A reader from down below asks:

You guys have been speaking lots about US financial exceptionalism lately with the caveat that homes are too costly. Honest sufficient. However try housing costs in Australia the place I reside. It’s insanity! Individuals have been saying it’s a bubble for years whereas costs simply preserve going increased. I don’t actually have a query. Simply needed to level out that costs within the states look tame by comparability. Cheers.

I’m in full settlement with my Australian good friend right here.

Whereas it looks like the U.S. housing market is totally damaged and costs are out of attain for tens of millions of People, the scenario is way worse in different nations. Particularly Australia.

The median value for an current residence in the USA is round $410,000. In Australia it’s greater than $800,000. In Syndey, the median value of a house is properly over $1 million.

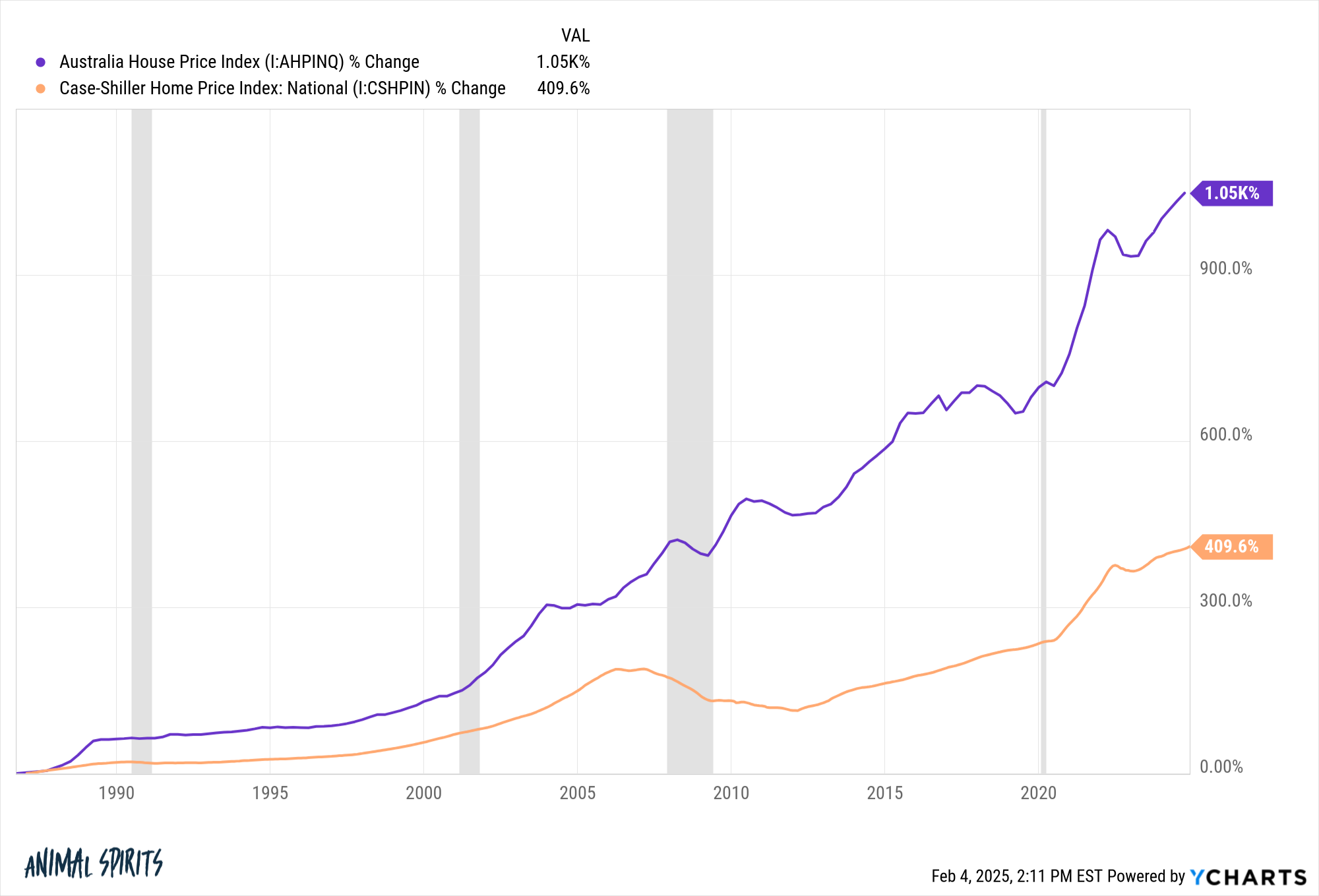

Owners within the U.S. have skilled unimaginable positive factors over the previous 30-40 years however we’ve bought nothing on Australia:

For the reason that late-Nineteen Eighties, housing costs down below have greater than doubled up our returns on homeownership.

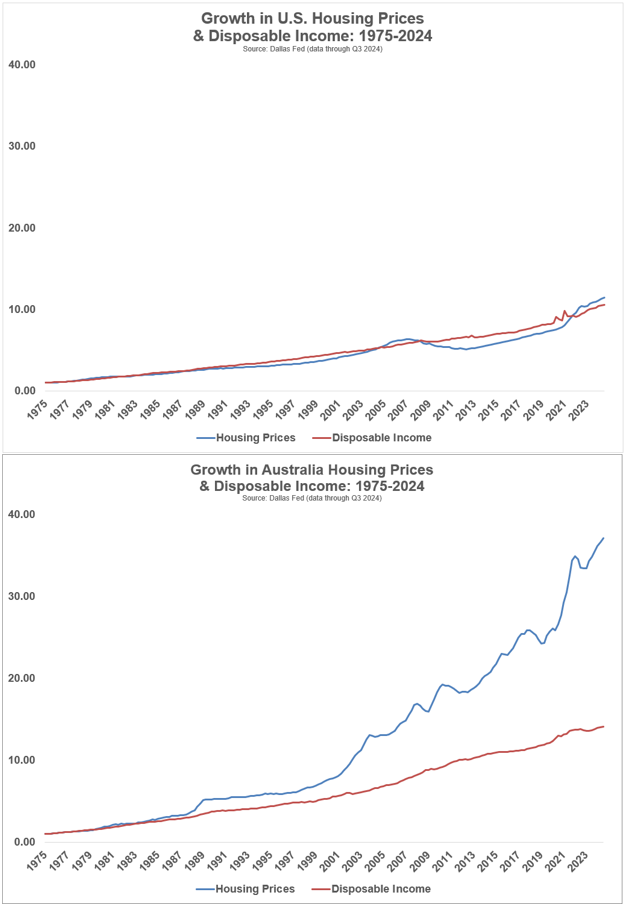

It’s additionally import to place these value positive factors into context by way of affordability. I like to do that by evaluating value positive factors to wage positive factors.

These charts present housing value progress versus the expansion in disposable revenue for each the USA and Australia going again to 1975:

I put these time collection on the identical scale to indicate simply how out of whack this relationship is in Australia. Within the U.S., housing costs and disposable incomes have grown roughly in lockstep with each other. Not so in Australia the place the chart appears to be like like an alligator opening extensive and exhibiting off its tooth.

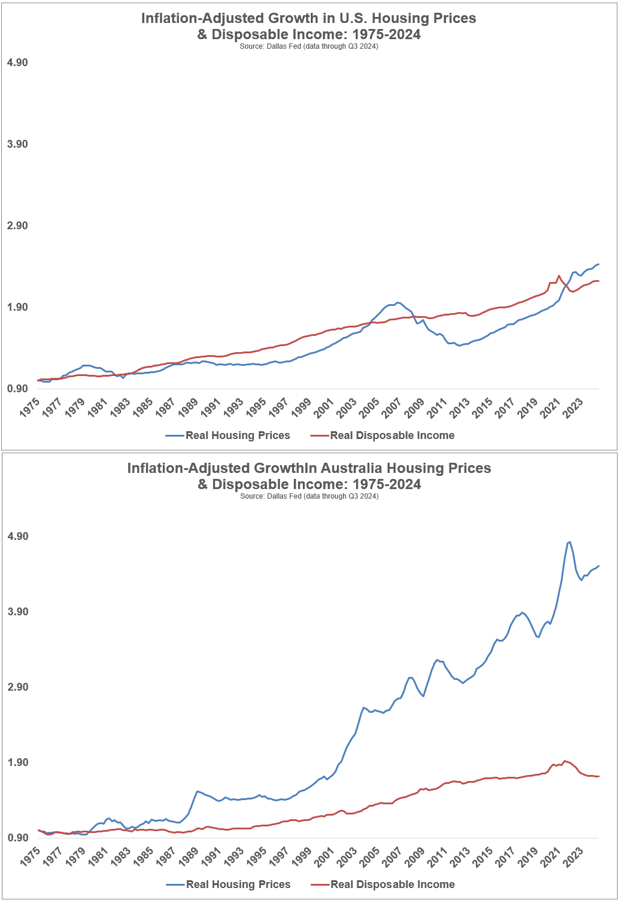

Some folks choose utilizing inflation-adjusted knowledge when making comparisons throughout borders:

The true knowledge paints an identical image.

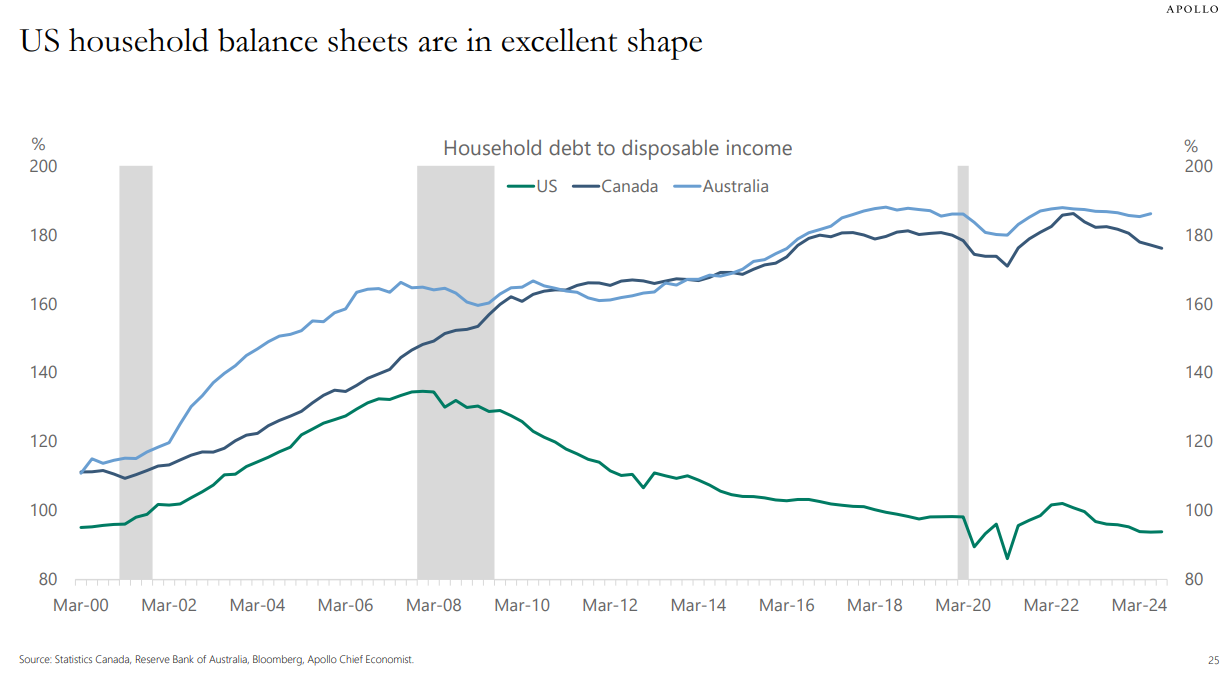

Torsten Slok has an awesome chart that compares family debt to disposable revenue within the U.S., Canada and Australia:

Canada and Australia have seen debt-to-income ratios rise for years now whereas U.S. households have been repairing their stability sheets ever because the Nice Monetary Disaster. Greater housing costs are clearly the primary perpetrator right here

Mortgage debt makes up 70% of family debt within the U.S. I don’t have the precise figures for Australian households however I’m guessing it’s an identical profile.

But it surely’s not simply increased housing prices which might be hurting Australian family stability sheets. Greater rates of interest lately have damage most householders due to how their mortgage market is structured.

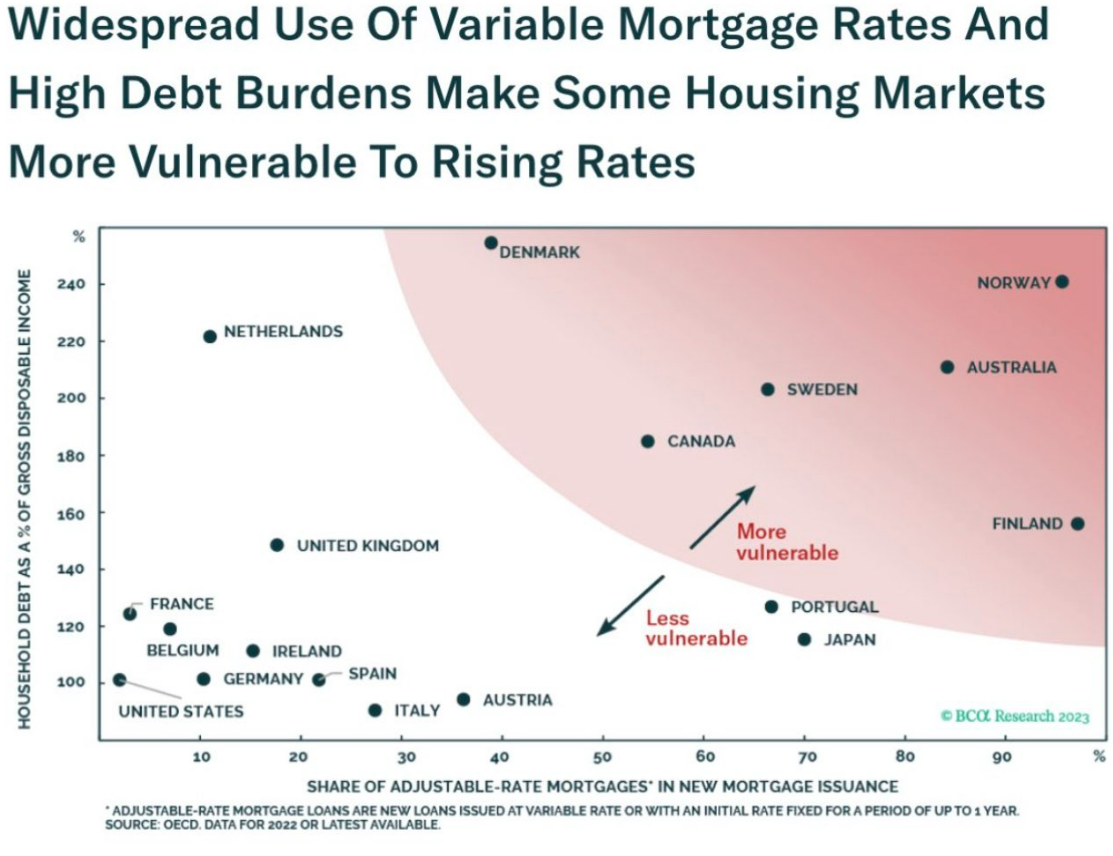

The next chart reveals debt to revenue by nation plotted towards the utilization of variable charge mortgages:

You may see Australia has one of many highest shares of variable-rate mortgages. So far as I can let you know’re capable of lock in your charge for round 5 years after which it resets. This was a beautiful set-up when charges have been falling, however now that we’re in a better rate of interest world, it’s dearer for present and new owners alike.

U.S. owners have been capable of lock in 3% mortgage charges in the course of the pandemic to protect themselves from a rising charge surroundings. That’s not the case in lots of different nations as a result of they don’t make the most of 30 12 months mounted charge mortgages like we do.

Does another person’s scenario make these struggling to purchase a house in America really feel any higher about their very own scenario?

In fact not!

But it surely’s value declaring that as dangerous because the housing market appears proper now within the U.S. from an affordability perspective it may at all times be worse. It is worse in loads of different nations.

And it’s attainable we may see affordability get even worse right here if we don’t make it simpler to construct extra houses to repair our housing scarcity.

We lined this query on the newest episode of Ask the Compound:

Invoice Candy joined me on the present this week to debate questions concerning the tax advantages of proudly owning rental properties, the tax implications of an inheritance, retirement planning for army service members and the way tariffs work.

Additional Studying:

The U.S. Housing Market vs. The Canadian Housing Market

This content material, which comprises security-related opinions and/or info, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There may be no ensures or assurances that the views expressed right here will probably be relevant for any explicit details or circumstances, and shouldn’t be relied upon in any method. You need to seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “submit” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital belongings, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding suggestion or supply to supply funding advisory companies. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding resolution. Previous efficiency shouldn’t be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from varied entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or suggest endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the chance of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.