The Federal Reserve appears to be on monitor to attaining its aim of a gentle touchdown. Inflation is shifting in the precise course, particularly within the items sector, and the financial system now appears prone to keep away from a recession. The Federal Reserve Financial institution of Philadelphia launched its First Quarter 2024 Survey of Skilled Forecasters on Feb. 9, 2024, projecting that actual GDP will develop 2.4% in 2024, up 0.7 proportion level from the estimate within the earlier survey. The forecast doesn’t embody a single quarter of detrimental financial development, not to mention a recession, only a gentle touchdown. The next reveals the survey’s imply chances of actual GDP development in 2024. It emphasizes the significance of fascinated with forecasts not by way of level estimates however as chances of a large dispersion of attainable outcomes (there aren’t any clear crystal balls). With that in thoughts, the forecasters put the chances of a recession in 2024 as follows:

- 1st quarter: 17.3%

- 2nd quarter: 23.9%

- third quarter: 25.6%

- 4th quarter: 25.2%

With the nice financial information, the extent of investor fears or stress, as measured by the VIX (an index representing the market’s expectations for volatility over the following 30 days), has been effectively beneath its historic common of about 20. Nevertheless, it has been modestly rising since ending 2023 at 12.45. As I write this on Feb. 28, 2024, it was at 13.64 (although it reached 15.07 on Feb. 20). The rise signifies that buyers have gotten considerably extra involved concerning the outlook for the market. Traditionally, the VIX has been inversely associated to the efficiency of the S&P 500—when the value of the VIX goes up, the value of the S&P 500 tends to go down.

There are good causes for growing investor fears. The geopolitical dangers are excessive and rising, and different financial dangers might result in a “monetary accident” that would negatively influence the inventory and bond markets. Here’s a record of considerations, any one in every of which might be problematic for markets. Earlier than studying them, take into account that if I do know this stuff, then so does the “market.” Thus, the knowledge ought to already be in costs. Or, maybe buyers are simply too optimistic, and FOMO retains costs elevated. Please observe that the record shouldn’t be meant as a forecast (my crystal ball stays cloudy as all the time). It’s only a record of potential occasions and their dangers to the markets.

- Will probably be tough for the Fed to get inflation beneath management given the robust housing market (by way of costs) as a result of housing makes up 40% of the inflation basket. Housing costs are, in reality, rebounding. Thus, the dangers are rising that the shelter parts of inflation will keep elevated and complicate the Fed’s path again to its 2% goal. As well as, the costs of providers (resembling householders and auto insurance coverage and auto and residential repairs) are rising at a lot sooner charges, complicating the Fed’s activity and growing the chance that charges must stay increased for longer than the markets at the moment count on.

- Geopolitical tensions are excessive in Ukraine, the Center East and China. China is especially regarding. Add to those issues growing nationalism, which might result in commerce wars and better inflation, negatively impacting international financial development.

- There’s the specter of at the very least a partial shutdown of the U.S. authorities (not to mention the chance of a default) as a result of Congress can’t agree on spending payments.

- The U.S. debt-to-GDP ratio has now exceeded 100%. The empirical analysis, together with the 2011 examine “The Actual Results of Debt, the 2013 examine “Does Excessive Public Debt Constantly Stifle Financial Development?”, the 2020 examine “Debt and Development: A Decade of Research,” and the 2021 research “The Impression of Public Debt on Financial Development” and “Public Debt and Financial Development: Panel Knowledge Proof for Asian International locations,” has discovered that debt at average ranges can enhance development, however at excessive ranges (thresholds someplace between 75% and 100%) it could actually develop into damaging—if the excessive ratio isn’t addressed and turns into persistent, the debt turns into a drag on financial development.

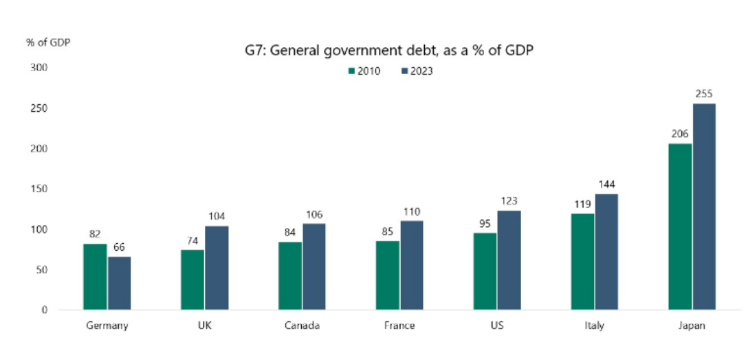

- There are persevering with will increase in sovereign debt in most developed nations and China. The U.S. shouldn’t be the one nation going through issues associated to rising debt-to-GDP ratios. “Since 2010, that ratio has elevated in all G7 international locations besides Germany.” Word within the chart beneath that each one G7 international locations besides Germany now have ratios above 100%, a determine that not solely hampers the federal government’s skill to handle future monetary crises but additionally constrains future development. The rising debt drawback is compounded by Europe’s must considerably enhance protection spending as a result of ongoing battle in Ukraine, with no sign of ending. Rising ratios enhance the dangers of the eventual downgrade of sovereign debt—with accompanying issues for the monetary markets. Protection spending additionally tends to be inflationary, because it doesn’t enhance the provision of merchandise shoppers purchase, but pumps funds into the financial system.

- With the Congressional Price range Workplace forecasting a $1.66 trillion deficit and a report $8.9 trillion of presidency debt maturing over the following 12 months, the Treasury must discover patrons for greater than $10 trillion in U.S. authorities bonds in 2024—greater than one-third of U.S. authorities debt excellent and greater than one-third of U.S. GDP. As well as, since September 2022 the Fed has been operating down its steadiness sheet holdings by $95 billion a month (quantitative tightening or QT). The power of the markets to soak up all that debt might be difficult, particularly when the biggest holders of Treasurys (foreigners) proceed to lower their possession of U.S. authorities bonds. The danger is that charges might stay increased than the market at the moment expects. How will markets react if there may be weak demand for Treasurys at a future public sale?

- The work-from-home motion, resulting in dramatic falls in workplace valuations, is already constraining financial institution lending and will result in extra financial institution failures.

- Municipal funds are coming beneath stress in giant cities (resembling New York, Chicago and Los Angeles) as a result of decline in property values of workplaces (resulting in decrease tax receipts) on the identical time they face growing bills as a result of surge in unlawful immigration. Downgrades of debt rankings are attainable if actions aren’t taken to handle the tendencies. These issues might result in decrease spending by municipalities, negatively impacting the financial system.

- For expertise shares, and particularly the Magnificent 7, there appears to be an growing threat of antitrust laws that would negatively influence the sector—the one with the very best valuations.

What, if something, ought to buyers do with this info?

Takeaways

Investing in equities is all the time dangerous due to uncertainty about future returns, amongst a myriad of different causes to not make investments. That’s the reason shares have traditionally offered excessive returns—buyers demand a big threat premium for accepting these dangers. Thus, the primary takeaway is that it’s important that you simply keep in mind the opportunity of left tail occasions occurring—within the type of black swans (unforeseeable occasions, resembling what occurred on 9/11) or “white swans” (foreseeable dangers like those talked about above)—and that they’re constructed into your funding plan, guaranteeing that you simply don’t take extra threat than you’ve gotten the power, willingness or must take.

The second takeaway is that in case you are involved concerning the aforementioned dangers, you are able to do one thing about it. Nevertheless, that ought to not embody making an attempt to time the market, which the proof on the failure of energetic managers reveals has been a loser’s sport. As a substitute, you possibly can scale back the dangers of left tails by lowering your publicity to the financial cycle dangers of conventional shares and bonds and growing your publicity to dangers that don’t extremely correlate with those self same financial cycle dangers.

A superb instance of an asset with distinctive dangers is reinsurance, as hurricanes and earthquakes don’t (usually) trigger bear markets and bear markets don’t trigger hurricanes or earthquakes. It is a significantly good time to think about reinsurance, as markets have “hardened” due to some years of poor returns (2017-19 and 2021). The result’s that premiums have gone approach up on the identical time that underwriting requirements have tightened and deductibles have risen (lowering dangers). Funds that buyers would possibly think about for gaining publicity to this asset class embody SRRIX, SHRIX and XILSX.

One other wonderful instance of property with low correlation to conventional shares and bonds is long-short (market impartial) issue funds, resembling QSPRX and QRPRX.

Buyers might additionally think about non-public, prime quality, senior secured, floating-rate (avoiding the chance of inflation) credit score, together with funds resembling CCLFX (with a web yield of about 12%).

It ought to be famous that every of those funds (aside from SHRIX) is an interval fund, offering restricted quarterly liquidity (buyers are compensated with increased anticipated returns for accepting that illiquidity threat).

Lastly, buyers might additionally think about trend-following methods (resembling QMHRX), which have traditionally carried out effectively in prolonged bear markets.

The advantages of diversification are well-known. In actual fact, it’s been referred to as the one free lunch in investing. Including distinctive dangers is essentially the most environment friendly and prudent solution to scale back left tail threat. Buyers who search to learn from diversification of the sources of threat and return of their portfolios should settle for the truth that including distinctive sources of threat implies that their portfolio will inevitably expertise what is named monitoring error—a measure of the efficiency of a portfolio relative to the efficiency of a benchmark, such because the S&P 500.

“Monitoring error remorse” (which happens when your diversified portfolio underperforms a broad market benchmark) raises its ugly head infrequently and may result in the abandonment of even well-thought-out plans. However diversification is like portfolio “insurance coverage” in opposition to having all of your threat eggs within the incorrect threat basket. It doesn’t get rid of the chance of losses or comparatively poor returns, nevertheless it does scale back them. And diversification requires accepting the truth that components of your portfolio will behave completely in a different way than the portfolio itself and will underperform a broad market index (such because the S&P 500) for a very long time. At the least between these two decisions (avoiding or accepting monitoring error), there is no such thing as a free lunch— you both have to just accept tail threat or enhance publicity to risk-free property, resembling one-month Treasury payments (and settle for their very low actual historic returns, even earlier than contemplating taxes).

Larry Swedroe is head of economic and financial analysis for Buckingham Wealth Companions, collectively Buckingham Strategic Wealth, LLC and Buckingham Strategic Companions, LLC.

For informational and academic functions and shouldn’t be construed as particular funding, accounting, authorized, or tax recommendation. Sure info is predicated on third get together information and will develop into outdated or in any other case outmoded with out discover. Third-party info is deemed dependable, however its accuracy and completeness can’t be assured. The opinions expressed listed below are their very own and will not precisely mirror these of Buckingham Strategic Wealth, LLC or Buckingham Strategic Companions, LLC, collectively Buckingham Wealth Companions. Neither the Securities and Change Fee (SEC) nor every other federal or state company have accepted, decided the accuracy, or confirmed the adequacy of this text. LSR-23-617