We’re at present within the “every thing market.” It doesn’t matter what you’ve in all probability invested in; it’s at present growing in worth. Nevertheless, it isn’t possible for the explanations you suppose. A current Marketwatch interview with the all the time bullish Jim Paulson obtained his reasoning for the rally.

“It’s this cocktail of ‘full help’ on the entrance finish of a bull market which generally has created an ‘All the pieces Market’ throughout the early a part of a brand new bull. That’s, for a interval, nearly every thing concurrently rises – worth, development, small, massive, defensive, and cyclical shares – and normally by lots.

Brief charges are falling, bond yields have declined, cash development is rising, fiscal stimulus has once more expanded, and disinflation continues to be evident; and due to this new and overwhelming help, expectations for a gentle touchdown ought to develop whereas each shopper and enterprise confidence improves.” – Jim Paulson

However that isn’t the explanation.

On the opposite facet of the bull/bear argument are “gold bugs” having fun with hovering gold costs as a result of “money owed and deficits” are lastly eroding the U.S. economic system. As Michael Hartnet of BofA not too long ago acknowledged:

“Lengthy-run returns in commodities are rising after the worst decade because the Thirties, led by gold, which is a hedge towards the 3Ds: debt, deficit, debasement.”

The proof doesn’t help that view. Traditionally, when deficits as a share of GDP improve, gold does very nicely as issues about U.S. financial well being improve (as per Michael Hartnett of BofA.) Nevertheless, gold performs poorly as financial development resumes and the deficit declines. Such is logical, besides that since 2020, gold has soared in value whilst financial well being stays strong and the deficit as a share of GDP continues to say no.

Whereas shares and gold have risen this yr, bonds, commodities, actual property, and cryptocurrencies have additionally loved positive factors.

In different phrases, no matter your “thesis” is for no matter asset you personal, the worth motion at present helps that thesis. That doesn’t imply your thesis is right.

In an “every thing rally,” rising asset costs cowl investing errors.

Due to this fact, this evaluation ought to elicit two essential questions: 1) what drives the “every thing rally,” and a couple of) when will it finish?

No matter Your Thesis Is – It’s Most likely Fallacious

With regards to what’s driving the “every thing rally,” everybody has their thesis. The “inventory jockeys” counsel that simpler financial lodging by the Fed and bettering earnings are the important thing drivers for equities. As famous above, the “gold bugs” are seduced by burgeoning authorities spending and expectations of a greenback decline to loft gold costs larger. Each asset class has its “motive” for going larger, however the actual motive could also be a lot easier. This submit will give attention to shares and gold as they garner essentially the most headlines and have essentially the most fervent of “true believers.”

In each market and asset class, the worth is decided by provide and demand. If there are extra patrons than sellers, then costs rise, and vice-versa. Whereas financial, geopolitical, or monetary knowledge factors might quickly have an effect on and shift the stability between these wanting to purchase or promote, ultimately, the worth is solely decided by asset flows.

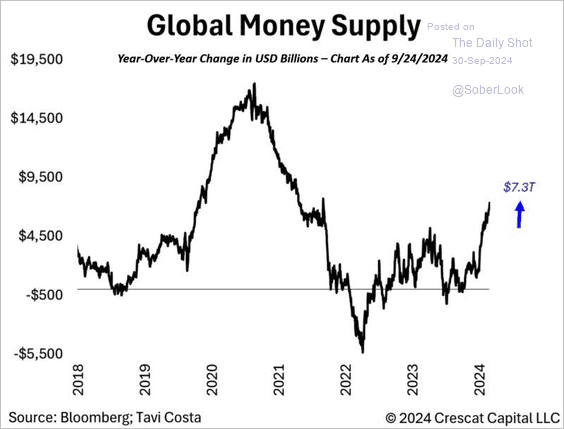

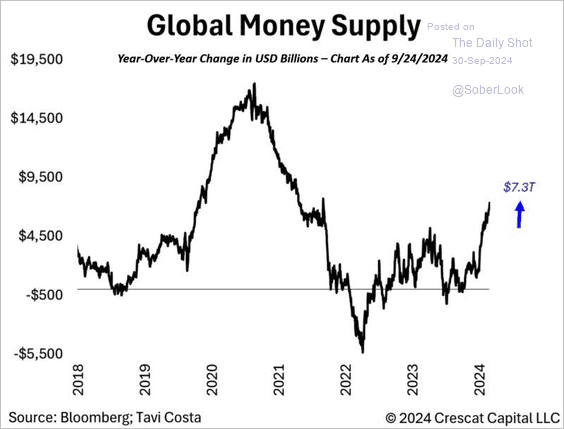

Notably, the sum of money flowing into belongings has been outstanding since 2014. Regardless of many “issues,” 2024 is on observe to be the second-strongest yr of financial inflows since 2021. That statistic is superb when contemplating the federal government was flooding the system with trillions in financial and financial stimulus then versus contracting it at present.

Unsurprisingly, as asset costs improve throughout the “every thing market,” extra money is pulled into these belongings, forcing costs to rise as demand outstrips provide. As we famous beforehand, for “each purchaser, there’s a vendor…at a selected value.” That “demand” for shares, gold, actual property, cryptocurrencies, and many others., comes from many sources.

- Hedge funds

- Personal fairness funds

- Company share buyback applications

- Passive indexes

- Pension funds

- Institutional funds

- Mutual Funds

- Retirement plans

- International buyers

- Retail buyers

Most essential is the provision of capital from Central Banks.

In fact, a large accumulation of money in cash market funds will face declining yields because the Federal Reserve cuts rates of interest.

As famous, no matter your “thesis” for proudly owning an asset in all probability isn’t the precise motive. There are three main explanation why asset costs are rising within the “every thing market.”

- Liquidity

- Liquidity

- Liquidity

In different phrases, in an “every thing market,” there may be an excessive amount of cash chasing too few belongings.

As famous, “cash flows” are the “demand facet” of the equation. As beforehand mentioned, the “provide facet,” or the quantity of “belongings out there,” continues to say no. Such explains why managers proceed to “chase shares” regardless of excessive valuations.

“The variety of publicly traded firms continues to say no, as proven within the following chart from Apollo. This decline has many causes, together with mergers and acquisitions, chapter, leveraged buyouts, and personal fairness. For instance, Twitter (now X) was as soon as a publicly traded firm earlier than Elon Musk acquired it and took it personal. Unsurprisingly, with fewer publicly traded firms, there are fewer alternatives as market capital will increase. Such is especially the case for giant establishments that should deploy massive quantities of capital over quick intervals.”

The identical is true for gold. Whereas the demand for gold will increase as costs rise, the provision of gold has declined since 2019.

As such, gold is not a “risk-off ” asset with a unfavourable correlation to equities however is now a risk-on asset, identical to equities. The 4-year correlation to the S&P 500 is close to earlier peaks, with subsequent efficiency.

In fact, these “every thing markets” can final for much longer than logic suggests. Nevertheless, they do finish. What causes “every thing markets” to finish is no matter exogenous, surprising occasion turns off the stream of liquidity.

Technically Talking

As famous, “every thing markets” can last more than logic dictates. Nevertheless, they ultimately finish, and we don’t know what is going to trigger it or when. Check out the 2 charts beneath.

In every chart, I’ve denoted intervals the place three elements occurred:

- The market traded at 2-or extra commonplace deviations above the 4-year shifting common

- Relative Power was overbought on a long-term foundation

- The MACD was elevated and triggering a “promote sign.”

In each instances, these technical extremes marked quick to long-term corrections and consolidations for shares and gold. For the S&P 500 index, these intervals additionally corresponded to extra essential headline occasions such because the “Crash of 1987,” the “Dot.com Crash,” and the “Monetary Disaster.” Notably, just like the S&P 500, the technical deviations for gold are additionally at ranges which have denoted quick to long-term corrective cycles.

As Paulsen famous in his interview, “every thing markets” usually final solely six months to a yr. He expects this one to be in drive at the least for “the following a number of months.”

“Though the street forward, even when a few of my considering proves right, will nonetheless be interrupted by common bouts of volatility, buyers might need to take into account staying bullish throughout the subsequent a number of months, lastly having fun with a mini restart to this bull market and maybe witness what full help can do to your portfolio.”

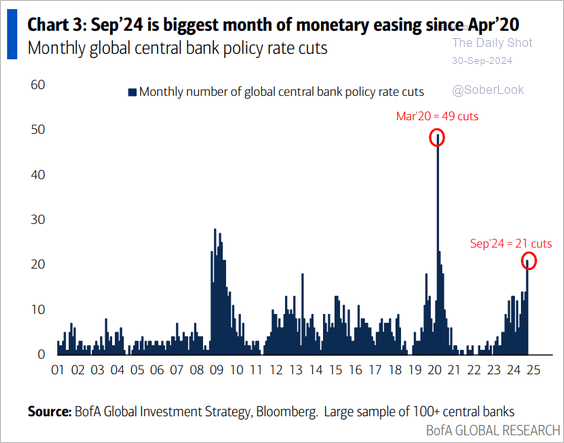

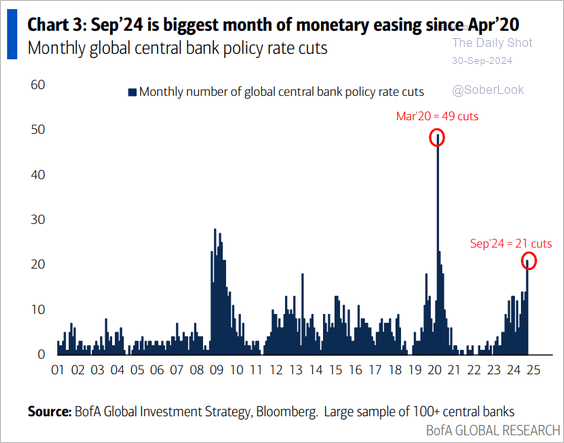

We don’t know what is going to ultimately trigger a shift in liquidity because the Federal Reserve and international central banks transfer again into easing mode. (The financial situations index combines rates of interest, the greenback, and inflation. It’s inverted to correspond to rising asset costs.)

Critically, September was the largest month of financial easing since April 2020 amid the worldwide pandemic disaster.

Notably, an eventual reversal might be brought on by a “disaster occasion” or a reversal of financial flows. The technical evaluation tells us that it’ll happen and sure when the fewest buyers anticipate it.

However that isn’t right this moment.

In fact, that is all the time the case, so buyers recurrently “purchase excessive and promote low.”

Bear in mind Warren Buffett’s well-known phrases when investing in an “every thing market.”

“Investing is lots like intercourse. It feels the very best simply earlier than the tip.”

In fact, perhaps that’s the reason Warren has been elevating numerous money currently.

That’s it for right this moment! In order for you extra insights like these, subscribe to our publication for normal updates on market traits and investing methods.

Publish Views: 244

2024/10/01