Latest findings from distinguished retirement companies akin to Vanguard, Constancy Investments, and Financial institution of America reveal a troubling development as an growing variety of people are tapping into their 401(ok) accounts for hardship withdrawals, highlighting the escalating monetary pressures and misery going through many People.

Tendencies From Financial institution Of America, Vanguard, Constancy

Inventory market investments have carried out nicely in 2023 after a dismal efficiency in 2022. The S&P 500 has risen over 20% year-to-date and is near the earlier all-time excessive.

Nonetheless, current studies by Financial institution of America point out that many People are prematurely tapping into their retirement financial savings. The variety of contributors taking hardship distributions elevated 36% year-over-year.

The Vanguard 2023 report exhibits hardship withdrawals, a probable indicator of economic stress, had been rising.

The Constancy report exhibits that within the third quarter of 2023, 2.3% of employees took a hardship withdrawal, up from 1.8% in 2022. The highest two causes behind this uptick had been avoiding foreclosures/eviction and medical bills.

Unraveling the Causes Behind the Surge in 401(ok) Hardship Withdrawals

Numerous urgent circumstances immediate people to contemplate these withdrawals, from unexpected medical bills to sudden job loss. Decreased private financial savings, the rising price of necessities resulting from inflation, and excessive bank card debt point out ongoing challenges within the monetary panorama.

IRS Cautions In opposition to 401(ok) Hardship Withdrawals

As per the IRS, hardship withdrawals permit employees to faucet their 401(ok) for an “speedy and heavy monetary want, and restricted to the quantity essential to fulfill that monetary want.” Nonetheless, the penalty may be waived if employees present satisfactory proof that the cash is getting used for a professional hardship, akin to an unreimbursed medical expense totaling greater than 10% of the person’s adjusted gross earnings.

Is a 401(ok) Mortgage Higher?

Contemplating the restrictions on contributing for the subsequent six months, choosing a 401(ok) mortgage may be extra advantageous in sure conditions. Below federal laws, staff can borrow as much as 50% of their account steadiness or a most of $50,000, whichever is decrease, with out going through penalties, offered the mortgage is repaid inside 5 years.

A bonus of choosing a 401(ok) mortgage over a hardship withdrawal is that once you borrow from a 401(ok), you pay again the mortgage with curiosity, and that additional curiosity goes again into your individual account. This helps compensate for the misplaced funding positive aspects once you borrowed the cash out of your retirement account. 401(ok) loans don’t report back to the credit score bureaus and don’t affect credit score scores.

Disadvantages of a 401(ok) Mortgage

The problem of a 401(ok) mortgage is that within the occasion of a job loss or securing new employment, many employers might demand immediate compensation of the remaining steadiness inside a shorter interval. Additionally, repaying the mortgage utilizing after-tax {dollars} means you’ll get double-taxed when finally receiving retirement age-appropriate distributions.

Go for Hardship Withdrawals Solely as a Closing Alternative

Many monetary advisors discourage tapping into 401(ok) investments because it entails further taxes and penalties. You additionally lose out on the potential progress from compound curiosity.

Riley Adams, CPA and founding father of WealthUp, says, “A 401(ok) hardship withdrawal is a tricky determination, not one which ought to be made calmly. Contemplating the longer term misplaced returns and the speedy tax implications you’ll seemingly face from withdrawing your cash, it behooves you to contemplate different choices earlier than pushing forward. Concerning the hit you possibly can count on to take from a tax perspective, you’ll have to pay earnings taxes on any beforehand untaxed earnings you’ve positioned into the account and a further 10% penalty except you’re 59.5 or older. Additional, you’re not eligible to contribute to your 401(ok) once more for six months after you obtain the distribution.”

It’s at all times higher to seek the advice of with a licensed monetary and tax advisor since everybody has distinctive circumstances.

Few Choices for Working People

At the moment, only a few choices exist to tide over emergencies. Promoting vested restricted inventory items (RSUs) or shares from worker inventory buy plans and liquidating brokerage belongings are different strategies to accumulate speedy funds when an emergency fund isn’t obtainable. Accessing a house fairness line of credit score (HELOC) or cash-out refinancing is dangerous in the event you can’t repay the cash.

SECURE ACT 2.0 Affords Some Reduction

Congress included the SECURE Act 2.0 provisions to offer simpler entry to emergency financial savings inside retirement accounts. Starting in 2024, people underneath 59.5 can withdraw as much as $1,000 from their retirement account for emergency bills with out the customary 10% tax penalty on early withdrawals. Nonetheless, penalties might apply if you don’t replenish these funds inside three years and require one other withdrawal resulting from the same circumstance.

Firms might permit their staff to arrange emergency financial savings accounts via computerized payroll deductions, with an higher restrict of $2,500 every year and the primary 4 withdrawals in a 12 months free from taxes and penalties.

A Story of Two Americas

Regardless of the challenges introduced by elevated hardship withdrawals, studies point out that sure 401(ok) balances have risen in comparison with the earlier 12 months, signaling resilience in some retirement accounts. The Financial institution of America report means that common 401(ok) balances will probably be up practically 10% in 2023. The inventory market’s sturdy efficiency has undoubtedly helped People who managed to proceed contributing to their retirement accounts.

Nonetheless, the excessive common 401(ok) balances current a misleadingly optimistic outlook, whereas the starkly contrasting decrease median values underscore the divided monetary panorama in America.

The Vanguard research confirmed that in 2022, the typical account steadiness for Vanguard contributors was $112,572, and the median steadiness was solely $27,376.

The U.S. Census Bureau paints a equally bleak image of median IRA and 401(ok) account balances at $30,000.

The excessive inflation charge and wages not protecting tempo with the rise in costs of products and companies have pressured cash-strapped People to dip into their retirement financial savings to make ends meet. The low unemployment charge gives hope, indicating that not all is misplaced for People’ monetary futures. There stays a chance for people to contribute to their retirement financial savings, primarily if inflation decreases, enabling them to navigate monetary hurdles and proceed securing their long-term financial well-being.

Like Monetary Freedom Countdown content material? Remember to observe us!

Trump Tax Cuts Expiring Quickly: Motion Steps You Must Take Now

A number of key parts of the Tax Cuts and Jobs Act (TCJA) are scheduled to lapse by 2025. This pivotal tax reform, carried out throughout President Trump’s tenure, introduced substantial adjustments to the U.S. tax construction. With the expiration drawing close to, it’s essential for people to take proactive steps of their tax planning.

Trump Tax Cuts Expiring Quickly: Motion Steps You Must Take Now

JPMorgan’s Stark Warning: How Impending Stagflation May Upend Your Monetary Future

JPMorgan has cautioned that the current financial panorama would possibly evolve right into a state of affairs paying homage to the Seventies, that includes stagflation characterised by elevated inflation and sluggish progress. JPMorgan attracts parallels between present geopolitical tensions and people of the Seventies, suggesting a possible inflationary affect.

JPMorgan’s Stark Warning: How Impending Stagflation May Upend Your Monetary Future

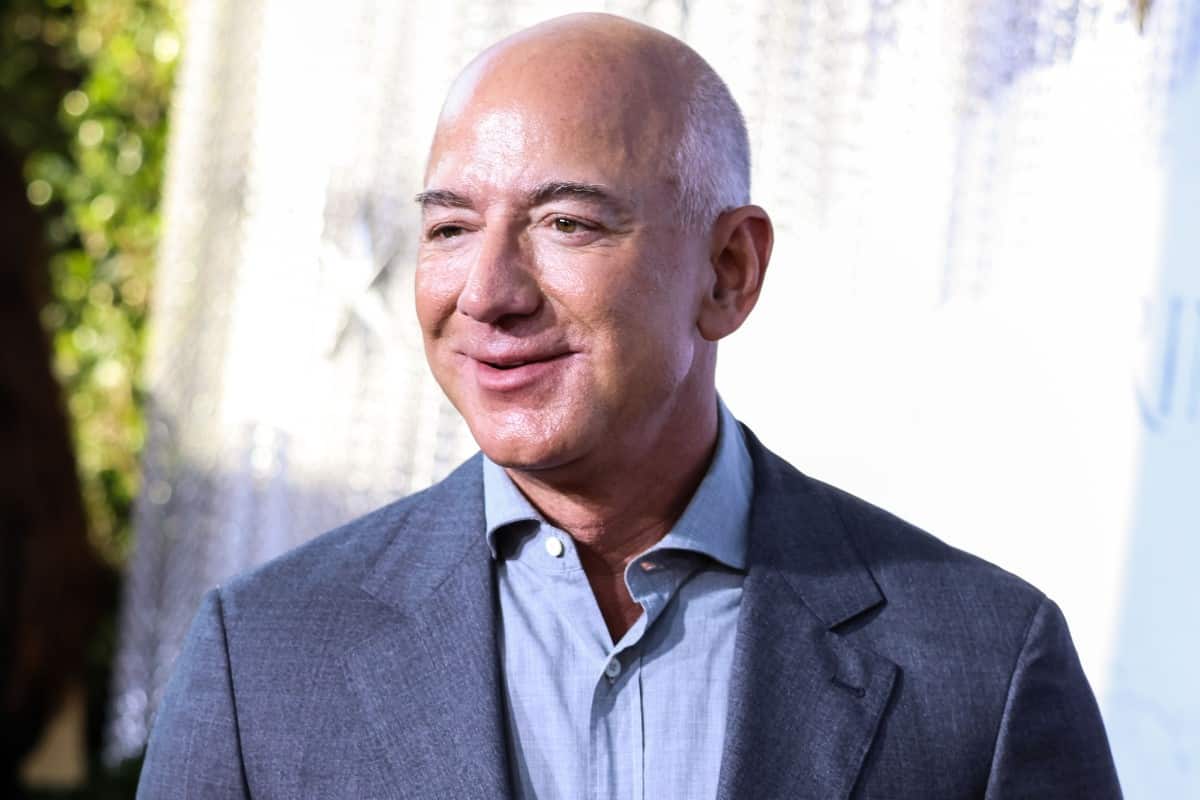

Jeff Bezos’ Transfer Sparks Intense Debate Over Tax Insurance policies

Amazon tycoon Jeff Bezos made waves in current headlines by asserting his transfer from Seattle to Miami. This surprising determination has piqued curiosity, sparking hypothesis in regards to the motives behind the relocation and its potential long-term impacts for Washington State.

Jeff Bezos’ Transfer Sparks Intense Debate Over Tax Insurance policies

Rework Your Funds by Shifting From an Worker to an Investor Mindset With Kiyosaki’s Cashflow Quadrant Methodology

Numerous programs have been established that present a a lot better understanding of what earnings era is, how it may be used, and the way people can set up their monetary life as they work in direction of monetary freedom. One of many extra profitable and better-known examples of economic schooling is the Cashflow Quadrant, the e-book by Robert Kiyosaki. Wealthy Dad’s Cashflow Quadrant was revolutionary for the way in which it organized cash and helped individuals higher discover ways to enhance their earnings. Because the title implies, there are 4 quadrants throughout the Cashflow Quadrant. By mastering every of the 4 classes – or specializing in a single – an individual can enhance their income stream and in the end earn more money.

Purchase, Borrow, Die: The Controversial Tax Loophole the Wealthy Use to Construct Generational Wealth

The “Purchase, Borrow, Die” technique is a favourite among the many prosperous, who work with monetary planners to maintain their lavish life whereas slashing their tax payments. Although it looks as if a contemporary development, Professor Ed McCaffery coined the time period within the mid-Nineteen Nineties to clarify how the rich legally keep away from paying taxes.

AARP Survey Reveals Over 50% of People 50 and Older Worry Monetary Smash in Retirement

A current AARP survey highlights a dire scenario for older People: 20% of adults aged 50 and above haven’t any retirement financial savings in any respect. This lack of economic preparedness is inflicting vital nervousness, with 61% of this age group frightened they received’t have the funds for to assist themselves in retirement.

AARP Survey Reveals Over 50% of People 50 and Older Worry Monetary Smash in Retirement

John Dealbreuin got here from a 3rd world nation to the US with solely $1,000 not figuring out anybody; guided by an immigrant dream. In 12 years, he achieved his retirement quantity.

He began Monetary Freedom Countdown to assist everybody suppose otherwise about their monetary challenges and reside their finest lives. John resides within the San Francisco Bay Space having fun with nature trails and weight coaching.

Listed below are his really helpful instruments

M1 Finance: John in contrast M1 Finance in opposition to Vanguard, Schwab, Constancy, Wealthfront and Betterment to search out the excellent funding platform. He makes use of it resulting from zero charges, very low minimums, automated funding with computerized rebalancing. The pre-built asset allocations and fractional shares helps one get began instantly.

Private Capital: This can be a free software John makes use of to trace his web price frequently and as a retirement planner. It additionally alerts him wrt hidden charges and has a price range tracker included.

Streitwise is offered for accredited and non-accredited buyers. They’ve one of many lowest charges and excessive “pores and skin within the sport,” with over $5M of capital invested by founders within the offers. It is additionally open to overseas/non-USA investor. Minimal funding is $5,000.

Platforms like Yieldstreet present funding choices in artwork, authorized, structured notes, enterprise capital, and so on. In addition they have fixed-income portfolios unfold throughout a number of asset courses with a single funding with low minimums of $10,000.