A reader asks:

My spouse and I plan on promoting our home as soon as my youngest graduates highschool in 2.5 years. My spouse is pushing for us to promote it this Spring of 2025 as an alternative of ready till Spring of 2027 as a result of she believes house costs might be down significantly in 2027 attributable to Trump’s insurance policies and inflation. I attempted to channel my inner-Ben and let her know that there isn’t a solution to predict these items, however she is urgent me laborious. Any solutions on how one can tackle somebody who thinks they know house costs might be decrease in 2027 than in 2025?

I’m undecided how I really feel about being utilized in a marital disagreement however I like the subject right here.1

Ben’s frequent sense rule of thumb #347 is don’t combine politics along with your portfolio. Have all of the political opinions you need however predicting how anybody political occasion or particular person politician will influence the market is a idiot’s errand. Buyers are nearly all the time improper about these predictions.

Vibes will not be actionable for investing functions.

I’m additionally not an enormous fan of timing the housing market.

Again in April 2021, I obtained a query from a house owner in Seattle who was questioning about taking some money off the desk:

The housing market remains to be loopy, my neighbor simply offered his home for $1M+, based mostly on what the actual property apps say I may promote this similar home lower than 3 years after I purchased it and, after prices and paying the mortgage, stroll away with about $500k. I do know it’s not some huge cash & I’m not planning to promote as a result of that is my main residence but it surely made me suppose: there needs to be a degree the place it makes mathematical sense to promote a home and simply begin renting. What are your ideas?

The housing market did appear loopy again then. Mortgage charges had been at 3%. There have been bidding wars all around the nation. Costs had been going bananas.

And guess what?

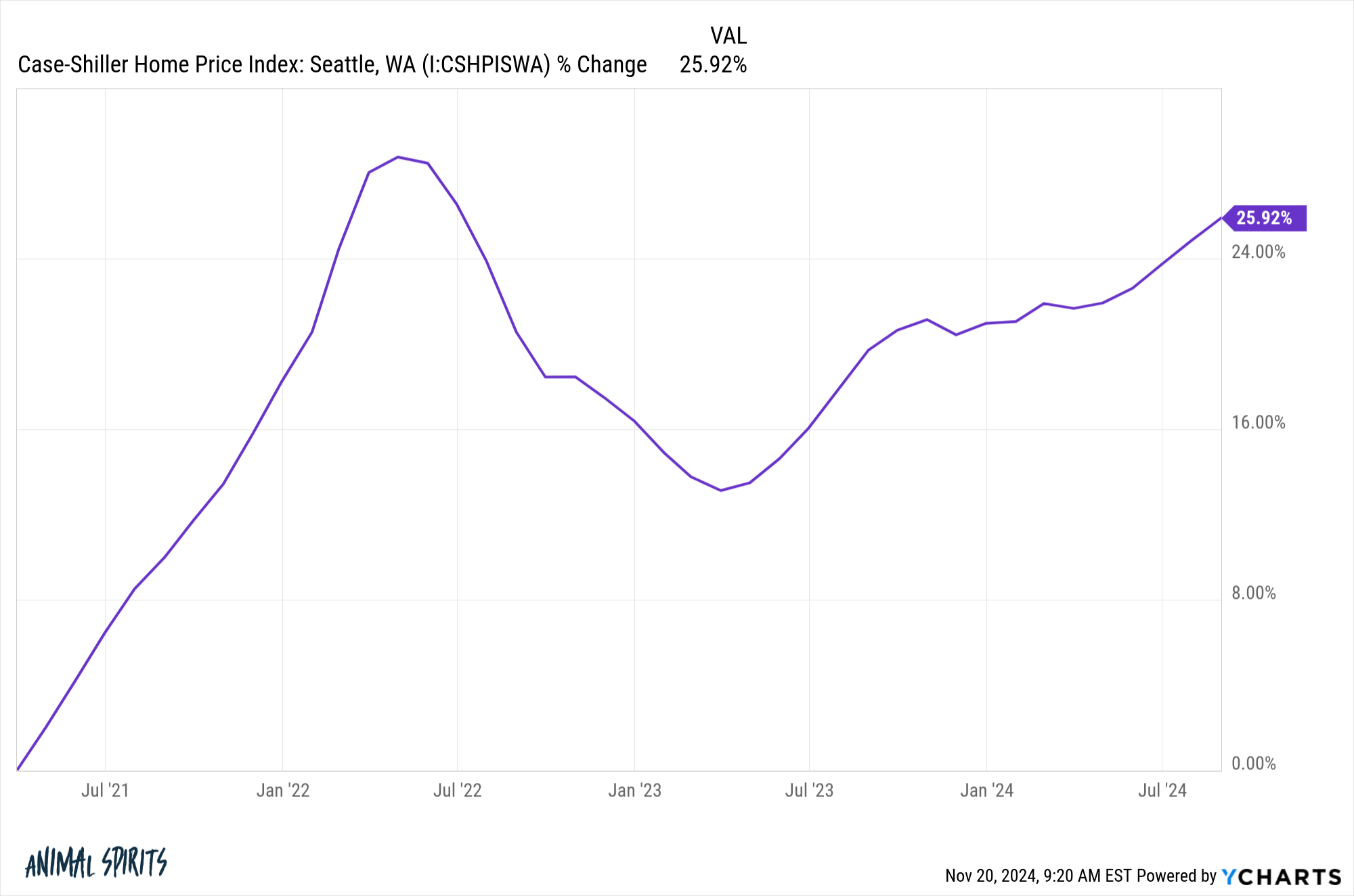

Issues received even crazier. Take a look at housing costs in Seattle since then:

They’re up nearly 30%, regardless of a quick pullback.

Taking cash off the desk would have meant leaving cash on the desk.

Clearly, nobody instances these transactions completely. Plus, a home isn’t meant to be traded like a inventory. You’re not supposed to leap out and in of it or timing the market.

When you can afford to service the debt and the ancillary prices of house possession, you can purchase if that’s what you need to do.

If you might want to promote your own home, it is best to achieve this in a time-frame that fits your wants and psyche.

I particularly hate the thought of making an attempt to time the housing market utilizing macro variables. Mortgage charges first hit 6% someday within the fall of 2022. How many individuals have been ready for them to fall ever since? And so they’ve truly gone larger, but costs by no means got here down!

Perhaps Trump is dangerous for the housing market, possibly not. Let’s say his insurance policies do trigger inflation to return roaring again. Inflation is usually good for housing costs. Housing was one of the best asset class within the Seventies, outperforming shares, bonds and money. Housing was an exquisite hedge in opposition to excessive inflation in 2022.

So excited about it from that perspective doesn’t make lots of sense.

However possibly your spouse merely needs some peace of thoughts. She is aware of it’s important to promote in just a few years. Ready round with that hanging over your head may be aggravating. Shopping for a brand new home whereas promoting an present property is usually a difficult state of affairs from a timing perspective.

When my spouse and I had been constructing our lake home we already owned one other property in the identical improvement. We knew we needed to promote the primary house in some unspecified time in the future to assist with the down cost on the brand new place.

This was again in the summertime of 2022 when mortgage charges had been simply beginning to rise. We noticed them go from 3% to five% in a rush and we had been nervous about how it might influence potential homebuyers. So we put the home available on the market a full 12 months earlier than the brand new home was completed.

Perhaps we missed out on additional upside however we didn’t care as a result of locking within the sale forward of time utterly took that fear off our plates.

A house is already probably the most emotional monetary asset in existence so I don’t like introducing politics into the equation. That superchargers the feelings even additional, turning it right into a 3x leveraged ETF-like state of affairs.

Nevertheless, I do suppose it’s value discussing the professionals and cons of promoting now versus ready from a stress administration perspective.

It’s laborious to place a value on peace of thoughts.

Barry Ritholtz joined me on Ask the Compound this week to debate this query:

We additionally answered questions on when it’s time to fireside your monetary advisor, the influence of the presidential election on the markets and economic system, investing a pile of money throughout a bull market and one of the best hedge for China invading Taiwan.

Additional Studying:

The Drawback With Timing the Housing Market

1Who am I kidding? I adore it!