The U.S. finances deficit surged to $1.897 trillion for the primary 11 months of fiscal 12 months 2024, based on the Treasury Division’s report on Thursday.

24% Enhance in Deficit In comparison with Final 12 months

The deficit marks a major 24% improve in comparison with the $1.525 trillion deficit throughout the identical interval final 12 months.

The spike is partly attributed to rising rates of interest and the absence of a $319 billion reversal from Biden’s pupil mortgage forgiveness program, which was struck down by the Supreme Court docket final 12 months. That discount final 12 months won’t repeat this 12 months.

With only one month left within the fiscal 12 months, the annual curiosity funds on public debt surpassed $1 trillion for the primary time.

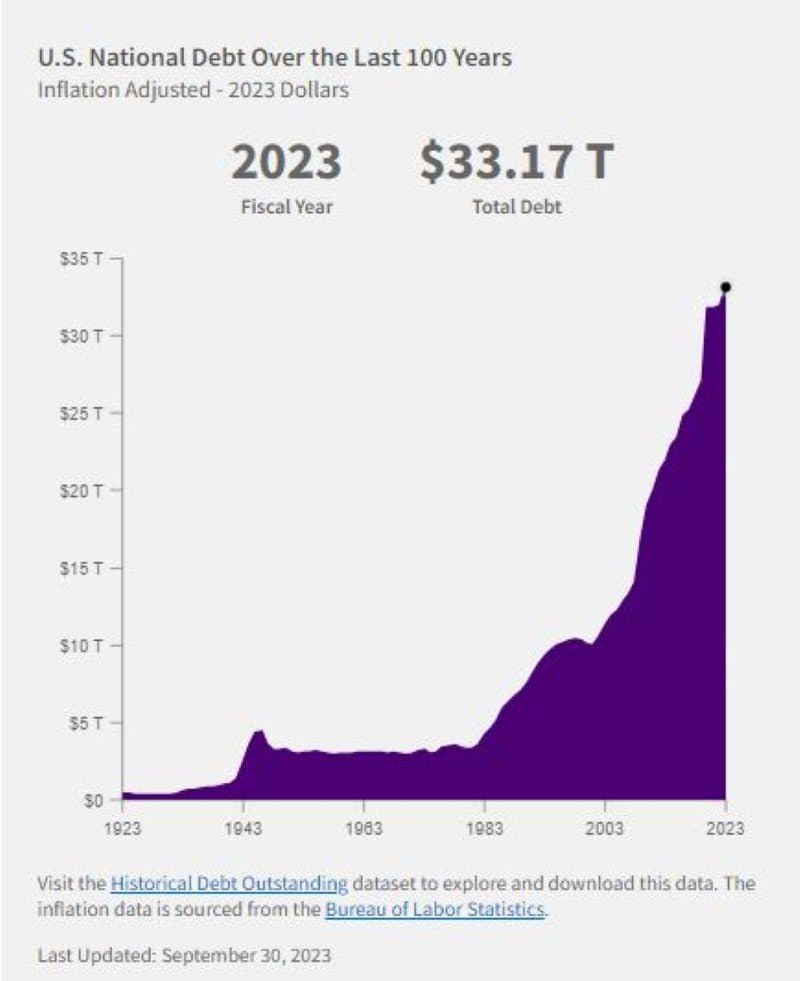

U.S. Debt at All-Time Excessive

As of Tuesday, the nationwide debt stood at $35.3 trillion.

Only a 12 months in the past, the debt was round $30 trillion.

The U.S. nationwide debt formally surpassed $34 trillion on January 4, as reported by the U.S. Division of the Treasury. Notably, it had reached $33 trillion on September 15, 2023, and $32 trillion on June 15, 2023, indicating an accelerated improve.

Previous to this, the ascent from $31 trillion to $32 trillion took roughly eight months.

Within the final century, the U.S. federal debt has surged from $403 billion in 1923 to a staggering $33.17 trillion in 2023.

Fed Chairman Jerome Powell has mentioned it’s previous time to have an “grownup dialog about fiscal duty.”

What does this relentless rise imply for Individuals and the way forward for the U.S. financial system?

Nationwide Deficit Growing

A deficit occurs when the federal authorities spends greater than it brings in.

In fiscal 12 months (FY) 2024, the federal government has spent $1.90 trillion past its income, resulting in a nationwide deficit.

To finance authorities applications amidst a finances shortfall, the federal authorities accrues debt via the issuance of U.S. Treasury, payments, and securities. This nationwide debt represents the entire of borrowed funds plus the curiosity as a result of traders who’ve purchased these monetary devices.

In FY 2023, the federal authorities spent $6.13 trillion whereas producing $4.44 trillion in income, making a deficit. The hole between spending and income—$1.70 trillion in 2023—is called deficit spending.

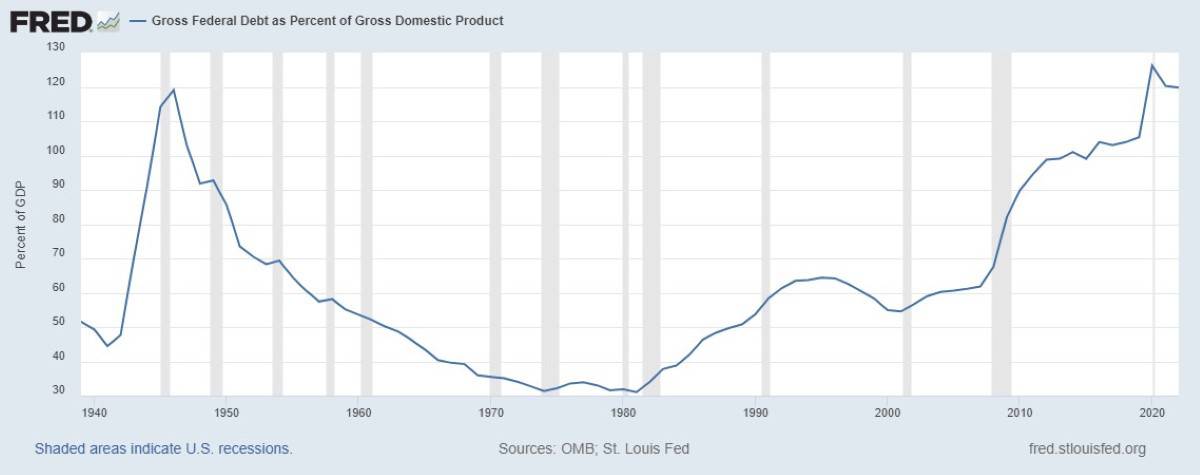

Unsustainable Federal Debt Ranges As Proportion of GDP

Assessing a nation’s debt in relation to its gross home product (GDP) gives perception into its capability to settle the debt. This ratio is deemed a extra informative gauge of a rustic’s fiscal well being in comparison with the uncooked nationwide debt determine, because it displays the debt burden relative to the nation’s general financial output, indicating its compensation functionality. The U.S. witnessed its debt-to-GDP ratio exceed 100% in 2013, with each debt and GDP hovering round 16.7 trillion.

The debt-to-GDP ratio is presently round 123%, and politicians should not displaying any signal of slowing spending.

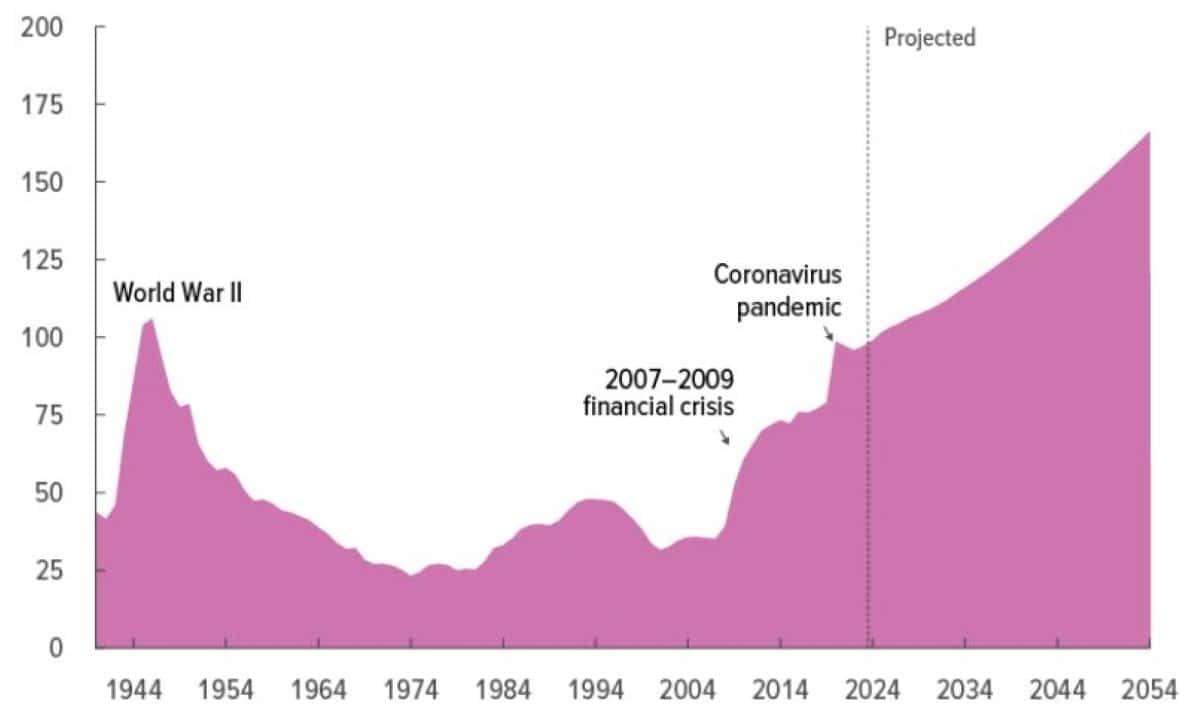

Federal Debt Held By The Public

Rising deficits result in a rise within the already substantial federal debt held by the general public, inflicting it to develop considerably over the following 30 years.

By 2054, the debt is projected to succeed in 166% of GDP, with expectations of continued development past that.

Curiosity On Debt Unsustainable

The Treasury’s year-to-date curiosity prices for fiscal 2024 reached $1.049 trillion via August, marking a rise of roughly 30% in comparison with the identical interval in fiscal 2023.

At present, curiosity spending is the 2nd largest outlay and it’ll surpass spending on Social Safety by early 2025.

Extra Taxes Or Print Cash

Greater debt should be financed with greater taxes or more cash creation. Elevating taxes may show troublesome, however the various of printing more cash might end in rampant inflation.

Individuals have suffered up to now three years as inflation has made on a regular basis requirements dearer. Though the tempo of worth will increase has slowed, meals and fuel costs are nonetheless greater than up to now.

The August core inflation knowledge was stickier than anticipated confirming the ache Individuals are dealing with on a regular basis.

Spending By Borrowing

Up to now, authorities spending has been financed by promoting U.S. debt to overseas nations. America’s capability to pay its debt is a priority for nations worldwide, which personal round $7.6 trillion of our debt.

Japan and China are the highest two international locations holding U.S. debt. Each international locations have been lowering their holdings of U.S. Treasuries. The final quarter knowledge reveals that Japan has slipped right into a recession.

If the U.S. authorities can now not discover consumers for its $1.7 trillion annual debt, important cuts should be imposed on social applications.

The CBO Report Unveils A Dire Path Forward

The most recent report launched by the non-partisan Congressional Finances Workplace (CBO) for March 2024, provided dire projections for the nation’s fiscal and financial panorama over the upcoming decade.

Important belief funds face looming insolvency. The Freeway Belief Fund is anticipated to exhaust its reserves by 2028, the Social Safety retirement belief fund by 2033, and the Medicare Hospital Insurance coverage belief fund is on monitor to deplete its funds by the mid-2030s.

Cuts to Social Packages

The insolvency of the belief funds would set off automated, across-the-board reductions of their payouts.

The CBO tasks that the Social Safety Outdated-Age and Survivors Insurance coverage (OASI) belief fund will run out of funds by 2033, coinciding with the second when people presently aged 58 attain the official retirement age and the youngest of at present’s retirees hit 71. Consequently, all recipients will expertise an automated 25 p.c discount in advantages, regardless of their age or monetary state of affairs.

Pressing Must Sort out Nationwide Debt

The U.S. Nationwide Debt is on monitor for a $2.8 trillion improve this 12 months. This unprecedented development, reaching historic highs, poses important challenges, together with a rising nationwide deficit, an unsustainable debt-to-GDP ratio, and unmanageable curiosity prices. The reliance on overseas nations for debt financing and the looming dangers of a recession add urgency to deal with the dire projections. Important belief funds, comparable to Social Safety and Medicare, are dealing with insolvency, emphasizing the necessity for quick and complete fiscal methods to navigate the advanced financial panorama forward.

Like Monetary Freedom Countdown content material? Be sure you observe us!

Retirement Is Overrated: 10 Causes Not To Retire

You may be pondering that retirement sounds wonderful – however what in case you can’t afford it? What if an unexpected disaster happens and also you want cash? The truth is that so many individuals are retiring later in life as a result of they don’t have sufficient saved up or can’t afford to take the danger of quitting their job earlier than they know the way a lot cash they’ll want every month. Retirees additionally face many challenges, from loneliness to boredom, however there are methods to fight these issues with the correct life-style adjustments. We are going to talk about why retirement isn’t at all times as glamorous because it appears and find out how to keep away from these pitfalls by pursuing your targets now!

Retirement Is Overrated: 10 Causes Not To Retire

Uncover the Prime 10 U.S. Cities The place Renters’ Revenue Goes the Furthest

With housing affordability at an all-time low, many Individuals are pressured to lease. Whereas sure cities provide a better revenue potential, in addition they have greater residing value. For renters, the optimum resolution typically lies find a center floor — reaching the right stability between revenue and bills. Fortunately, people in quest of flats can now make knowledgeable selections by exploring the most recent report on RentCafe.com, which identifies cities the place they’ll maximize the worth of their finances. Listed below are the highest 10 cities the place renters can stretch their {dollars}.

Uncover the Prime 10 U.S. Cities The place Renters’ Revenue Goes the Furthest

Evaluating Retirement Ages: How Does the US Stack Up Towards Different International locations?

Retirement age fluctuates throughout nations, influenced by numerous elements comparable to labor market dynamics, job sorts, financial insurance policies, gender roles, and pension techniques. For example, Saudi Arabia stands out as the only nation providing full retirement advantages to people underneath 50, whereas in 2023, France confronted uproar after elevating its retirement age by two years, sparking widespread strikes. The Group for Financial Co-operation and Growth (OECD) collects and analyzes retirement knowledge utilizing distinct metrics: – The Present Retirement Age signifies the age at which people can retire with full pension advantages after a profession beginning at age 22, with out dealing with any deductions. – The Efficient Retirement Age represents the typical age at which employees aged 40 or older exit the workforce, influenced by private selections or job availability.

Evaluating Retirement Ages: How Does the US Stack Up Towards Different International locations?

The ten States Taxing Social Safety in 2024 and the two That Simply Stopped

As 2023 tax submitting season attracts to an in depth, retirees throughout the nation are adjusting their monetary plans for 2024, however an important element might drastically alter the panorama of retirement residing: the taxing of Social Safety advantages. Whereas many bask within the perception that their golden years might be tax-friendly, residents in ten particular states are dealing with a actuality verify as their Social Safety advantages come underneath the taxman’s purview. Conversely, a wave of reduction is about to clean over two states, marking an finish to their period of taxing these advantages. This shift paints a fancy portrait of retirement planning throughout the U.S., underscoring the significance of staying knowledgeable of the ever altering tax legal guidelines. Are you residing in one in every of these states? It’s time to uncover the affect of those tax adjustments in your retirement technique and probably rethink your locale alternative for these serene post-work years. Listed below are the states taxing social safety advantages.

The States Taxing Social Safety in 2024 and the two That Simply Stopped

Keep away from These Pricey IRA Errors Earlier than They Wreck Your Retirement

Particular person Retirement Accounts (IRAs) are one of the crucial vital instruments for securing a financially steady retirement. With contribution limits for tax 12 months 2024 set at $7,000 ($8,000 for these over 50), these accounts are accessible to most Individuals for retirement planning. But, regardless of their relative simplicity, there are many pitfalls traders face when managing their IRAs. Whether or not it’s selecting the mistaken sort of IRA, mishandling withdrawals, or misjudging tax implications, these errors can result in pointless prices and missed alternatives. Listed below are among the most typical errors and find out how to keep away from them.

Keep away from These Pricey IRA Errors Earlier than They Wreck Your Retirement

John Dealbreuin got here from a 3rd world nation to the US with solely $1,000 not realizing anybody; guided by an immigrant dream. In 12 years, he achieved his retirement quantity.

He began Monetary Freedom Countdown to assist everybody suppose in a different way about their monetary challenges and reside their greatest lives. John resides within the San Francisco Bay Space having fun with nature trails and weight coaching.

Listed below are his really useful instruments

M1 Finance: John in contrast M1 Finance in opposition to Vanguard, Schwab, Constancy, Wealthfront and Betterment to search out the excellent funding platform. He makes use of it as a consequence of zero charges, very low minimums, automated funding with automated rebalancing. The pre-built asset allocations and fractional shares helps one get began immediately.

Private Capital: This can be a free instrument John makes use of to trace his internet price frequently and as a retirement planner. It additionally alerts him wrt hidden charges and has a finances tracker included.

Streitwise is out there for accredited and non-accredited traders. They’ve one of many lowest charges and excessive “pores and skin within the sport,” with over $5M of capital invested by founders within the offers. It is additionally open to overseas/non-USA investor. Minimal funding is $5,000.

Platforms like Yieldstreet present funding choices in artwork, authorized, structured notes, enterprise capital, and many others. In addition they have fixed-income portfolios unfold throughout a number of asset courses with a single funding with low minimums of $10,000.