Vistara, one of the vital common airways provide 7 bank cards co-branded with main card issuers- Axis, SBI, IndusInd and IDFC FIRST. These playing cards maintain a good place amongst the highest journey bank cards in India for the substantial financial savings potential supplied to vacationers, who’re additionally frequent Vistara flyers. Customers can earn free flight ticket vouchers as welcome and milestone advantages together with CV factors on all spends. Whereas these options are common to all Vistara playing cards, the vary of advantages varies throughout entry degree, mid-range and premium card varieties. To assist customers discover the perfect card amongst these, right here is our comparability on these playing cards.

To decide on the perfect card customers should preserve in examine their private preferences with respect to the cardboard’s options and advantages. Every card has its personal execs and cons, that is likely to be subjectively appropriate from one consumer to a different. The very best factor to do here’s a cost-benefit evaluation. For this, some factors to think about in thoughts are:

1. Determine your Eligibility & Preferences: Are all playing cards the identical?

To start with, determine your eligibility and in addition preserve in examine your payment fee means. Vistara bank cards are scattered throughout entry-level, mid-range and premium playing cards classes, thus they aren’t truly similar however differ as per the charges, options and eligibility necessities. As per the cardboard vary, the annual payment will increase and the eligibility standards turns into stringent.

| Entry degree | Membership Vistara SBI ; Axis Platinum |

| Mid-range | Membership Vistara IDFC ; Membership Vistara SBI Prime, Axis Signature |

| Premium | Axis Infinite; IndusInd Explorer |

After shortlisting card, examine playing cards foundation the next options:

2. Welcome Advantages : Free Flight Ticket Voucher, A Good Begin. Which card gives it the perfect?

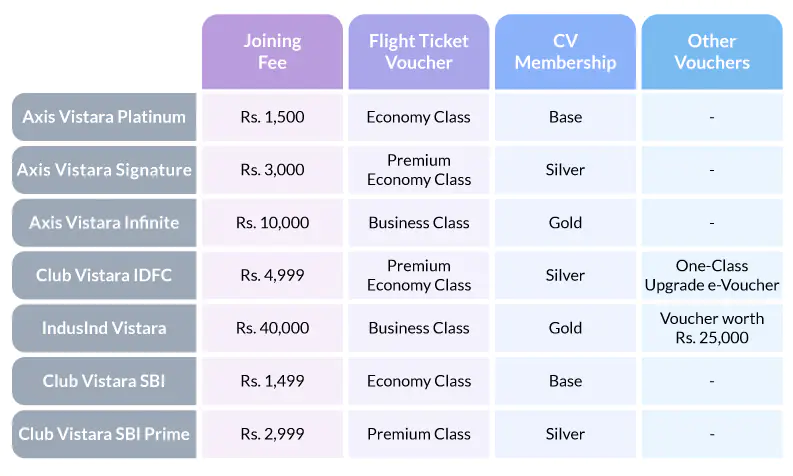

Whereas welcome advantages shouldn’t be a serious governing issue to decide on a bank card, in some instances it may very well be in any other case. All Vistara playing cards gives comparable sort of advantages on card activation justifying the becoming a member of payment, as follows:

Amongst entry-level playing cards, the distinction is none, as each provide an economic system ticket voucher and CV base membership. For mid-range playing cards, Membership Vistara IDFC has an edge over different variants, as together with the premium economic system voucher and CV Silver membership, customers additionally get an improve voucher, enabling customers a high-end expertise.

IndusInd Explorer comes with a excessive becoming a member of payment of Rs. 40,000 compared to Axis Infinite. Nevertheless, the previous clearly justifies it through an extra good thing about Rs. 25,000 over and above the Enterprise class ticket and CV Gold membership. The great half is, customers have the pliability to make the most of the voucher for buying or journey because of a number of model choices from Oberoi Inns & Resorts, Lux Present Card and Vouchagram.

3. Reward Construction – CV factors on all spends however redemption towards Vistara flights. The place is the Most Reward Profit?

Reward construction is a serious space of comparability. All Vistara playing cards provide rewards in CV factors which can be redeemable throughout Vistara flight ticket bookings. There isn’t any per reward worth of CV factors because it finally will depend on the flight you might be redeeming for, ticket class sort, date of journey and many others. However the extra the factors, the higher it’s.

Amongst entry-level playing cards, Membership Vistara SBI has an edge over Axis Platinum, because of a barely higher reward earn price of three factors per Rs. 200, compared to 2 factors per Rs. 200. Moreover, SBI card consists of gas, a serious on a regular basis class within the rewards program, which the opposite excludes. The lengthy listing of exclusions on Axis Playing cards is a serious drawback throughout all its variants. Whereas it’s acceptable for the fundamental variant, for the opposite two that is troublesome, as they arrive with a excessive payment of Rs. 3,000 and Rs. 10,000.

Much like the fundamental variants, in case of mid-range playing cards as effectively, the SBI variant has an edge over Axis Signature as a result of inclusion of gas spends. Nevertheless, the IDFC variant clearly wins because of incremental rewards on birthday spends; inclusion of not simply gas however utility, hire, Govt transactions and insurance coverage within the rewards program, together with premium degree reward earn price (amongst Vistara playing cards) of 6 per Rs. 200 on spends above Rs. 1 Lakh.

In the case of the premium playing cards, the IndusInd Vistara Explorer clearly disappoints with a low earn price of two per Rs. 200 on retail spends. The cardboard gives the best rewards solely on journey bookings, thus an acceptable alternative for these sticking to Vistara playing cards for simply journey advantages and never something past.

However the query is, does the voucher value Rs. 25,000 justifies the low reward price on retail spends on IndusInd Variant? No, for the reason that voucher comes solely as a welcome profit and never yearly on card renewal.

Subsequently, premium prospects in search of not simply flight tickets however total reward advantages as effectively, should anyday desire Axis infinite over IndusInd Explorer.

Click on to examine detailed reward construction and exclusions.

4. Milestone Profit- A serious spotlight. However, variety of free flight tickets or class sort?

On placing most bills on these playing cards, customers can earn as much as 5 free ticket vouchers. These are sufficient to avoid wasting on the foremost expense of flight ticket bookings for a number of holidays in a yr. Moreover, customers additionally get bonus CV factors on nominal spend worth of as much as Rs. 1 Lakh. This additional enhances the consumer’s financial savings on journey spends, as CV factors can be used for Vistara flight bookings.

Here’s what we might infer :

IndusInd Explorer doesn’t provide any bonus CV factors not like all different playing cards, even entry degree variants provide these. Vistara Infinite alternatively, gives the best 10,000 CV factors for a nominal spend worth of Rs. 1 Lakh, too simple a goal for a premium card.

Amongst the mid-range playing cards, Membership Vistara IDFC has an edge over Axis Signature and SBI Prime, because it gives the best variety of free flight tickets. Nevertheless, the spend primarily based situation on the cardboard is the best. As an illustration, it’s essential to spend round Rs. 90,000 to earn 6,000 factors with this card, however Rs. 75,000 to earn 3,000 factors with the opposite two playing cards. Thus, the IDFC card is a extra appropriate choice for terribly excessive spenders.

Each entry-level playing cards, Vistara Platinum and Membership Vistara SBI provide as much as 3 free tickets as milestone advantages. Nevertheless, the SBI card has an edge right here, as the utmost spend restrict is Rs. 5 Lakh compared to Rs. 6 Lakh required by the Axis variant. In addition to, the previous additionally gives a resort reward voucher of Rs. 5,000, value an excellent worth for home travellers.

An necessary factor to notice right here, whereas spending Rs. 12 Lakh on the premium variant might fetch consumer’s 4 free flight tickets, with IDFC card customers can earn 5 on this spend worth. Thus, even at a relatively low payment of Rs. 4,999, IDFC variant gives an equal milestone profit as premium playing cards. The one distinction is the category sort, customers not bothered by the premium economic system or enterprise class stature could make a alternative accordingly.

5. Journey advantages past Vistara. Are you a frequent traveller or only a Vistara loyalist?

Contemplating that these playing cards broadly belong to the journey class, one of many main issues to think about is journey privileges apart from Vistara.

| All Variants Axis (Platinum, Signature,Infinite) | Membership Vistara IDFC | Membership Vistara SBI | Membership Vistara SBI Prime | IndusInd Vistara Explorer | |

| Lounge Entry | Home Airport – 2 per quarter | Home Airport Spa & Lounge – 2 per quarter

Worldwide Airport Lounge – 1 per quarter |

4 home (1 per quarter) & Precedence Go membership | 8 home ( 2 per quarter); Precedence Go membership with 4 worldwide lounge visits (topic to max of two per quarter) |

4 home (1 per quarter); Precedence Go membership with 16 worldwide lounge visits (4 per quarter) |

| Foreign exchange Markup | 3.5% | 2.99% | 3.50% | 3.50% | 0% |

Justifying its premium label, IndusInd Vistara Explorer gives a 0% foreign exchange markup and good frequency of worldwide lounge entry. Thus a good selection for frequent worldwide vacationers, who’re primarily sticking to this card for journey advantages. On the similar time, Axis Infinite loses its plot considerably right here by providing no concessional foreign exchange markup and even worldwide lounge entry. This places the cardboard’s premium standing in query.

Speaking concerning the entry degree playing cards, Membership Vistara SBI has an edge over Vistara Platinum for providing higher home lounge entry and even complimentary Precedence Go membership. However the usual 3.5% foreign exchange retains these playing cards restricted as an acceptable choice for home travellers.

Mid-range playing cards Vistara IDFC and Axis Signature additionally prolong advantages to airport lounge entry. However IDFC variant clearly does higher with an honest entry to worldwide lounges and foreign exchange markup payment of two.99%, decrease than the usual 3.5%. Worldwide vacationers, in search of the acceptable card amongst these, may have to examine if the advantages are enough or not.

Thus, selecting the perfect bank card is subjective foundation the consumer’s want. One should entry if they’re comfy with the Vistara particular advantages together with rewards incomes, redemption , welcome and milestone advantages, and if they’ll make the most of these effectively as a result of inclination for Vistara flights or by sticking to it for his or her airline journey.

Customers should additionally entry in the event that they already personal a premium bank card, rewards bank card or a card providing low foreign exchange markup to cowl up for a number of the drawbacks these playing cards include. As an illustration, Vistara mid-range and entry-level playing cards can work effectively with customers proudly owning one other bank card with worldwide lounge entry, low foreign exchange markup, resort membership, and many others. Equally customers proudly owning one other rewards bank card can effectively make the most of the milestone, welcome and 0 foreign exchange profit on IndusInd explorer.

Moreover, these in search of life-style particular advantages on golf, films, eating and many others, can desire Axis Vistara Signature or Infinite for golf and eating advantages, and IndusInd explorer for profit on films.

Thus, finally it’s your name foundation the kind of advantages you need out of your bank card, co-branded Vistara or all rounder.