Listed below are some details and figures in regards to the S&P 500:

- In response to International Monetary Knowledge, the S&P solely contained 90 shares when it was created in 1928.

- It grew to become the S&P 500 in 1957. On the time, the index was comprised of 425 industrial shares, 60 utilities and 15 railroads.

- Financials and transportation shares weren’t added till 1976.

- Within the late-Nineteen Eighties, the index was lastly revamped to account for the extra fashionable U.S. economic system.

- Immediately, the market cap of the S&P 500 is quickly approaching $50 trillion.

- The highest 10 shares alone are price practically $17 trillion or greater than 35% of the overall.

- The highest 25 shares account for 48% of the market cap.

- Six shares are price greater than $1 trillion: Microsoft, Apple, Nvidia, Google, Amazon, and Fb (these six corporations are 29% of the index).

- The tech sector makes up roughly one-third of the index however is probably going greater than that when you think about the businesses included within the Communication Companies (Google, Fb and Netflix) and Shopper Discretionary (Amazon) sectors.

- The S&P now makes up practically 40% of world fairness market share (it was extra like 20% heading into the 2008 monetary disaster).

The S&P 500 is an enormous a part of the U.S. economic system however there are many variations between the inventory market and the economic system.

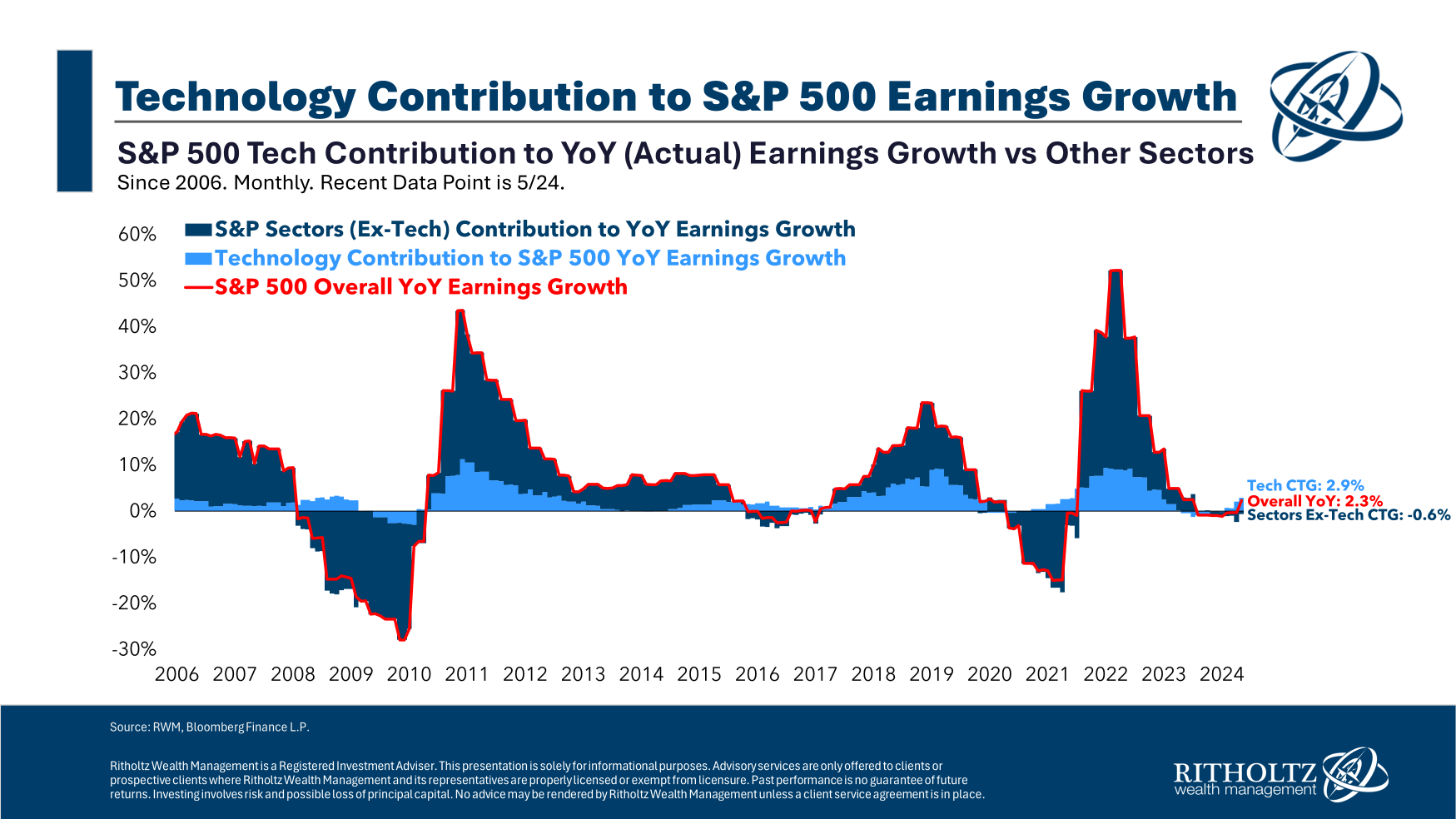

As an example, the know-how sector has an outsized impression on S&P 500 earnings progress over time:

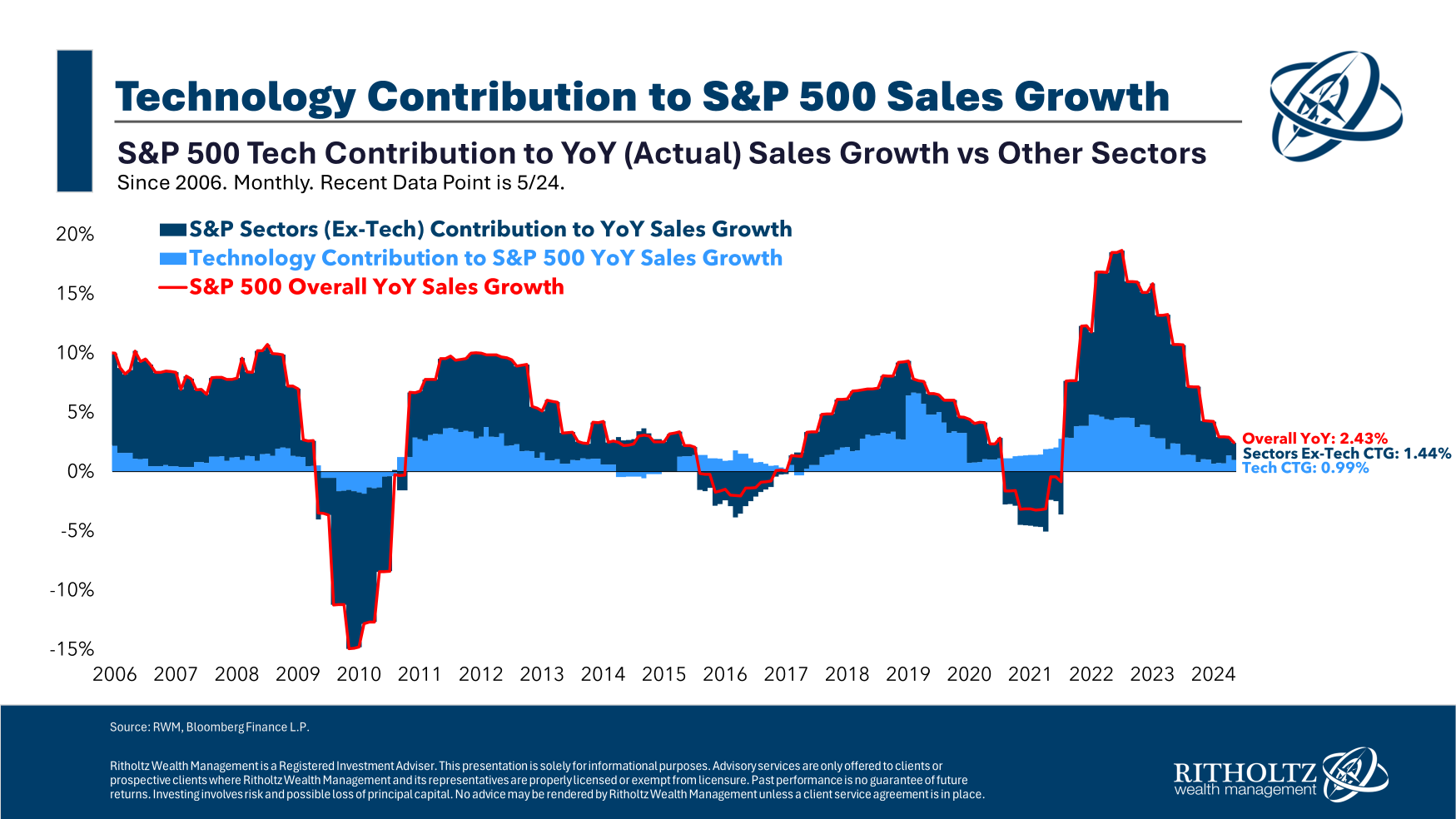

Relying on the timeframe, the tech sector could make up the vast majority of each earnings good points and losses. The identical is true of gross sales:

The BEA estimates tech’s contribution to GDP to be 10%.1 That’s nonetheless near $3 trillion however the economic system is much extra diversified and unfold out than the inventory market.

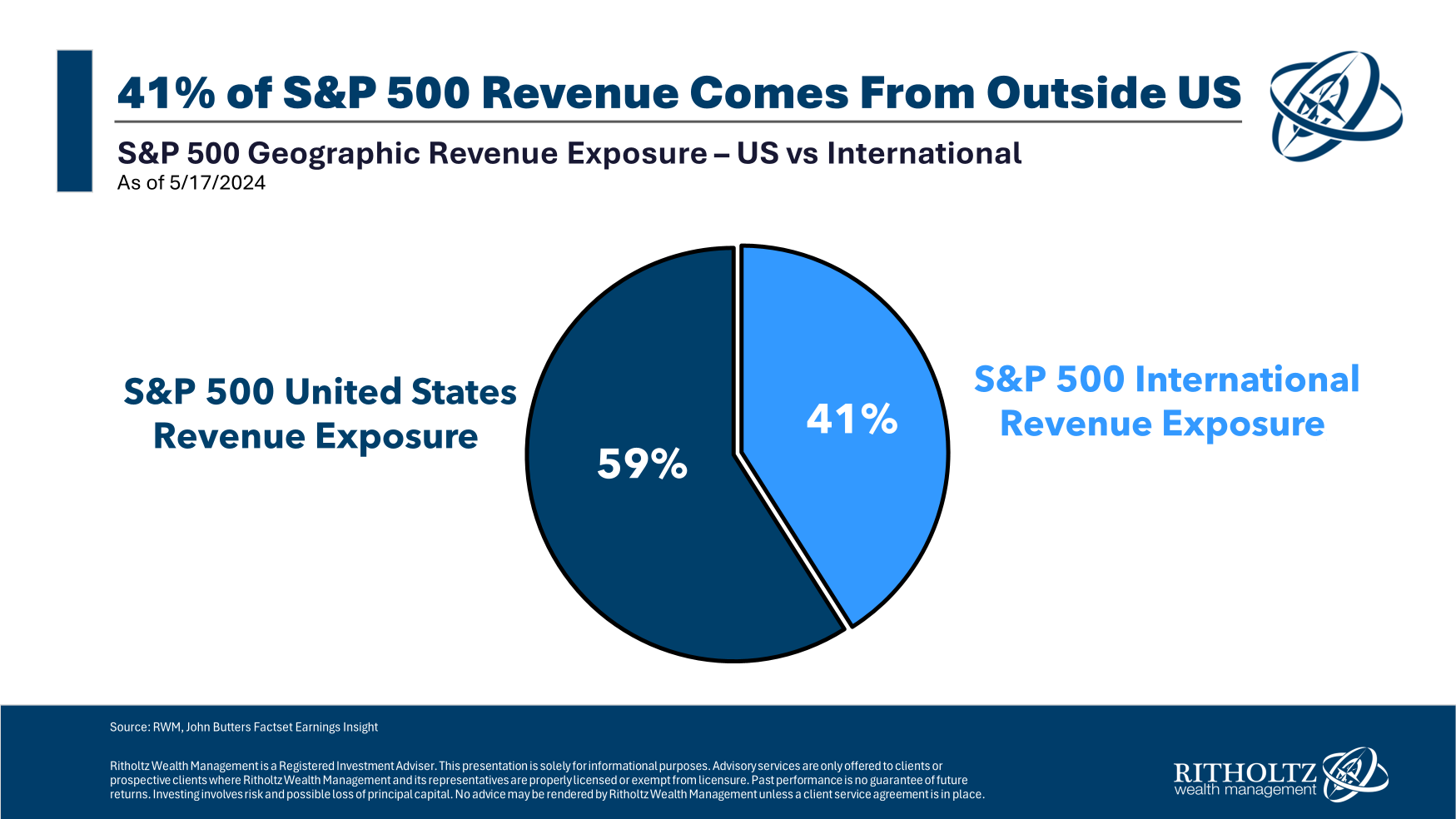

A good chunk of gross sales for S&P 500 corporations additionally comes from outdoors our borders:

The S&P 500 is a U.S. index however it’s comprised of world firms.

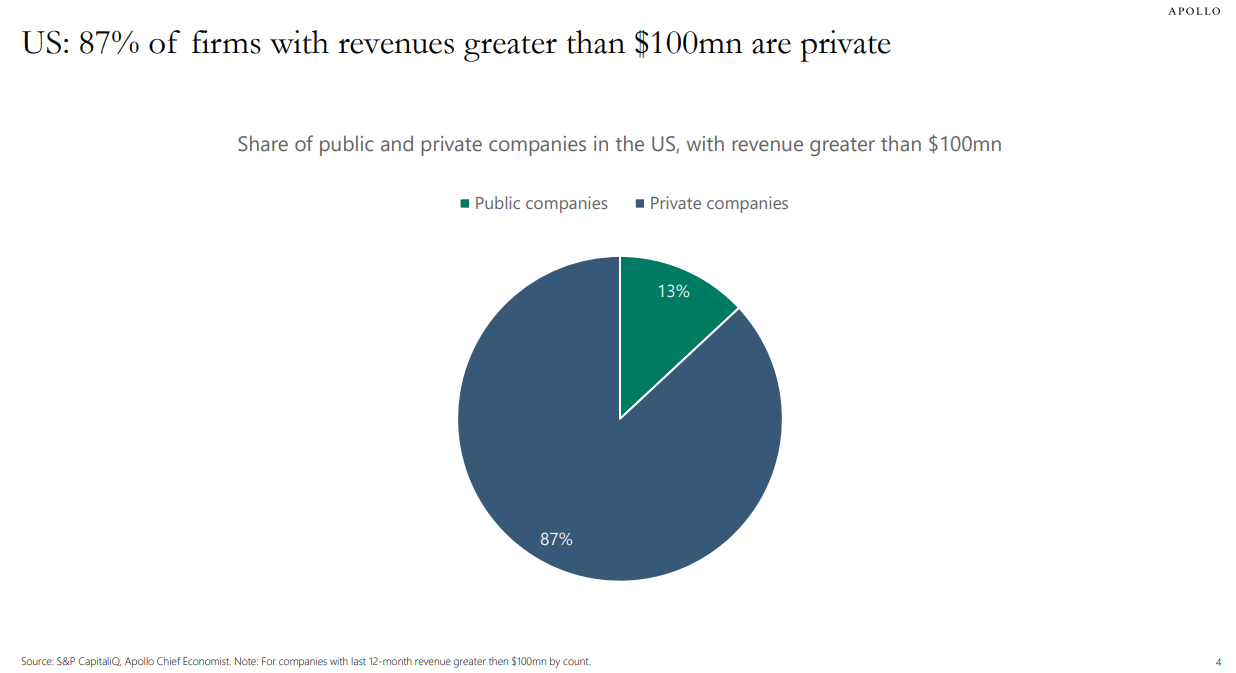

Apollo’s Torsten Slok has some wonderful charts that spotlight the variations between the inventory market and the economic system.

S&P 500 corporations are huge however the majority of companies with $100 million or extra in gross sales are personal corporations:

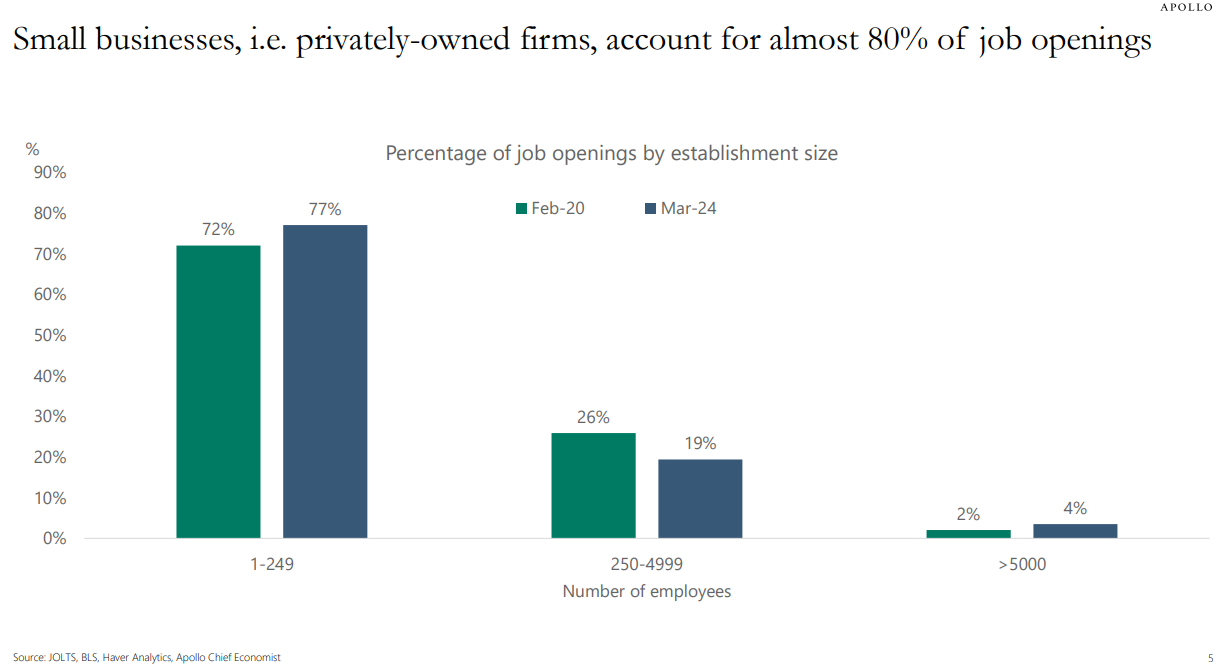

A lot of the job openings come from smaller, privately-owned companies as effectively:

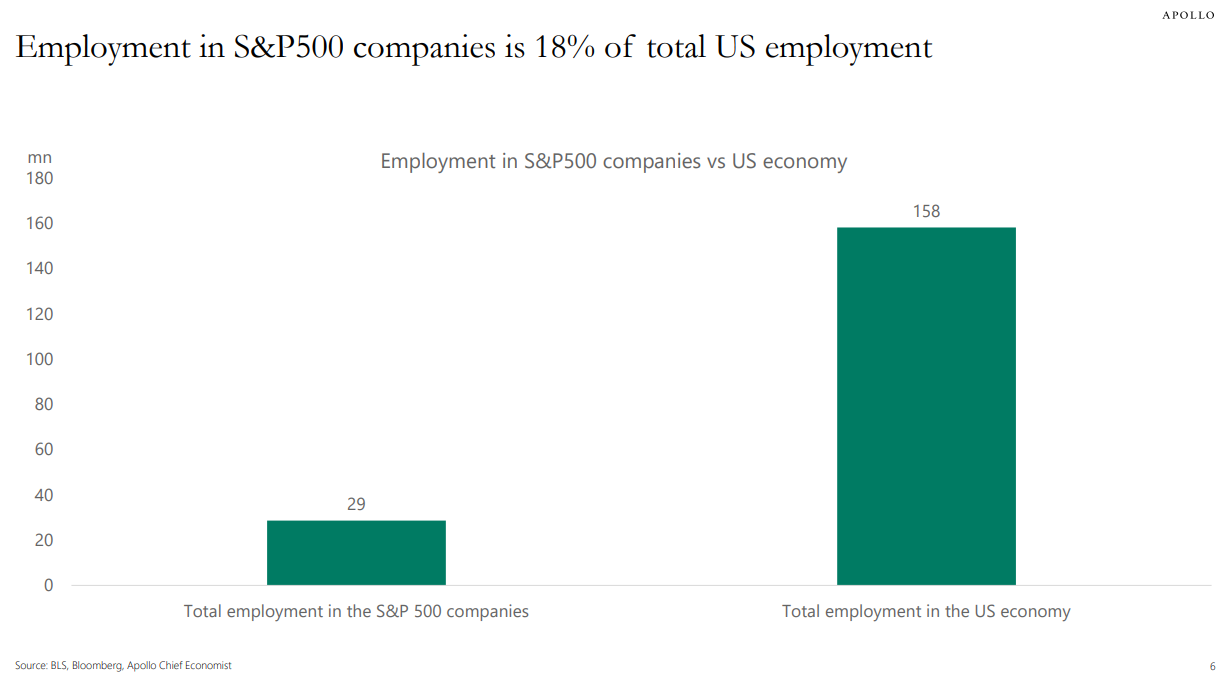

S&P 500 corporations account for roughly 1 in 5 jobs in the US:

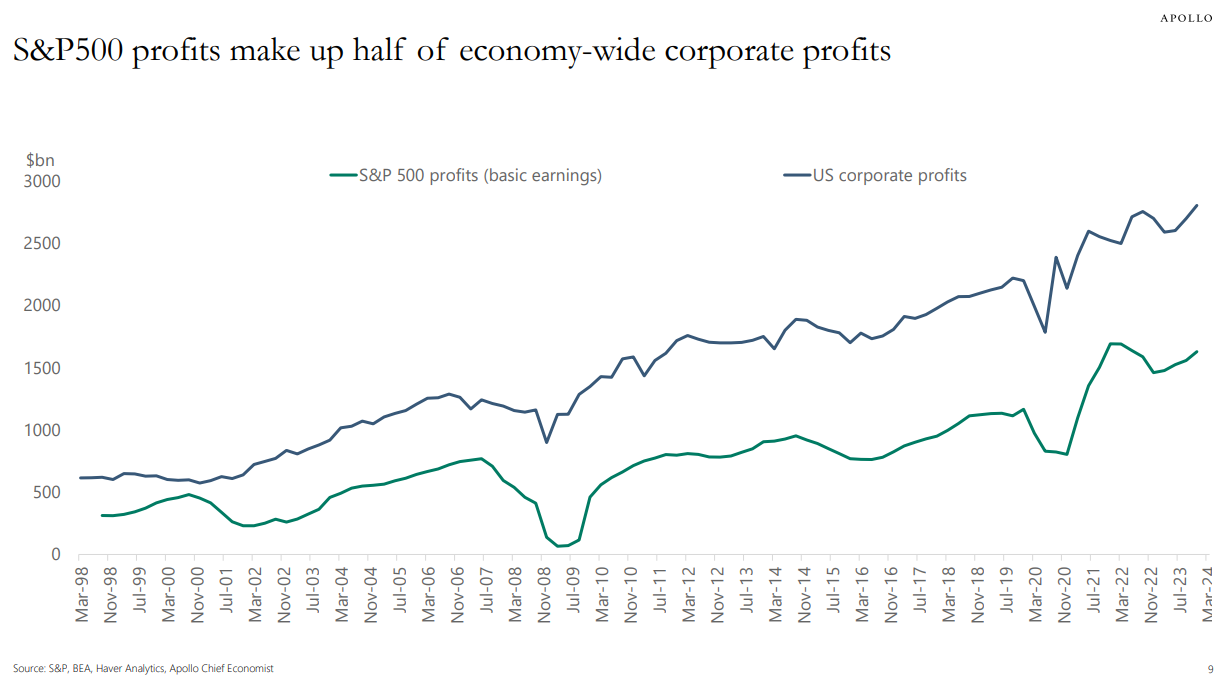

However these firms are insanely environment friendly and worthwhile, accounting for half of the income in America:

Typically the inventory market follows the economic system. Typically the market front-runs the economic system. Typically the market rises or falls even when the economic system doesn’t.

Should you ever end up considering that the inventory market doesn’t make plenty of sense that’s as a result of generally it marches to the beat of its personal drummer. At instances that drummer is a raging lunatic.

The inventory market and the economic system want one another however they’re completely different animals.

Michael and I talked in regards to the S&P 500 vs. the economic system and rather more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

What’s Driving Inventory Market Returns?

Now right here’s what I’ve been studying currently:

Books:

1You may most likely quibble with this quantity since tech is now so ingrained in all the things we do.