A reader asks:

My spouse and I are in our late 30s and hoping to retire at 60, once we can start withdrawing from our retirement accounts penalty-free. Our plan is to let our present inventory portfolio, which is valued at roughly $650K, journey for that 22 12 months interval, whereas persevering with to max out our Roth IRAs yearly. Let’s say that the inventory market’s common annual fee of return, when adjusted for inflation, is round 7%. We are able to due to this fact estimate that our portfolio, once we retire at age 60, will probably be about $3.6 million (in in the present day’s {dollars}). A extra conservative 6% fee of return yields a portfolio of $3 million. In fact we’re not assured a 7% or perhaps a 6% annual fee of return, particularly when looking over a couple of years. My query is, primarily based on historic information, how confident can we be that over a 22 12 months interval we’ll get an annual fee of return that approaches the common fee of let’s say 7%. In inventory market historical past, what’s the worst annual fee of return over a 22 12 months interval? What share of twenty-two 12 months durations have an annual fee of return that’s at the least 6%?

Some folks may take a look at this as homework. I take a look at is as a problem.

This query is certainly within the Ben Carlson wheelhouse. What can I say — I’m a sucker for market historical past and retirement situation planning.

A number of issues I like about this query:

- I like how they’re considering in actual phrases since inflation can add up over the many years.

- I like how they’re fascinated with inflatin adjusted returns since spending is what issues throughout retirement.

- I like how they’re considering when it comes to each baseline and worst-case situations. It’s essential to take a look at a spread of outcomes when setting expectations.

- I like how they’re considering long-term of their late 30s.

Let’s go to the info!

From 1926 by way of June 2024, the S&P 500 had compounded at an inflation-adjusted return of seven.2% per 12 months. That’s a reasonably darn good common. Actual returns haven’t been this excessive in most different international locations however the winners write the inventory market historical past books, as they are saying.

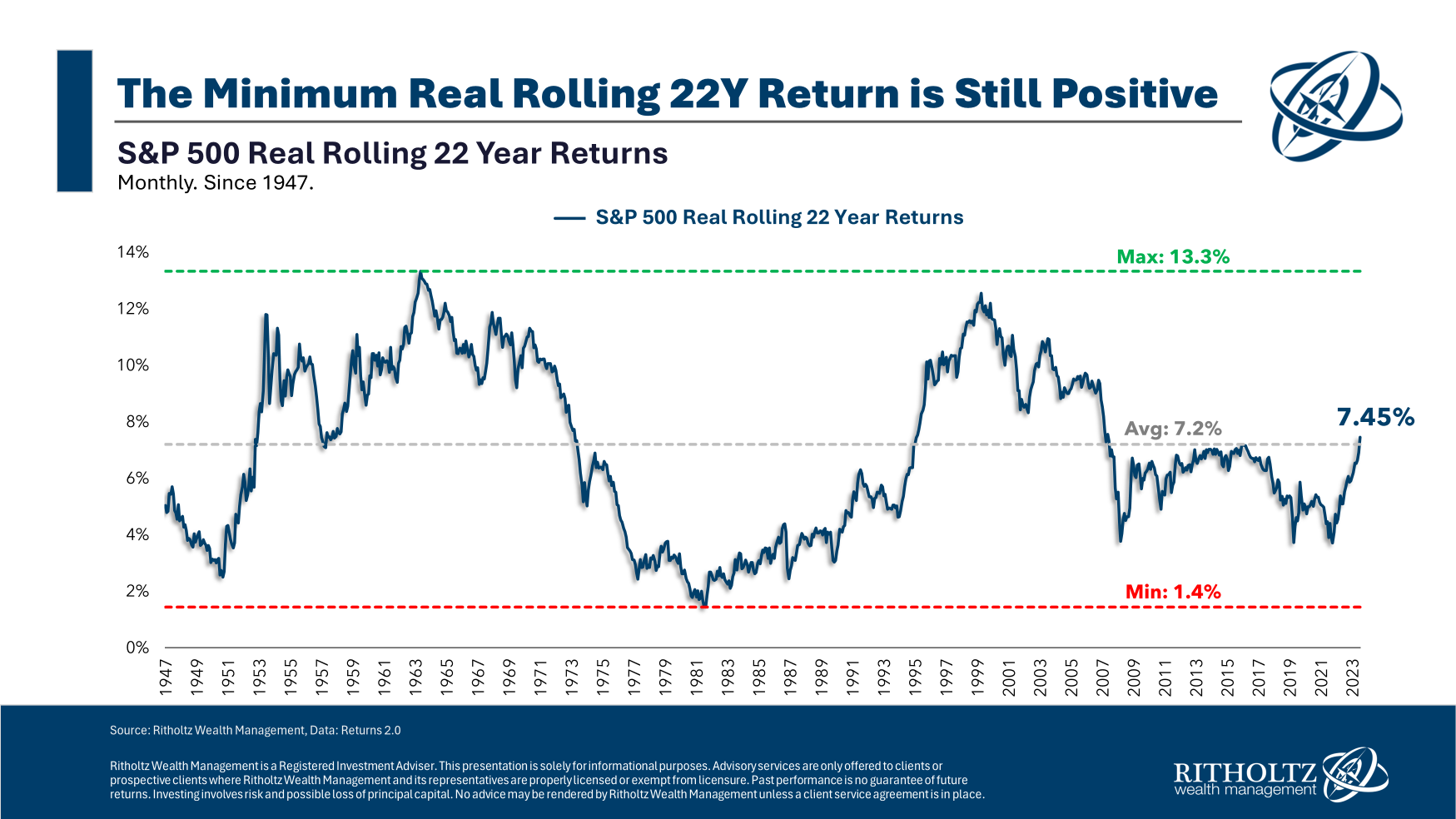

Right here’s a take a look at the rolling 22-year actual annual returns for the S&P 500:

Surprisingly, the worst 22 12 months interval for actual returns was not within the aftermath of the Nice Despair however moderately within the Nineteen Seventies. The 2-plus decade actual return ending in the summertime of 1982 was simply 1.4% per 12 months. That time-frame featured an annual inflation fee of almost 6% which is a excessive hurdle fee to beat.

The very best return got here within the interval main as much as that prime inflation, with a 13.2% actual annual return ending within the spring of 1964. The interval after the Nineteen Seventies debacle additionally produced great actual returns, with near 13% annual inflation-adjusted features ending March 2000.

As at all times, markets are cyclical.

The latest interval ending June 2024 was near the long-term common at 7.5% actual yearly.

The excellent news is that actual returns haven’t been adverse over the previous ~100 years. The unhealthy information is that there generally is a wide selection of outcomes, even over the long term.

Listed here are the historic win charges at totally different annual actual return ranges:

- At the very least 3% (92% of the time)

- At the very least 4% (80% of the time)

- At the very least 5% (71% of the time)

- At the very least 6% (59% of the time)

- At the very least 7% (45% of the time)

- At the very least 8% (40% of the time)

The long run doesn’t need to appear to be the previous, however even when we use historical past as a information, excessive actual returns should not a positive factor.

In two out of each 5 cases, actual returns had been lower than 6% over these rolling 22-year durations. In my e-book, a 4-5% actual return is fairly respectable, and people ranges had been hit as a rule.

Nonetheless, danger exists within the inventory market, even with a time horizon of two-plus many years.

That is what makes retirement planning so tough. There are every kind of unknowns to cope with, returns being one of the vital nerve-racking.

When planning for a multi-decade time horizon it’s essential to:

- Set baseline expectations with the understanding they’re educated guesses.

- Replace your plans as these expectations do or don’t develop into actuality.

- Embody a margin of security within the planning course of.

- Make course corrections alongside the way in which when wanted.

Funding planning can be a lot simpler in case you had been promised a selected fee of return however monetary markets don’t work like that.

It’s important to make affordable selections within the current about an unknowable future and be versatile sufficient to adapt when issues don’t go as deliberate.

That’s not the exact reply most individuals wish to hear however monetary planning doesn’t include 100% precision.

And in case you’re planning for retirement in your late 30s, you’re not sure to a 22-year time horizon.

You’ll be able to work longer or save extra or change plans if needed.

I broke down this query on the newest Ask the Compound:

My colleagues Dan LaRosa and Cameron Rufus joined me on the present this week to debate questions on discover the perfect auto insurance coverage charges, owner-only outlined profit plans, discovering shoppers as a monetary advisor and the way a lot of your portfolio must be in different investments.

Additional Studying:

When is Imply Reversion Coming within the Inventory Market