makes about $148K per 12 months and had $2.3mm in investible belongings final 12 months after we accomplished the plan. With solely $80K in annual bills (inflated at 3%) and assumed development of her investments at 5%, the plan estimated that her complete income-generating belongings at age 90 was slightly below $5mm. Her plan means that she had sufficient to retire with base assumptions, so I really helpful decreasing the general danger in her investments as she doesn’t have to tackle further danger. This eased her considerations momentarily.”

Roughly 75% of employees and 66% of retirees prioritize guaranteeing a constant month-to-month earnings for all times in comparison with preserving principal balances.

Sadly, 2022 and 2023 will not be your typical 12 months for shares and bonds in comparison with historic averages. Even conservative-leaning portfolios suffered, with bond investments performing the worst within the final 40 years. The Bloomberg Barclays US Mixture Bond Index returned -13.01% in 2022.

Social Safety and Medicare Considerations

There was a decline in employee confidence relating to Medicare, with simply half feeling considerably assured it’s going to proceed to supply advantages of equal worth to these obtained at present.

Amanda M. Howerton, CFP, CDFA, advocates constructing a plan that addresses retiree’s monetary targets and incorporates their emotions and values surrounding cash. She says, “If peace of thoughts is a dearly held worth, it sometimes goes hand in hand with not being a burden to others.

Some particular worries are the price of well being care and rising long-term care bills. For purchasers involved explicitly about this, we mannequin these prices in our planning software program and speak about whether or not or not saving and spending habits want to alter or whether or not or not we have to contemplate long-term care insurance coverage.”

Furthermore, a current Axios/Ipsos ballot reveals Individuals imagine they can’t depend on Social Safety to cowl their bills throughout retirement. 62% of Individuals who will not be retired really feel that Social Safety will cowl lower than half of their prices. Simply 37% of retired individuals say that Social Safety covers lower than half of their bills.

Based on the current Social Safety Trustees report estimates, retirees after 2034 will obtain solely 77% of their advantages if Congress doesn’t replace this system.

Delaying Retirement

The EBRI survey signifies roughly 33% of employees anticipate retiring at 70 or later or by no means retiring.

Based on a Transamerica Middle for Retirement Research report, 40 % of Technology X employees and practically half of boomers anticipate retiring after 70 or not retiring in any respect.

Equally, Axios/Ipsos’s retirement ballot signifies that round 20% of Individuals imagine they are going to by no means retire resulting from monetary worries.

Most Individuals who’ve but to retire (52%) intend to relocate to an space with a decrease value of residing upon retirement.

Retirement Planning Can Assist Ease Considerations

Retirement is without doubt one of the most vital transitions in life. Retirees at present face increased inflation, financial uncertainty, and political turmoil, along with the standard considerations of healthcare prices, residing too lengthy, operating out of cash, sustaining a sure lifestyle, and with the ability to fulfill bucket record gadgets. Unsurprisingly, this transition creates quite a lot of nervousness about preparedness for individuals approaching retirement.

The one method to deal with these considerations with excessive confidence is to finish a monetary plan that measures the probability of success by modeling a person’s earnings, bills, development of investments, debt payoff, and what-if eventualities that maintain the potential retiree awake at night time.

There isn’t any golden rule for retirement, as too many variables from one individual to the subsequent can alter the chance of success. Finishing a monetary plan will assist retiree know the place they at the moment stand based mostly on their targets and present funds and information them on bettering their probability of success.

The prospect of retirement is more and more changing into a supply of hysteria amongst Individuals. Financial challenges, rising healthcare prices, and residing bills have led to rising considerations that they might by no means attain a financially safe retirement. With unsure Social Safety advantages and insufficient financial savings, the imaginative and prescient of a peaceable retirement appears extra like an elusive dream than a reachable actuality for a lot of.

Like Monetary Freedom Countdown content material? Make sure you comply with us!

Traders Snatch 26% of Inexpensive Properties, Crushing Desires of Homeownership for Many

Within the fourth quarter of 2023, actual property traders secured a whopping 26.1% of reasonably priced properties bought within the U.S as per a Redfin report. This determine, a report excessive, marks a major surge from the earlier 12 months’s 24%. Traders additionally acquired 13.6% of mid-priced properties (a slight lower from 14.3% a 12 months earlier) and 15.9% of high-priced properties (a slight enhance from 15.4% a 12 months earlier).

Traders Snatch 26% of Inexpensive Properties, Crushing Desires of Homeownership for Many

Social Safety Faces Insolvency in Simply 10 Years

The Trustees of Social Safety and Medicare unveiled their yearly monetary forecasts for each packages, wanting forward over the subsequent 75 years. The newly launched projections for Social Safety paint a grim image of speedy development in direction of insolvency in 10 years, underscoring the pressing want for belief fund cures to avert widespread profit reductions or sudden changes in taxes or advantages.

Social Safety Faces Insolvency in Simply 10 Years

Surging 401(ok) Hardship Withdrawals Unveil a Rising Concern Threatening Center-Class Monetary Stability

Latest stories from main retirement gamers like Vanguard, Constancy Investments, and Financial institution of America level to a troubling development. Extra people are resorting to hardship withdrawals from their 401(ok) accounts, signaling an increase in rapid monetary strains. This rising sample signifies that many Individuals are navigating extreme monetary challenges.

U.S. Nationwide Debt Soars, Including $1 Trillion Each 100 Days – Why It Issues

The US Nationwide Debt started the 12 months at $34 trillion and surged to $34.47 trillion by the top of February, piling on $470 billion in merely two months. With the debt frequently compounding, it’s on a trajectory to swell by $1 trillion each roughly 100 days. At this charge of borrowing, the Nationwide Debt is projected to balloon by $2.8 trillion over the course of this 12 months. With Federal Debt spirally uncontrolled, what lies forward for Individuals and the US financial system?

U.S. Nationwide Debt Soars, Including $1 Trillion Each 100 Days – Why It Issues

Remodel Your Funds by Shifting From an Worker to an Investor Mindset With Kiyosaki’s Cashflow Quadrant Methodology

Numerous methods have been established that present a a lot better understanding of what earnings technology is, how it may be used, and the way people can manage their monetary life as they work in direction of monetary freedom. One of many extra profitable and better-known examples of monetary training is the Cashflow Quadrant, the e book by Robert Kiyosaki. Wealthy Dad’s Cashflow Quadrant was revolutionary for the best way it organized cash and helped individuals higher discover ways to enhance their earnings. Because the identify implies, there are 4 quadrants throughout the Cashflow Quadrant. By mastering every of the 4 classes – or specializing in a single – an individual can enhance their income stream and finally make more cash.

Purchase, Borrow, Die: The Controversial Tax Loophole the Wealthy Use to Construct Generational Wealth

The “Purchase, Borrow, Die” technique is a favourite among the many prosperous, who work with monetary planners to maintain their lavish life whereas slashing their tax payments. Although it looks like a contemporary development, Professor Ed McCaffery coined the time period within the mid-Nineties to elucidate how the rich legally keep away from paying taxes.

John Dealbreuin got here from a 3rd world nation to the US with solely $1,000 not figuring out anybody; guided by an immigrant dream. In 12 years, he achieved his retirement quantity.

He began Monetary Freedom Countdown to assist everybody assume otherwise about their monetary challenges and stay their greatest lives. John resides within the San Francisco Bay Space having fun with nature trails and weight coaching.

Listed below are his really helpful instruments

M1 Finance: John in contrast M1 Finance towards Vanguard, Schwab, Constancy, Wealthfront and Betterment to search out the excellent funding platform. He makes use of it resulting from zero charges, very low minimums, automated funding with automated rebalancing. The pre-built asset allocations and fractional shares helps one get began straight away.

Private Capital: This can be a free instrument John makes use of to trace his internet price regularly and as a retirement planner. It additionally alerts him wrt hidden charges and has a price range tracker included.

Streitwise is on the market for accredited and non-accredited traders. They’ve one of many lowest charges and excessive “pores and skin within the recreation,” with over $5M of capital invested by founders within the offers. It is additionally open to international/non-USA investor. Minimal funding is $5,000.

Platforms like Yieldstreet present funding choices in artwork, authorized, structured notes, enterprise capital, and so forth. In addition they have fixed-income portfolios unfold throughout a number of asset lessons with a single funding with low minimums of $10,000.