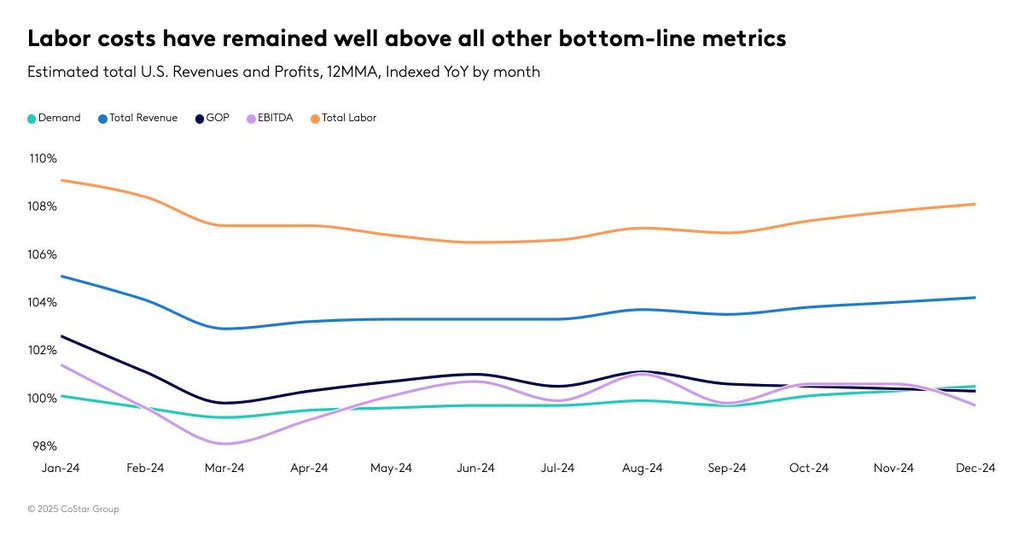

U.S. lodge trade earnings grew in 2024, however elevated labor prices and inflation restricted development, based on P&L knowledge from CoStar. CoStar is a number one supplier of on-line actual property marketplaces, data and analytics within the property markets.

2024 per-available-room metrics (% change from 2023)

- GOPPAR: US$73.60 (+3.2%)

- TRevPAR: US$209.67 (+7.2%)

- EBITDA PAR: US$51.88 (+2.5%)

- LPAR (Labor Prices): US$72.44 (+11.2%)

“Progress in whole working bills, particularly labor, has had the largest impression on earnings,” mentioned Raquel Ortiz, senior supervisor of monetary efficiency at STR. “GOPPAR continued to gradual on the finish of the 12 months with development beneath the speed inflation. On the optimistic aspect, demand development has been key to driving whole revenues, which have been the perfect protection in opposition to excessive bills and allowed for motels to extend earnings, albeit minimal. A rise in teams have helped enhance F&B revenues, however not sufficient to mitigate the labor value development that has impacted margins.”

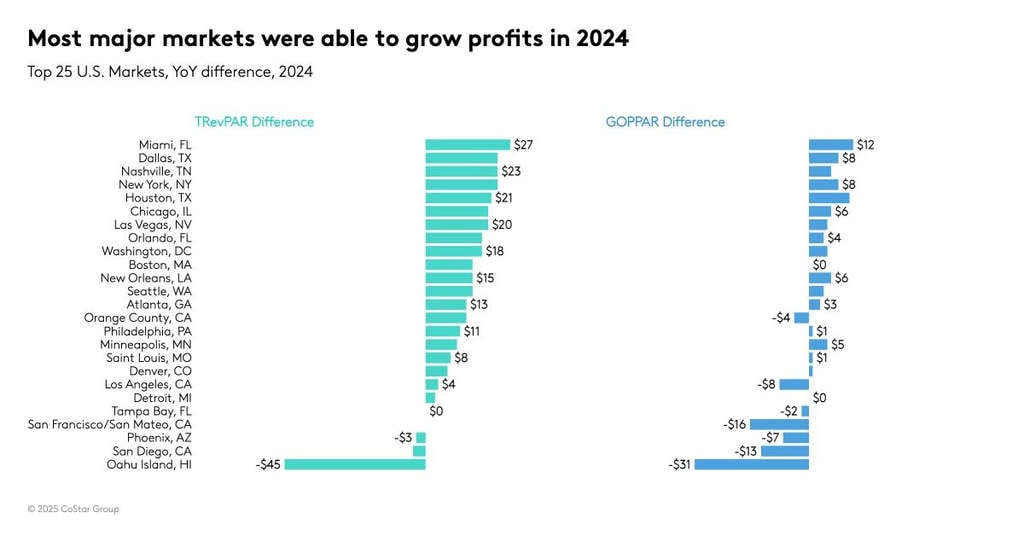

Among the many Prime 25 Markets, Miami posted the best distinction in GOPPAR (+$12) and TRevPAR (+$27). Oahu realized the biggest drops in each metrics, probably as a result of decrease demand attributable to the labor strikes.

For extra details about the corporate and its services and products, please go to www.costargroup.com.