Family web price is at all-time highs.

Housing costs are at all-time highs.

The inventory market is close to all-time highs.

However not everyone seems to be feeling nice about their funds.

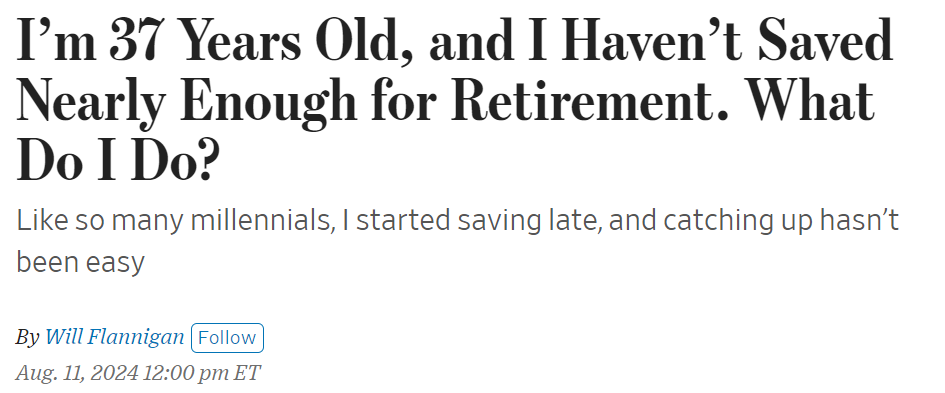

Right here’s a have a look at common retirement balances by age together with the share of every cohort who seems like they’re heading in the right direction for retirement:

The excellent news is confidence tends to extend as you age. The dangerous information is the share of people that really feel like their retirement financial savings are on observe doesn’t attain 50% for any age group.

A part of this stems from the truth that some individuals won’t ever really feel like they’ve sufficient. Retirement is a scary prospect for a lot of households. There are numerous uncertainties concerned within the course of.

However there are clearly loads of individuals who don’t have sufficient saved.

Why is that this?

Listed below are among the greatest causes some individuals don’t come up with the money for saved for retirement:

You don’t make sufficient cash. That is doubtless the most important cause most households don’t have sufficient retirement financial savings. Some individuals merely don’t earn a excessive sufficient earnings to have any cash left over.

There are private finance individuals who would love you to imagine it’s all dangerous habits that trigger individuals to underfund their retirement.

Many individuals don’t have any extra remaining after paying for requirements.

The best technique to save extra is to earn extra.

You’re overwhelmed. Nobody teaches you how one can put together for retirement. You’re by yourself.

How a lot must you save? The place must you save? What must you spend money on? Which accounts must you open? When must you change your investments?

It may be an awesome course of if you happen to’re not a private finance particular person or don’t get some assist.

You procrastinate. Retirement is a great distance away for most individuals. When prioritizing your funds it’s a lot simpler to concentrate on the stuff that feels extra pressing within the second.

I’ll simply begin saving sooner or later once I’m prepared.

By the point you’re really prepared to save lots of for retirement, you’ve most likely already missed out on the most important advantages of compounding.

You don’t know how one can save. Some persons are dangerous with their funds.

You spend an excessive amount of cash. You may’t or received’t finances accurately. Delaying gratification is tough.

It’s not everybody however some persons are simply dangerous with cash.

You might have household obligations. Being a guardian, I sympathize with individuals who don’t save sufficient for retirement as a result of they put their children first.

Kids are costly. You need to give them every little thing they need and extra.

Will Flannigan at The Wall Avenue Journal wrote a refreshingly sincere piece this week on the topic:

Right here’s his rationalization:

Like so many individuals of my era, I’ve fallen behind in my retirement financial savings. The mix of getting into the workforce throughout the monetary disaster and the burden of pupil debt has put me and plenty of others behind from the start. And the upper price of dwelling over the previous few years has solely made saving more durable. When you’re behind slightly, it’s simple to maintain falling farther and farther behind.

This half about his pals and their retirement financial savings touched the affect children can have on this equation:

Since then, they’ve purchased a house, had two youngsters and began small companies. Nonetheless, the quantity they put aside for retirement financial savings maxes out at a few hundred {dollars} a month. “There’s by no means been a second the place we really feel 100% assured to spare extra money as a result of life occurs–we had children, if one thing occurred to our home, or we modified jobs,” says Jamie, who’s now 36.

For Jamie and Anna, it’s a case of creating powerful decisions. “There was a interval the place we had been near pulling cash out of our retirement” financial savings, he says. “Will we sacrifice our retirement to pay for our children’ faculty? We don’t know what’s finest.”

Life occurs.

They are saying you must put your oxygen masks on first and save for retirement earlier than faculty financial savings. This is sensible from a private finance perspective however most mother and father desire to place the youngsters first.

It’s not ultimate to attend however you’ll be able to nonetheless salvage your retirement financial savings later in life.

You simply should supercharge your financial savings when the youngsters are out of the home. As soon as they get off your payroll you need to use no matter cash you had been spending on faculty or no matter and play catch-up.

You don’t get the identical compounding advantages however it’s nonetheless attainable to save lots of your retirement.

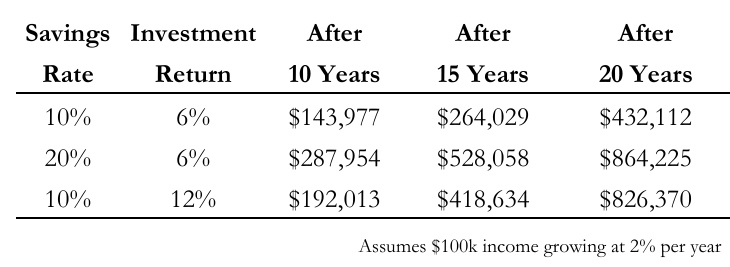

In Every thing You Have to Know About Saving For Retirement I wrote about how doubling your financial savings charge over 10, 15 and 20 years would result in a greater consequence than doubling your funding return:

All shouldn’t be misplaced if you happen to’re behind on retirement financial savings as a result of life obtained in the way in which.

You simply should make it a precedence.

Your children will thanks for it in the future in order that they don’t should deal with you in outdated age.

Additional Studying:

You In all probability Want Much less Cash Than You Assume For Retirement