Let me ask you…

If you first began buying and selling, what had been a few of the first stuff you discovered?

Candlesticks.

Transferring averages.

Vary and trending markets.

And sure, they’re vital subjects for a newbie…

However as buying and selling piques your curiosity, what occurs?

You need extra!

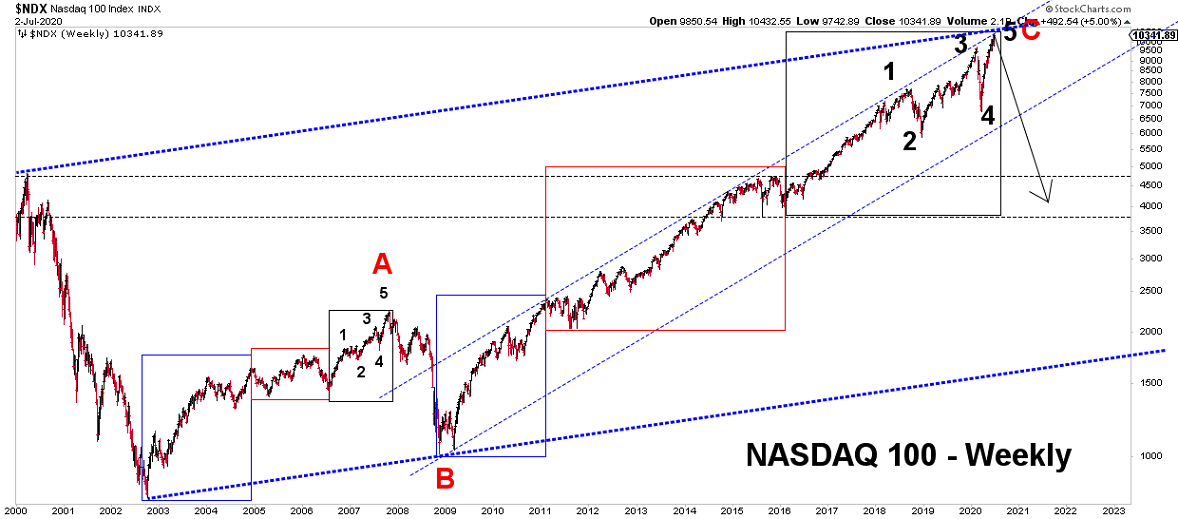

You begin to look into extra difficult subjects, reminiscent of Elliot waves…

Superior chart patterns…

Supply: Buying and selling Empowered

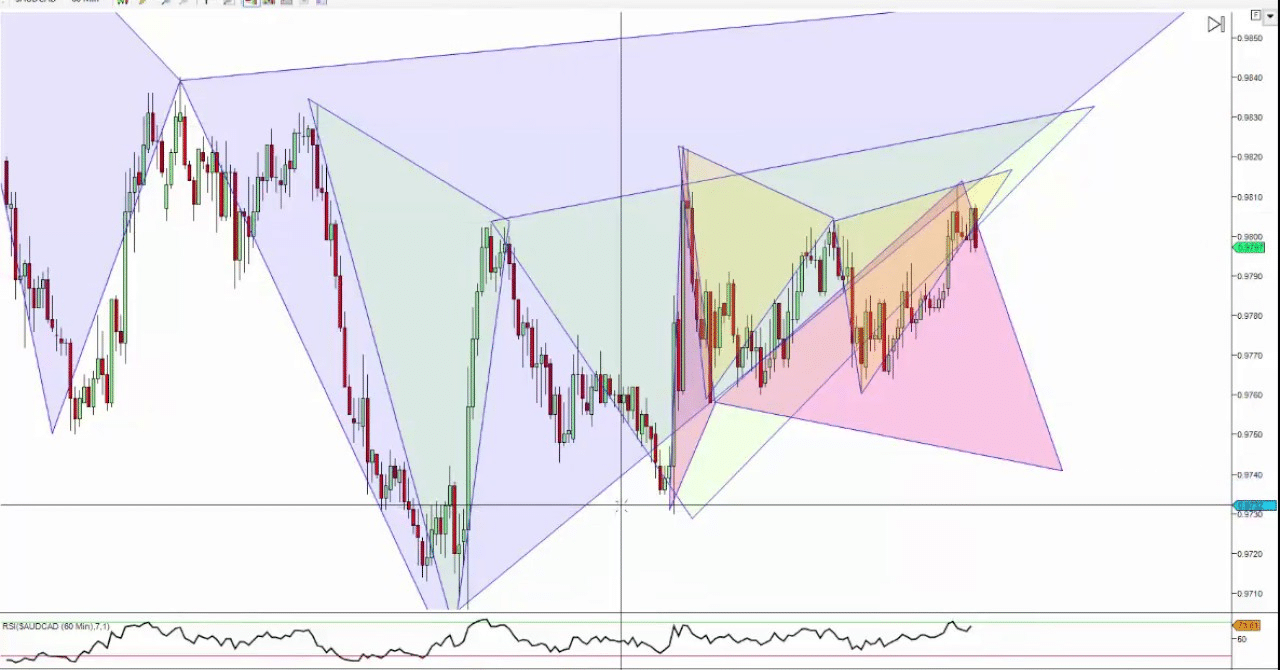

And, in fact, divergence buying and selling…

Supply: Bybit

At this level, you’ve possibly taken a peek into these subjects.

However I guess you’re nonetheless questioning:

“How do I exploit it to commerce the markets?”

“How do I time my entries, cease loss, and take revenue ranges?”

Nicely, that’s why in in the present day’s information…

I’ll provide the full image of what it’s wish to grasp divergence buying and selling!

Particularly, you’ll study:

- The “hidden” precept behind divergence buying and selling that no different textbook will inform you

- A fool-proof approach that may provide help to grasp figuring out all forms of divergences in buying and selling

- Which indicator is the most effective for divergence buying and selling (it’s not what you suppose)

- A whole and easy divergence buying and selling technique (together with entries and exits)

- Errors to keep away from when buying and selling divergences and options to beat these errors

It is a jam-packed masterclass information.

So…

I recommend you get your notes and charts up and let’s get began!

What’s divergence buying and selling and the way does it work? (it’s not what you suppose)

To place it merely…

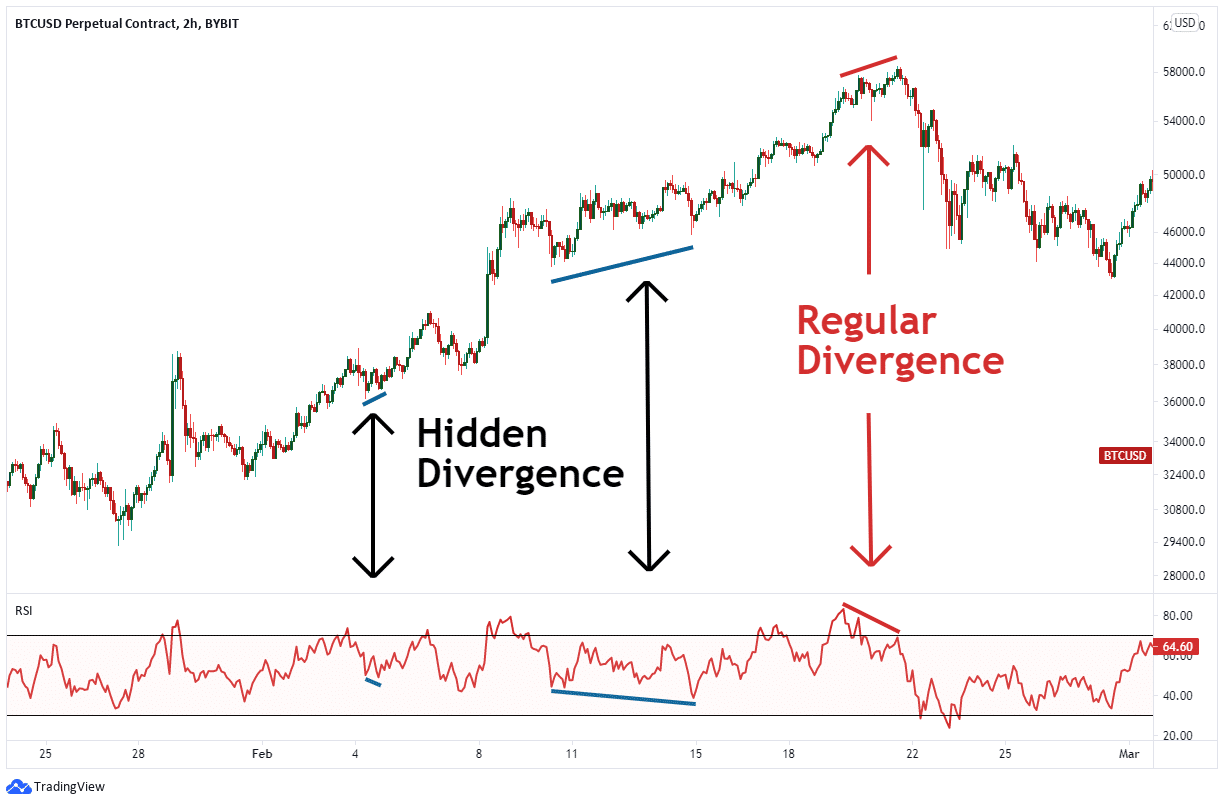

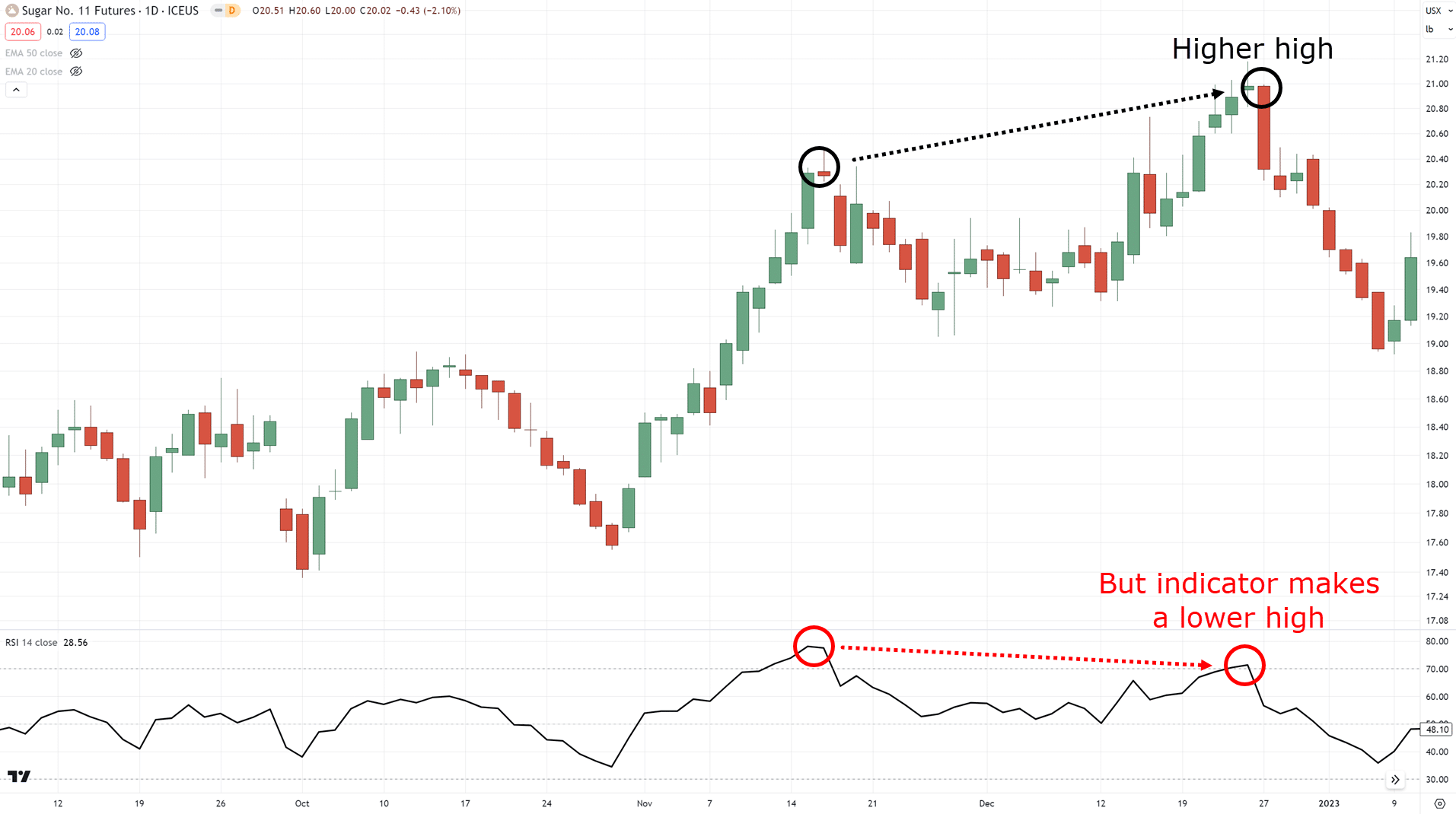

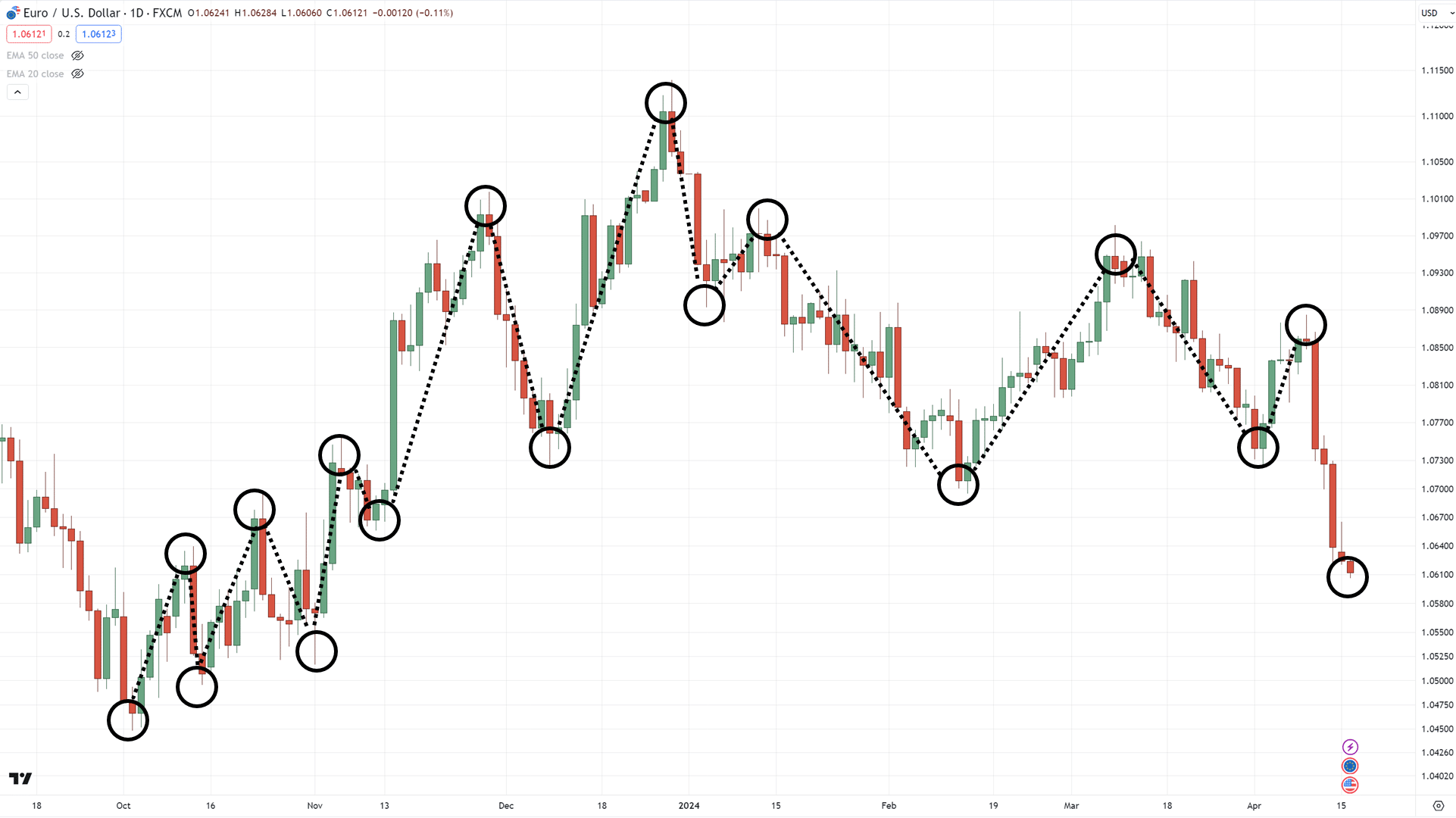

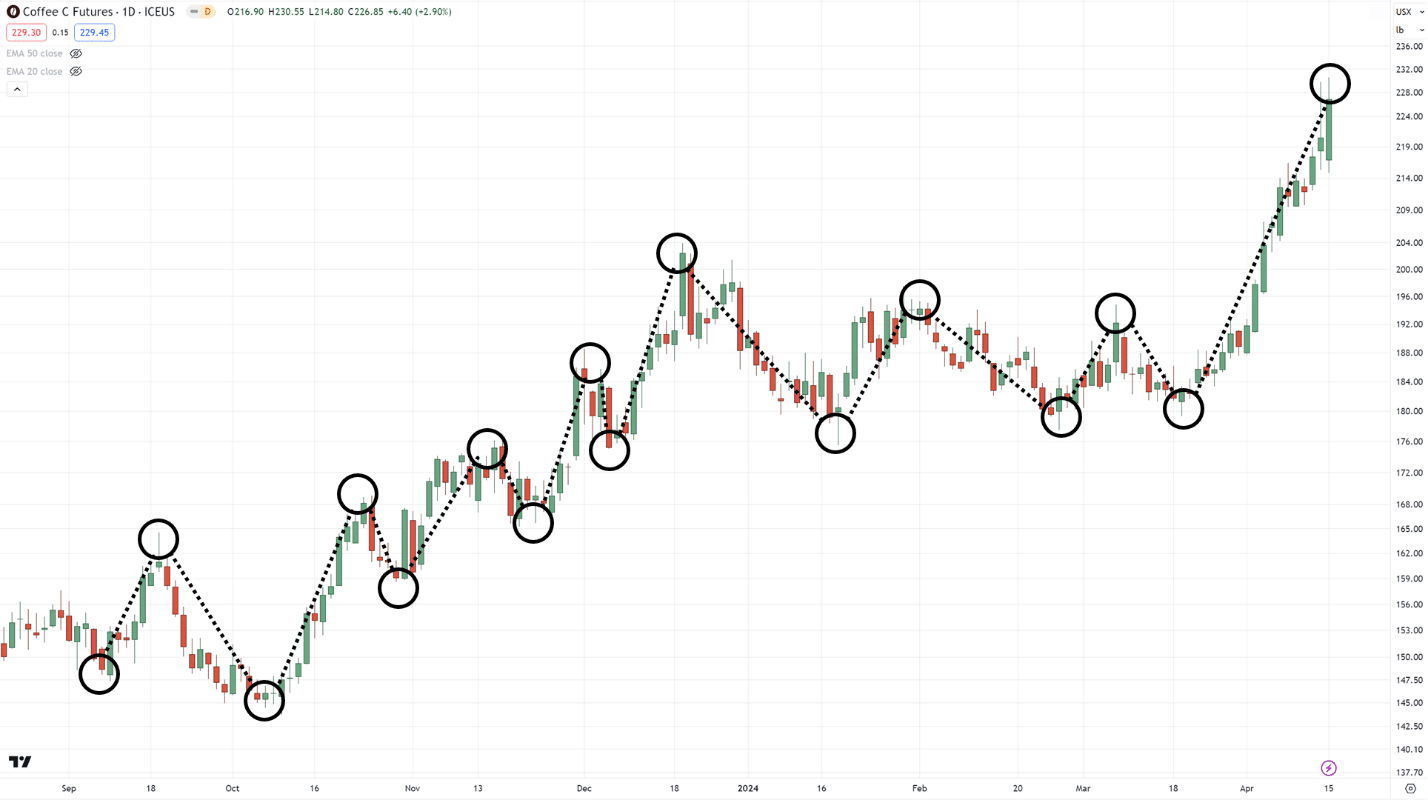

A “divergence” in buying and selling occurs when the swing highs/lows in your chart are totally different from the swing highs/lows proven in your indicator…

And there could be a number of variations of them, as seen on this cheatsheet!…

Now, right here’s the factor…

The market consists of patrons and sellers, right?

That’s why you wish to ask:

How does divergence buying and selling work?

Should you ask somebody how divergences work, they’ll in all probability say…

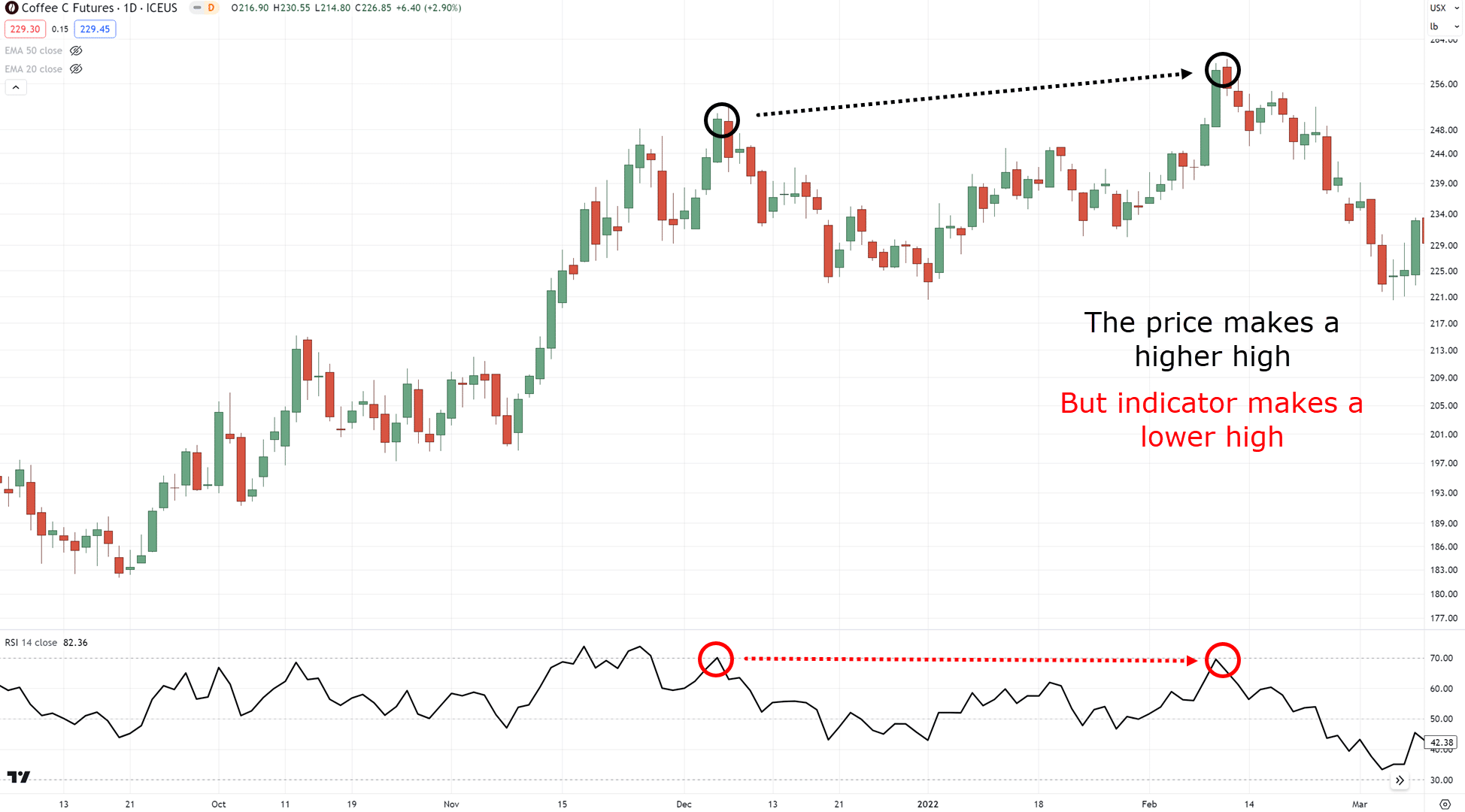

“Oh, divergences in buying and selling are when the value makes a better excessive, however the indicator makes a decrease low”

And certain, that’s the textbook definition.

However what does it truly imply?

What are the patrons and sellers doing particularly when divergence occurs?

What does your indicator characterize?

Let me inform you…

Think about you’re on a operating monitor, and also you’re prepared to start a 100-meter sprint.

As soon as the gunshot pops…

You dash and make it to the end line in simply 9 seconds!

Holy cow, you’re fairly quick!

Now…

Think about you make the identical 100-meter sprint, however this time you might be being pushed again by a hurricane wind simply to complete the race

What do you suppose would occur?

Absolutely, you’ll end the race twice as lengthy with this rain and wind!

So, how does this relate to divergence buying and selling?

Easy!

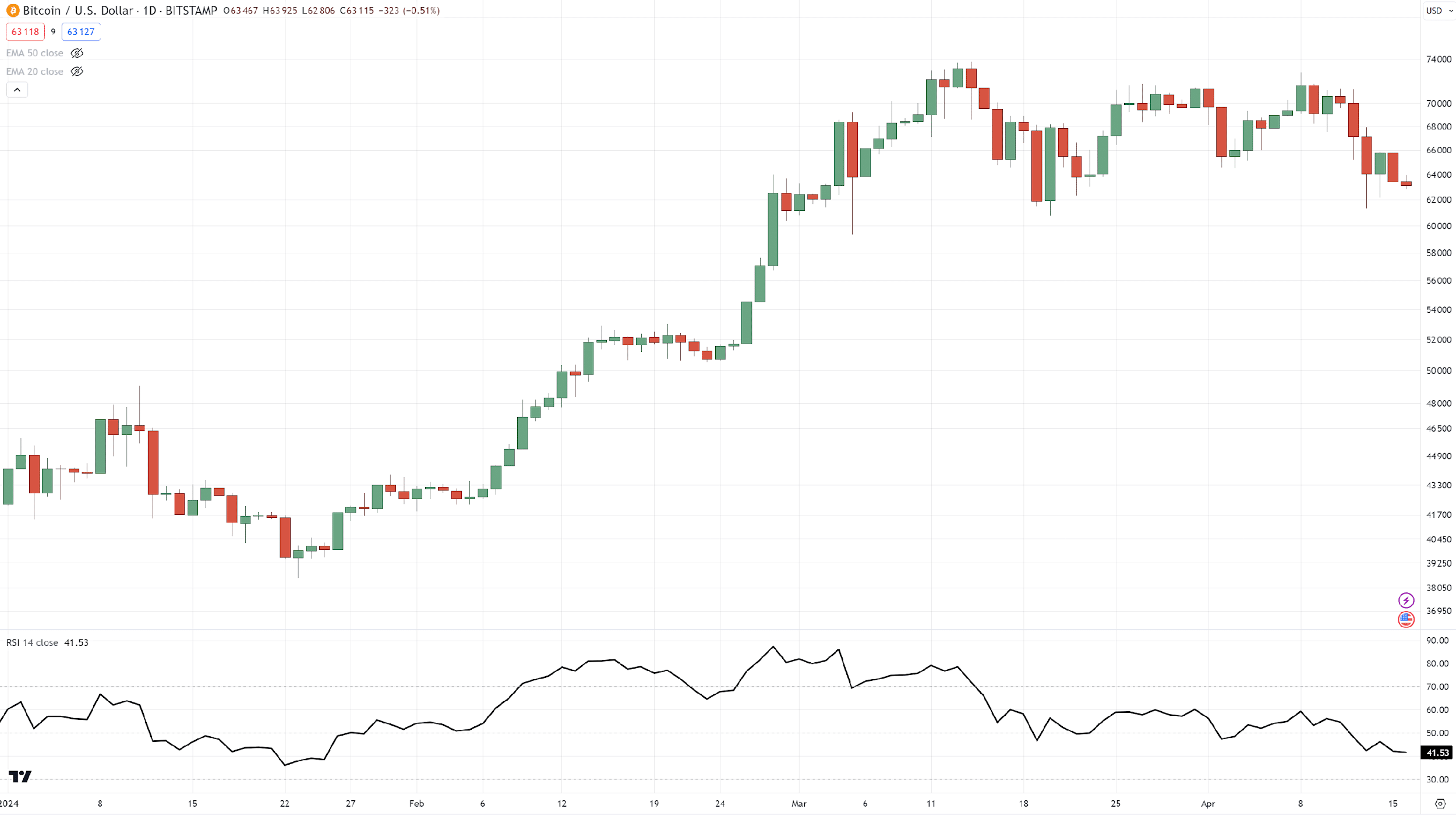

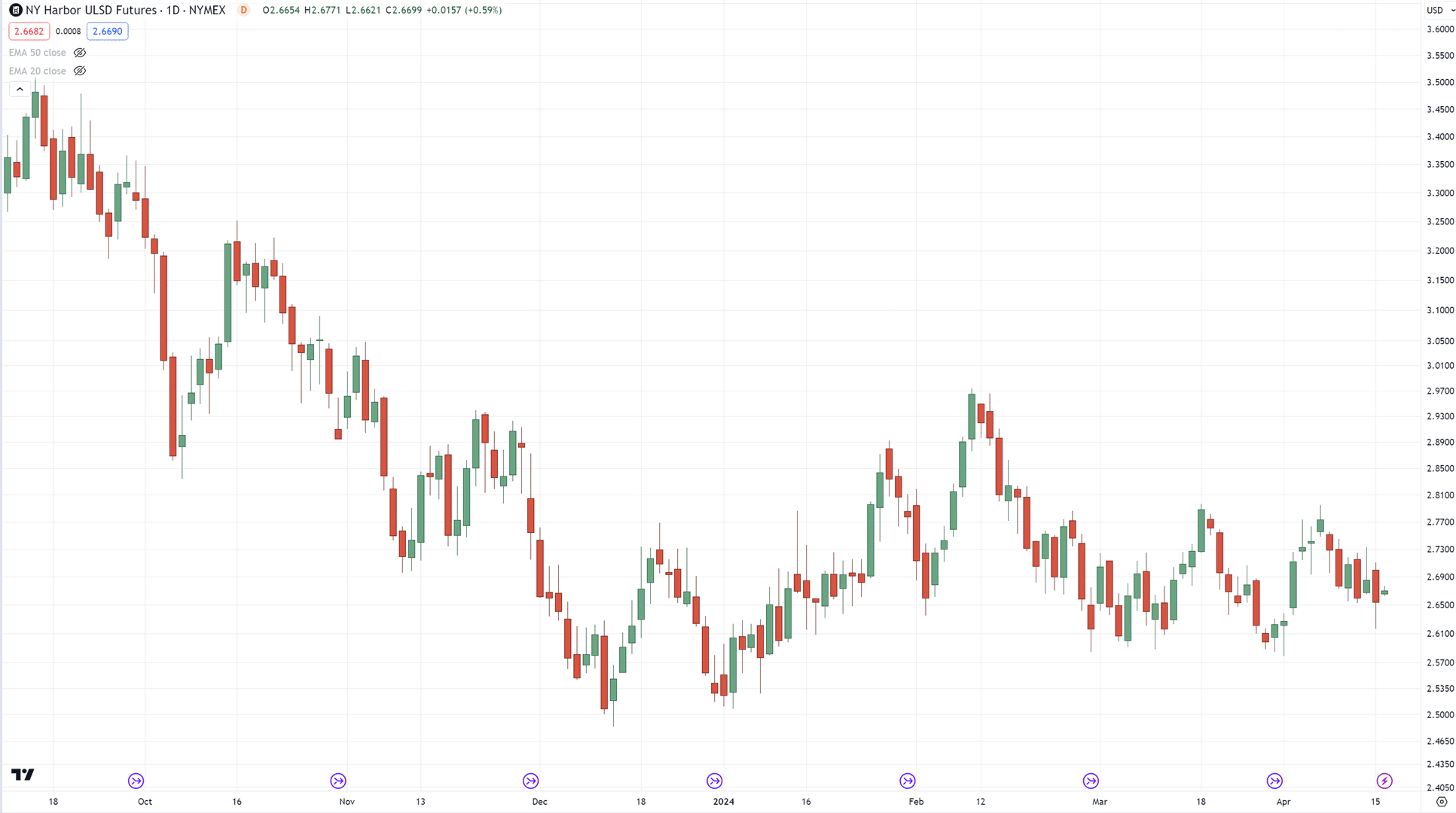

There are occasions when the market could make a +16.65% acquire in simply 13 days, phew!

Then again, you possibly can see how Sugar struggled to make +11.17% inside 19 days…

This distinction in momentum is a divergence!

Despite the fact that the patrons had been in a position to attain a +11% acquire…

…you possibly can see that they struggled to get there!

In flip, this could inform you the patrons aren’t as robust as you may suppose…

Now you is perhaps questioning:

“In that case, we are able to spot these simply on our charts anyway, proper?”

“Why can we even want an indicator?”

The reply is that charts could be manipulated.

Not by establishments or brokers, that’s not what I imply!

What I imply is that your charts can look totally different relying on…

…whether or not you might be on a pc…

… or on a cell phone…

…in case your chart is in logarithmic…

…or non-logarithmic scale…

…the looks could be extraordinarily diverse.

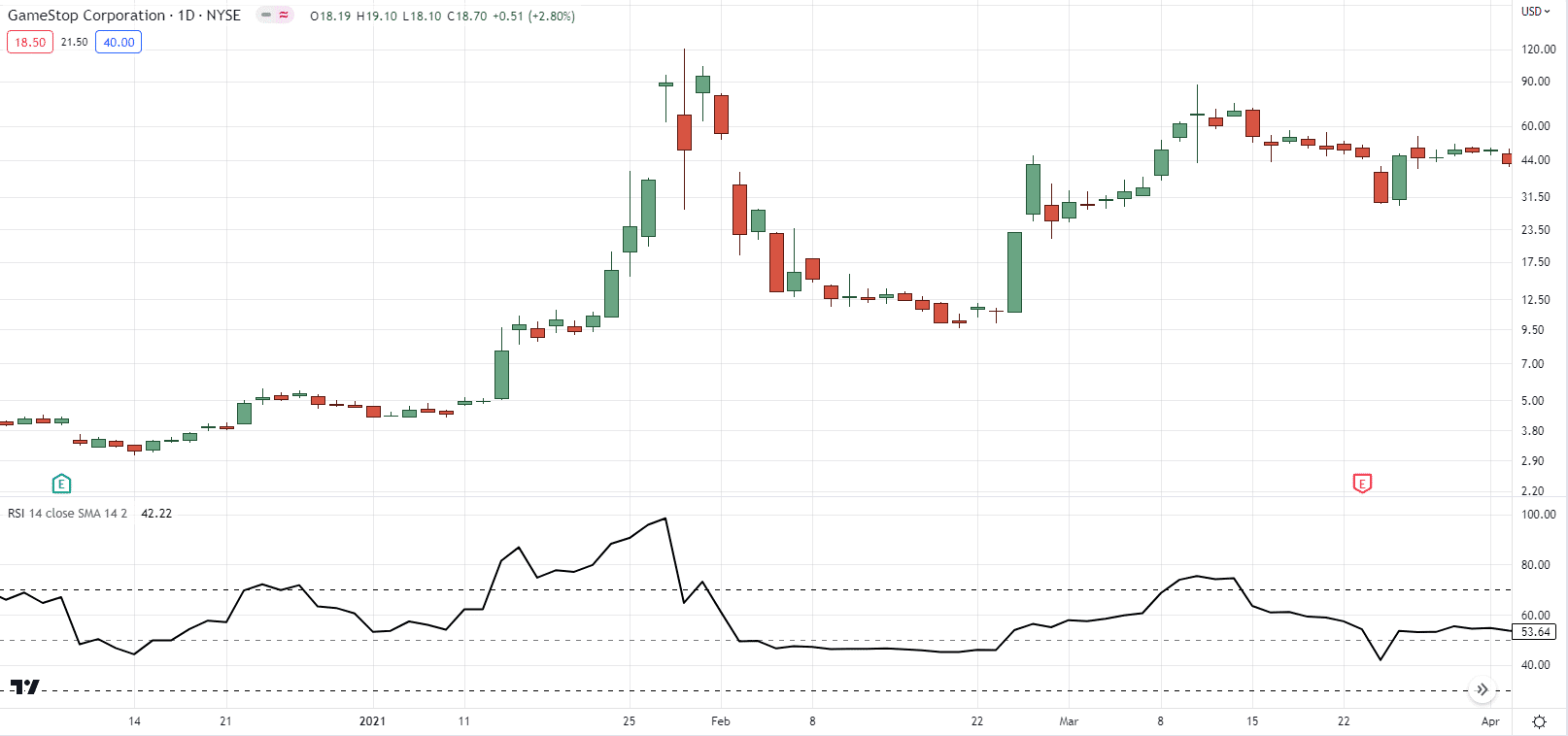

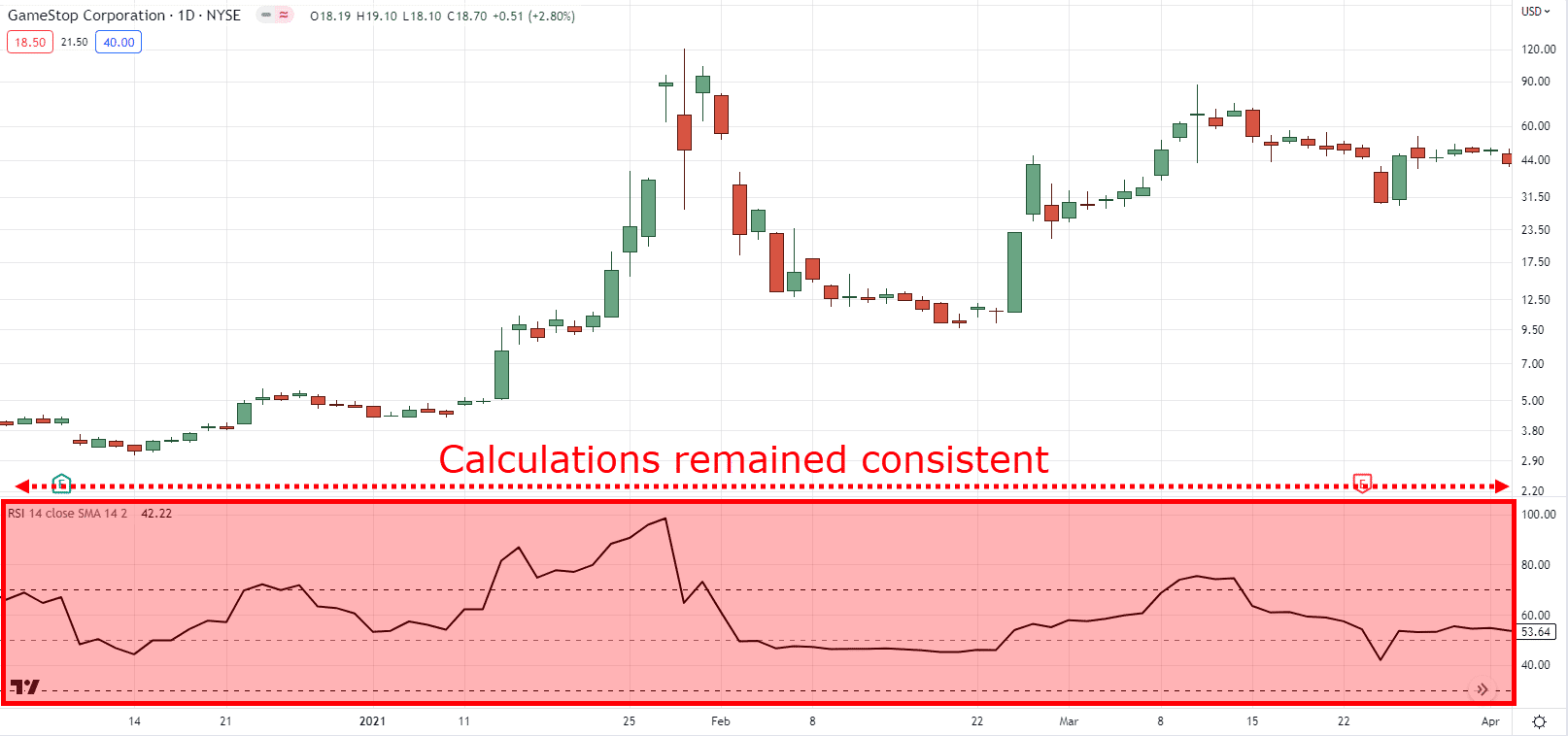

However with an indicator – issues stay the identical, regardless!…

Because of this your indicator can act as an additional set of eyes when detecting market divergence.

Which now results in the subsequent query…

How do you notice divergence buying and selling?

As a result of certainly…

What’s written in a textbook not often matches up with real-time markets, agree?

That’s why within the subsequent part I’ll share with you confirmed suggestions that can assist you spot divergences higher and extra precisely.

Learn on!

Grasp this buying and selling talent first when utilizing a divergence buying and selling technique

Right here’s the reality:

Recognizing divergence buying and selling takes observe.

And the most effective talent to start out nailing down first is:

Studying how one can spot market buildings

Right here’s what I imply…

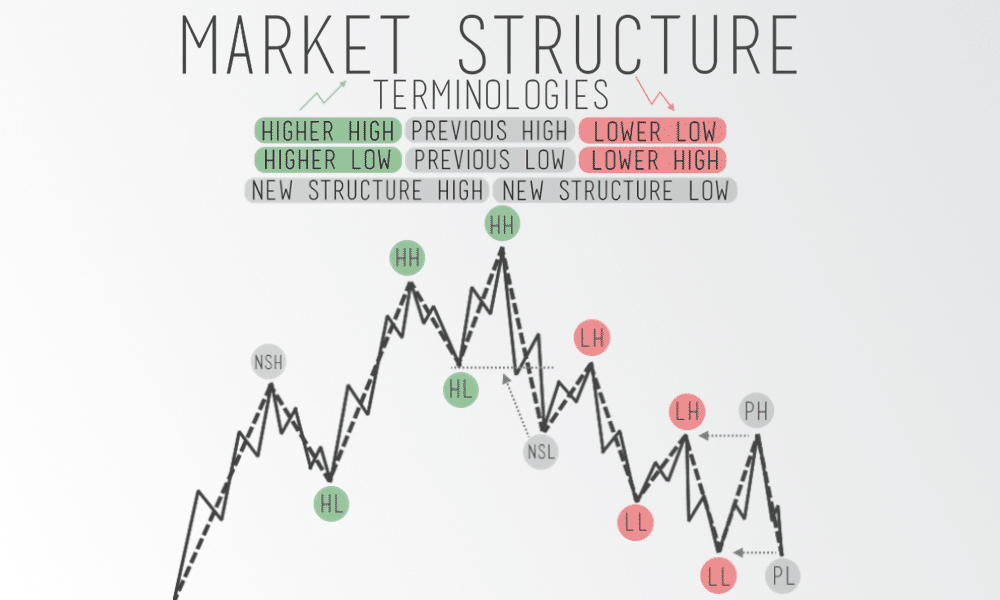

As you possibly can see, worth motion out there could make the next:

- Increased highs

- Increased lows

- Decrease lows

- Decrease highs

And studying how one can spot these is vital to mastering divergence in buying and selling!

Thankfully…

I’ve made a complete buying and selling information devoted to you, which you’ll try right here:

Easy methods to Learn Worth Motion (For Dummies)

However within the meantime…

Let’s have a fast train, we could?

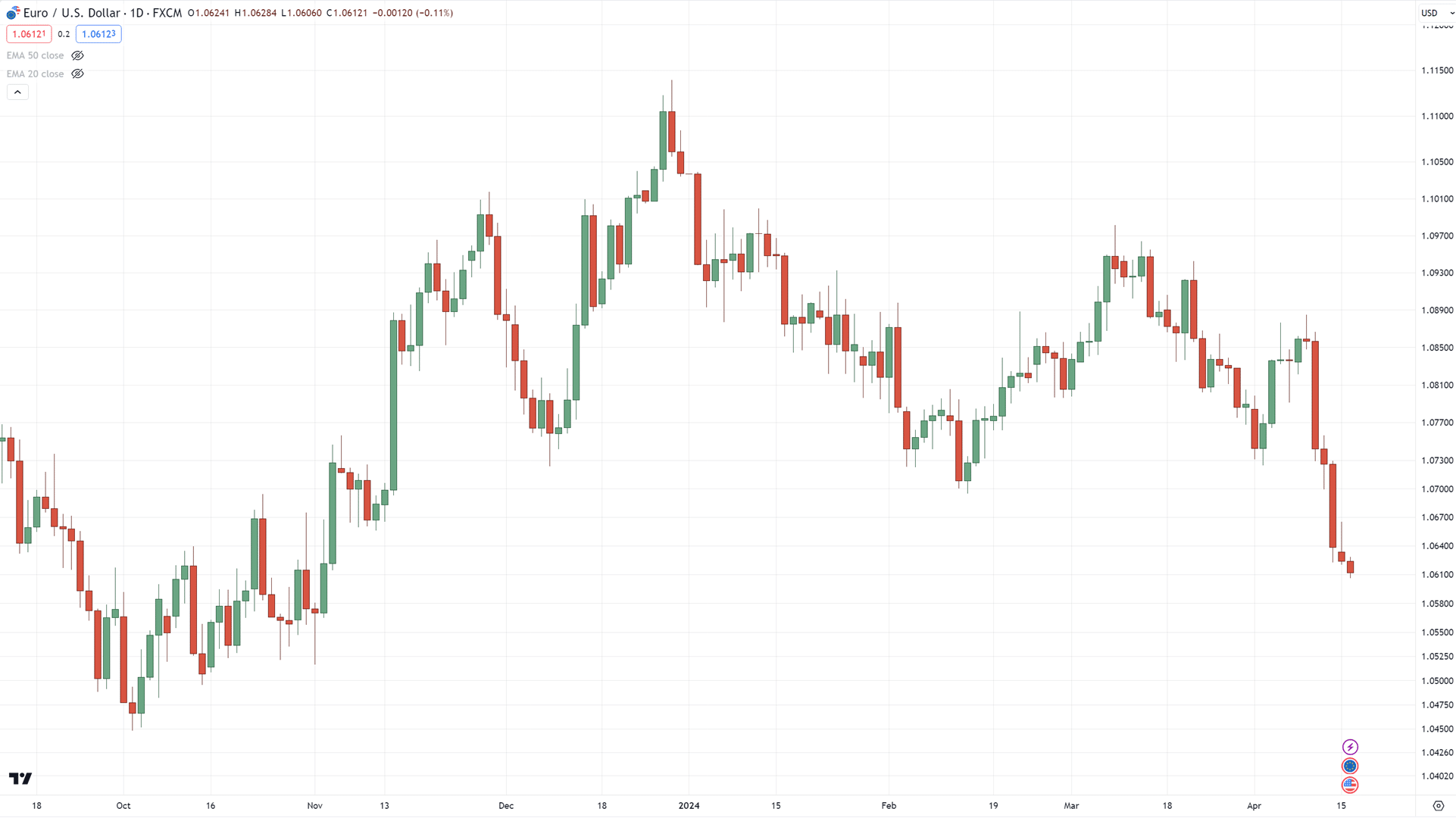

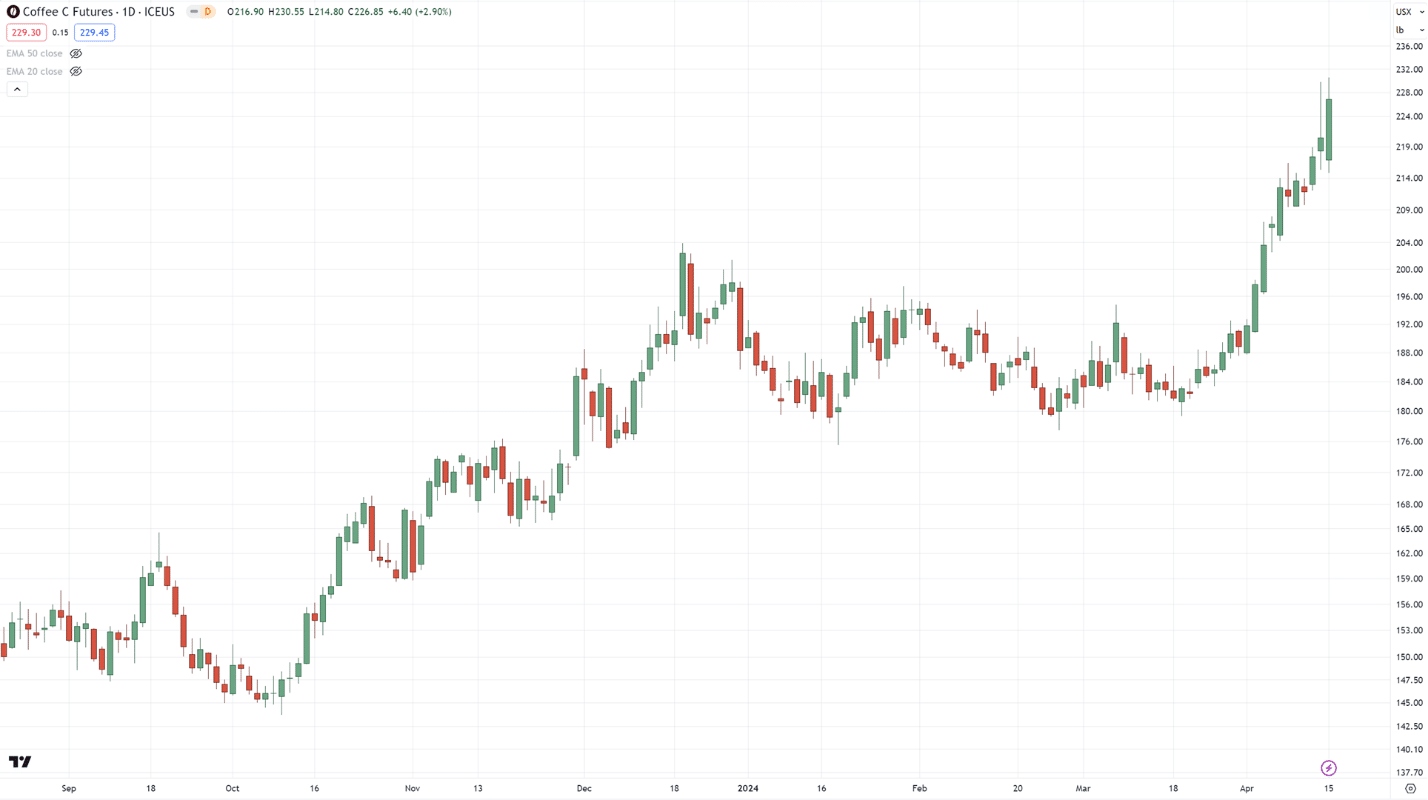

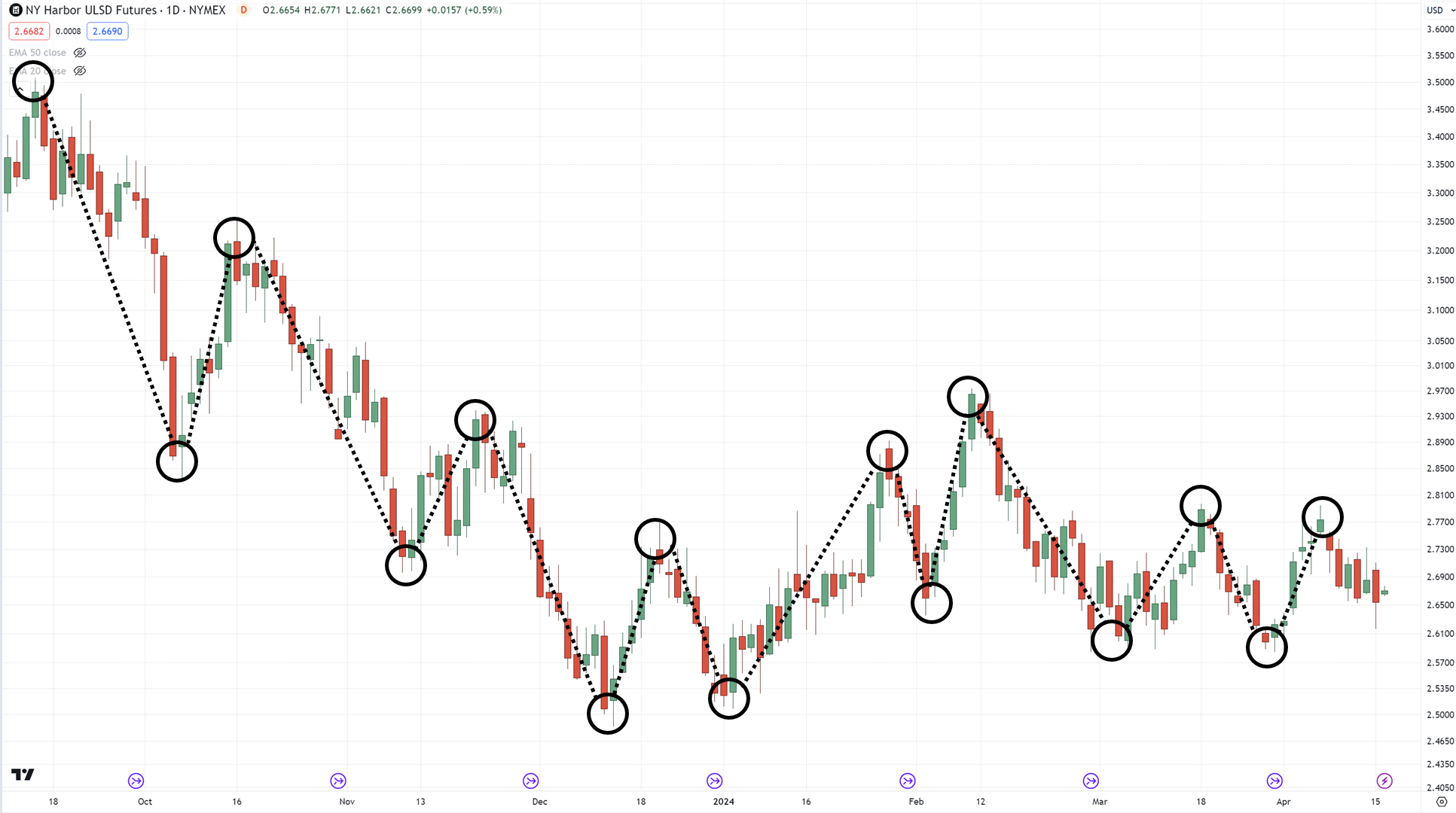

Taking a look at these charts, are you able to plot the place the swing highs and lows are?…

All accomplished?

Able to see the reply?

Nicely, right here you go…

The perfect half is that yours doesn’t need to match mine 100% on a regular basis.

…and also you don’t need to plot all of them all the way down to the smallest element!

Bought it?

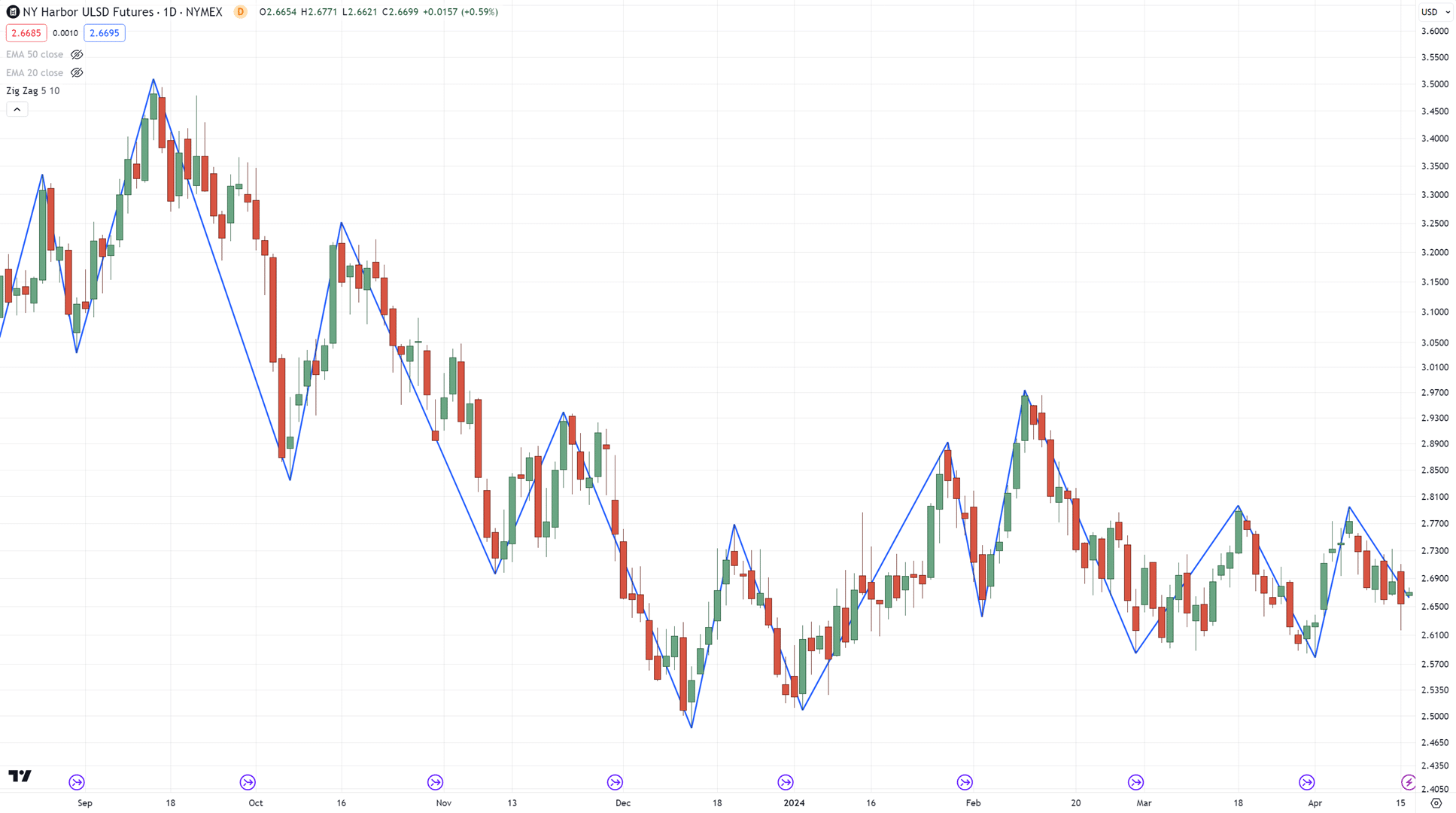

However in order for you one thing extra constant to start out with, you possibly can try the zigzag indicator…

It does all of the be just right for you routinely!

However there’s far more to this indicator than I can write about right here, so I recommend checking this information out:

The Final Information To Zig Zag Indicator

Now, talking of indicators…

Which one do you employ for divergence buying and selling?

Let’s sort out that within the subsequent part…

What’s the greatest indicator for divergence buying and selling?

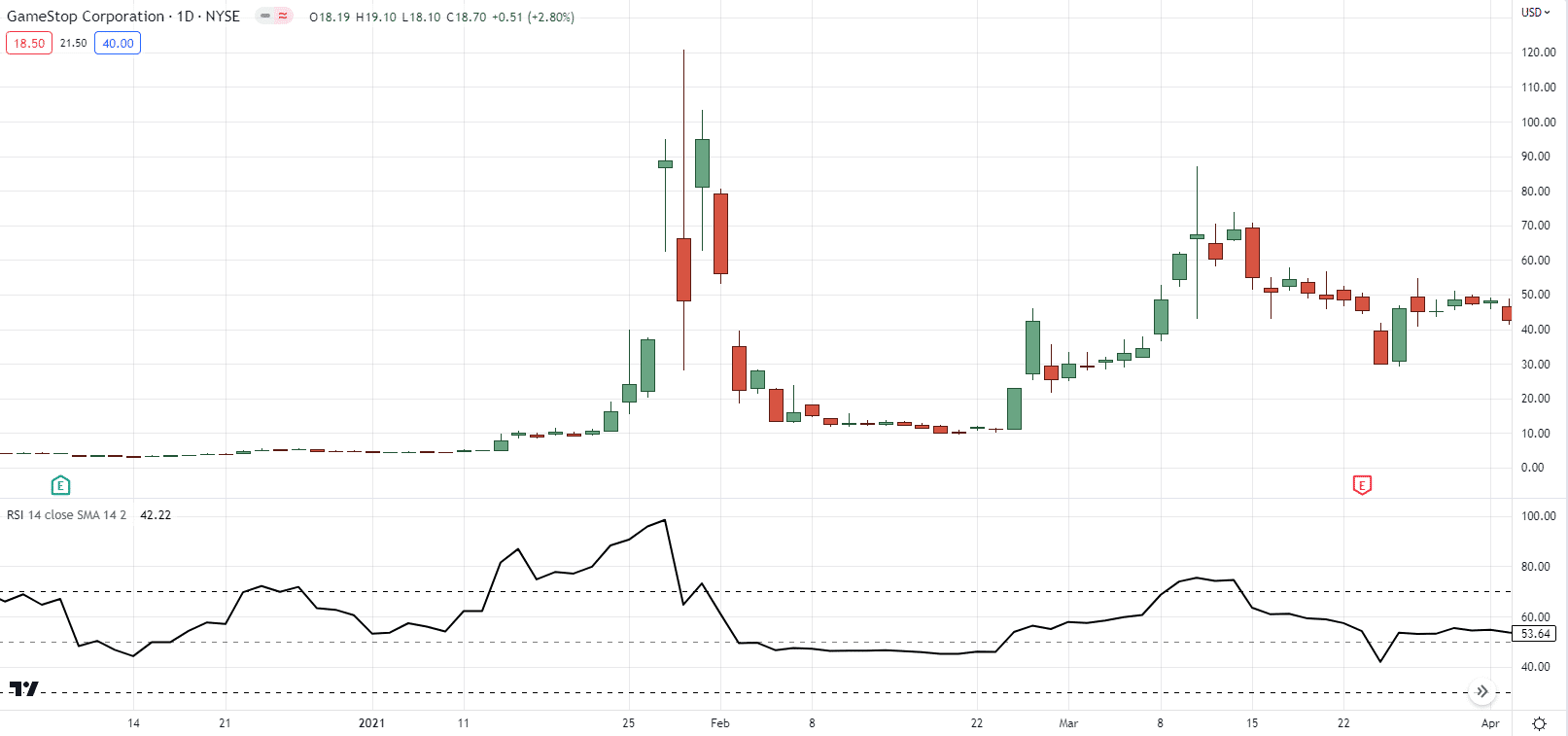

The reality is that a number of indicators can be utilized for divergence buying and selling.

There is no such thing as a “greatest” indicator on the market!

Let me offer you an instance…

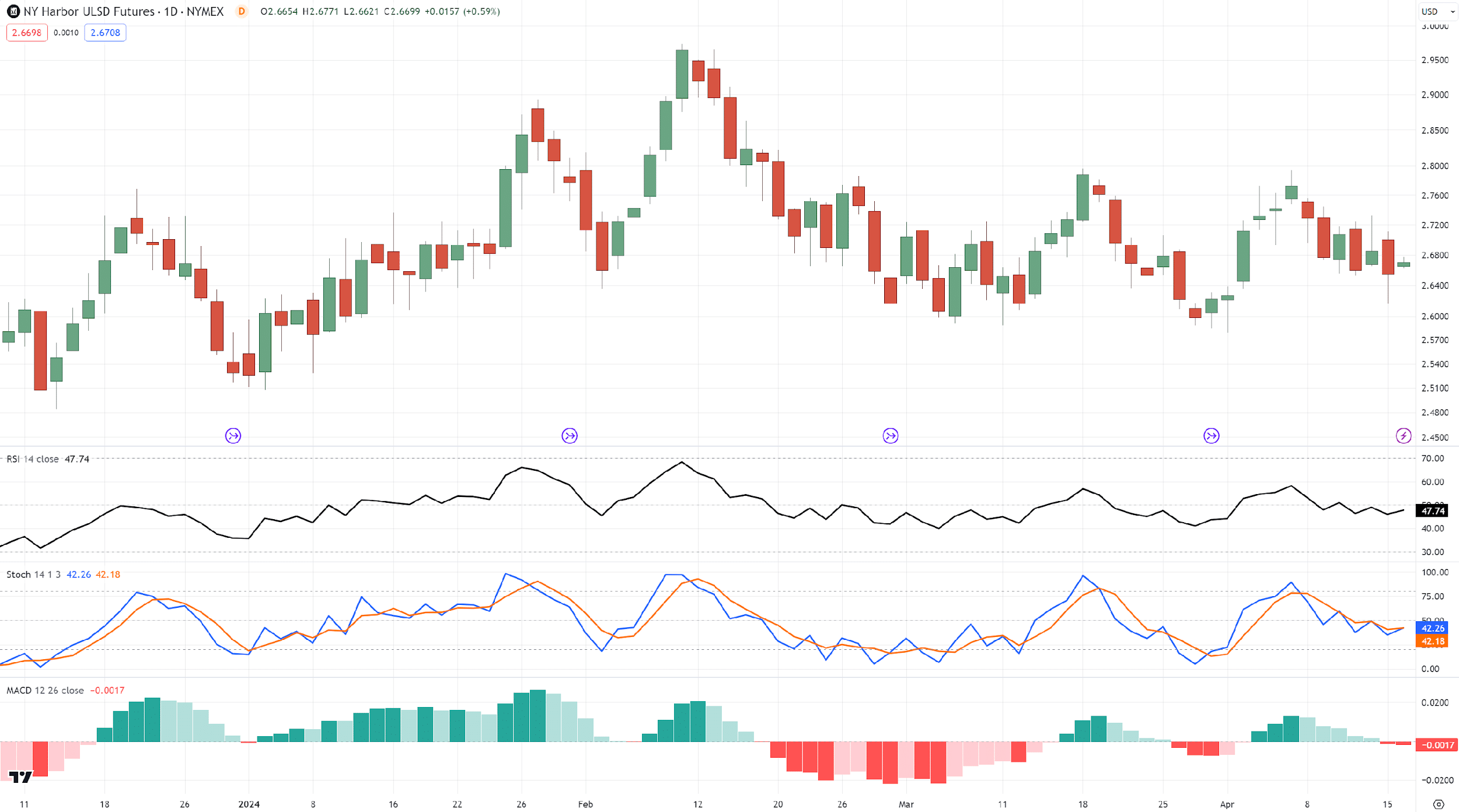

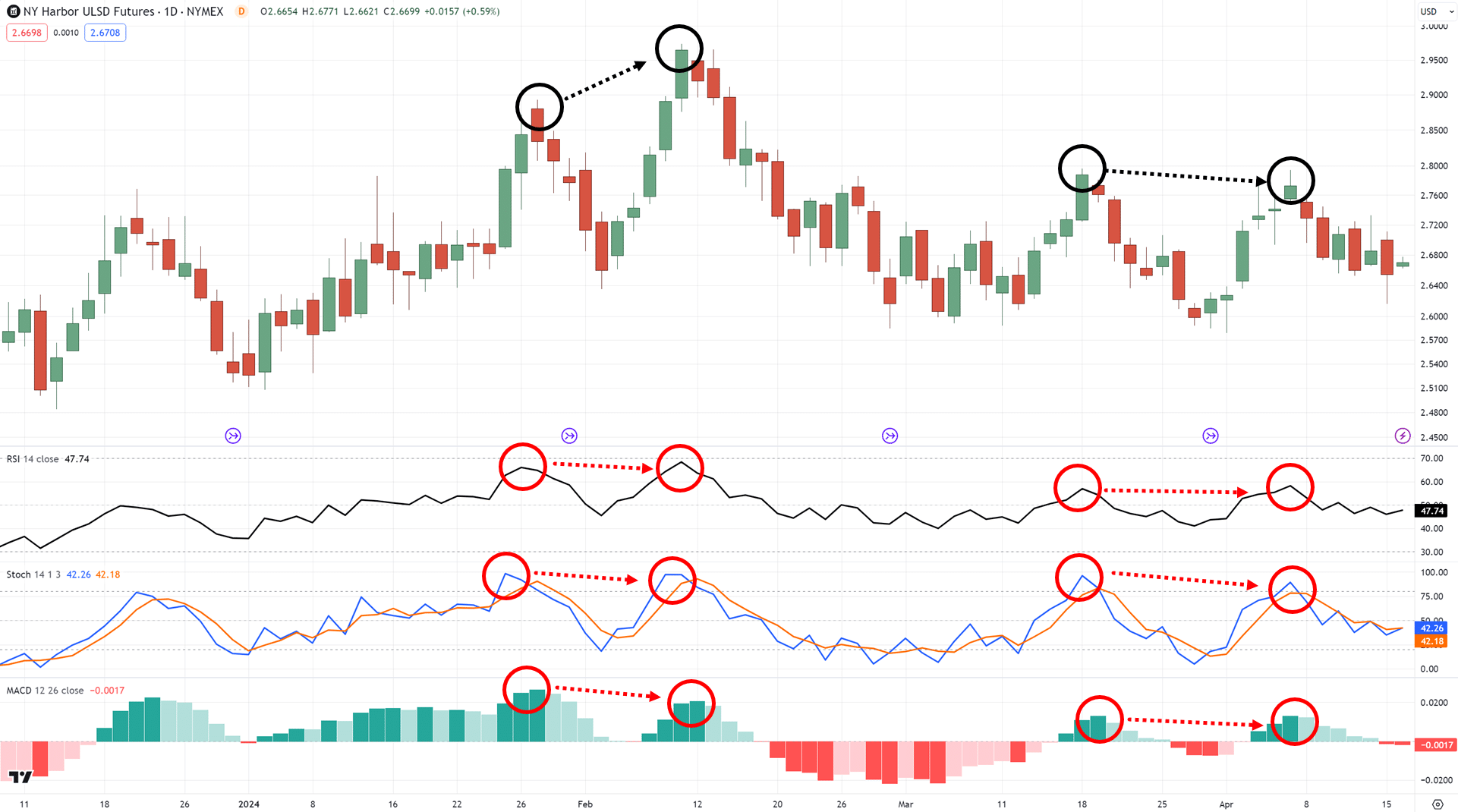

Listed below are three indicators positioned collectively…

As you possibly can see, all of them are able to detecting divergences!

And most significantly, even on the similar time…

It’s because they’re all momentum indicators, meant to measure the momentum of the markets!

In that case… how have you learnt which indicator to choose for divergence buying and selling?

The hot button is this:

Know the indicator to the deepest degree, and select one which makes probably the most sense to you.

I do know it comes as a headache to you, however that’s proper…

It’s essential to know an indicator all the way down to its core particulars, reminiscent of its system.

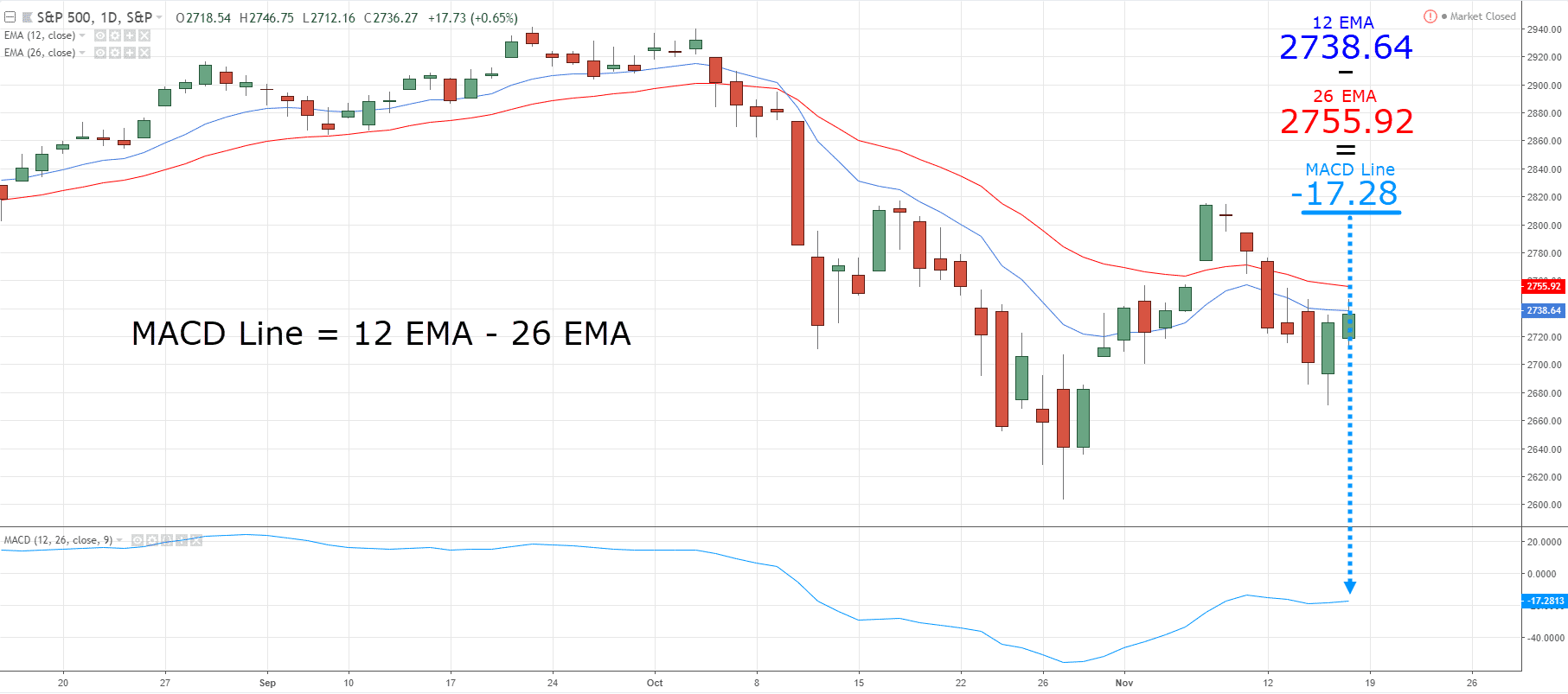

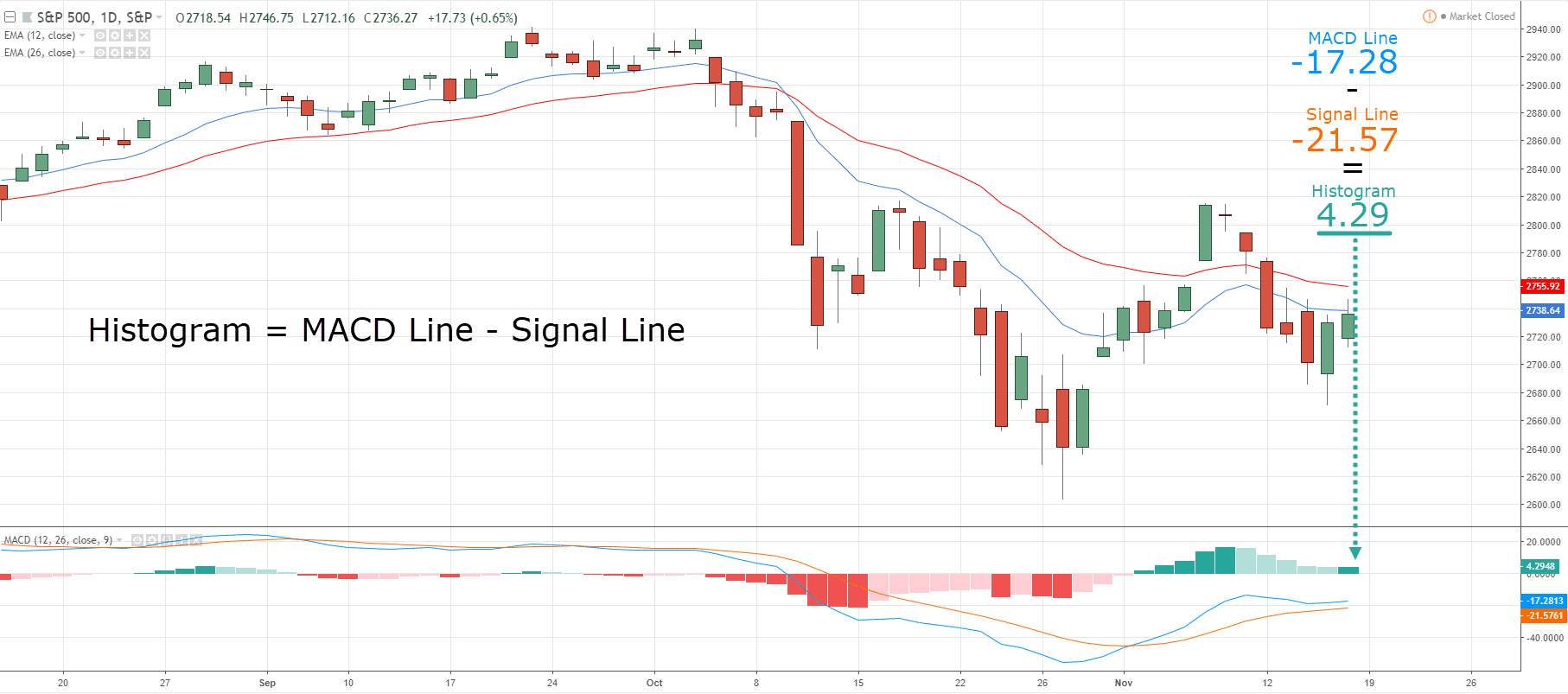

For instance, the MACD’s line is calculated by two totally different shifting averages…

One short-term indicator to measure the short-term momentum of the market…

…and one to measure the medium-term momentum of the market.

The sign line then averages the results of the MACD line, and the distinction between that sign line and the MACD line creates the histogram that you just see!…

It’s like measuring the temperature knowledge in your space for the previous month, after which gaining further temperature knowledge from the previous three months…

By trying on the temperature modifications, I’m certain you possibly can inform if issues are heading into winter or summer time!

Alright – so, how concerning the RSI indicator?

Its system is just about designed to instantly measure the momentum within the markets in a simple method:

RSI = 100 – 100 / [1 + RS]

These numbers may daunting, I do know…

However it boils all the way down to this:

Common Achieve / Common Loss

Merely put, if there are extra days when that particular market is doing effectively than when that market is doing badly…

The RSI worth will increase!

That is much like counting energy when making an attempt to drop some pounds…

Should you lose extra energy than you acquire, you drop some pounds!

Lastly, check out the stochastic indicator.

It’s measured on this method:

%Ok = (Present Shut – Lowest Low) / (Highest Excessive – Lowest Low) * 100

%D = 3-day SMA of %Ok

The place:

Lowest Low = lowest low for the look-back interval

Highest Excessive = highest excessive for the look-back interval

%Ok is multiplied by 100 to maneuver the decimal level to 2 locations

To visualise it, think about you’re at a playground watching a baby on a swing…

The kid swings greater and decrease relying on how a lot momentum they’ve.

The stochastic indicator is like measuring how excessive the kid swings relative to the best level they’ve reached!

The %Ok worth tells you ways excessive they’re proper now, whereas the %D worth is the typical top of their swings over the previous jiffy.

This helps you see if the kid’s momentum is rising or reducing, identical to the stochastic indicator helps you gauge the momentum of a inventory’s worth motion.

Make sense?

So, at this level…

I’m certain you possibly can inform me that each one these indicators have one finish purpose…

…and that’s to measure momentum within the markets in several methods, proper?

Nevertheless – all that issues is which of them take advantage of sense to you.

Importantly, it’s best to by no means blindly use an indicator simply because another person is utilizing it…

…a profitable dealer should perceive it at a deeper degree.

Now…

How does this all fall into place?

How will you do divergence buying and selling?

Enter, handle, and exit your trades?

Most guides solely inform you what divergence buying and selling is, however don’t train you how one can commerce them.

So let’s use the whole lot that you just’ve discovered to date to commerce the markets with divergences!

Divergence buying and selling technique: How do use it to enter, handle, and exit your trades

Repeat after me:

Divergence buying and selling is just one a part of a buying and selling plan.

That’s proper!

Recognizing bullish and bearish divergences is just one small a part of an even bigger buying and selling plan.

For this reason I developed a simple strategy when taking a look at your charts.

And that’s:

The M.A.E.E system

This system merely means you…

- Determine the Market construction first (downtrend, uptrend, vary?)

- Determine the Space of worth on the chart (the place’s your help and resistance?)

- Discover the place your Entry is (bullish or bearish divergence setup)

- Determine your Exit (trailing cease loss or earlier than the closest market construction)

And now…

I’ll show to you ways this works!

Determine the Market Construction

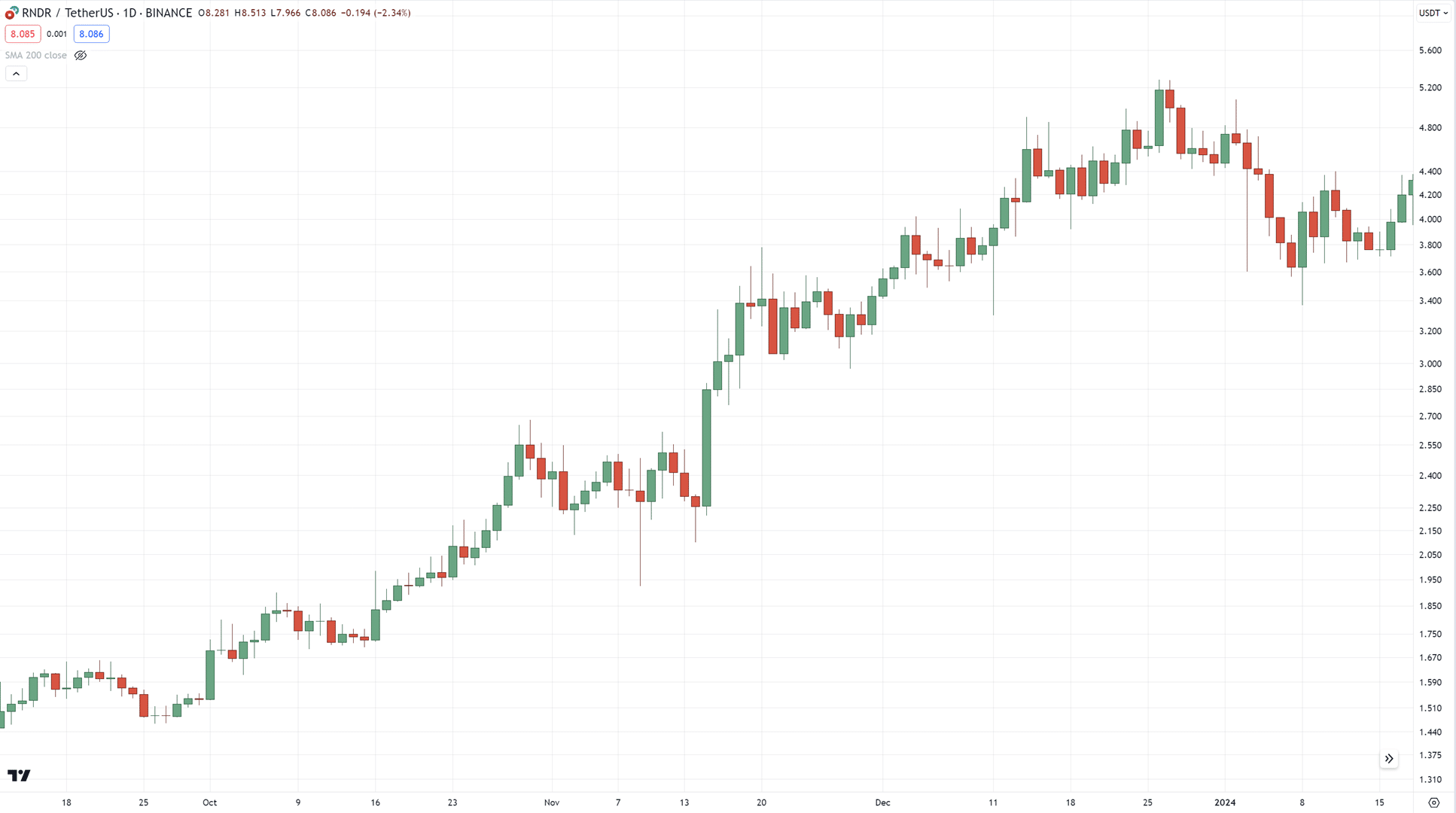

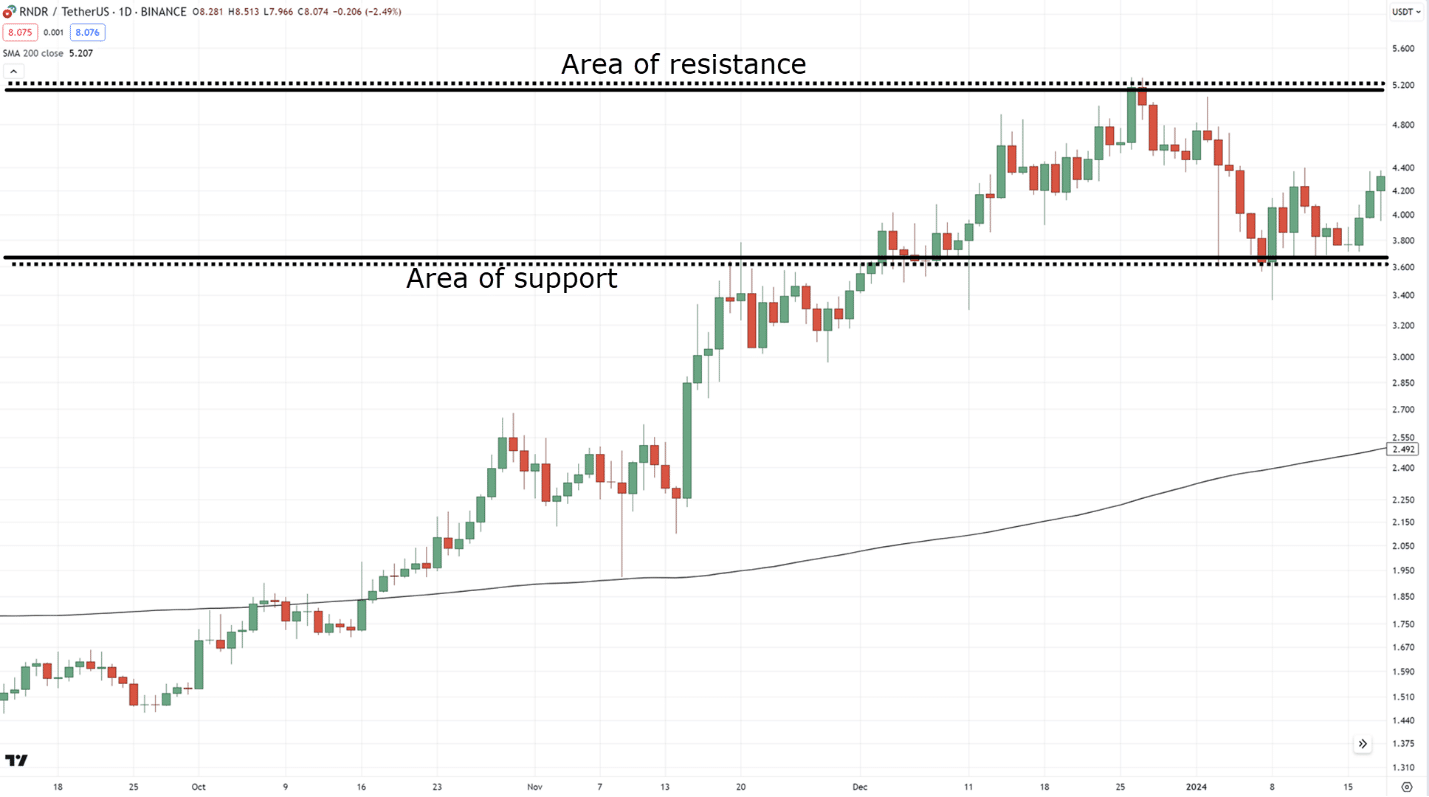

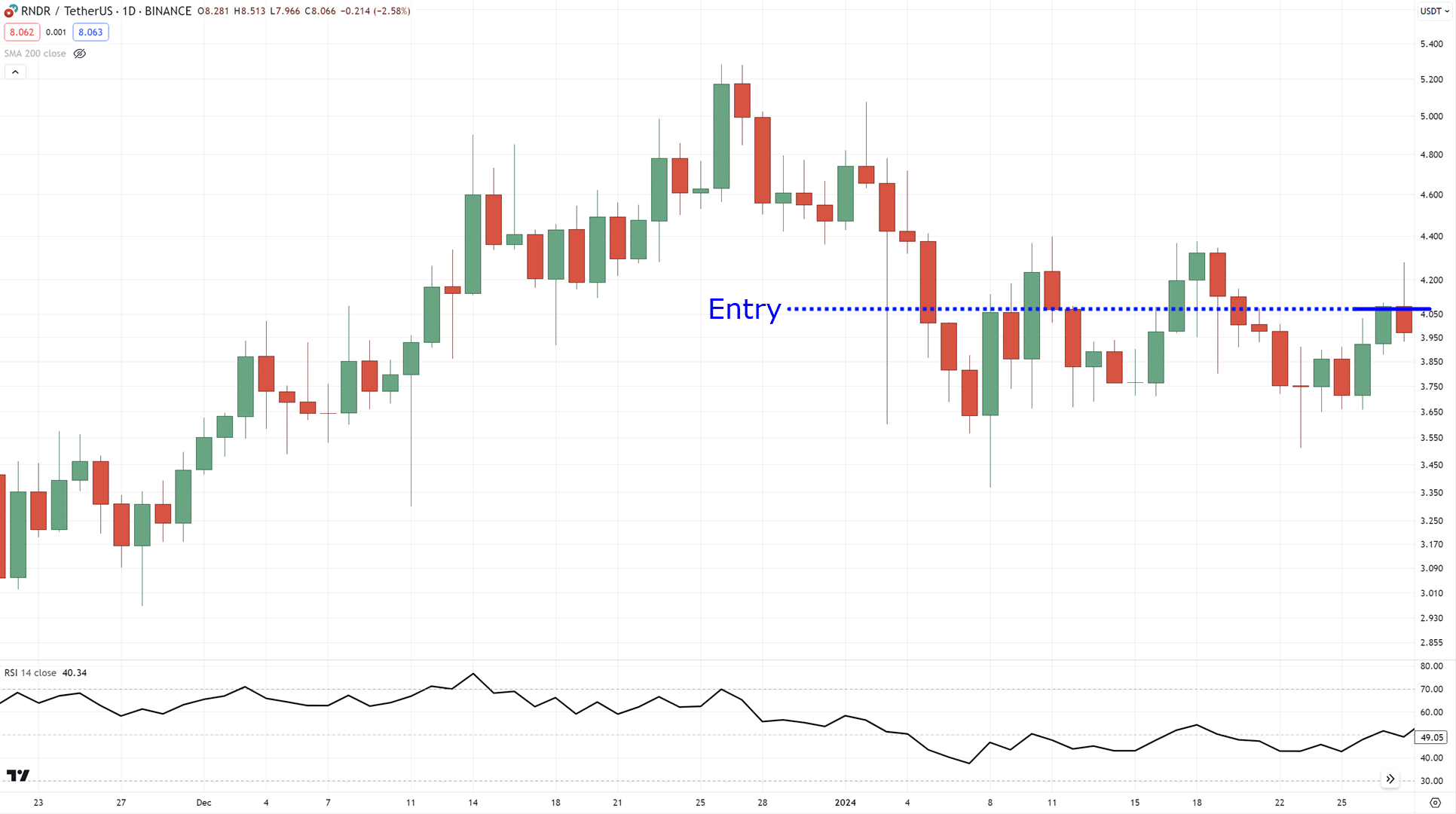

The instance that we are going to use in the present day is RNDR on the each day timeframe…

Now you wish to ask your self:

Is that this in an uptrend?

Downtrend?

Or in a spread?

Nicely, it’s in an uptrend.

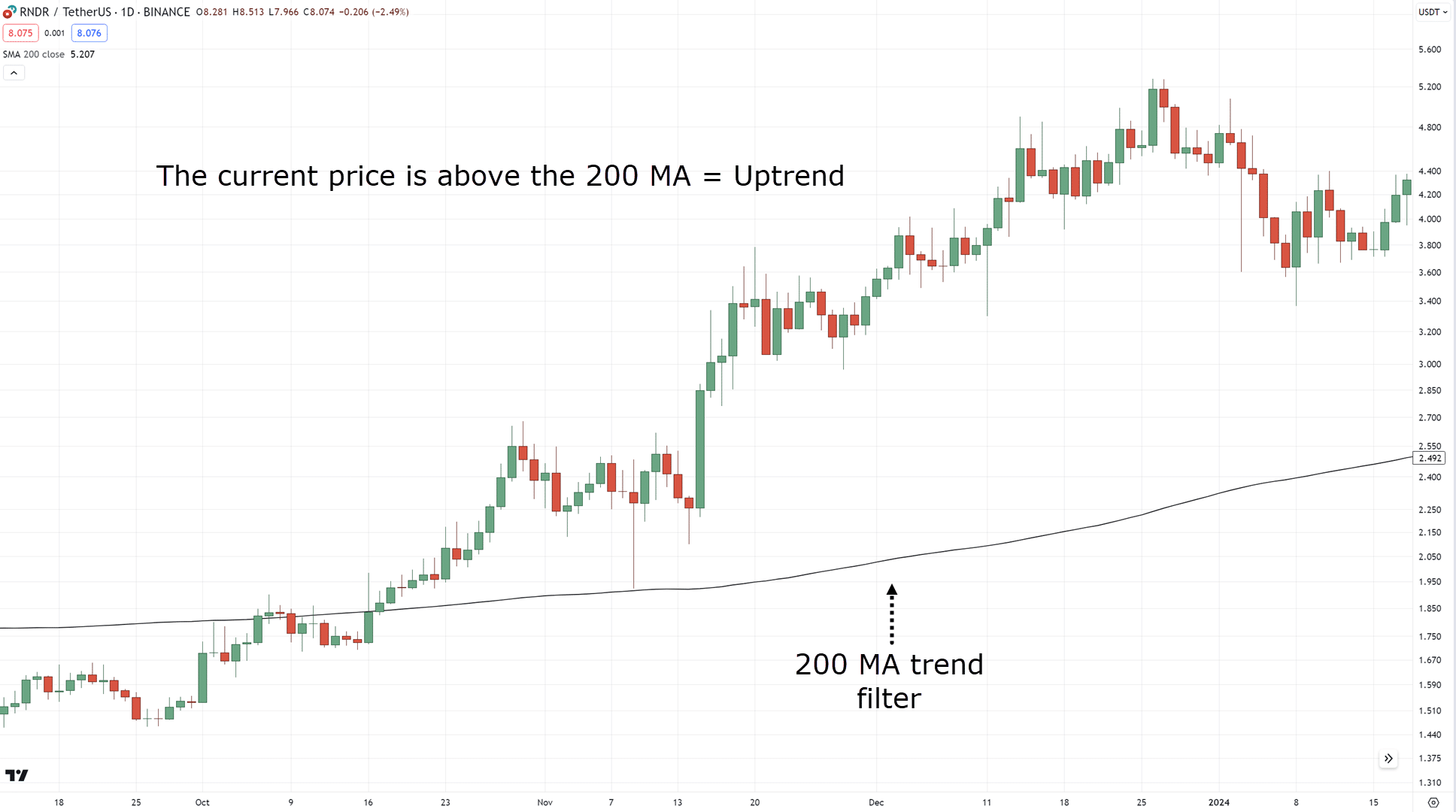

However you wish to develop a rule that constantly defines whether or not a market is in an uptrend or downtrend!

One such device that may provide help to is the 200-period shifting common…

If the value is under the 200 MA = Downtrend

If the value is above the 200 MA = Uptrend

This half is at all times a very powerful.

Why?

As a result of when you outline that the market is in an uptrend, you wish to make sure you discover the “related” setup in such market circumstances!

Because of this in an uptrend, we solely search for bullish divergence.

Make sense?

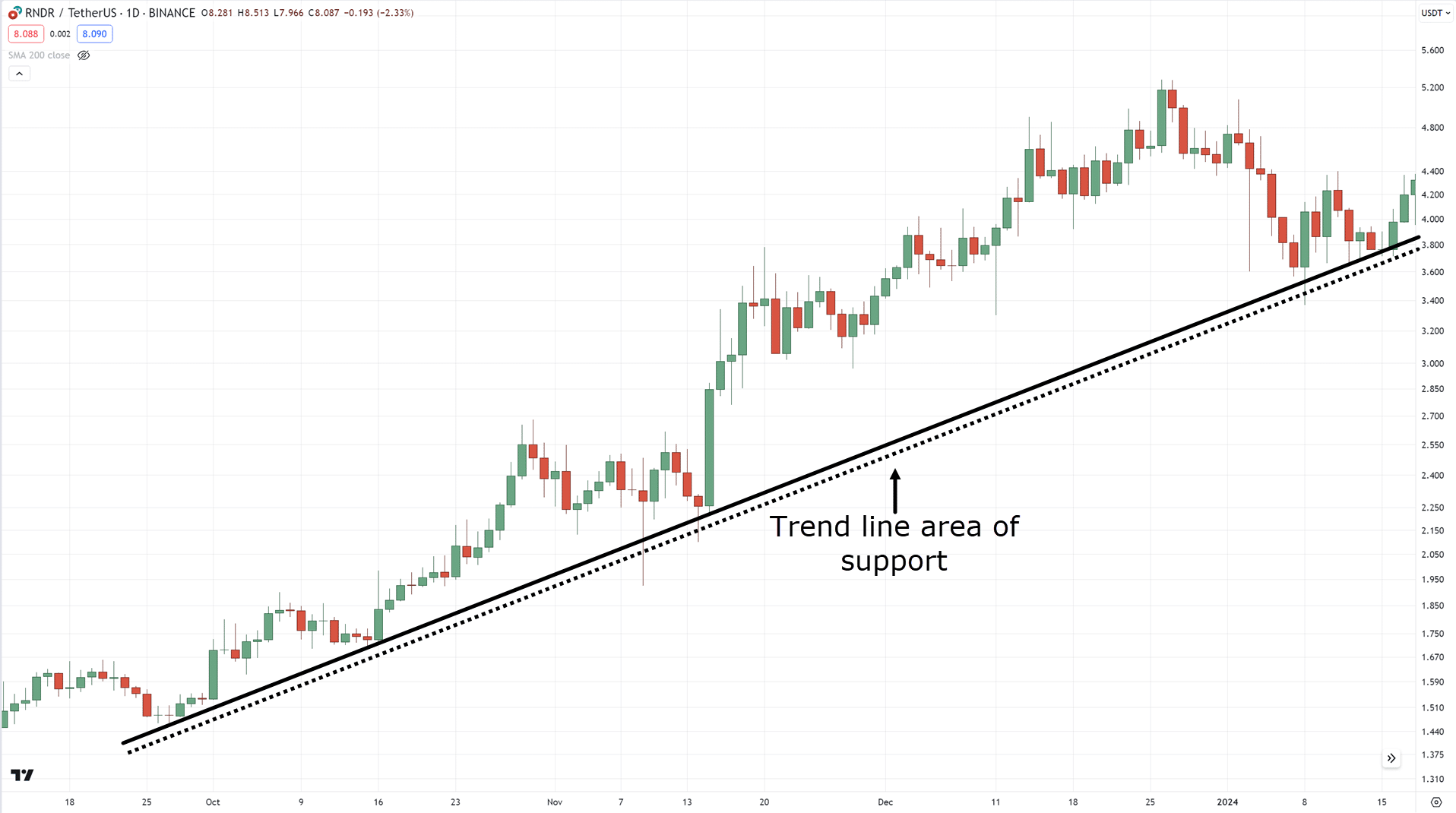

Determine the Space of worth

In terms of the realm of worth, what involves thoughts?

Nevertheless, at all times be sure that to remember the fact that pattern strains even have an edge out there and are an important device for locating areas of worth in trending markets…

So, now that we’ve outlined our uptrend and space of worth, subsequent is our entries.

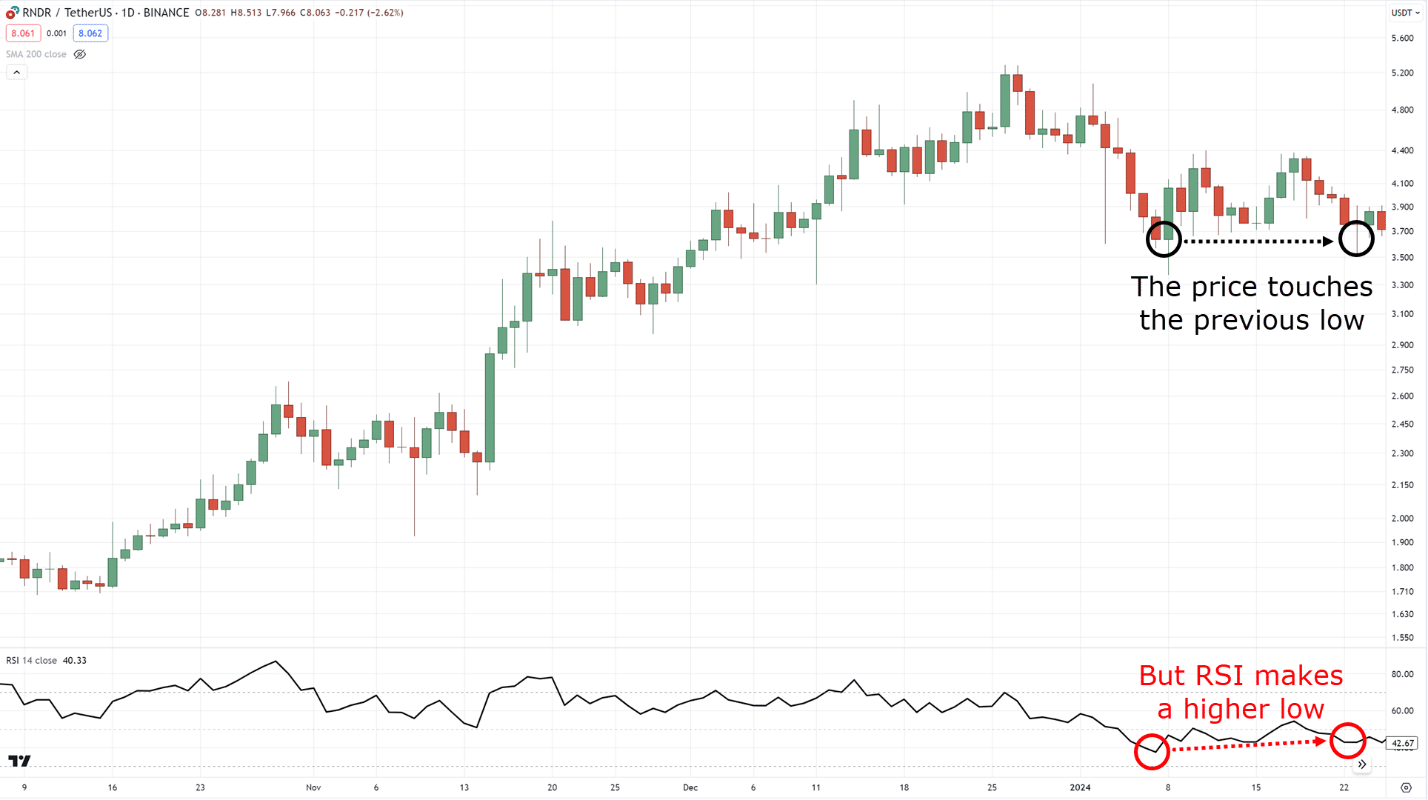

Determine your Entry

As a recap, right here’s the cheat sheet for divergence buying and selling…

You in all probability have already got it saved in your pc, however how and when precisely do you enter?

For this instance, we’ll use the 14-period RSI.

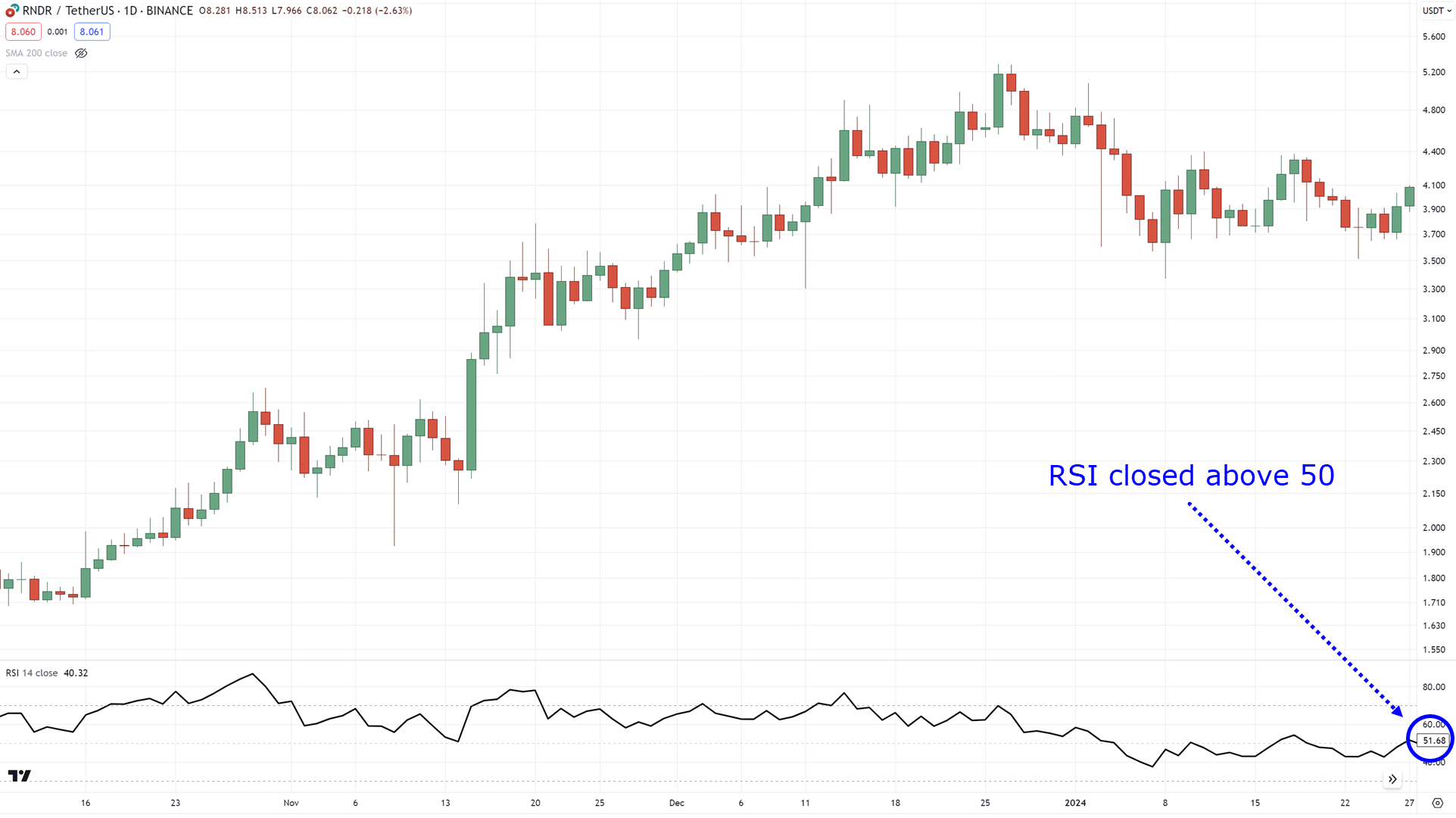

So, as soon as you notice a bullish divergence…

You then wish to anticipate the value to shut above RSI 50…

You then enter the commerce on the subsequent candle!…

By the way in which…

If the bullish divergence occurs when the value is under RSI 30, then you possibly can anticipate the value to shut above RSI 30 as an alternative.

In our instance, the divergence occurred when the RSI was above 30, so we waited for the value to shut above RSI 50.

All clear?

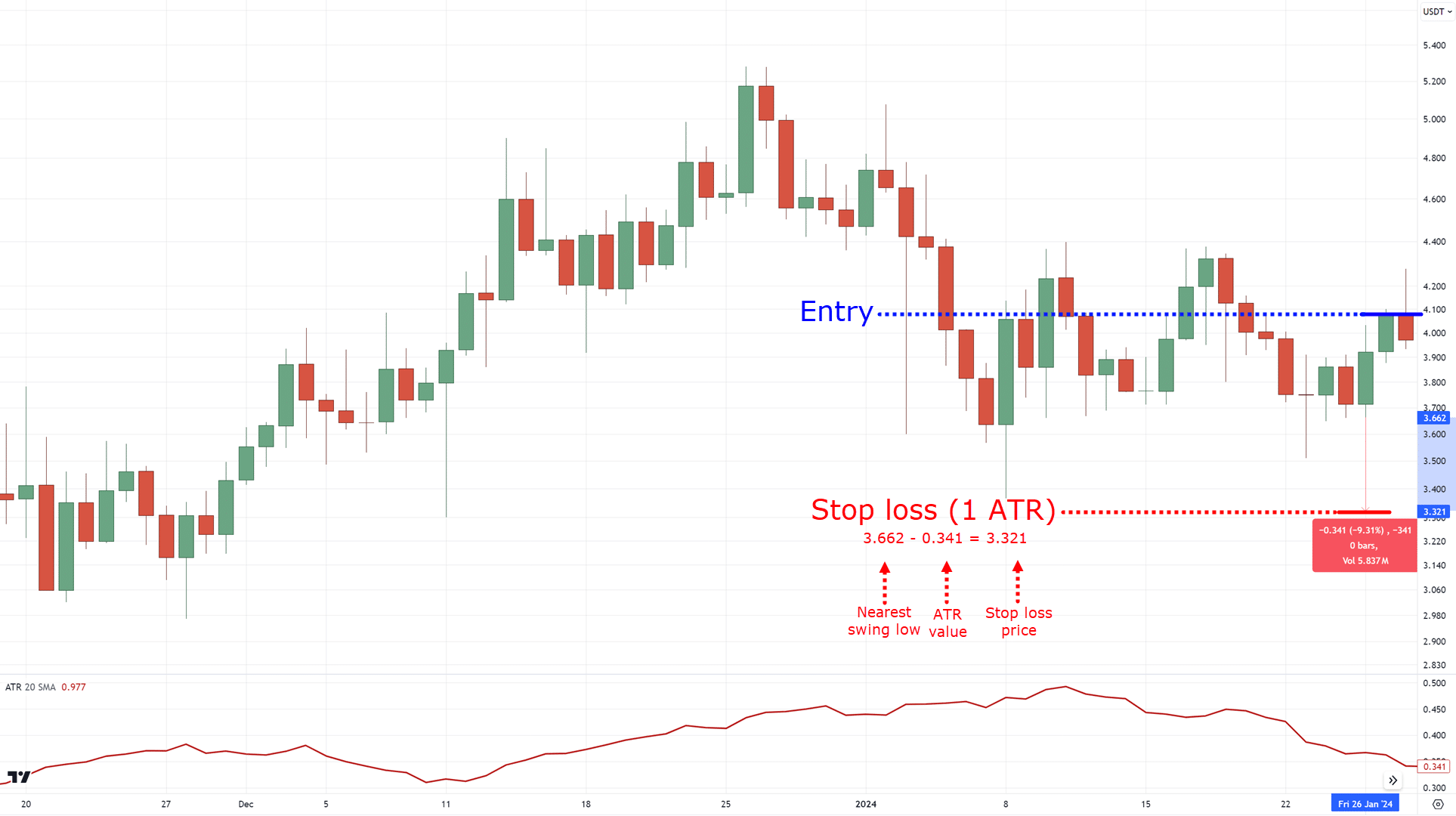

Determine your Exits

This may be labored with a few caveats to consider…

The place’s your exit in case you’re proper, and the place’s your exit in case you might be incorrect?

What about your cease loss and take earnings?

Now, if the value closes above RSI 30 and makes a legitimate bullish divergence buying and selling setup, you wish to subtract 1 ATR under the lows…

Should you’re a daily reader, then you definitely’ve in all probability heard concerning the ATR a number of occasions.

However that’s as a result of this indicator is so versatile, and provides you an goal method to set your cease loss!

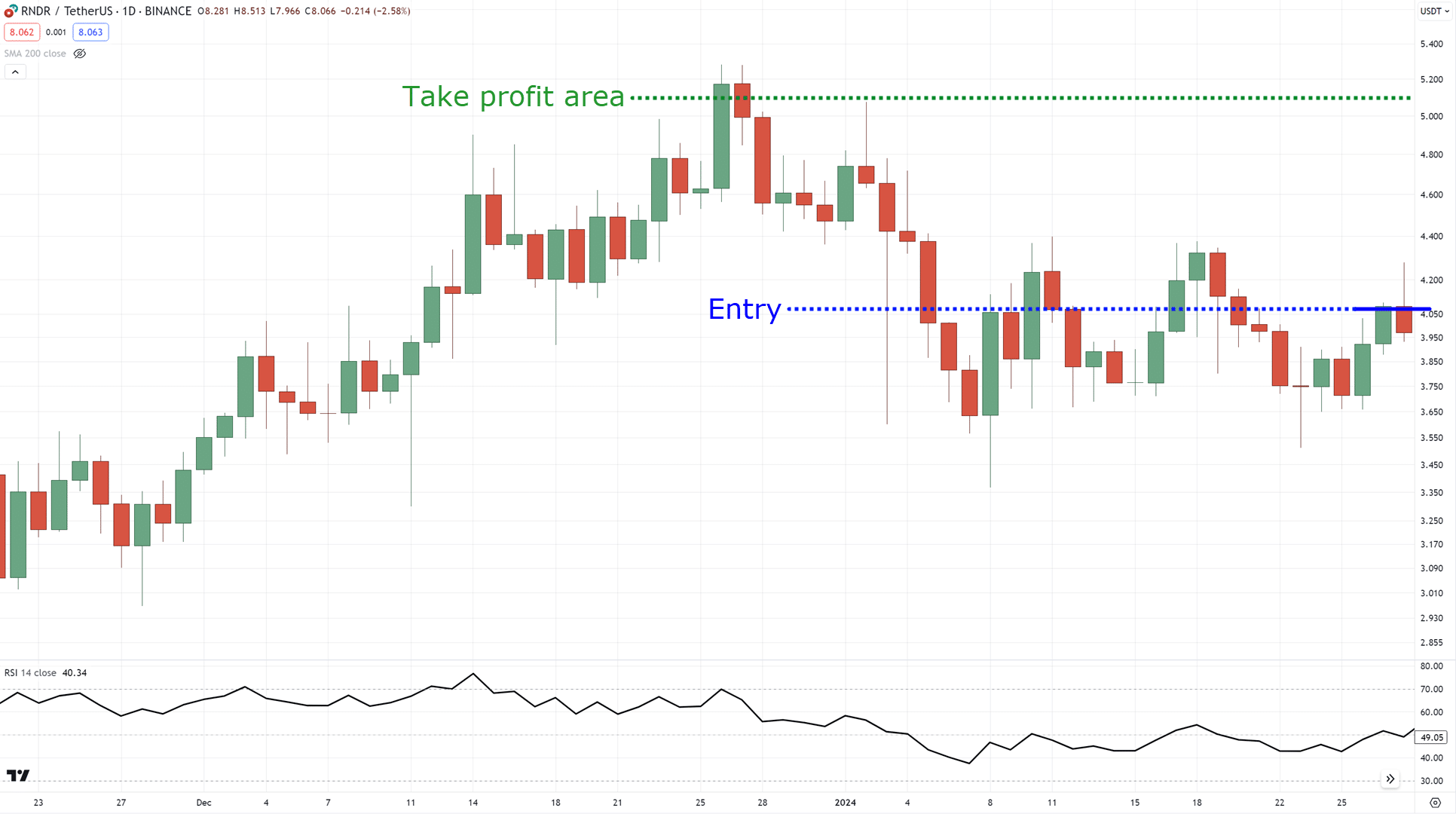

Now, how about taking earnings?

You’ll be able to think about taking revenue earlier than the closest excessive…

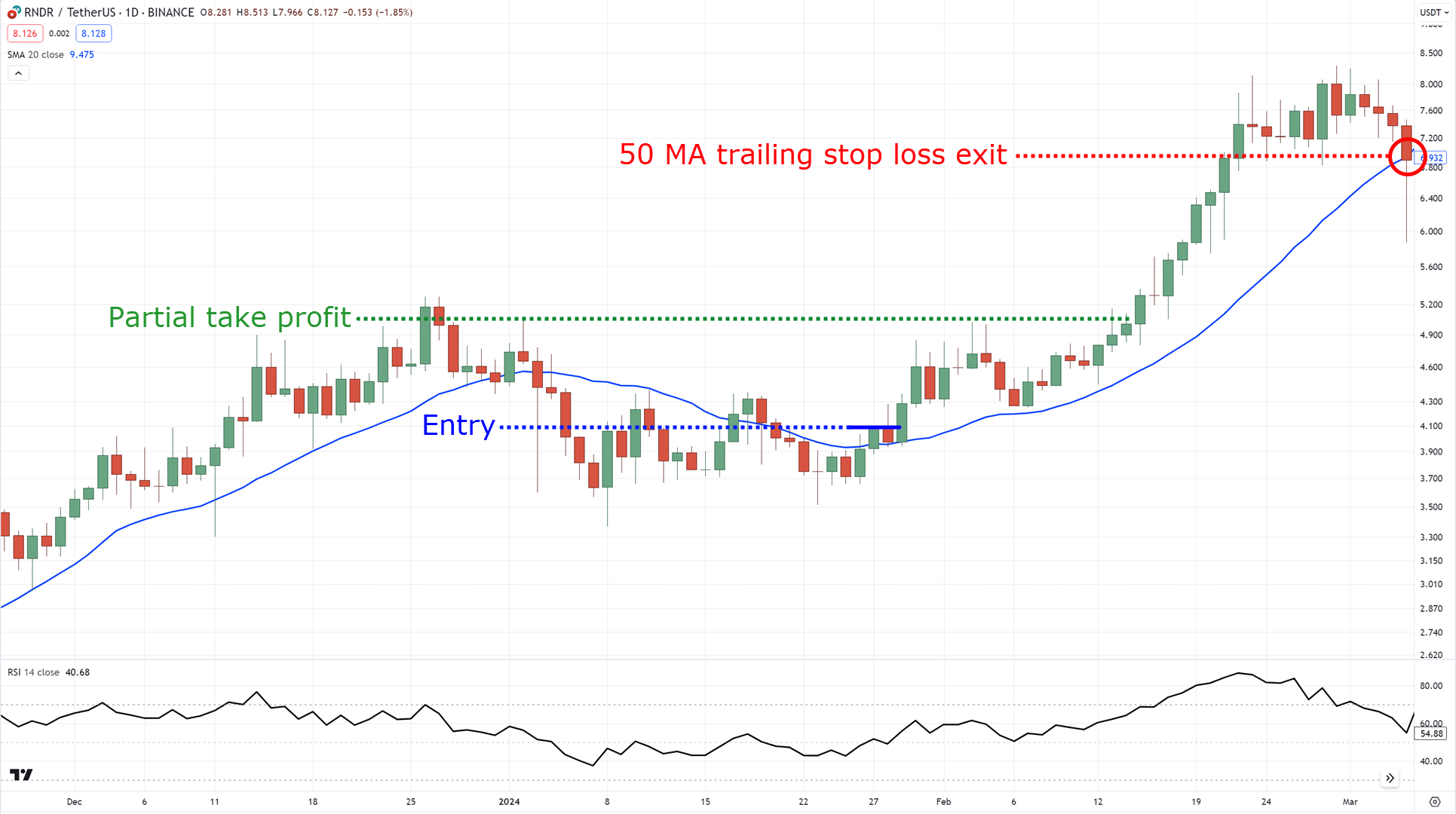

Or you possibly can think about partially taking revenue on the nearest excessive and path your cease loss utilizing a medium-term shifting common such because the 50 MA!…

After all, that is only a cherry-picked instance, however it is sensible, proper?

Now right here’s the factor…

This setup is fairly conditional.

That means, it may possibly take some time to identify a setup the place bullish or bearish divergences type at an space of worth.

To treatment this, you could have two choices:

- Commerce the decrease timeframes, reminiscent of M30 – H1

- Or commerce the greater timeframes however concentrate on a number of markets and have extra open trades

Bought it?

Lastly, earlier than I finish this information…

I wish to share with you some further notes on what to not do with divergence buying and selling.

That is essential, because it’s vital to know how one can do it the best method and how one can do it the incorrect method!

What to not do when utilizing a divergence buying and selling technique

There’s little doubt about it…

There are a number of issues that it’s essential to consider as a dealer.

Nevertheless, listed here are a very powerful issues on what to not do with divergence buying and selling…

Being inconsistent together with your timeframe

I discussed which you can select to do divergence buying and selling on the decrease timeframe or greater timeframe.

For this reason I’ve to emphasise to you proper now to decide on a timeframe that you possibly can persist with.

After getting it, observe recognizing divergences in buying and selling on that constant timeframe.

The very last thing you wish to do is attempt to spot divergences on all timeframes… it will get messy quick!

Bear in mind, if you’re inconsistent in your buying and selling, you get inconsistent outcomes.

Blindly following the divergence buying and selling cheat sheet

Right here’s the reality:

It doesn’t matter what the same old textbook (and even this information) exhibits you…

There’ll at all times be slight variations, and there could be exceptions.

So when unsure, keep out!

Lastly…

Not training sufficient to establish swing highs and lows

The effectiveness of divergence buying and selling primarily is dependent upon how effectively you possibly can spot them.

For this reason it’s essential to continuously observe plotting your swing highs and lows with or with out the zigzag indicator that I shared with you!

And once more, we now have an entire coaching information devoted to it, which you’ll try right here:

Easy methods to Learn Worth Motion (For Dummies)

Sound good?

With that mentioned, let’s have a fast recap of what you’ve discovered in the present day!

Conclusion

There’s no method round it…

Divergence buying and selling can take a while and observe to get used to.

That’s why I designed this information in a method to shortcut that studying curve, provide help to keep away from noise, and direct you to ideas that want your focus in your method to divergence buying and selling.

Nonetheless, right here’s what you’ve discovered in the present day:

- A divergence occurs when the value seems to make vital good points however the indicator detects that the momentum to achieve such good points is slowing down (and vice versa for bearish)

- Studying how one can spot swing highs and lows successfully is the important thing to figuring out and recognizing divergences

- Totally different indicators can be utilized for divergence buying and selling reminiscent of MACD, Stochastic, and RSI, however what’s essential is so that you can select an indicator that makes probably the most sense to you

- Utilizing the MAEE system creates an entire buying and selling technique for divergence buying and selling

- At all times be sure that to be open for slight variations of divergences within the cheatsheet, real-time buying and selling will at all times be totally different

There you go!

A whole masterclass to divergence buying and selling!

Now…

As you apply this methodology, at all times be at liberty to return to this information.

Nonetheless, right here’s what I’d wish to know:

When have you ever first heard of divergence buying and selling?

Do you propose on making an attempt it out after studying this information?

Should you’re already utilizing divergence buying and selling, what suggestions would you suggest?

Let me know within the feedback under!