Empirical analysis has discovered that at reasonable ranges debt can enhance development, however at excessive ranges (thresholds someplace between 75% and 100%) it could actually turn out to be damaging (if the excessive ratio isn’t addressed and turns into persistent)—the debt turns into a drag on financial development. (See the 2011 examine “The Actual Results of Debt,” the 2013 examine “Does Excessive Public Debt Constantly Stifle Financial Progress?” the 2020 examine “Debt and Progress: A Decade of Research” and the 2021 research “The Influence of Public Debt on Financial Progress” and “Public Debt and Financial Progress: Panel Knowledge Proof for Asian Nations.”)

The reasons for the unfavourable financial affect embrace: increased rates of interest (buyers, notably international buyers, could demand an elevated danger premium), increased taxes (which decrease incomes), restraints on the long run capacity to offer countercyclical fiscal coverage to battle recessions (resulting in better financial volatility), the crowding out of personal sector funding (decreasing innovation and productiveness) and rising curiosity funds consuming an growing portion of the federal funds, leaving lesser quantities of public funding for analysis and improvement, infrastructure and schooling.

The Congressional Finances Workplace (an impartial company created in 1974) estimates the U.S. debt-to-GDP ratio sitting at 98% at year-end 2023 and projected to succeed in 181% in 30 years. With these prognostications in thoughts, Roberto Cram, Howard Kung and Hanno Lustig, authors of the September 2023 examine “Can U.S. Treasury Markets Add and Subtract,” analyzed all (15,533) CBO price releases for all payments launched by Congress from 1997 to 2022. Their goal was to find out the affect of spending will increase on rates of interest. Following is a abstract of their key findings:

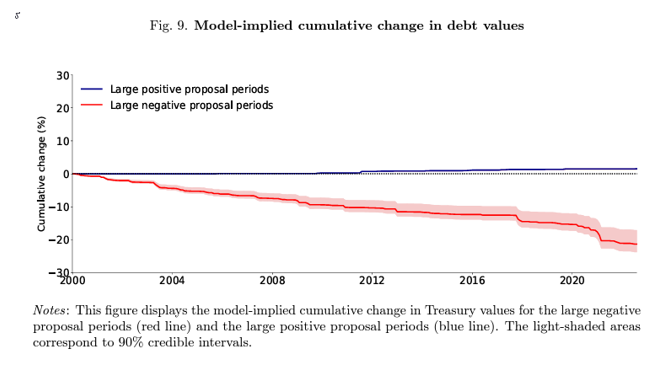

- Value releases with giant unfavourable money move projections have lowered the valuation of all excellent Treasurys by greater than 20% between 1997 and 2022. Value releases enabled buyers to be taught concerning the unfavourable drift within the surplus coverage. The massive unfavourable price releases generated vital revisions in expectations, resulting in systematic unfavourable Treasury worth responses.

In line with John Cochrane’s The Fiscal Idea of the Value Stage, market expectations of inflation additionally elevated throughout horizons in each day occasion home windows round giant unfavourable proposal days, notably at lengthy horizons.

The Treasury valuation results of antagonistic fiscal information had been concentrated at longer maturities, with an general improve of 4% in long-term nominal yields. The rise was pushed by a rise in time period premia and inflation expectations and a drop in comfort yield (the worth buyers assign to the liquidity and security attributes) of Treasury securities.

The authors famous: “Over their pattern interval, Fed coverage imputed a secular downward drift to long-term bond yields. Over the identical pattern interval, the cumulative change of the 10-year nominal yield on FOMC assembly days is -3.18%. The FOMC bulletins successfully offset the whole impact of the fee releases.”

Their findings led the authors to conclude: “In each day occasion home windows, we discover that price releases of huge proposals anticipated to extend future deficits considerably decrease the Treasury valuations.”

Utilizing their estimated mannequin, they inferred {that a} 1 share level shock improve within the provide of Treasurys, expressed as a fraction of GDP, corresponds to a rise of the 10-year nominal yield of 31 foundation factors and a drop within the comfort yield of seven.5 foundation factors. With the CBO estimating that there can be an 83 share level improve (from 98% to 181%) within the debt-to-GDP ratio, there could be a dramatic improve in the price of authorities debt with an equally dramatic unfavourable affect on financial development.

Investor Takeaway

The CBO’s price projections about future deficits comprise beneficial budgetary information, permitting bond buyers to be taught concerning the trajectory of the debt-to-GDP ratio. The takeaway for buyers is that their monetary plans ought to contemplate a attainable unfavourable affect on financial development attributable to rising debt and that it might result in decrease fairness returns. Decrease potential financial development together with the danger of elevated inflation, when mixed with traditionally excessive valuations of U.S. shares as represented by the S&P 500, ought to no less than elevate considerations. Prudent buyers plan for these dangers. For instance, they alter forecasts of future returns to replicate present valuations and yields (versus counting on historic returns). They might additionally contemplate growing allocations to fixed-income belongings which are much less vulnerable to inflation shocks (similar to TIPS and floating price debt) and rising low cost charges on Treasurys. They might additionally contemplate growing publicity to danger belongings which are much less correlated with financial development and inflation dangers—similar to reinsurance (utilizing interval funds similar to SRRIX and XILSX) and long-short issue methods (similar to AQR’s QSPRX and QRPRX).

Larry Swedroe is head of monetary and financial analysis for Buckingham Wealth Companions, collectively Buckingham Strategic Wealth, LLC and Buckingham Strategic Companions, LLC.

For informational and academic functions and shouldn’t be construed as particular funding, accounting, authorized, or tax recommendation. Sure data relies on third get together information and will turn out to be outdated or in any other case outdated with out discover. Third-party data is deemed dependable, however its accuracy and completeness can’t be assured. The opinions expressed listed below are their very own and will not precisely replicate these of Buckingham Strategic Wealth, LLC or Buckingham Strategic Companions, LLC, collectively Buckingham Wealth Companions. Neither the Securities and Change Fee (SEC) nor another federal or state company have permitted, decided the accuracy, or confirmed the adequacy of this text. LSR-23-617