Have you ever observed how some merchants appear to develop their accounts unbelievably shortly?

In some way, they flip modest beginnings into spectacular sums…

Are they utilizing a hidden method, maybe?

Nicely, whereas it may appear unbelievable – the reality is much less complicated and really achievable.

The key lies in mastering the facility of compounding.

It’s a primary however highly effective technique that reinvests earnings to develop your account extra shortly.

By understanding and making use of compounding, you’ll be able to remodel regular returns into extraordinary outcomes.

The catch?

It requires endurance, self-discipline, and a transparent technique to make it work.

Now, should you’ve ever felt daunted by compounding or averted it as too technical, don’t fear.

On this article, I’ll break it down for you step-by-step.

By the tip, you’ll uncover:

- What compounding in buying and selling actually means and why it’s so highly effective.

- The mathematics behind compounding and easy methods to calculate your potential development.

- Methods to maximise compounding whereas managing dangers.

- Frequent errors to keep away from that may derail your progress.

Able to take your buying and selling to the following degree?

Nice – Let’s get began!

What does it imply to compound your buying and selling returns, and why must you care about it?

Compounding your buying and selling returns is a strong course of whereby earnings earned on trades are reinvested to generate even larger returns.

You could assume, “However I wish to take earnings and use that cash!”

However, bear with me for a second.

When used accurately, compounding creates a wealth-generating suggestions loop the place a interval’s earnings are added to beginning capital, rising the bottom for future development.

Not like customary returns, which develop steadily, compounding accelerates your wealth over time.

Think about a dealer beginning with $10,000 and attaining constant 10% month-to-month returns, taking their earnings alongside the best way…

…in a single yr, they may develop their account to $22,000. Not dangerous.

Now, evaluate this to a dealer utilizing compounding, rising their investments as their account grows…

…in the identical timeframe, they might see their account develop to $31,000!

Are you excited now?!

Let’s dig deeper into this…

Key Ideas

The core of compounding lies in reinvestment.

Two elements drive the method: the speed of return and the way typically you compound.

They’re completely key!

However compounding additionally rewards self-discipline and endurance.

The longer you retain earnings in your account, the extra pronounced the compounding impact turns into.

Consider it like a snowball rolling downhill: because it gathers pace, it accumulates extra snow, and will get larger, and so forth…

Really, the correct idea to compound your returns in buying and selling.

It’s the reinvestment that basically amplifies development over time.

The truth is, I wish to share certainly one of my favorite quotes with you.

Einstein’s eighth Marvel of The World

Albert Einstein famously referred to compound curiosity as “the eighth surprise of the world,” saying, “He who understands it, earns it; he who doesn’t, pays it.”

This quote highlights the large potential of compounding for wealth creation.

For merchants, it’s a instrument to exponentially develop their capital via consistency and time.

It additionally reveals the significance of beginning early, staying disciplined, and reinvesting good points.

Those that grasp the artwork of compounding can unlock further wealth, whereas those that overlook it threat lacking out.

Let’s dig into its technicals!

The mathematics to compound your buying and selling returns

So, compounding is all in regards to the lengthy recreation.

The straightforward equation to work out the long run worth of your buying and selling account is the next:

Future Worth = Principal × (1 + Fee/100)^Time

To grasp it higher, let’s break it into its parts:

- Principal: That is your beginning capital or the preliminary quantity in your buying and selling account.

- Fee: The share return per compounding interval (e.g., month-to-month or yearly), expressed as a decimal or fraction of 100.

- Time: The variety of compounding durations, similar to months or years, over which earnings are reinvested.

Let’s check out an instance to image this higher.

Instance

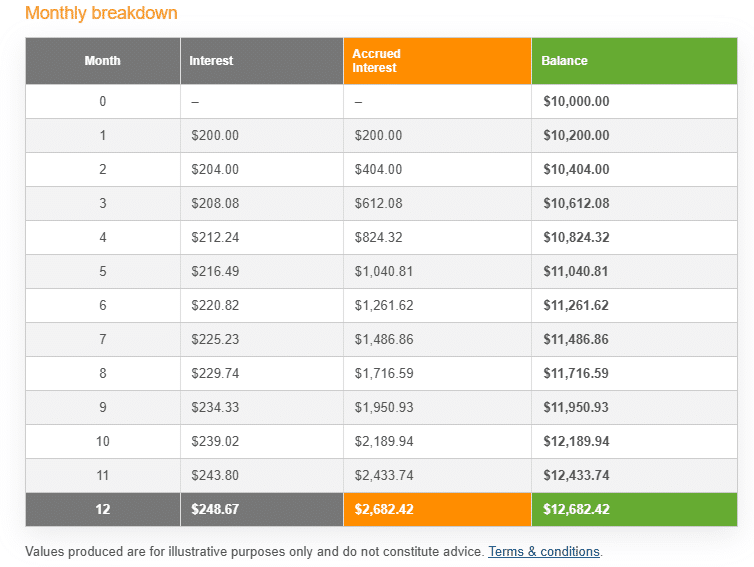

Suppose you begin with $10,000 (Principal), and also you persistently earn 2% monthly (Fee). You wish to calculate your account stability after 12 months (Time)…

Future Worth = $10,000 × (1 + 2/100)^12

Step-by-step:

Convert the speed: 2/100 = 0.02

Add 1 to the speed: 1 + 0.02 = 1.02

Increase to the facility of time: 1.02^12 ≈ 1.2682

Multiply by the principal: $10,000 × 1.2682 = $12,682…

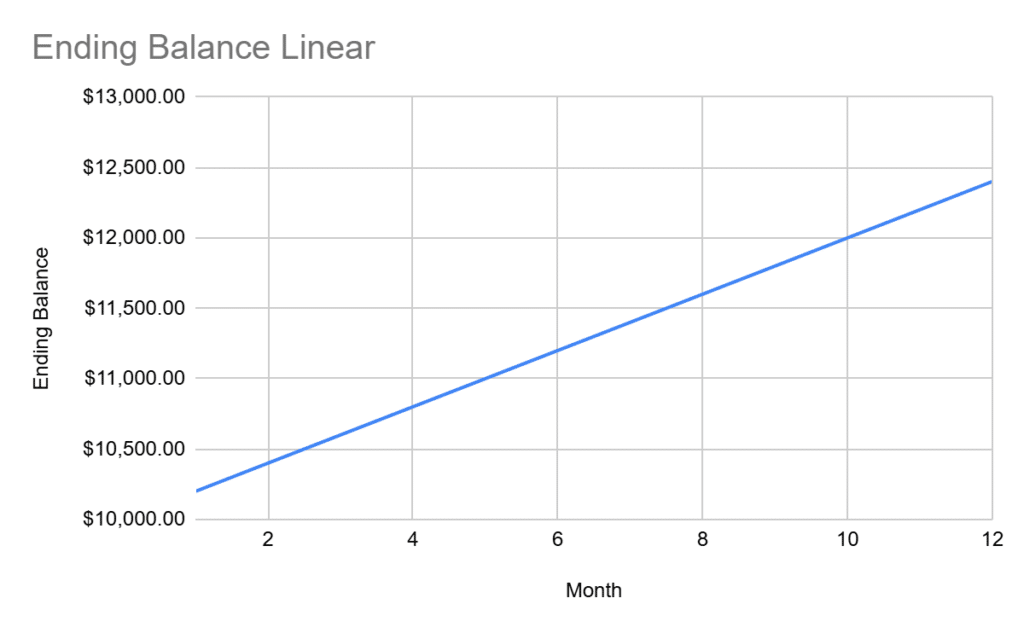

Comparability with out compounding your buying and selling returns

Now, let’s see how, with out reinvesting, the account grows in a straight line…

Calculate the entire revenue: 2% × $10,000 = $200 monthly

Multiply by 12 months: $200 × 12 = $2,400

Whole stability: $10,000 + $2,400 = $12,400

This reveals that compounding provides an additional $282, purely from reinvesting earnings…

That may not look like quite a bit, however there may be greater than a month’s value of earnings that you’re lacking out on!

You must also notice that as time goes on, the distinction turns into an increasing number of excessive.

However earlier than I present you that, I wish to clarify why frequency is vital, too.

Compounding Frequency

Unsurprisingly, the extra ceaselessly you reinvest, the sooner your account grows.

Month-to-month compounding (as within the instance) is much simpler than yearly compounding, particularly in unstable markets like foreign exchange.

Instruments like compound curiosity calculators might help you perceive these situations…

To point out you extra clearly, I wish to return to the snowball impact from earlier…

The Snowball Impact in Buying and selling

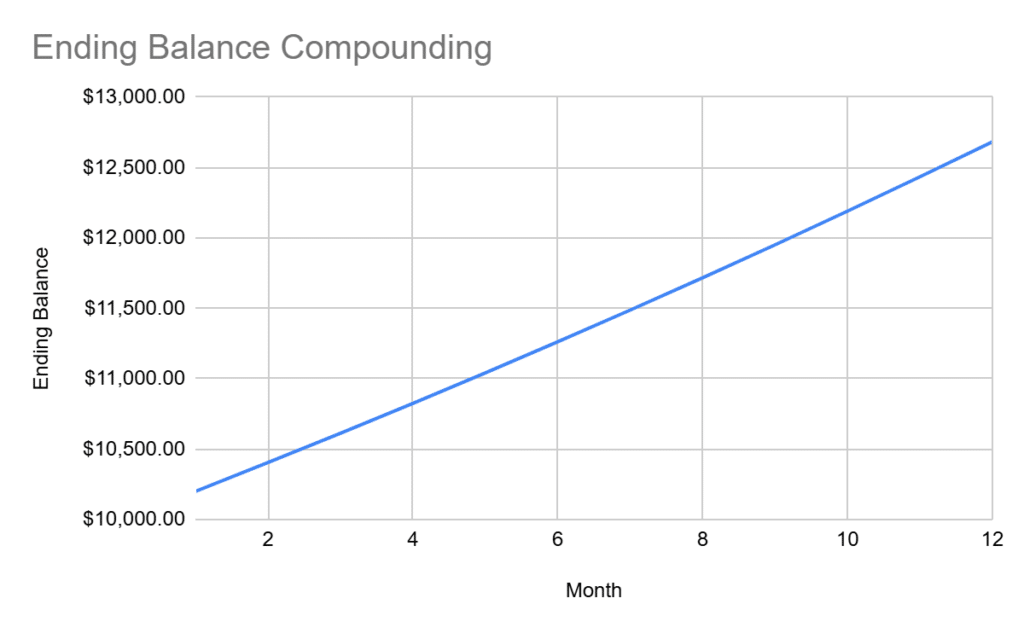

How Compounding Your Buying and selling Returns Accelerates as Your Account Grows

That is the place compounding will get actually thrilling.

The snowball impact is a superb visualization of how compounding good points momentum over time.

In buying and selling, each worthwhile commerce provides to your account stability, which means the next trades have extra capital to work with.

This step-by-step development means earnings can multiply exponentially, as returns are earned in your beginning capital PLUS any good points you might have, therefore, compounding your returns in buying and selling.

Take this instance:

You will have a beginning stability of $1,000.

With month-to-month returns of 2%.

Within the first month, you earn $20, rising your stability to $1,020.

Nonetheless, within the second month, your 2% return applies to $1,020, yielding $20.40

Stepping via additional, you’ll be able to see that by the tip of the yr, your account will develop considerably extra by reinvesting the additional earnings…

Let’s plug in some extra numbers to see it extra clearly.

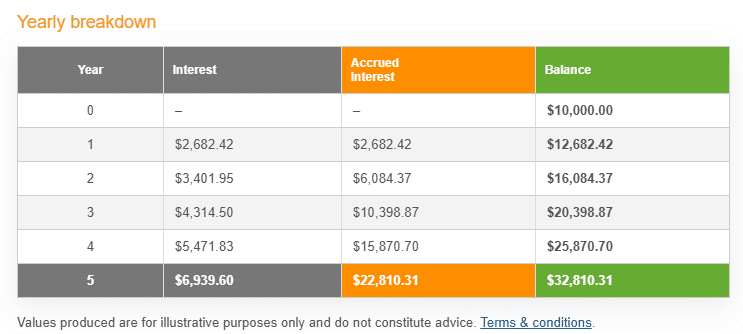

Beginning with $10,000…

You persistently obtain 2% monthly in your buying and selling account.

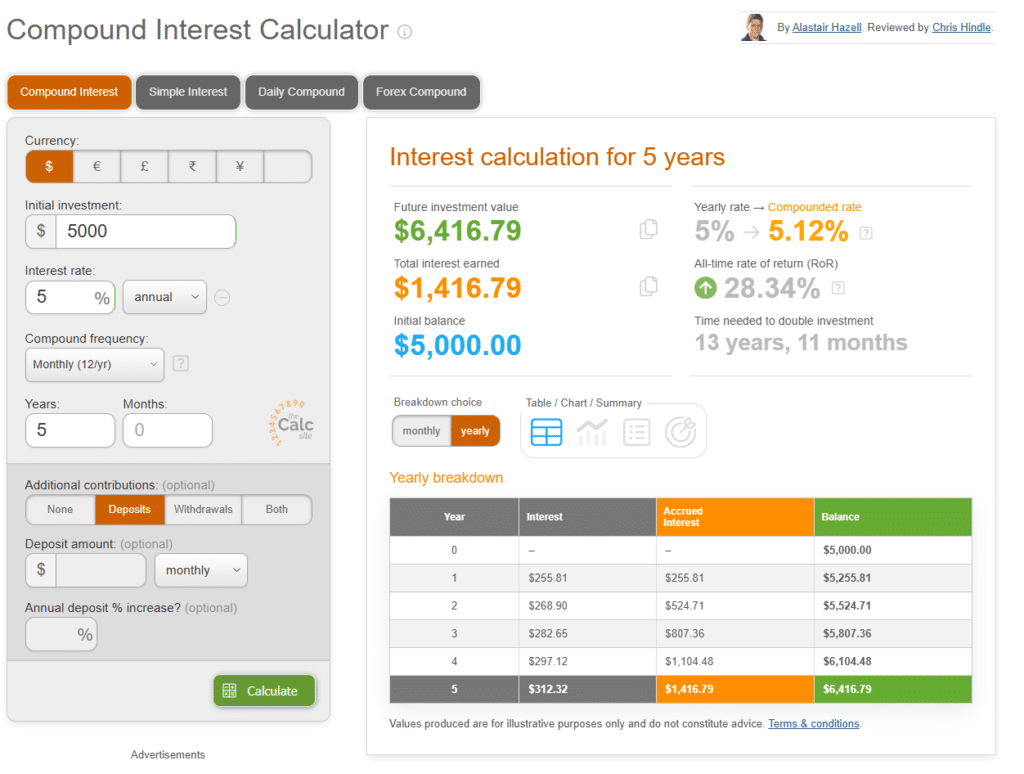

Let’s use the compound curiosity calculator offered by Thecalculatorsite.com

That is what your first buying and selling yr would seem like utilizing compounding…

First-Yr Breakdown Foreign exchange Compounding Calculator:

Not dangerous!

Contemplating all you’re doing is utilizing your earnings and funneling them again into your buying and selling account.

Nevertheless it will get tremendous fascinating as you attain the 5-10-year interval.

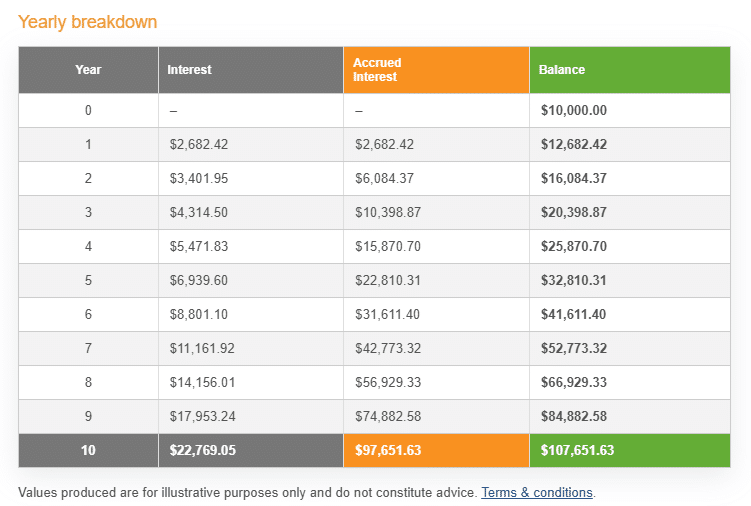

Take a look at the 5-year breakdown should you had been to proceed these constant earnings…

5-Yr Breakdown Foreign exchange Compounding:

One thing ought to stand out right here.

Are you able to see how lengthy it takes time to your preliminary funding to double?

It wasn’t till the third yr, proper?

With out understanding higher, most individuals lose belief within the methodology earlier than seeing its true energy.

Nonetheless, you probably have the endurance to breach that barrier… the additional earnings actually start to shine!

Want extra convincing?

Let’s take a look at 10 years…

10-Yr Breakdown Foreign exchange Compounding Calculator:

…a whopping $107,651 from 10,000 {dollars} begin!

Now, you may be considering, “10 years is a very long time for that type of achieve…”

However you need to keep in mind this makes use of returns of two% monthly.

It’s positively achievable to compound your returns in buying and selling!

In fact, numbers might fluctuate relying on profitability and consistency…

In precise buying and selling, there are ups and downs affecting how compounding works…

Nonetheless, the facility of compounding is obvious.

You’ll be able to see the snowball impact in play, as your account begins small however good points momentum, rising bigger.

Let’s transfer on to some methods to maximise these earnings even additional!

Methods to compound your buying and selling returns

1. Reinvesting Income

It’s the entire basis of what it means to compound a buying and selling account.

Nonetheless, you need to notice that some merchants take the strategy of reinvesting some of their earnings – not all of their earnings.

I like to recommend attempting out compounding with smaller numbers at first.

And keep in mind – taking cash out right here and there’ll solely delay the method.

While you begin to make important good points and wish to take cash out of your account, withdraw solely what you want…

…minor sacrifices now result in a lot bigger rewards later!

As you noticed within the earlier instance of what 10 years of constant profitability seems like, years 4 onwards ship a major revenue.

Reinvesting calls for a disciplined mindset and a strong buying and selling technique to handle bigger place sizes successfully with out falling to undue dangers.

I’ve additionally seen very profitable merchants reinvest their earnings in different investments, such because the inventory market, mutual funds, or ETFs.

That’s what good wealth technology seems like.

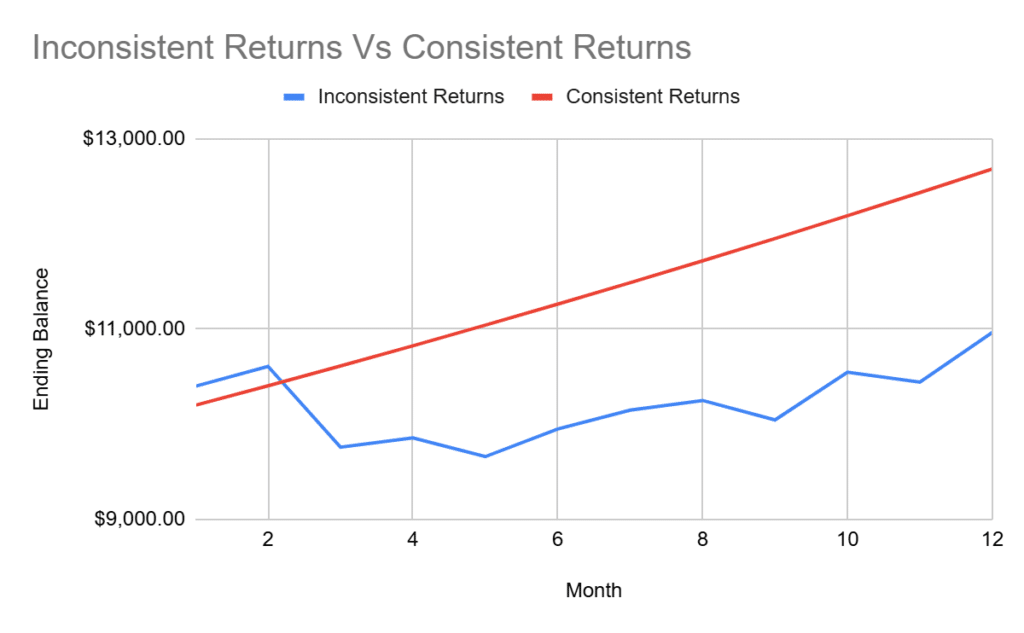

2. Attaining Constant Returns

Constant good points are means higher than sporadic good points relating to compounding.

Common and slight profitability typically provides higher long-term outcomes than irregular, massive wins.

For instance, a dealer persistently incomes 2% monthly will outperform one who alternates between 5% good points one month and 4% losses the following.

To attain consistency, merchants ought to deal with high-probability trades, disciplined execution, and avoiding pointless dangers.

Instruments like commerce journals and efficiency monitoring might help preserve focus and refine methods for regular returns, which in flip will compound your returns in buying and selling…

Inconsistent Returns Vs Constant Returns:

As you’ll be able to see from the graph above, inconsistent returns severely affect the speed of profitability.

This isn’t to say that compounding is a foul concept for many who could also be barely inconsistent of their buying and selling returns, although.

In spite of everything, dropping months will all the time happen in buying and selling, and that’s pure.

Nonetheless, it’s one thing to be conscious of as you undergo your buying and selling journey.

3. Danger Administration

Danger administration is a no brainer in any buying and selling plan, however its affect on compounding is large.

With out efficient threat administration, compounding efforts can shortly come undone!

To guard capital and maintain development, I like to recommend all the time setting a most threat per commerce, similar to 1-2% of the account stability.

You must also regulate place sizes to match account development so your publicity doesn’t fluctuate.

This strategy minimizes the affect of losses, particularly throughout unstable market circumstances.

Say you might have a $1000 buying and selling account and incur a dropping streak of 5 trades to lose 5% of your account….

Your account is now $950.

On this case, it’s essential to place your new trades as in case your buying and selling account is now 5% much less.

This implies your place sizing ought to match the 1-2% of $950, not the unique $1000.

This restricts additional losses from having a bigger affect in your remaining stability.

In fact, this restricts your winners as effectively…

…however once you construct the account again up, it really works in your favor. (as proven within the tables)

Emotional self-discipline is equally vital, as bigger account sizes amplify potential good points and dangers.

Sticking to your threat thresholds implies that development continues steadily with out exposing the account to devastating drawdowns.

Belief the compounding course of and proceed to focus on your share enhance quite than counting the cash misplaced and received on every particular person commerce.

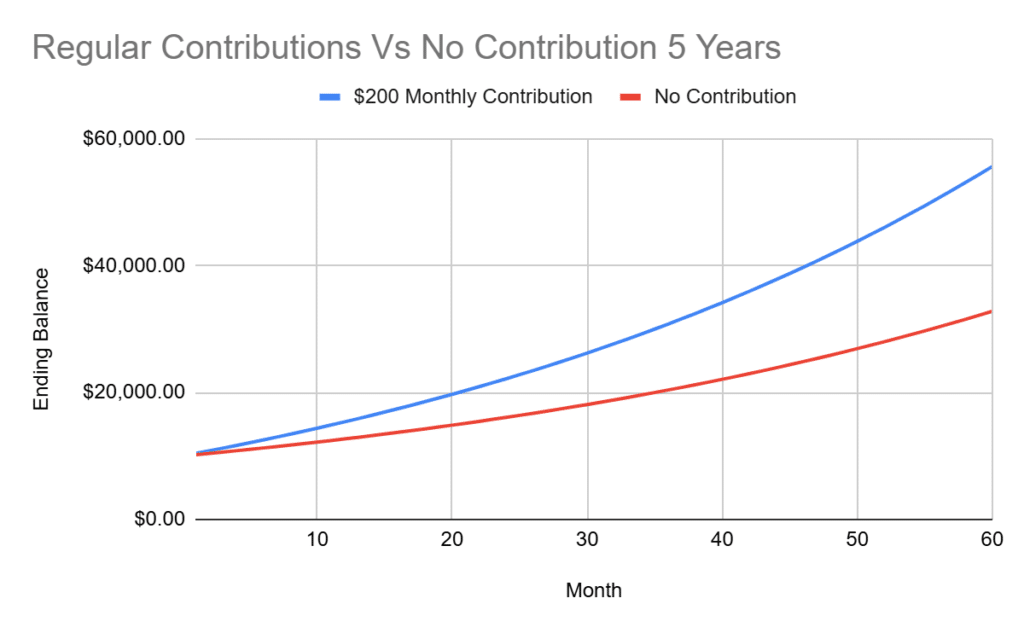

4. Common Contributions

I can’t stress sufficient how a lot common contributions, on high of earnings, can affect your buying and selling account.

This isn’t about only a bodily win.

It’s a psychological win, particularly you probably have reached constant profitability.

Including exterior funds to a buying and selling account and reinvesting earnings can additional speed up development.

For instance, a dealer contributing $200 month-to-month to an account incomes 2% monthly will expertise considerably sooner development than relying simply on buying and selling good points.

This twin strategy good points from the mixed energy of financial savings and compounding your returns in buying and selling, making it particularly priceless for merchants with regular revenue sources outdoors of buying and selling.

Let’s take a look at an instance.

In case you had been to contribute an additional $200 a month to your account over 12 months, your progress would look quite a bit higher…

After deducting the $2400 contributed over the yr, you’ll nonetheless find yourself near $300 {dollars} higher off.

It doesn’t sound like quite a bit, proper?

However what about over a 5-year interval?…

Over 5 years, the distinction is far more noticeable!

The common contributions ending worth is $55,620 vs. no contribution at $32,810, merely from including an additional $200 a month.

Once more, even should you deduct the quantity contributed, you continue to find yourself round $11,000 higher off.

You’ll be able to think about that as you proceed your buying and selling journey and play with extra money, these variations start to get extra excessive, too.

So, now that you simply see the true energy of compounding, let’s take a look at some errors to keep away from.

Errors to keep away from in compounding your buying and selling returns

Market Volatility

When contemplating on compounding your returns in buying and selling, volatility will not be your good friend.

Market volatility typically tempts you to make impulsive selections, chasing sudden worth swings or exiting positions too early.

Whereas volatility is all a part of the market, failing to include it into your technique can result in important losses.

To mitigate the dangers of volatility, you need to keep away from excessive volatility market instances similar to information occasions or excessive unfold buying and selling instances.

If you’re in a commerce, use a cease loss to forestall market volatility from having a major affect in your account stability.

Diversify your trades throughout totally different pairs or property to attenuate publicity to volatility.

Keep in mind, a disciplined strategy with a sound threat administration plan ensures you’ll be able to navigate unstable durations with out derailing your progress.

Emotional Self-discipline

In my view, feelings are one of many largest obstacles to buying and selling success.

Concern, greed, and overconfidence, also known as the “buying and selling triad”, can result in pricey errors.

For instance, worry may forestall you from taking well-calculated dangers.

Greed might drive overtrading or trigger you to carry onto trades for too lengthy and never take earnings on the applicable time.

Overconfidence can lead to careless trades with out correct evaluation.

To take care of emotional self-discipline:

- Comply with a structured buying and selling plan.

- Take breaks when feeling careworn or overwhelmed.

- Preserve expectations practical to keep away from emotional highs and lows.

Having management over your feelings is crucial for long-term success and maximizing the advantages of compounding.

Lack of Endurance

Everybody’s been there.

I wish to Get Wealthy Fast!

However do you keep in mind the story of the hare and the tortoise?

Impatience is a standard buying and selling pitfall.

Dashing into low-quality setups or revenge buying and selling when issues don’t go your means can hinder each profitability and the advantages of compounding.

True success in buying and selling requires a long-term perspective.

To observe endurance, you need to all the time anticipate high-probability setups quite than drive trades.

Permitting trades to achieve their deliberate outcomes as a substitute of appearing on impulse is one other nice option to observe endurance.

The secret is to deal with the larger image, understanding that constant development takes time.

Keep in mind, it is a marathon, not a dash!

Be the tortoise.

Inconsistent Technique

Ceaselessly altering technique isn’t simply dangerous for compounding; it’s a poor buying and selling method generally.

Always switching approaches typically results in erratic returns and missed alternatives, stopping merchants from realizing their potential development.

As talked about earlier than, inconsistency is an actual compound killer.

If you end up eager to swap methods, you need to as a substitute decide to a well-tested and confirmed technique that aligns with market circumstances.

This isn’t to say which you can’t regulate your strategy, small changes are advantageous…

…however your core beliefs by which you’re buying and selling mustn’t seriously change from each day or week to week.

I all the time suggest you repeatedly assessment and refine your strategy based mostly on efficiency and evolving developments.

Conclusion

Compounding your returns in buying and selling is a strong instrument that has the potential to remodel a modest buying and selling account into substantial capital over time.

Through the use of the strategy of reinvesting earnings, sustaining constant returns, and practising stable threat administration, you’ll be able to unlock unbelievable development.

On this article, you lined the important methods and pitfalls of compounding in buying and selling:

- Exploring how compounding works and why it’s a game-changer for merchants.

- Reviewing the arithmetic behind compounding with real-world examples.

- Inspecting the snowball impact and its position in accelerating account development.

- Studying sensible methods to maximise compounding, together with reinvesting earnings and constant contributions.

- Observing frequent errors that may derail your compounding journey and easy methods to keep away from them.

By making use of these ideas and avoiding the pitfalls, you’ll not solely enhance your buying and selling outcomes but additionally construct a disciplined, strong strategy for long-term success.

While you actually perceive the facility of compounding, your buying and selling journey turns into much more thrilling.

Now it’s your flip!

Have you ever skilled the facility of compounding in your buying and selling?

What methods have labored greatest for you?

Share your experiences and ideas under.

I’d love to listen to what steps you’re taking to compound your buying and selling returns!