A reader asks:

Please assist settle a disagreement my pal and I are having: He says he’d slightly the inventory market solely go down a little bit bit after which go up a gradual quantity yearly throughout his working years as a result of recovering from a 30% drawdown in your present portfolio can be tough. I’d slightly purchase shares on sale. I’d desire the market be down 30% for the following 5 years, which can permit me to acquire shares at a reduction. Then after I retire have the market rip for the following 10+ years. Are you able to assist mathematically show which situation makes essentially the most sense?

I like the truth that these associates are having inventory market disagreements. These are my folks.

It is a good query for the present atmosphere too.

There have been 46 new all-time highs on the S&P 500 this yr. The market retains going up.

In 2022, there was only a single new all-time excessive on the primary buying and selling day of the yr. From there, the market simply stored happening.

So what’s the higher situation — investing with drawdowns early in your profession or a gradual state the place issues simply preserve going up?

It actually is determined by what stage you’re in of your investing lifecycle.

The present market atmosphere is great in case you already personal a bunch of monetary property. Child boomers ought to love these new all-time highs as a result of they’ve been invested for thus lengthy and are in or approaching retirement.

You don’t need drawdowns early in your retirement years since you don’t need to be pressured to promote shares whereas they’re down. Sequence of return danger is usually a drawback when you have unhealthy timing or not sufficient diversification to see you thru an early tough patch within the withdrawal part.

Should you’re a teen who might be making contributions for years to come back you don’t need to see new all-time highs frequently. You must hope for extra volatility to benefit from decrease costs. You must pray for bear markets to purchase shares on sale.

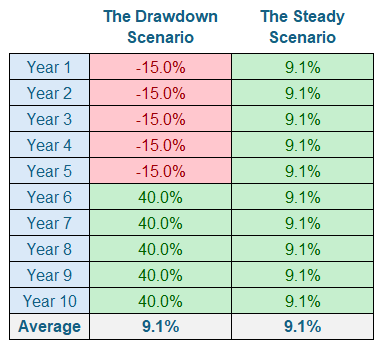

Let’s take a look at a easy instance to place some numbers on it. Listed here are the 2 situations specified by the query at hand:

Each the drawdown and regular situations find yourself with the identical annual return of 9.1%, however the path to get there may be a lot totally different.

So which one is healthier for a saver?

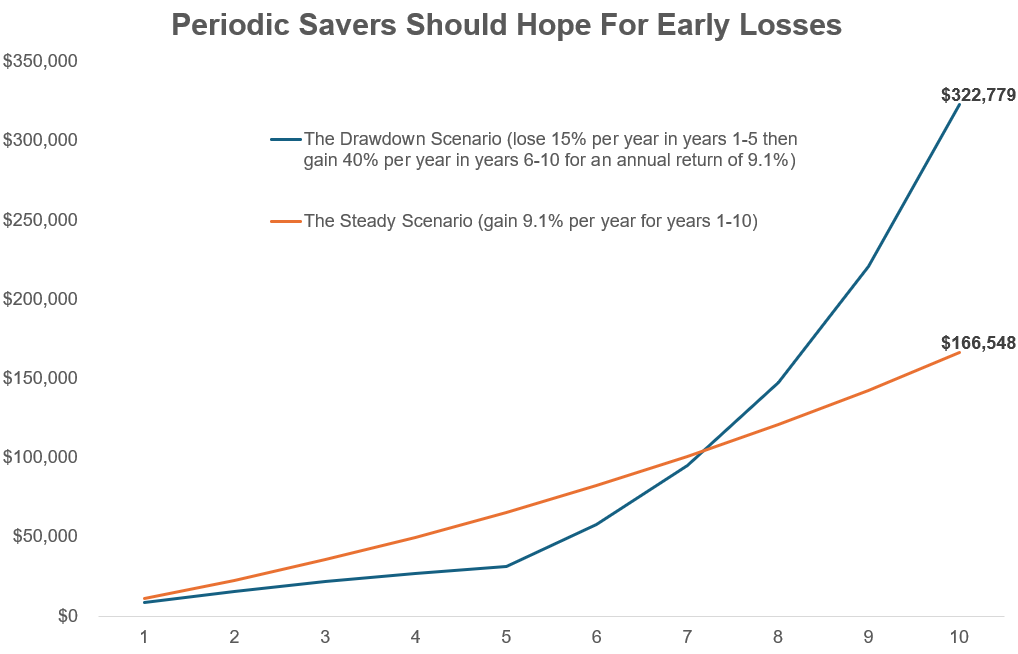

Let’s assume you set $10,000 to work at the beginning of every yr for 10 years in every situation.

After 5 years the regular situation is clearly higher. Being down 15% for five years in a row would result in a drawdown of greater than 55%. However take a look at the place issues find yourself after 10 years of saving and investing:

Each situations have the identical quantity invested ($100k in whole) and the identical 10 yr annualized return (9.1%) however you just about double your cash below the early drawdown situation.

How is that this attainable?

You spent 5 years shopping for shares at decrease costs after which they performed catch up over the following 5 years. That’s the dream.

After all, that is a lot simpler to dream about than implement. Not everybody has the intestinal fortitude to take a position when shares are getting hammered.

Plus, you haven’t any management over the sequence of market returns. It’s kind of random and primarily based on luck and timing than anything.

The purpose right here is that totally different dangers matter at totally different instances to totally different traders. There is no such thing as a one-size-fits-all market atmosphere.

You deal with what you possibly can management, diversify, make good choices again and again, enhance the quantity you save annually and do your finest.

However make no mistake — down markets are a win for younger traders who might be internet savers for years to come back. You need markets to fall so you possibly can snap up some screaming offers.

Simply don’t run out of the shop when every little thing goes on sale.

We dissected this query on the most recent version of Ask the Compound:

Callie Cox joined me on the present once more this week to debate questions on investing in options, the plight of the homebuyer, the present state of inventory market valuations, and overcoming monetary errors.

Additional Studying:

What If You Invested on the Peak Proper Earlier than the 2008 Disaster?

This content material, which incorporates security-related opinions and/or info, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There could be no ensures or assurances that the views expressed right here might be relevant for any explicit info or circumstances, and shouldn’t be relied upon in any method. You must seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “publish” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital property, or efficiency information, are for illustrative functions solely and don’t represent an funding suggestion or provide to supply funding advisory providers. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding determination. Previous efficiency shouldn’t be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from varied entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or indicate endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the danger of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.