Foreign exchange lot sizes can look like a little bit of a thriller from the skin.

Though usually neglected, they play an important function in efficient foreign currency trading.

Actually understanding them may help you handle threat, resulting in gradual, extra dependable account progress.

In reality, I usually get requested about lot sizes and one of the best methods to work them out…

…which is strictly why I made this information!

So on this article, you’ll cowl:

- What precisely foreign exchange tons are

- A clearer understanding of pips and their function in lot sizing

- Appropriate lot sorts for varied account sizes

- Sensible examples exhibiting the best way to calculate lot sizes utilizing charts

- Helpful instruments for fast lot measurement calculations

Are you prepared?

Then let’s dive in!

What’s a foreign exchange lot?

A foreign exchange lot is the scale of a place you are taking within the foreign exchange market, lengthy (purchase) or quick (promote).

There’s a parallel idea in conventional inventory buying and selling.

Simply because the variety of shares purchased determines the place measurement in shares…

…lot sizes inform you what number of forex models are in a foreign exchange commerce.

Let’s examine by utilizing a inventory market state of affairs.

Say you put money into an organization and buy 10,000 shares at $1 per share.

The whole worth of your funding is just 10,000 shares multiplied by $1, which equals $10,000.

Your amount is 10,000 shares, and your funding is $10,000.

Now, think about you’re buying and selling forex pairs as an alternative.

In the event you purchase 1 Normal lot of the EUR/USD forex pair, which is 100,000 models of the bottom forex (on this case, the euro), your place measurement equals 100,000 euros.

Alternatively, buying 1 Mini lot of that very same forex pair, 10,000 models of the bottom forex, means your place measurement is 10,000 euros.

As you may see, lot sizes merely decide the quantity of forex models concerned within the commerce.

To really grasp lot sizing, although, it’s necessary to know the idea of pips…

Understanding Pips

Pips, quick for “proportion in factors” are the common unit of measurement in foreign currency trading.

They point out the smallest value change within the trade price of a forex pair.

For many forex pairs, one pip means 0.0001 – aside from pairs involving the Japanese yen, which I’ll focus on shortly.

Let’s test it out in an instance.

Suppose you’re buying and selling the EUR/USD forex pair, and the present trade price is 1.2000.

If the trade price strikes from 1.2000 to 1.2005, it has elevated by 5 pips.

Then again, if it strikes from 1.2000 to 1.1995, it has decreased by 5 pips.

Acquired it?

Buying and selling forex pairs involving the Japanese yen is completely different, although, resulting from its comparatively low worth in comparison with different main currencies.

On this case, one pip is equal to 0.01 moderately than 0.0001, so that you’ll want to regulate your math.

For instance, think about buying and selling the AUD/JPY forex pair, the place the trade price is 80.00.

If the trade price strikes from 80.00 to 80.09, it has elevated by 9 pips.

Equally, if it strikes from 80.00 to 79.91, it has decreased by 9 pips.

Did you discover the distinction? (test the decimal locations!)

Nice – then let’s transfer on!

Completely different Sorts of Lot sizes

Foreign exchange brokers supply varied lot sizes – for merchants with every kind of threat preferences and account sizes.

Principally, there are 4 various kinds of Lot Sizes:

- Normal Lot: 100,000 models of the bottom forex

- Mini Lot: 10,000 models of the bottom forex

- Micro Lot: 1,000 models of the bottom forex

- Nano Lot: 100 models of the bottom forex

Normal Lot: Most well-liked by institutional traders and skilled merchants resulting from its substantial measurement, permitting vital publicity to the market.

Mini Lot: Mini tons are appropriate for merchants with smaller account sizes or those that want to commerce with much less capital in danger.

Micro Lot: Micro tons are standard amongst novice merchants and people with restricted buying and selling capital, as they permit exact threat administration and smaller place sizes.

Nano Lot: The smallest lot measurement obtainable, Nano tons are perfect for training buying and selling methods or executing trades with minimal threat.

It’s value noting that orders will be positioned at a fraction of 1 full lot, no matter its kind, permitting for precision in place sizing (e.g., 0.54 Heaps).

Check out the next desk…

Notice that Pip Worth will all the time be within the quote pair forex, and most main pairs will probably be quoted in divisions of $10.

This Pip Worth signifies how a lot your revenue or loss will change with one pip motion…

For instance, in the event you’re buying and selling 1 Normal lot and the worth strikes 5 pips in your favor, you’ll acquire near $50 in revenue, minus charges and spreads.

Then again, in the event you had been buying and selling a Micro lot, the identical 5-pip motion would end in solely $0.50 in revenue.

So, when utilizing calculators to find out lot measurement, it’s essential to contemplate the pip worth for the precise lot measurement you’re utilizing!

Let’s take a more in-depth look…

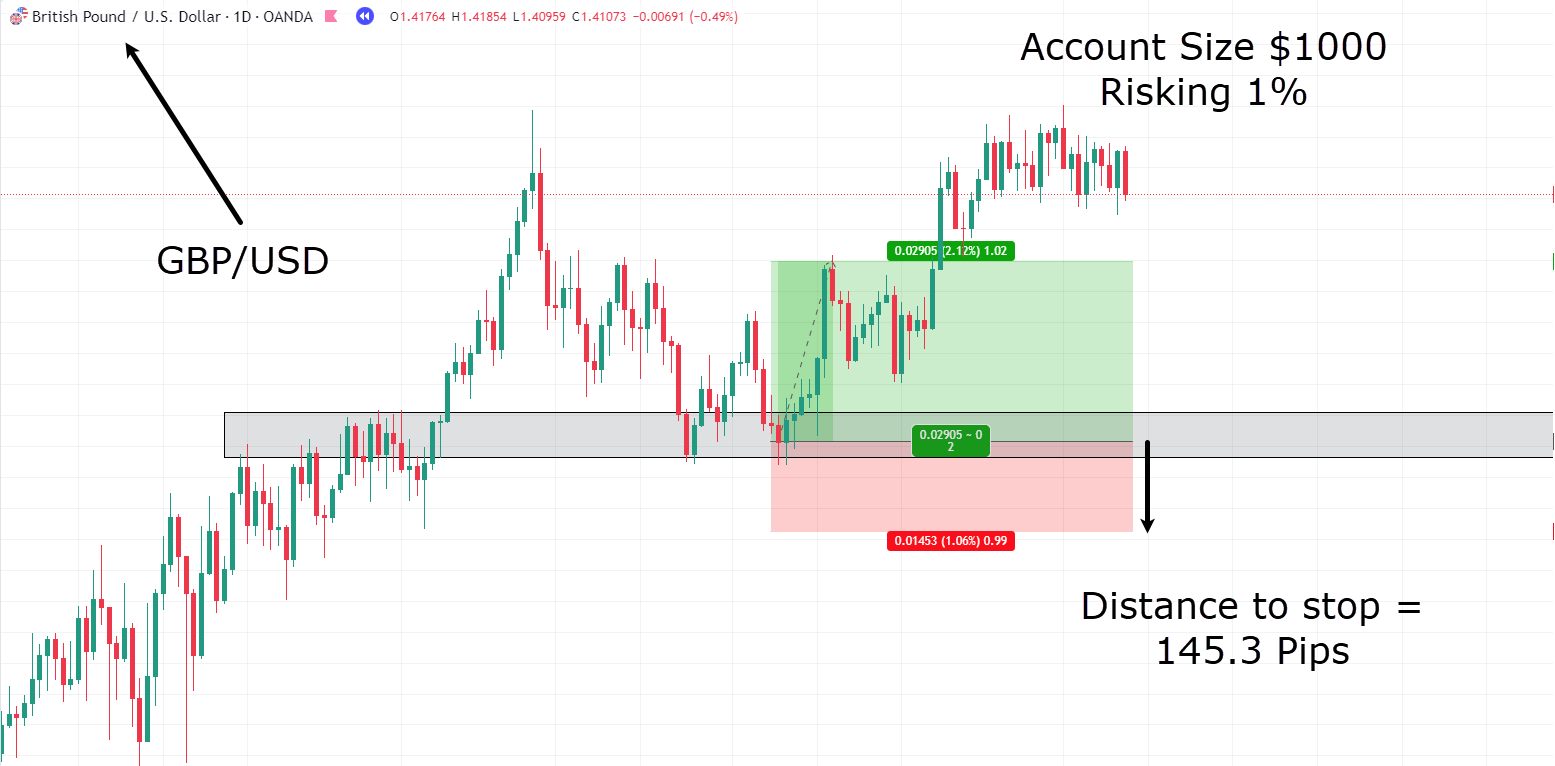

GBP/USD Day by day Chart Commerce Entry:

Think about you will have a $1000 buying and selling account and need to threat $10 per commerce.

The gap to your cease loss is 145.3 pips, which we’ll spherical to 145 for simplicity.

The calculation for figuring out the lot measurement is as follows:

Lot Dimension = (Account Stability x Danger Share) / (Pip Worth x Cease Loss in Pips)

Remember that the Pip Worth is dependent upon the kind of lot you’ll be utilizing, however I’ll use a Normal lot right here:

Lot Dimension = (1000 x 0.01) / (10 x 145)

= 10 / 1450

≈ 0.0069 Normal Heaps

This implies you’d want to make use of roughly 0.0069 Normal Heaps.

Nonetheless, getting into such a exact lot measurement will not be possible, which makes an awesome use case for Mini or Micro tons as an alternative…

Utilizing Micro tons:

Lot Dimension = (1000 x 0.01) / (0.1 x 145)

= 10 / 14.5

≈ 0.69 Micro Heaps

OK so, I perceive what you is perhaps pondering…

“I can’t undergo all this maths every time I need to enter a place!”

…which is strictly why I like to recommend utilizing a place measurement calculator to automate the method.

(Nonetheless, you could perceive how lot sizes are labored out behind the scenes!)

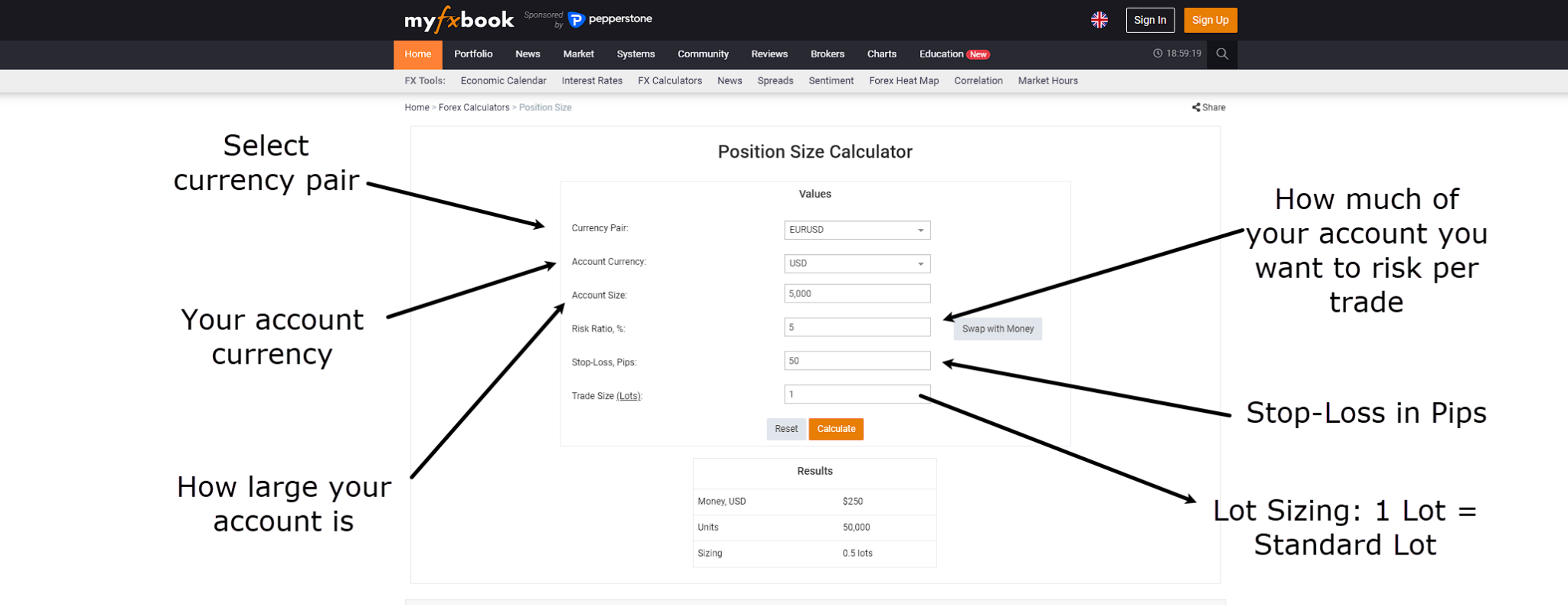

For the following instance, let’s use a free web-based place measurement calculator, Myfxbook…

Myfxbook Place Dimension Calculator

Suppose you will have a $20,000 account and are prepared to threat 2 % on every commerce, which quantities to $400 per commerce.

Given this threat tolerance, you may afford Normal lot positions, as it really works nicely with the $10 value motion per pip.

Now, let’s study the chart…

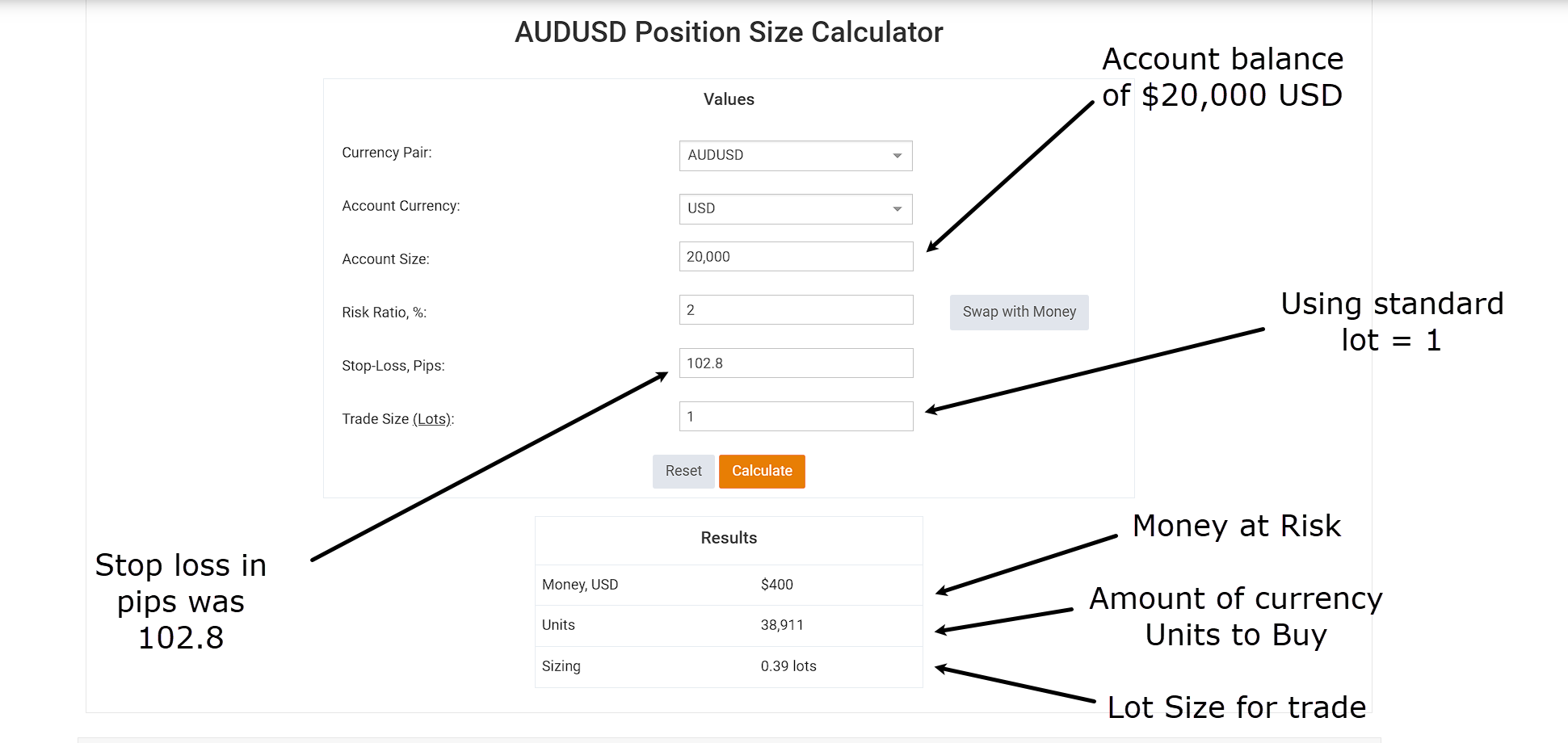

AUD/USD Day by day Chart Commerce Entry:

On this state of affairs, we’re taking a look at a brief commerce on the AUD/USD pair.

The gap to the cease loss from the entry level is 102.8 pips.

However how would you enter this commerce right into a place measurement calculator?

Let’s discover out…

Place Dimension Calculator Commerce Instance AUD/USD:

As you may see, the calculated models required for this commerce quantity to 38,911.

When calculating lot sizes, although, it’s frequent to spherical up or all the way down to the closest decimal level.

On this case, 38,911 is rounded as much as 39,000, that means quite a bit measurement of 0.39 Normal Heaps.

If the worth hits your cease loss, your cease will set off a purchase order, and you’ll purchase again 0.39 tons at a lack of -$400.

Conversely, if the worth reaches the 2RR (Danger-Reward) goal, your take-profit order would purchase again your 0.39 Heaps at a revenue of round $800.

Does this make sense?

Nice!

Then let’s delve into some additional strategies for calculating your lot sizes…

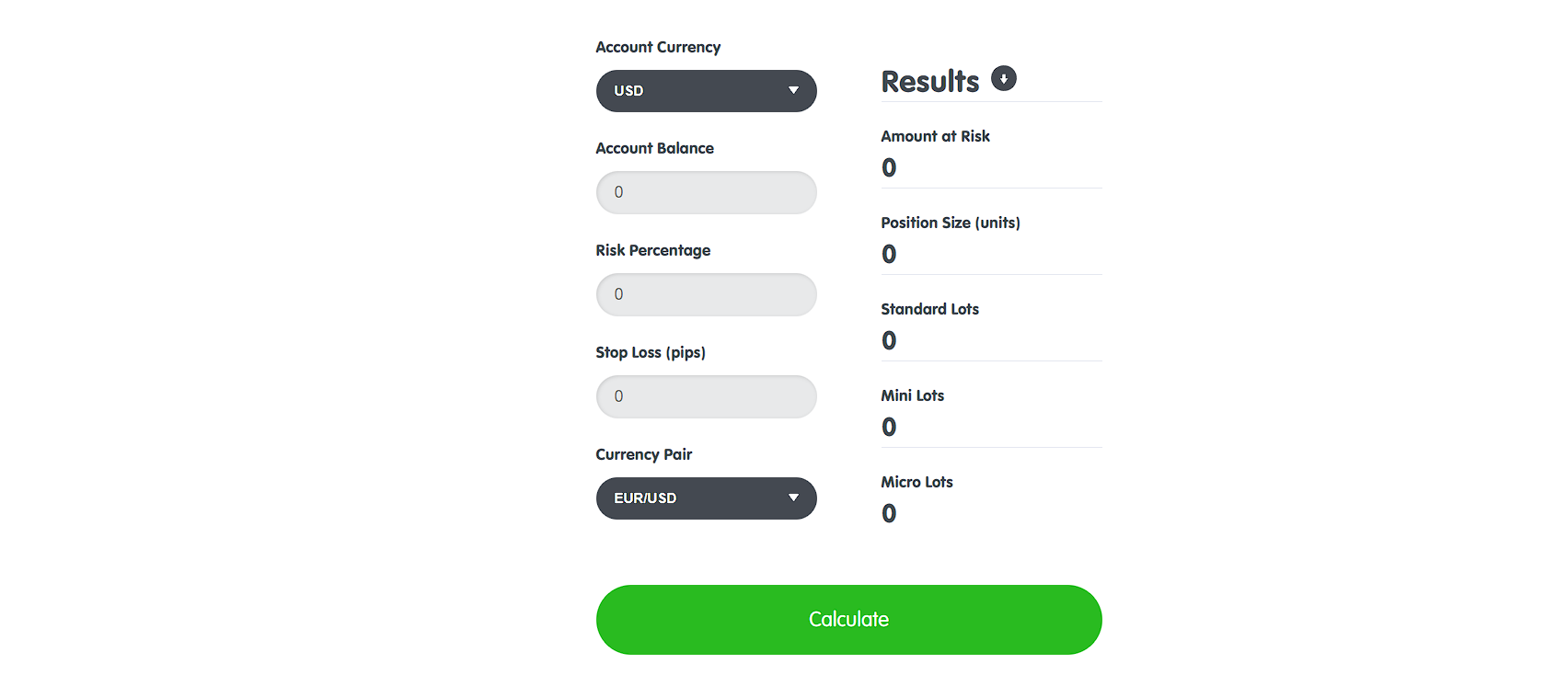

Different Lot Dimension Calculators

Internet Browser Calculators

Identical to the Myfxbook calculator, plenty of different foreign exchange brokers and web sites supply related instruments, by web browsers on varied units.

You possibly can enter your account particulars, threat parameters, and commerce specifics to obtain on the spot lot measurement suggestions.

For instance…

BabyPips Place Dimension Calculator:

TradingView

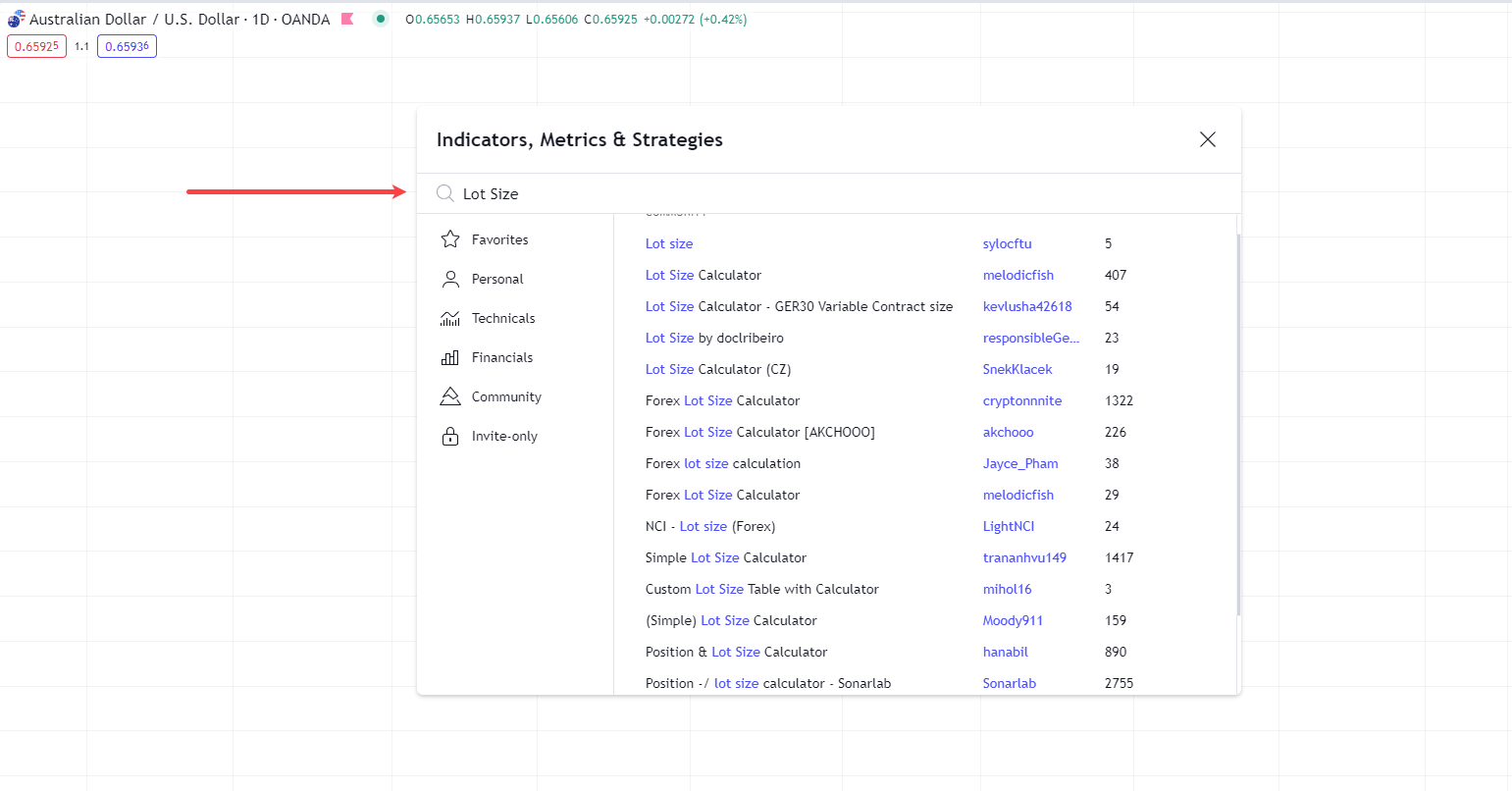

In the event you favor utilizing TradingView as your lot measurement calculator, there are quite a few indicators and plugins obtainable without cost.

Merely seek for “Lot Dimension” within the indicators window to discover a listing of them.

Take a look at out just a few choices and select the one which most closely fits your wants, adjusting any settings to match your account particulars and preferences…

TradingView Lot Dimension Calculators:

Metatrader

Utilizing Metatrader as your lot measurement calculator could require a bit extra preliminary setup, however it capabilities principally the identical as different choices.

Whether or not you’re utilizing Metatrader 4 or 5, seek for lot measurement calculators particular to the platform you’re utilizing.

Most of those plugins present set up directions, permitting you so as to add them as layers or indicators to your Metatrader platform…

Earnforex.com Metatrader Plugin:

Conclusion

In conclusion, mastering right place sizing is crucial for achievement in buying and selling.

Efficient foreign exchange lot sizing performs an important function in managing threat, enabling sustainable progress in your buying and selling account.

Ignoring or neglecting it might simply result in losses and hinder your progress as a dealer – so take notice!

To summarize, on this article, you’ve:

- Realized what Foreign exchange lot sizes are

- Explored the function pips play in place sizing

- Found the various kinds of lot sizes

- Recognized the best way to calculate you lot sizes manually

- Discovered new instruments to calculate lot sizes effectively

Congratulations on uncovering one other essential device for profitable buying and selling!

You’re nicely in your option to turning into a worthwhile dealer by calculating the right place sizing.

Now – I’m keen to listen to your ideas on foreign exchange lot sizing…

Do you at the moment use sure instruments or web sites to calculate your lot sizes?

Have you ever thought-about the connection between pips and lot sizes in your buying and selling technique?

Share your ideas and experiences within the feedback under!